UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

MakeMyTrip Limited

(Name of Subject Company (Issuer))

MakeMyTrip Limited

(Name of Filing Person (Issuer))

0.00% Convertible Senior Notes due 2028

(Title of Class of Securities)

56087F AB0

(CUSIP Number of Class of Securities)

Mohit Kabra

Group Chief Financial Officer

19th Floor, Building No. 5

DLF Cyber City

Gurugram, India, 122002

Telephone: (+91-124) 439-5000

with copy to:

Rajiv Gupta

Stacey Wong

Latham & Watkins LLP

9 Raffles Place

#42-02 Republic Plaza

Singapore 048619

+65 6536 1161

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

|

|

☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐ |

third-party tender offer subject to Rule 14d-1. |

☒ |

issuer tender offer subject to Rule 13e-4. |

☐ |

going-private transaction subject to Rule 13e-3. |

|

|

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

2

On February 9, 2021, MakeMyTrip Limited (the “Company”) issued US$230,000,000 in aggregate principal amount of its 0.00% Convertible Senior Notes due 2028 (the “Notes”). The Notes will mature on February 15, 2028, unless earlier repurchased, redeemed or converted.

As required by, pursuant to the terms of and subject to the conditions set forth in, the Indenture dated as of February 9, 2021 (the “Indenture”) for the Notes, by and between the Company and The Bank of New York Mellon, as trustee (the “Trustee”), each holder (the “Holder”) of the Notes has the right to require the Company to repurchase the Notes on February 15, 2024 and February 15, 2026 (which is, respectively, approximately three and five years after the Notes were initially issued). The Company is the issuer of the Notes and is obligated, on the Repurchase Date (as defined in the Indenture) occurring on February 15, 2024, to purchase at par all of the Notes, if properly tendered by the Holders, subject to the terms and conditions set forth herein.

This Tender Offer Statement on Schedule TO (“Schedule TO”) is filed by the Company with respect to the right of each Holder of the Notes to require the Company to repurchase the Notes on February 15, 2024, as set forth in the Company’s Notice to the Holders dated January 17, 2024 (the “Repurchase Right Notice”) and the related notice materials filed as exhibits to this Schedule TO (which Repurchase Right Notice and related notice materials, as amended or supplemented from time to time, collectively constitute the “Repurchase Right”).

This Schedule TO is intended to satisfy the disclosure requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934 (the “Exchange Act”).

The Company is the issuer of the Notes and is obligated, on the Repurchase Date (as defined in the Indenture) occurring on February 15, 2024 to purchase all of the Notes if properly tendered by the Holders under the terms and subject to the conditions set forth in the Repurchase Right. The Notes are convertible into the Company’s Ordinary Shares, par value US$0.0005 per share (the “Ordinary Shares”) at the conversion rate of 25.8035 Ordinary Shares, subject to the terms, conditions and adjustments specified in the Indenture and the Notes. The Company maintains its principal executive office at 19th Floor, Building No. 5, DLF Cyber City, Gurugram, India, 122002, and the telephone number at this address is (+91-124) 439-5000. The Company’s registered office in the Republic of Mauritius is located at c/o IQ EQ Corporate Services (Mauritius) Limited, 33, Edith Cavell Street, Port Louis, Republic of Mauritius, 11324.

As permitted by General Instruction F to Schedule TO, all of the information set forth in the Repurchase Right is incorporated by reference into this Schedule TO.

ITEM 10. FINANCIAL STATEMENTS.

(a) Pursuant to Instruction 2 to Item 10 of Schedule TO, the Company’s financial condition is not material to a Holder’s decision whether to put the Notes to the Company because (i) the consideration being paid to Holders surrendering Notes consists solely of cash, (ii) the Repurchase Right is not subject to any financing conditions, (iii) the Company is a public reporting company under the Exchange Act that files reports electronically on EDGAR, and (iv) the Repurchase Right applies to all outstanding Notes. The financial condition and results of operations of the Company, its subsidiaries and consolidated affiliate entities are reported electronically on EDGAR on a consolidated basis.

(b) Not applicable.

ITEM 11. ADDITIONAL INFORMATION.

(a) Not applicable.

(c) The Company plans to report its fiscal 2024 third quarter unaudited interim financial and operating results before the US market opens on January 23, 2024 and expects to furnish, at that time, a Form 6-K with such earnings release with the Securities and Exchange Commission.

3

(a)(1)* Repurchase Right Notice to Holders of 0.00% Convertible Senior Notes due 2028 issued by the Company, dated as of January 17, 2024.

(a)(5)(A)* Press Release issued by the Company, dated as of January 17, 2024.

(b) Not applicable.

(d) Indenture, dated as of February 9, 2021, between the Company and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 99.1 to the Company’s Form 6-K (File No. 001-34837) as filed with the Securities and Exchange Commission on February 9, 2021).

(g) Not applicable.

(h) Not applicable.

________________________

* Filed herewith.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3.

Not applicable.

4

_________________________

* Filed herewith.

5

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

MakeMyTrip Limited

By: /s/ Rajesh Magow

Name: Rajesh Magow

Title: Group Chief Executive Officer

Dated: January 17, 2024

6

Exhibit (a)(1)

MAKEMYTRIP LIMITED

NOTICE OF REPURCHASE OF NOTES

AT OPTION OF HOLDERS

TO HOLDERS OF

0.00% CONVERTIBLE SENIOR NOTES DUE 2028

ISSUED BY

CUSIP No. 56087F AB0

Reference is made to that certain Indenture, dated as of February 9, 2021 (the “Indenture”), by and between MakeMyTrip Limited (the “Company”) and The Bank of New York Mellon, as trustee and paying agent (the “Trustee” and the “Paying Agent”), for the Company’s 0.00% Convertible Senior Notes due 2028 (the “Notes”). The Notes will mature on February 15, 2028, unless earlier repurchased, redeemed or converted. Capitalized terms used but not defined herein shall have the meaning ascribed to such terms in the Indenture.

