Bitcoin and Ether register strong surge in record month

On the last Thursday of February, cryptocurrencies, led by

Bitcoin (COIN:BTCUSD) and Ether (COIN:ETHUSD), witnessed a

significant increase. “The movement observed in BTC today is an

exhaustion move. After strong gains over the past few weeks, we

were in a zone where there had never been so many investors with

open sell contracts. It is common, in this situation, to have a day

of explosion to liquidate all these bettors. The lesson given by

the market today has been given several times in the past and this

will not be the last. Never bet against BTC,” commented

analyst Fernando Pereira from Bitget.

At the time of writing, the price of Bitcoin saw a decline of

2.4%, reaching $61,070, while Ether rose 0.23% to $3,395. Both

currencies experienced notable growth in February, with Bitcoin

increasing by 43.42% and Ether by 49.15%, both achieving the sixth

consecutive month of advances. This growth was driven by a

combination of increasing demand and anticipated events such as the

upcoming Bitcoin halving, along with a significant influx into

Bitcoin ETFs, highlighting a triumphant month for

cryptocurrencies.

MicroStrategy scales to Top 500 US companies with historic surge in

stock

MicroStrategy (NASDAQ:MSTR) achieved a prominent position among

the top 500 largest US companies by market capitalization, after a

significant jump of 46 positions, reaching the 427th place. This

advance came on the back of a 45% increase in the value of its

shares in just five days, surpassing the $1000 mark, which raised

its market capitalization to an impressive $16.76 billion. This

accelerated growth opens up the possibility of the company’s

inclusion in the prestigious S&P 500 index, reflecting its

strong financial performance and the success of its Bitcoin

(COIN:BTCUSD) investment strategy, which recently generated

unrealized profits exceeding $1 billion in just 24 hours.

Bitcoin halving in April may reduce miners’ profits and pressure

prices, according to JPMorgan

JPMorgan Chase (NYSE:JPM) predicts that the upcoming Bitcoin

halving event in April will negatively impact miners’ profitability

due to reduced rewards and increased production costs, potentially

leading to a decline in cryptocurrency prices. The report indicates

that the production cost of Bitcoin, which historically sets a

floor for prices, could fall to $42,000 after the halving. The

estimate considers a possible 20% reduction in the Bitcoin

network’s hashrate and an increase in production costs to $53,000,

impacting miners with higher costs and favoring larger operators

with superior efficiency.

Marathon Digital announces 2023 records and launch of Anduro

network for Bitcoin

Marathon Digital (NASDAQ:MARA), a Bitcoin mining giant,

highlighted an unprecedented year in its 2023 annual report, with

significant advancements on multiple fronts. In addition to

achieving a record production of 12,852 Bitcoins, the company

launched an innovative Layer-2 network called Anduro, aiming to

enrich the Bitcoin ecosystem. Under the leadership of Fred Thiel,

Marathon not only optimized its mining operations but also saw a

notable leap in profits and efficiency, marking a historic year for

the company. Revenue soared to $387.5 million, a 229% increase over

the previous year, while net profit reached a historic milestone of

$261.2 million, reversing the $694 million loss in 2022.

Additionally, the company improved its operational efficiency,

increasing its hash rate to 24.7 EH/s and expanding its facilities

to a total capacity of 900 megawatts, distributed across three

continents. Despite the strong performance in results, MARA shares

are down by over 17% on Thursday. Over the last 12 months, shares

have risen by 264%.

Coinbase overcomes technical challenges and innovates with new

crypto wallets to facilitate access

After an error that zeroed user balances due to excessive

traffic, cryptocurrency exchange Coinbase (NASDAQ:COIN), led by CEO

Brian Armstrong, works on scalability solutions. The platform is

already showing recovery, with improvements in access and

transactions, although it still faces intermittent challenges.

Additionally, Coinbase has launched a smart wallet and embedded

wallets, facilitating access to cryptocurrency. These solutions

eliminate complex processes, promoting smooth integration for new

users, with the smart wallet offering simplified key recovery and

embedded wallets allowing customization for businesses.

