DIH Reports First Half Fiscal 2024 Financial Results

February 20 2024 - 7:00AM

DIH Holding US, Inc. ("DIH")(NASDAQ:DHAI), a leading global

robotics and virtual reality (“VR”) technology provider in the

rehabilitation and human performance industry, today reported

financial results for the six months ended September 30, 2023.

Recent Highlights

- Revenue of $27.3 million for the 6

months end September 30, 2023, representing growth of 57.7% over

the prior year period

- Revenue from device sales in the 6

months end September 30, 2023 increased by 73.9%

- Publicly listed on Nasdaq Global

Markets following completion of the business combination with

Aurora Technology Acquisition Corp (ATAK) on February 7, 2024

- Introduction of the Armeo®Spring

Pro to the upper extremity device portfolio

“We are very pleased with the Company’s

performance in the first half of Fiscal Year 2024 as we’re

continuing to penetrate new and existing markets, seeing strong

growth momentum throughout the first two quarters after strong

growth in the prior year,” said Jason Chen, Chairman and CEO of

DIH. “I’m excited by the significant growth opportunities ahead of

us as we begin to operate as a publicly traded company; and look

forward to connecting with the many valued stakeholders in DIH’s

mission to advance our vision for a transformative rehabilitative

care model.”

First Half 2024 Financial Results

Revenue for the six months ended September 30,

2023 increased by $10.0 million, or 57.7%, to $27.3 million from

$17.3 million for the six months ended September 30, 2022. The

overall increase was primarily due to a net increase in devices

sold of $9.0 million, or 73.9%, which consisted of an increase in

sales to third-party customers. The increase in devices revenue was

driven by higher sales volume in Europe, the Americas and Asia.

Services revenue represented an increase of $0.8 million, up 16.1%

compared to the prior period. Other revenues represented an

increase of $0.2 million, up 76.1% compared to the prior

period.

Changes in foreign currency exchange rates had a

favorable impact on our combined net sales in six months ended

September 30, 2023, resulting in an increase of approximately $0.7

million. This was mainly driven by fluctuations in Euro valuations

throughout the period.

Cost of sales for the six months ended September

30, 2023 increased by $7.7 million, or 109.7%, to $14.7 million

from $7.0 million for the six months ended September 30, 2022. The

Cost of Goods for device sales increased by $5.0 million, which is

directly correlates to the increase in device sales and related

margins remained relatively constant in local currency. The

additional increase in cost of sales is mainly driven by an

increase of $0.7 million in inventory reserve for slow moving parts

as well as $2 million services parts costs.

Selling, general and administrative expense for

the six months ended September 30, 2023 increased by $1.8 million,

or 15.8%, to $13.7 million from $11.8 million for the six months

ended September 30, 2022. The increase was primarily due to

professional service and IT costs increase of $2.5 million related

to audit, legal and other professional services in preparation for

the anticipated business combination with ATAK and becoming a

publicly listed company, and investment in finance capacity in

preparation for public company reporting obligations, and offset by

decreases in bad debt allowance and overhead expenses.

Research and development costs for the six

months ended September 30, 2023 decreased by $0.1 million, or 2.4%,

to $3.8 million from $3.9 million for the six months ended

September 30, 2022. The decrease was primarily due to a decrease in

consulting costs, research and development materials and services

of $0.3 million offset by slight increase in personnel expenses of

$0.2 million.

As of September 30, 2023 DIH’s cash and cash

equivalents amounted to $2.0 million.

About DIH Holding US, Inc.

DIH stands for the vision to “Deliver

Inspiration & Health” to improve the functioning of millions of

people with disability and functional impairments. DIH is a global

solution provider in blending innovative robotic and virtual

reality (“VR”) technologies with clinical integration and insights.

Built through the mergers of global-leading niche technologies

providers, DIH is positioning itself as a transformative total

smart solutions provider and consolidator in a largely fragmented

and manual-labor-driven industry.

Caution Regarding Forward-Looking

Statements

This press release contains certain statements

which are not historical facts, which are forward-looking

statements within the meaning of the federal securities laws, for

the purposes of the safe harbor provisions under The Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include certain statements made with respect to the

business combination, the services offered by DIH and the markets

in which it operates, and DIH’s projected future results. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are predictions

provided for illustrative purposes only, and projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties that could cause the actual results to differ

materially from the expected results. These risks and uncertainties

include, but are not limited to: general economic, political and

business conditions; the inability of the parties to consummate the

proposed business combination or the occurrence of any event,

change or other circumstances that could give rise to the

termination of the business combination agreement, failure to

realize the anticipated benefits of the business combination,

including as a result of a delay in consummating the potential

transaction or difficulty in integrating the businesses of DIH; the

inability to maintain the listing of the DIH’s securities on

Nasdaq; costs related to the proposed business combination; While

DIH may elect to update these forward-looking statements at some

point in the future, DIH specifically disclaims any obligation to

do so.