As required by, pursuant to the terms of and subject to the conditions set forth in, the Indenture, each holder (the “Holder”) of the Notes has the right to require the Company to repurchase the Notes on February 15, 2024 and February 15, 2026 (which is, respectively, approximately three and five years after the Notes were initially issued). The Company is the issuer of the Notes and is obligated, on the Repurchase Date occurring on February 15, 2024, to purchase all of the Notes, if properly tendered by the Holders subject to the terms and conditions set forth in herein. Notice is hereby given pursuant to Section 15.01 of the Indenture that, at the option of each Holder of the Notes, the Company will repurchase such Holder’s Notes or any portion of the principal thereof that is equal to US$1,000 or an integral multiple thereof at a repurchase price (the “Repurchase Price”) equal to 100% of the principal amount of the Notes to be repurchased, plus any accrued and unpaid Special Interest, if and to the extent such Special Interest is payable pursuant to the terms of the Indenture, to, but excluding, February 15, 2024, subject to the terms and conditions of the Indenture, the Notes, and this Repurchase Right Notice and related notice materials, as amended and supplemented from time to time (the “Repurchase Right”). As of the date hereof, no such Special Interest is payable on the Notes or is expected by the Company to be payable on the Repurchase Date. To exercise its Repurchase Right, a Holder must deliver a Repurchase Notice (as further described in this Repurchase Right Notice) at any time between 9:00 a.m., New York City time, on Thursday, January 18, 2024 and 5:00 p.m., New York City time, on Tuesday, February 13, 2024 (the “Expiration Date”), which is the second Business Day immediately preceding the Repurchase Date.

To exercise your Repurchase Right and receive the Repurchase Price, you must deliver the Notes through the transmittal procedures of the Depository Trust Company (“DTC”) prior to 5:00 p.m., New York City time, on the Expiration Date. Notes delivered through the transmittal procedures of the DTC for purchase may be withdrawn at any time prior to 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date, by complying with the withdrawal procedures of the DTC. The surrender by a Holder of any Notes to the DTC via the transmittal procedures of the DTC’s Automated Tender Offer Program will constitute delivery of a Repurchase Notice that satisfies such Holder’s notice requirements for its exercise of its Repurchase Right.

The Trustee has informed the Company that, as of the date of this Repurchase Right Notice, all custodians and beneficial holders of the Notes hold the Notes through the DTC accounts and that there are no certificated Notes in non-global form.

The name and addresses for the Conversion Agent and Paying Agent are as follows:

Paying Agent:

The Bank of New York Mellon

By Mail, Overnight Courier, or Email:

BNY Mellon

ATTN: CT REORG

1

111 Sanders Creek Pkwy

E. Syracuse, NY 13057

CT_Reorg_Unit_Inquiries@bnymellon.com

By Facsimile (for Eligible Institutions only):

+1 (732) 667-9408

For Information or Confirmation by Telephone:

+1 (315) 414-3317

Conversion Agent:

The Bank of New York Mellon

240 Greenwich Street, New York, NY 10286, USA

Facsimile No.: +1-212-815-5915

Attention: Global Corporate Trust – MakeMyTrip Limited

Additional copies of this Repurchase Right Notice may be obtained from the Paying Agent at its addresses set forth above.

Very truly yours,

MakeMyTrip Limited

By: /s/ Rajesh Magow

Name: Rajesh Magow

Title: Group Chief Executive Officer

Dated: January 17, 2024

2

TABLE OF CONTENTS

|

|

SUMMARY TERM SHEET |

5 |

IMPORTANT INFORMATION CONCERNING THE REPURCHASE RIGHT |

9 |

1. Information Concerning the Company |

9 |

2. Information Concerning the Notes |

9 |

2.1 Interest |

9 |

2.2 The Company’s Obligation to Purchase the Notes |

9 |

2.3 Repurchase Price |

9 |

2.4 Source of Funds |

10 |

2.5 Conversion Rights of the Notes |

10 |

2.6 Market for the Notes and the Company’s ADSs |

10 |

2.7 Redemption |

11 |

2.8 Ranking |

11 |

3. Procedures to Be Followed by Holders Electing to Exercise the Repurchase Right |

11 |

3.1 Method of Delivery |

11 |

3.2 Agreement to Be Bound by the Terms of the Repurchase Right |

12 |

3.3 Exercise of Repurchase Right; Delivery of Notes |

13 |

4. Right of Withdrawal |

13 |

5. Payment for Surrendered Notes |

14 |

6. Notes Acquired |

14 |

7. Plans or Proposals of the Company |

14 |

8. Interests of Directors, Executive Officers and Affiliates of the Company in the Notes |

15 |

9. Agreements Involving the Company’s Securities |

15 |

10. U.S. Federal Income Tax Considerations |

15 |

11. Additional Information |

17 |

12. No Solicitation |

17 |

13. Definitions |

18 |

14. Conflicts |

18 |

No person has been authorized to give any information or to make any representation other than those contained in this Repurchase Right Notice and, if given or made, such information or representation must not be relied upon as having been authorized. You should not assume that the information contained in this Repurchase Right Notice is accurate as of any date other than the date on the front of this Repurchase Right Notice. This Repurchase Right Notice

3

does not constitute an offer to buy or the solicitation of an offer to sell securities in any circumstances or jurisdiction in which such offer or solicitation is unlawful. The delivery of this Repurchase Right Notice shall not under any circumstances create any implication that the information contained in this Repurchase Right Notice is current as of any time subsequent to the date of such information. None of the Company, its board of directors, or its executive management is making any representation or recommendation to any Holder as to whether or not to exercise the Repurchase Right. You should consult your financial and tax advisors and must make your own decision as to whether to exercise the Repurchase Right and, if so, the principal amount of Notes for which the Repurchase Right should be exercised.