Gemini agrees to pay fine and return $1.1 billion to customers

after compliance failures

Cryptocurrency exchange Gemini has agreed to pay a significant

fine and reimburse $1.1 billion to participants of Gemini Earn, as

determined by the New York State Department of Financial Services.

The agreement stems from compliance failures identified by Gemini

when dealing with Genesis Global Capital, LLC, which went bankrupt.

The measure aims to compensate Gemini Earn customers affected by

the exchange’s lack of diligence and the subsequent collapse of

Genesis. This agreement underscores Gemini’s commitment to fully

reimburse digital assets to its users, as promised in a recent

statement.

Nigeria interrogates Binance executives and confiscates passports

for illegal operations

Nigeria detained two senior officials of Binance, the global

cryptocurrency giant, upon their arrival in the country. Accused of

operating illegally, their passports were confiscated by the

National Security Adviser’s Office. While not formally charged yet,

they face potential charges of forex fraud and tax evasion. The

incident, not considered a formal arrest, is under investigation

for national security issues, involving discussions between various

agencies.

MNNC Group emerges from the ashes of LedgerPrime

Following discontinuation due to FTX’s bankruptcy, LedgerPrime

has rebranded as MNNC Group, led by former members including

Shiliang Tang. This Cayman Islands-based fund, supported by both

old and new investors, operates with 11 professionals, formerly of

LedgerPrime, which previously managed $400 million with a 40%

annual return. Additionally, former members founded Split Capital,

focused on liquid tokens for long-term investments.

IOTA’s Ecosystem Foundation drives new startups with $10 million

investment

IOTA’s Ecosystem Foundation announced an initial investment of

$10 million in emerging startups specializing in digital commerce

and asset tokenization. The first beneficiaries, focused on

tradetech technologies and based in the United Arab Emirates and

Africa, will be revealed soon. This move follows the regulatory

registration of the Foundation in the United Arab Emirates,

resulting in a significant increase in the value of the IOTA token

(COIN:IOTAUSD). The initiative aims to strengthen the global

commercial ecosystem, promoting innovations in tradetech and

offering an acceleration program for startups utilizing IOTA

technology.

Floki plans to burn 2% of token supply to boost value and security

The Floki team (COIN:FLOKIUSD) proposes to eliminate 2% of

tokens in circulation, valued at over $11 million, to increase

scarcity and reinforce network security. The burn, which

permanently removes tokens from the market by sending them to an

inaccessible wallet, has already resulted in a price increase after

a similar event in January. The tokens earmarked for elimination

come from reserves previously withdrawn from the bankrupt

Multichain platform, aiming to prevent their future

circulation.

Seneca suffers $6 million exploitation in Ethereum and Arbitrum

Seneca, a stablecoin protocol, faced a critical exploitation

resulting in the loss of over $6 million across Ethereum and

Arbitrum networks. An unidentified attacker exploited a critical

flaw in Seneca’s smart contract approval mechanisms, allowing

unauthorized fund diversion. Blocksec, a security company,

identified an “arbitrary call issue” in the contracts as the

primary flaw. The Seneca team is already taking action, urging

users to revoke permissions to mitigate further losses.

SEC investigates $166 million diversion by Terraform Labs to law

firm

The SEC has accused Terraform Labs of channeling approximately

$166 million to Dentons US LLC, under the guise of an advance for

legal fees. This action, according to the regulator, aims to

conceal the company’s assets ahead of potential litigation. While

the SEC acknowledges Dentons as legal counsel, it highlights the

“extraordinary” volume of funds transferred as concerning. The

regulatory body now seeks to recover $81 million unused in legal

expenses, aiming to preserve resources for victims of the Terraform

Labs collapse.

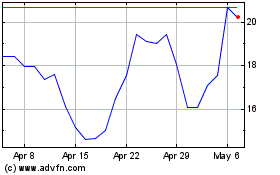

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024