Investor ContactGreg

Chodaczek332-895-3230Investor.relations@dih.com

|

|

|

DIH HOLDING US, INC. AND

SUBSIDIARIESINTERIM CONDENSED COMBINED BALANCE

SHEETS(UNAUDITED) (in thousands) |

|

|

|

|

|

As of September 30,2023 |

|

|

As of March 31,2023 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,987 |

|

|

$ |

5,560 |

|

|

Restricted cash |

|

|

501 |

|

|

|

415 |

|

|

Accounts receivable, net of allowances of $901 and $1,771,

respectively |

|

|

4,891 |

|

|

|

6,079 |

|

|

Inventories, net |

|

|

8,170 |

|

|

|

6,121 |

|

|

Promissory note - related party |

|

|

405 |

|

|

|

— |

|

|

Due from related party |

|

|

119 |

|

|

|

7,400 |

|

|

Other current assets |

|

|

5,611 |

|

|

|

5,210 |

|

|

Total current assets |

|

|

21,684 |

|

|

|

30,785 |

|

| Property, and equipment, net |

|

|

632 |

|

|

|

826 |

|

| Capitalized software, net |

|

|

2,293 |

|

|

|

2,203 |

|

| Other intangible assets, net |

|

|

380 |

|

|

|

380 |

|

| Operating lease, right-of-use

assets, net |

|

|

4,887 |

|

|

|

3,200 |

|

| Deferred tax assets |

|

|

— |

|

|

|

1 |

|

| Other assets |

|

|

46 |

|

|

|

39 |

|

| Total assets |

|

$ |

29,922 |

|

|

$ |

37,434 |

|

| Liabilities and Equity

(Deficit) |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,638 |

|

|

$ |

3,200 |

|

|

Employee compensation |

|

|

3,684 |

|

|

|

3,678 |

|

|

Due to related party |

|

|

— |

|

|

|

7,322 |

|

|

Current maturities of long-term debt |

|

|

1,472 |

|

|

|

1,514 |

|

|

Revolving credit facilities |

|

|

10,931 |

|

|

|

12,976 |

|

|

Current portion of deferred revenue |

|

|

8,992 |

|

|

|

9,374 |

|

|

Current portion of long-term operating lease |

|

|

1,675 |

|

|

|

1,255 |

|

|

Advance payments from customers |

|

|

9,918 |

|

|

|

6,878 |

|

|

Accrued expenses and other current liabilities |

|

|

12,692 |

|

|

|

12,411 |

|

| Total current liabilities |

|

|

55,002 |

|

|

|

58,608 |

|

|

Long-term debt, net of current maturities |

|

|

— |

|

|

|

489 |

|

|

Non-current deferred revenues |

|

|

3,906 |

|

|

|

2,282 |

|

|

Long-term operating lease |

|

|

3,238 |

|

|

|

1,970 |

|

|

Deferred tax liabilities |

|

|

409 |

|

|

|

391 |

|

|

Other non-current liabilities |

|

|

3,281 |

|

|

|

2,748 |

|

| Total liabilities |

|

$ |

65,836 |

|

|

$ |

66,488 |

|

| Commitments and contingencies

(Note 15) |

|

|

|

|

|

|

| Equity (Deficit): |

|

|

|

|

|

|

|

Net parent company investment |

|

|

(39,093 |

) |

|

|

(32,977 |

) |

|

Accumulated other comprehensive income |

|

|

3,179 |

|

|

|

3,923 |

|

| Total (deficit) |

|

$ |

(35,914 |

) |

|

$ |

(29,054 |

) |

| Total liabilities and

(deficit) |

|

$ |

29,922 |

|

|

$ |

37,434 |

|

|

See accompanying notes to the condensed combined financial

statements. |

|

|

|

DIH HOLDING US, INC. AND

SUBSIDIARIESINTERIM CONDENSED COMBINED STATEMENTS

OF OPERATIONS(UNAUDITED) (in

thousands) |

|

|

|

|

|

For the Six Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

$ |

27,314 |

|

|

|

$ |

17,325 |

|

| Cost of sales |

|

|

14,736 |

|

|

|

|

7,028 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

|

12,578 |

|

|

|

|

10,297 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general, and administrative expense |