4

SUMMARY TERM SHEET

The following are answers to some of the questions that you may have about the Repurchase Right. To understand the Repurchase Right fully and for a more complete description of the terms of the Repurchase Right, we urge you to carefully read the remainder of this Repurchase Right Notice because the information in this summary is not complete. We have included page references to direct you to a more complete description of the topics in this summary.

Who is offering to purchase my Notes?

MakeMyTrip Limited, a Mauritius company (the “Company”), is obligated to purchase those 0.00% Convertible Senior Notes due 2028 with respect to which you validly exercise your Repurchase Right. (Page 9)

Why is the Company offering to purchase my Notes?

The right of each Holder of the Notes to sell and the obligation of the Company to purchase such Holder’s Notes pursuant to the Repurchase Right at the time described in this Repurchase Right Notice is a term of the Notes and has been a right of the Holders from the time the Notes were initially issued on February 9, 2021. We are required, on the Repurchase Date occurring on February 15, 2024 (which is approximately three years after the Notes were initially issued under the Indenture), to repurchase at par the Notes, if properly tendered by any Holder in exercise of its Repurchase Right pursuant to the terms of the Notes and the Indenture. (Page 9)

Which of the Notes is the Company obligated to purchase?

We are obligated to purchase all of the Notes surrendered (and not withdrawn) by any Holder through the facilities of, and in accordance with the procedures of, the Depository Trust Company (“DTC”) prior to 5:00 p.m., New York City time, on the Expiration Date in compliance with the Repurchase Right Notice. As of January 12, 2024, US$230,000,000.00 in aggregate principal amount of the Notes was outstanding. The Notes were issued under the Indenture, dated as of February 9, 2021 (the “Indenture”), by and between the Company and The Bank of New York Mellon, as trustee and paying agent (the “Trustee” and the “Paying Agent”). The surrender by a Holder of any Notes to the DTC via the transmittal procedures of the DTC’s Automated Tender Offer Program will constitute delivery of a Repurchase Notice that satisfies such Holder’s notice requirements for its exercise of its Repurchase Right. (Pages 9, 11-12)

How much will the Company pay and what is the form of payment?

Pursuant to the terms of the Indenture and the Notes, we will pay, in cash, a repurchase price (the “Repurchase Price”) equal to 100% of the principal amount of the Notes, plus any accrued and unpaid Special Interest, if and to the extent such Special Interest is payable pursuant to the terms of the Indenture, to, but excluding, February 15, 2024, which is the date specified for repurchase in the Indenture (the “Repurchase Date”), with respect to any and all Notes validly surrendered for repurchase and not withdrawn; provided that such accrued and unpaid Special Interest, if any, will not be paid to the Holder submitting the Notes for repurchase on February 15, 2024 but will be paid to the Holder of record as of 5:00 p.m., New York City time, on Thursday, February 1, 2024. As of the date hereof, no such Special Interest is payable on the Notes or is expected by the Company to be payable on the Repurchase Date. (Pages 9-10, 14)

Can the Company redeem the Notes?

Subject to the provisions of the Indenture, the Company may, at its option, on not less than 35 days’ nor more than 60 days’ prior notice, redeem all but not part of the Notes (except in respect of certain Holders that elect otherwise as described in the Indenture) in connection with certain changes in tax laws, as set forth in the definition of “Tax Redemption” in the Indenture, at a redemption price equal to 100% of the principal amount plus accrued and unpaid Special Interest, if any, to, but not including, the redemption date as described in the Indenture. Upon receiving such notice of redemption, each Holder will have the right to elect to not have its Notes redeemed, subject to the provisions of the Indenture. (Page 11)

5

What are my rights to convert my Notes at this time?

Subject to and upon compliance with the provisions of the Indenture, a Holder has the right, at such Holder’s option, to convert all or any portion (if the portion to be converted is US$1,000 principal amount or an integral multiple thereof) of such Note at any time prior to 5:00 p.m., New York City time, on Friday, February 11, 2028 into Ordinary Shares at the conversion rate of 25.8035 Ordinary Shares (subject to certain adjustments, the “Conversion Rate”) per US$1,000 principal amount of Notes (subject to certain settlement provisions, the “Conversion Obligation”). If a Holder has already delivered a Repurchase Notice with respect to a Note, such Holder may not surrender that Note for conversion until the Holder has withdrawn the applicable Repurchase Notice in accordance with the Indenture. The conversion of your Notes is subject to the provisions regarding conversion contained in the Indenture and the Notes and, in respect of Notes in the global form, the applicable procedures of the DTC.

Generally, if you exercise the conversion right and the price per Ordinary Share is less than the Conversion Price at the time when the Conversion Obligation is settled in accordance with the Indenture, the value of the consideration that you receive in exchange for your converted Notes will be less than the aggregate principal amount of your converted Notes. The Conversion Price at any given time is computed by dividing US$1,000 by the applicable Conversion Rate at such time. (Page 10)

How will the Company fund the purchase of the Notes?

The Company plans to use its cash balance as of the Repurchase Date to fund the repurchase of the Notes. There are no alternative financing arrangements or financing plans for funding the Repurchase Right. (Page 10)

How can I determine the market value of the Notes?

There is no established reporting system or market for trading in the Notes. To the extent that the Notes are traded, prices of the Notes may fluctuate widely depending on trading volume, the balance between buy and sell orders, prevailing interest rates, the Company’s operating results, the market price and implied volatility of the Company’s Ordinary Shares, and the market for similar securities. To the extent available, Holders are urged to obtain current market quotations for the Notes and assess their other alternatives, such as converting the Notes or continuing to hold the Notes, prior to making any decision with respect to the Repurchase Right. (Pages 10-11)

What does the board of directors of the Company think of the Repurchase Right?

The board of directors of the Company has not made any recommendation as to whether you should exercise the Repurchase Right. You must make your own decision whether to exercise the Repurchase Right and, if so, the principal amount of Notes for which the Repurchase Right should be exercised. (Page 10)

When does the Repurchase Right expire?

Your right to exercise the Repurchase Right expires at 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date. We will not extend the period, unless required to do so by U.S. federal securities law. (Page 11)

What are the conditions to the purchase by the Company of the Notes?

Our purchase of Notes for which the Repurchase Right is validly exercised is not subject to any condition other than such purchase being lawful, the relevant Notes being surrendered, and the procedural requirements described in this Repurchase Right Notice being satisfied. (Page 9)

How do I exercise the Repurchase Right?

The Trustee has informed the Company that, as of the date of this Repurchase Right Notice, all custodians and beneficial holders of the Notes hold the Notes through the DTC accounts and that there are no certificated Notes in non-global form. Accordingly, you may exercise the Repurchase Right with respect to your Notes held through the DTC, prior to 5:00 p.m., New York City time, on the Expiration Date, in the following manner

6

If your Notes are held through a broker, dealer, commercial bank, trust company, or other nominee, you must contact such nominee if you desire to exercise the Repurchase Right and instruct such nominee to exercise the Repurchase Right by surrendering the Notes on your behalf through the transmittal procedures of the DTC’s Automated Tender Offer Program (“ATOP”) before 5:00 p.m., New York City time, on the Expiration Date; or

If you are a DTC participant and hold your Notes through the DTC directly, you must surrender your Notes electronically through ATOP before 5:00 p.m., New York City time, on the Expiration Date, subject to the terms and procedures of ATOP, if you desire to exercise the Repurchase Right.

While we do not expect any Notes to be issued to a Holder other than the DTC or its nominee in physical certificates after the date hereof, in the event that physical certificates evidencing the Notes are issued to such a Holder, any such Holder who desires to tender Notes pursuant to the Repurchase Right and holds physical certificates evidencing such Notes must complete and sign a Repurchase Notice in the form attached hereto as Annex A (a “Repurchase Notice”) in accordance with the instructions set forth therein, have the signature thereon guaranteed and timely deliver such manually signed Repurchase Notice, together with the certificates evidencing the Notes being tendered and all necessary endorsements, to the Paying Agent.

By surrendering your Notes through the transmittal procedures of the DTC or to the Paying Agent, as applicable, you agree to be bound by the terms of the Repurchase Right set forth in this Repurchase Right Notice. (Pages 11-13)

HOLDERS THAT HOLD NOTES THROUGH THE DTC ACCOUNTS MAY ONLY EXERCISE THE REPURCHASE RIGHT BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF THE DTC AND SHOULD NOT SUBMIT A PHYSICAL REPURCHASE NOTICE.

If I exercise the Repurchase Right, when will I receive payment for my Notes?

We will forward the appropriate amount of cash required to pay the Repurchase Price for your Notes surrendered in the exercise of the Repurchase Right prior to 5:00 p.m., New York City time on the Expiration Date, to the Paying Agent, prior to 10:00 a.m., New York City time, on Thursday, February 15, 2024, which is the Repurchase Date, and the Paying Agent will promptly distribute the consideration to the DTC, the sole Holder of record of the Notes. The DTC will thereafter distribute the cash to its participants in accordance with its procedures. To the extent that you are not a DTC participant, your broker, dealer, commercial bank, trust company, or other nominee, as the case may be, will distribute the cash to you. (Page 14)

Until what time may I withdraw my previous exercise of the Repurchase Right?

You may withdraw your exercise of the Repurchase Right with respect to any Notes at any time until 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date. (Page 13)

How do I withdraw my previous exercise of the Repurchase Right?

To withdraw your previous exercise of the Repurchase Right with respect to any Notes, you must comply with the withdrawal procedures of the DTC prior to 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date. While the Trustee has informed us that there are currently no certificated Notes in non-global form, in the event that after the date hereof physical certificates evidencing the Notes are issued to a Holder other than the DTC or its nominee, any such Holder who desires to withdraw any Notes evidenced by physical certificates with respect to which a Repurchase Notice was previously delivered must, instead of complying with the DTC withdrawal procedures, complete and sign a notice of withdrawal specifying (i) the principal amount of the Notes with respect to which such notice of withdrawal is being submitted, which portion must be US$1,000 aggregate principal amount or an integral multiple thereof, (ii) the certificate numbers of the Notes in respect of which such notice of withdrawal is being submitted, and (iii) the principal amount, if any, of such Note which remains subject to the Repurchase Notice, which portion must be US$1,000 aggregate principal amount or an integral multiple thereof, and deliver such manually signed notice of withdrawal to the Paying Agent prior to 5:00 p.m., New York City time, on the Expiration Date. (Pages 13-14)

7

HOLDERS THAT HOLD NOTES THROUGH THE DTC ACCOUNTS MAY ONLY WITHDRAW THEIR PREVIOUS EXERCISE OF THE REPURCHASE RIGHT WITH RESPECT TO SUCH NOTES BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF THE DTC AND SHOULD NOT SUBMIT A PHYSICAL NOTICE OF WITHDRAWAL.