|

|

13,713 |

|

|

|

|

11,837 |

|

|

Research and development |

|

|

3,763 |

|

|

|

|

3,857 |

|

| Total operating expenses |

|

|

17,476 |

|

|

|

|

15,694 |

|

| Operating loss |

|

|

(4,898 |

) |

|

|

|

(5,397 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

|

(500 |

) |

|

|

|

(411 |

) |

|

Other income (expense), net |

|

|

(430 |

) |

|

|

|

325 |

|

| Total other income (expense) |

|

|

(930 |

) |

|

|

|

(86 |

) |

| Loss before income taxes |

|

|

(5,828 |

) |

|

|

|

(5,483 |

) |

| Income tax expense (benefit) |

|

|

278 |

|

|

|

|

(34 |

) |

| Net loss |

|

$ |

(6,106 |

) |

|

|

$ |

(5,449 |

) |

|

See accompanying notes to the condensed combined financial

statements. |

|

|

|

DIH HOLDING US, INC. AND

SUBSIDIARIESINTERIM CONDENSED COMBINED STATEMENTS

OF COMPREHENSIVE LOSS(UNAUDITED) (in

thousands) |

|

|

| |

|

For the Six Months Ended September 30, |

|

| |

|

2023 |

|

2022 |

|

|

Net loss |

|

$ |

(6,106 |

) |

|

$ |

(5,449 |

) |

| Other comprehensive (loss)

income, net of tax: |

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(314 |

) |

|

|

1,486 |

|

|

Pension liability adjustments |

|

|

(430 |

) |

|

|

(226 |

) |

|

Other comprehensive (loss) income |

|

|

(744 |

) |

|

|

1,260 |

|

| Comprehensive loss |

|

$ |

(6,850 |

) |

|

$ |

(4,189 |

) |

|

See accompanying notes to the condensed combined financial

statements. |

|

|

|

DIH HOLDING US, INC. AND

SUBSIDIARIESINTERIM CONDENSED COMBINED STATEMENTS

OF CHANGES IN EQUITY (DEFICIT)(UNAUDITED) (in

thousands) |

|

|

|

|

|

Net ParentCompanyInvestment |

|

|

AccumulatedOtherComprehensiveIncome (Loss) |

|

|

|

Total Equity(Deficit) |

|

| Balance, March 31,

2022 |

|

$ |

(30,503 |

) |

|

$ |

4,081 |

|

|

|

$ |

(26,422 |

) |

| Net loss |

|

|

(5,449 |

) |

|

|

- |

|

|

|

|

(5,449 |

) |

| Other comprehensive income, net

of tax |

|

|

- |

|

|

|

1,260 |

|

|

|

|

1,260 |

|

| Net transactions with parent |

|

|

(4 |

) |

|

|

- |

|

|

|

|

(4 |

) |

| Balance, September 30,

2022 |

|

$ |

(35,956 |

) |

|

$ |

5,341 |

|

|

|

$ |

(30,615 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Net ParentCompanyInvestment |