Do I need to do anything if I do not wish to exercise the Repurchase Right?

No. If you do not exercise the Repurchase Right before the expiration of the Repurchase Right, we will not purchase your Notes on the Repurchase Date and such Notes will remain outstanding subject to their existing terms. (Page 11)

If I choose to exercise the Repurchase Right, do I have to exercise the Repurchase Right with respect to all of my Notes?

No. You may exercise the Repurchase Right with respect to all of your Notes or any portion of your Notes. If you wish to exercise the Repurchase Right with respect to a portion of your Notes, you must exercise the Repurchase Right with respect to Notes for a principal amount of US$1,000 or an integral multiple thereof. (Pages 10-11)

If I do not exercise the Repurchase Right, will I continue to be able to exercise my conversion rights?

Yes. If you do not exercise the Repurchase Right, your conversion rights will not be affected. You will continue to have the conversion rights subject to the terms, conditions, and adjustments specified in the Indenture and the Notes. (Pages 10-11)

If I exercise the Repurchase Right, will my receipt of cash for Notes with respect to which I exercised the Repurchase Right be a taxable transaction for U.S. federal income tax purposes?

Yes. The receipt of cash for Notes pursuant to an exercise of the Repurchase Right will be a taxable transaction for U.S. federal income tax purposes. You should consult with your tax advisor regarding the U.S. federal income tax considerations to you of the receipt of cash for Notes pursuant to an exercise of the Repurchase Right. (Pages 15-17)

Who is the Paying Agent?

The Bank of New York Mellon, the Trustee under the Indenture, is serving as Paying Agent in connection with the Repurchase Right. Its address and telephone number are set forth on the front cover page of this Repurchase Right Notice.

Whom can I talk to if I have questions about the Repurchase Right?

Questions and requests for assistance in connection with the exercise of the Repurchase Right may be directed to the Investor Relations Department by calling 1-800-962-4284 from within the U.S. or 781-575-3120 from outside the U.S. or by emailing vipul.garg@go-mmt.com.

8

IMPORTANT INFORMATION CONCERNING THE REPURCHASE RIGHT

1. Information Concerning the Company.

MakeMyTrip Limited is India's leading travel group operating well-recognized travel brands including MakeMyTrip, Goibibo and redBus. Through our primary websites www.makemytrip.com, www.goibibo.com, www.redbus.in, and mobile platforms, travellers can research, plan and book a wide range of travel services and products in India as well as overseas. Our services and products include air ticketing, hotel and alternative accommodations bookings, holiday planning and packaging, rail ticketing, bus ticketing, car hire and ancillary travel requirements such as facilitating access to third-party travel insurance, visa processing and foreign exchange.

We provide our customers with access to all major domestic full-service and low-cost airlines operating in India and all major airlines operating to and from India, a comprehensive set of domestic accommodation properties in India and a wide selection of properties outside of India, Indian Railways and all major Indian bus operators. For more information, visit https://www.makemytrip.com/about-us/company_profile.php.

2. Information Concerning the Notes.

The Notes were issued under the Indenture. The Notes mature on February 15, 2028.

2.1 Interest.

The Notes do not bear regular interest. Special Interest, if any, is payable semi-annually in arrears on each February 15 and August 15, commencing on August 15, 2021, if any Special Interest if then payable, to Holders of record at the close of business on the preceding February 1 and August 1 (whether or not such day is a Business Day), respectively. If payable, Special Interest on the Notes, if any, shall be computed on the basis of a 360-day year composed of twelve 30-day months and, for partial months, on the basis of actual days elapsed over a 30-day month. As of the date hereof, no such Special Interest is payable on the Notes or is expected by the Company to be payable on the Repurchase Date. Unless the Company fails to make the payment of the Repurchase Price for Notes for which a Repurchase Notice has been submitted and not properly withdrawn, such Notes will no longer be outstanding and, to the extent any Special Interest is then payable on the Notes, such Special Interest on the Notes will cease to accrue on and after the Repurchase Date.

2.2 The Company’s Obligation to Purchase the Notes.

Pursuant to the terms of the Indenture and the Notes, on February 15, 2024, which is the Repurchase Date, the Company is obligated to purchase all Notes for which the Repurchase Right has been timely exercised and not withdrawn by the Holders. This Repurchase Right will expire at 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date. The terms and conditions of the Indenture and Notes require Holders that choose to exercise the Repurchase Right to do so by 5:00 p.m., New York City time, on the Expiration Date, and we do not expect to extend the period that Holders have to exercise the Repurchase Right unless required to do so by U.S. federal securities law. Regardless of whether we extend this period, the Indenture does not provide us with the right to delay the Repurchase Date. The purchase by the Company of Notes for which the Repurchase Right is validly exercised is not subject to any condition other than such purchase being lawful, the relevant Notes being surrendered, and the procedural requirements described in this Repurchase Right Notice being satisfied. You may only exercise the Repurchase Right with respect to Notes in principal amounts equal to US$1,000 or integral multiples thereof.

2.3 Repurchase Price.

The Repurchase Price to be paid by the Company with respect to any and all Notes validly surrendered for repurchase and not withdrawn on the Repurchase Date is equal to 100% of the principal amount of the Notes, plus any accrued and unpaid Special Interest, if and to the extent such Special Interest is payable pursuant to the terms of the Indenture, to, but excluding, February 15, 2024; provided that such accrued and unpaid Special Interest, if any, will not be paid to the Holder submitting the Notes for repurchase on February 15, 2024 but will be paid to the Holder of record as of 5:00 p.m., New York City time, on Thursday, February 1, 2024. Pursuant

9

to the terms of the Indenture and the Notes, on February 15, 2024, which is the Repurchase Date, the Company will pay accrued and unpaid Special Interest, if any, on all of the Notes through February 14, 2024, to all Holders who were Holders of record as of 5:00 p.m., New York City time, on Thursday, February 1, 2024, regardless of whether the Repurchase Right is exercised with respect to such Notes. As a result, there will be no accrued and unpaid Special Interest on the Notes on February 15, 2024. As of the date hereof, no such Special Interest is payable on the Notes or is expected by the Company to be payable on the Repurchase Date. The Repurchase Price will be paid in cash with respect to any and all Notes validly surrendered for repurchase and not withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date.

The Repurchase Price, which will be paid in cash, is based solely on the requirements of the Indenture and the Notes and bears no relationship to the market price of the Notes or the Ordinary Shares. Thus, the Repurchase Price may be significantly greater or less than the market price of the Notes on the Repurchase Date. Holders are urged to obtain the best available information as to potential current market prices of the Notes, to the extent available, and the Ordinary Shares before making a decision whether to exercise the Repurchase Right.

None of the Company, its board of directors or its executive management is making any recommendation to Holders as to whether to exercise the Repurchase Right or refrain from exercising the Repurchase Right. Each Holder must make such Holder’s own decision whether to exercise the Repurchase Right with respect to such Holder’s Notes and, if so, the principal amount of Notes for which the Repurchase Right should be exercised.

2.4 Source of Funds.

If the Repurchase Right is exercised for any Notes, the Company plans to use its cash balance as of the Repurchase Date to pay the Repurchase Price for the Notes. There are no alternative financing arrangements or financing plans for funding the Repurchase Right.

2.5 Conversion Rights of the Notes.

Subject to and upon compliance with the provisions of the Indenture, a Holder will have the right, at such Holder’s option, to convert all or any portion (if the portion to be converted is US$1,000 principal amount or an integral multiple thereof) of such Note at any time prior to 5:00 p.m., New York City time, Friday, February 11, 2028 at the conversion rate of 25.8035 Ordinary Shares (subject to certain adjustments) per US$1,000 principal amount of Notes. If a Holder has already delivered a Repurchase Notice with respect to a Note, such Holder may not surrender that Note for conversion until the Holder has withdrawn the applicable Repurchase Notice in accordance with the Indenture. The conversion of your Notes is subject to the provisions regarding conversion contained in the Indenture and the Notes.

Generally, if you exercise the conversion right and the price per Ordinary Share is less than the Conversion Price at the time when the Conversion Obligation is settled in accordance with the Indenture, the value of the consideration that you receive in exchange for your converted Notes will be less than the aggregate principal amount of your converted Notes. The Conversion Price at any given time is computed by dividing US$1,000 by the applicable Conversion Rate at such time.

2.6 Market for the Notes and the Company’s Ordinary Shares.

There is no established reporting system or market for trading in the Notes. To the extent that the Notes are traded, prices of the Notes may fluctuate widely depending on trading volume, the balance between buy and sell orders, prevailing interest rates, the Company’s operating results, the market price and implied volatility of the Company’s Ordinary Shares, and the market for similar securities. To the extent available, Holders are urged to obtain current market quotations for the Notes and assess their other alternatives, such as converting the Notes or continuing to hold the Notes, prior to making any decision with respect to the Repurchase Right. As of January 12, 2024, US$230,000,000.00 in aggregate principal amount of the Notes was outstanding.

The Company’s Ordinary Shares into which the Notes are convertible are listed on the NASDAQ Global Market under the ticker symbol “MMYT.” The following table sets forth, for the calendar quarters indicated, the highest and lowest trading prices of the Ordinary Shares during the respective periods.

10

|

|

|

Quarter Ended |

High |

Low |

|

(US$) |

First Quarter 2022 |

29.42 |

20.06 |

Second Quarter 2022 |

29.56 |

21.36 |

Third Quarter 2022 |

34.68 |

24.76 |

Fourth Quarter 2022 |

33.70 |

26.06 |

First Quarter 2023 |

31.06 |

23.59 |

Second Quarter 2023 |

28.92 |

22.50 |

Third Quarter 2023 |

41.47 |

25.76 |

Fourth Quarter 2023 |

47.39 |

36.81 |

Source - MMYT Historical Data, available on nasdaq.com (last checked January 16, 2024)

On January 16, 2024, the Last Reported Sale Price of the Ordinary Shares was US$47.66 per Ordinary Share. As of December 31, 2023, there were approximately 69,396,934 Ordinary Shares and 39,667,911 Class B Ordinary Shares outstanding. We urge you to obtain current market information for the Notes, to the extent available, and the Ordinary Shares before making any decision to exercise the Repurchase Right.