|

|

AccumulatedOtherComprehensiveIncome (Loss) |

|

|

|

Total Equity(Deficit) |

|

| Balance, March 31,

2023 |

|

$ |

(32,977 |

) |

|

$ |

3,923 |

|

|

|

$ |

(29,054 |

) |

|

Net loss |

|

|

(6,106 |

) |

|

|

- |

|

|

|

|

|

(6,106 |

) |

| Other comprehensive loss, net of

tax |

|

|

- |

|

|

|

(744 |

) |

|

|

|

|

(744 |

) |

| Net transactions with parent |

|

|

(10 |

) |

|

|

- |

|

|

|

|

(10 |

) |

| Balance, September 30,

2023 |

|

$ |

(39,093 |

) |

|

$ |

3,179 |

|

|

|

$ |

(35,914 |

) |

|

See accompanying notes to the condensed combined financial

statements. |

|

|

|

DIH HOLDING US, INC. AND

SUBSIDIARIESINTERIM CONDENSED COMBINED STATEMENTS

OF CASH FLOWS(UNAUDITED) (in

thousands) |

|

|

|

|

|

For the Six Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(6,106 |

) |

|

$ |

(5,449 |

) |

| Adjustments to reconcile net loss

to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

211 |

|

|

|

235 |

|

|

Allowance for doubtful accounts |

|

|

(870 |

) |

|

|

97 |

|

|

Allowance for inventory obsolescence |

|

|

708 |

|

|

|

(121 |

) |

|

Gain on disposal of fixed assets |

|

|

- |

|

|

|

(3 |

) |

|

Pension contributions |

|

|

(324 |

) |

|

|

(296 |

) |

|

Pension (income) expense |

|

|

136 |

|

|

|

(245 |

) |

|

Foreign exchange (gain) loss |

|

|

428 |

|

|

|

(320 |

) |

|

Noncash lease expense |

|

|

1,000 |

|

|

|

935 |

|

|

Noncash interest expense |

|

|

2 |

|

|

|

68 |

|

|

Deferred income tax |

|

|

12 |

|

|

|

(89 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

- |

|

|

Accounts receivable |

|

|

2,004 |

|

|

|

1,996 |

|

|

Inventories |

|

|

(2,470 |

) |

|

|

(1,568 |

) |

|

Due from related parties |

|

|

- |

|

|

|

(60 |

) |

|

Due to related parties |

|

|

- |

|

|

|

(1 |

) |

|

Other assets |

|

|

(150 |

) |

|

|

(916 |

) |

|

Operating lease liabilities |

|

|

(898 |

) |

|

|

(798 |

) |

|

Accounts payable |

|

|

1,840 |

|

|

|

754 |

|

|

Employee compensation |

|

|

(81 |

) |

|

|

316 |

|

|

Other liabilities |

|

|

74 |

|

|

|

424 |

|

|

Deferred revenue |

|

|

1,604 |

|

|

|

206 |

|

|

Advance payments from customers |

|

|

2,992 |

|

|

|

7,847 |

|

|

Accrued expense and other current liabilities |

|

|

(2 |

) |

|

|

735 |

|

| Net cash provided by operating

activities |

|

|

110 |

|

|

|

3,747 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(49 |

) |

|

|

(15 |

) |

|

Proceeds from sale of property and equipment |

|

|

62 |

|

|

|

- |

|

|

Payments to related party for promissory note |

|

|

(405 |

) |

|

|

- |

|

| Net cash used in investing

activities |

|

|

(392 |

) |

|

|

(15 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

Payments on credit facilities |

|

|

(2,679 |

) |

|

|

(1,462 |

) |

|

Payments on long term debt |

|

|

(625 |

) |

|

|

(465 |

) |

| Net cash used in financing

activities |

|

|

(3,304 |

) |

|

|

(1,927 |

) |

| Effect of currency translation on

cash and cash equivalents |

|

|

99 |

|

|

|

(262 |

) |

| Net decrease in cash, and cash

equivalents, and restricted cash |

|

|

(3,487 |

) |

|

|

1,543 |

|

| Cash, and cash equivalents, and

restricted cash - beginning of year |

|

|

5,975 |

|

|

|

3,687 |

|

| Cash, and cash equivalents, and

restricted cash - end of year |

|

$ |

2,488 |

|

|

$ |

5,230 |

|

| Cash and cash equivalents - end

of year |

|

$ |

1,987 |

|

|

$ |

4,832 |

|

| Restricted cash - end of

year |

|

|

501 |

|

|

|

398 |

|

| Total cash, and cash equivalents,

and restricted cash - end of year |

|

$ |

2,488 |

|

|

$ |

5,230 |

|

| Supplemental disclosure

of cash flow information: |

|

|

|

|

|

|

|

Interest paid |

|

$ |

498 |

|

|

$ |

346 |

|

| Supplemental disclosure

of non-cash investing and financing activity: |

|

|

|

|

|

|

|

Settlement of related party receivables and payables |

|

$ |

7,322 |

|

|

$ |

- |

|

| See accompanying

notes to the condensed combined financial statements. |

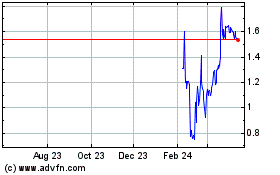

DIH Holdings US (NASDAQ:DHAI)

Historical Stock Chart

From Apr 2024 to May 2024

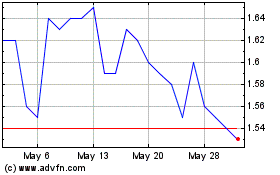

DIH Holdings US (NASDAQ:DHAI)

Historical Stock Chart

From May 2023 to May 2024