2.7 Redemption.

Subject to the provisions of the Indenture, the Company may, at its option, on not less than 35 days’ nor more than 60 days’ prior notice, redeem all but not part of the Notes (except in respect of certain Holders that elect otherwise as described in the Indenture) in connection with certain changes in tax laws, as set forth in the definition of “Tax Redemption” in the Indenture, at a redemption price equal to 100% of the principal amount plus accrued and unpaid Special Interest, if any, to, but not including, the redemption date as described in the Indenture. Upon receiving such notice of redemption, each Holder will have the right to elect to not have its Notes redeemed, subject to the provisions of the Indenture.

2.8 Ranking.

The Notes are senior unsecured obligations of the Company, ranking senior in right of payment to any of the Company’s indebtedness that is expressly subordinated in right of payment to the notes, and equal in right of payment to any of the Company’s unsecured indebtedness that is not so subordinated. The Notes are effectively junior in right of payment to any of the Company’s secured indebtedness to the extent of the value of the assets securing such indebtedness, and effectively junior to all indebtedness and other liabilities (including trade payables) of the Company’s subsidiaries and consolidated affiliated entities.

3. Procedures to Be Followed by Holders Electing to Exercise the Repurchase Right.

Holders will not be entitled to receive the Repurchase Price for their Notes unless they elect to exercise the Repurchase Right by delivering their Repurchase Notice on or before 5:00 p.m., New York City time, on the Expiration Date and have not withdrawn the Repurchase Notice prior to 5:00 p.m., New York City time, on the Expiration Date. Holders may exercise the Repurchase Right with respect to some or all of their Notes. Any Repurchase Notice must specify a principal amount of Notes to be purchased by the Company of US$1,000 or an integral multiple thereof. If Holders do not elect to exercise the Repurchase Right, their Notes will remain outstanding subject to the existing terms of the Indenture and the Notes.

3.1 Method of Delivery.

The Trustee has informed the Company that, as of the date of this Repurchase Right Notice, all custodians and beneficial holders of the Notes hold the Notes through the DTC accounts and that there are no certificated Notes in non-global form. Accordingly, unless physical certificates are issued following the date hereof, all Notes surrendered for repurchase hereunder must be delivered through the DTC’s ATOP system. Valid delivery of Notes via ATOP will constitute delivery of a Repurchase Notice that satisfies such Holder’s notice requirements for its exercise of its Repurchase Right. Delivery of Notes and all other required documents, including delivery and acceptance through ATOP, is at the election and risk of the person surrendering such Notes.

11

HOLDERS THAT HOLD NOTES THROUGH THE DTC ACCOUNTS MAY ONLY EXERCISE THE REPURCHASE RIGHT BY COMPLYING WITH THE TRANSMITTAL PROCEDURES OF THE DTC AND SHOULD NOT SUBMIT A PHYSICAL REPURCHASE NOTICE.

3.2 Agreement to Be Bound by the Terms of the Repurchase Right.

By exercising the Repurchase Right with respect to any portion of your Notes, you acknowledge and agree as follows:

such Notes shall be purchased as of the Repurchase Date pursuant to the terms and conditions set forth in this Repurchase Right Notice;

you agree to all of the terms of this Repurchase Right Notice;

you have received this Repurchase Right Notice and acknowledge that this Repurchase Right Notice provides the notice required pursuant to the Indenture;

upon the terms and subject to the conditions set forth in this Repurchase Right Notice, the Indenture, and the Notes, and effective upon the acceptance for payment thereof, you (i) irrevocably sell, assign, and transfer to the Company all right, title, and interest in and to all the Notes surrendered, (ii) release and discharge the Company and its directors, officers, employees, and affiliates from any and all claims you may now have, or may have in the future, arising out of, or related to, the Notes, including, without limitation, any claims that you are entitled to receive additional principal or interest payments with respect to the Notes or to participate in any redemption or defeasance of the Notes, and (iii) irrevocably constitute and appoint the Paying Agent as your true and lawful agent and attorney-in-fact with respect to any such surrendered Notes, with full power of substitution and resubstitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (a) deliver certificates representing such Notes, or transfer ownership of such Notes on the account books maintained by the DTC, together, in any such case, with all accompanying evidences of transfer and authenticity, to the Company, (b) present such Notes for transfer on the relevant security register, and (c) receive all benefits or otherwise exercise all rights of beneficial ownership of such Notes (except that the Paying Agent will have no rights to, or control over, funds from the Company, except as agent for the Company for the Repurchase Price of any surrendered Notes that are purchased by the Company), in accordance with the terms set forth in this Repurchase Right Notice;

you represent and warrant that you (i) own the Notes surrendered and are entitled to surrender such Notes and (ii) have full power and authority to surrender, sell, assign, and transfer the Notes surrendered hereby and that when such Notes are accepted for purchase and payment by the Company, the Company will acquire good title thereto, free and clear of all liens, restrictions, charges, and encumbrances and not subject to any adverse claim or right;

you agree, upon request from the Company, to execute and deliver any additional transfer documents deemed by the Paying Agent or the Company to be necessary or desirable to complete the sale, assignment, and transfer of the Notes surrendered;

you understand that all Notes properly surrendered for purchase prior to 5:00 p.m., New York City time, on the Expiration Date for which a Repurchase Notice has been delivered and not withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date, will be purchased at the Repurchase Price, in cash, pursuant to the terms and conditions of the Indenture, the Notes, this Repurchase Right Notice, and related notice materials, as amended and supplemented from time to time;

surrendered Notes may be withdrawn by complying with the withdrawal procedures of the DTC at any time prior to 5:00 p.m., New York City time, on the Expiration Date; and

12

all authority conferred or agreed to be conferred pursuant to your exercise of the Repurchase Right hereby shall survive your death or incapacity and every obligation of yours shall be binding upon your heirs, personal representatives, executors, administrators, successors, assigns, trustees in bankruptcy, and other legal representatives.

3.3 Exercise of Repurchase Right; Delivery of Notes.

Notes Held Through a Custodian. If you wish to exercise the Repurchase Right with respect to any of your Notes and your Notes are held by a broker, dealer, commercial bank, trust company, or other nominee, you must contact such nominee and instruct such nominee to surrender the Notes for purchase on your behalf through the transmittal procedures of the DTC as set forth below in “Notes Held by a DTC Participant” on or prior to the deadline set by such nominee to permit such nominee to surrender the Notes by 5:00 p.m., New York City time, on the Expiration Date.

Notes Held by a DTC Participant. If you are a DTC participant who wishes to exercise the Repurchase Right with respect to any of your Notes, you must electronically transmit your acceptance through the DTC’s ATOP system, subject to the terms and procedures of that system, on or prior to 5:00 p.m., New York City time, on the Expiration Date.

In exercising the Repurchase Right through ATOP, the electronic instructions sent to the DTC by you or by a broker, dealer, commercial bank, trust company, or other nominee on your behalf, and transmitted by the DTC to the Paying Agent, will acknowledge, on behalf of you and the DTC, your receipt of and agreement to be bound by the terms of the Repurchase Right, including those set forth above under 3.2 — “Agreement to Be Bound by the Terms of the Repurchase Right.”

Notes Held in Certificated Non-Global Form. While we do not expect any Notes to be issued to a Holder other than the DTC or its nominee in physical certificates after the date hereof, in the event that physical certificates evidencing the Notes are issued to such a Holder, then, in order to exercise the Repurchase Right with respect to such Notes, any such Holder of the Notes must complete and sign a Repurchase Notice in the form attached hereto as Annex A in accordance with the instructions set forth therein, have the signature thereon guaranteed and deliver such manually signed Repurchase Notice to the Paying Agent prior to 5:00 p.m., New York City time, on the Expiration Date. For such a Holder to receive payment of the Repurchase Price for such Notes with respect to the Repurchase Right was exercised, the Holder must deliver such Notes to the Paying Agent prior to, 5:00 p.m. New York City time on the Expiration Date together with all necessary endorsements.

All signatures on a Repurchase Notice and endorsing the Notes must be guaranteed by a recognized participant in the Securities Transfer Agents Medallion Program, the NYSE Medallion Signature Program, or the Stock Exchange Medallion Program (each, an “Eligible Institution” ); provided, however, that signatures need not be guaranteed if such Notes are tendered for the account of an Eligible Institution. If a Repurchase Notice or any Note is signed by a trustee, executor, administrator, guardian, attorney-in-fact, agent, officer of a corporation, or other person acting in a fiduciary or representative capacity, such person must so indicate when signing, and proper evidence satisfactory to the Company of the authority of such person so to act must be submitted.

You bear the risk of untimely surrender of your Notes. You must allow sufficient time for completion of the necessary the DTC or Paying Agent procedures, as applicable, before 5:00 p.m., New York City time, on the Expiration Date.

4. Right of Withdrawal.

You may withdraw your previous exercise of the Repurchase Right with respect to any Notes at any time prior to 5:00 p.m., New York City time, on the Expiration Date, which is the second Business Day immediately preceding the Repurchase Date.

Except as described below with respect to Notes, if any, for which physical certificates are issued to a Holder other than the DTC or its nominee, in order to withdraw your previous exercise of the Repurchase Right, you must comply with the withdrawal procedures of the DTC prior to 5:00 p.m., New York City time, on the

13

Expiration Date. This means you must deliver, or cause to be delivered, a valid withdrawal request through the ATOP system before 5:00 p.m., New York City time, on the Expiration Date.

If after the date hereof physical certificates evidencing the Notes are issued to a Holder other than the DTC or its nominee, any such Holder who desires to withdraw any previously surrendered Notes evidenced by physical certificates must, instead of complying with the DTC withdrawal procedures, complete and sign a notice of withdrawal specifying (i) the principal amount of the Notes with respect to which such notice of withdrawal is being submitted, which portion must be US$1,000 aggregate principal amount or an integral multiple thereof, (ii) the certificate numbers of the Notes in respect of which such notice of withdrawal is being submitted, and (iii) the principal amount, if any, of such Note which remains subject to the Repurchase Notice, which portion must be US$1,000 aggregate principal amount or an integral multiple thereof, and deliver such manually signed notice of withdrawal to the Paying Agent prior to 5:00 p.m., New York City time, on the Expiration Date.

In addition, pursuant to Rule 13e-4(f)(2)(ii) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), Holders are advised that if they timely surrender Notes for purchase under the Repurchase Right, they are also permitted to withdraw such Notes on Thursday, March 14, 2024 (New York City time) in the event that we have not yet accepted the Notes for payment as of that time. Pursuant to the Indenture, we are required to forward the appropriate amount of cash required to pay the Repurchase Price for your Notes to the Paying Agent, prior to 10:00 a.m., New York City time, on Thursday, February 15, 2024, which is the Repurchase Date.

You may exercise the Repurchase Right with respect to Notes for which your election to exercise your Repurchase Right had been previously withdrawn, by following the procedures described in Section 3 above. We will determine all questions as to the validity, form and eligibility, including time of receipt, of notices of withdrawal.

You bear the risk of untimely withdrawal of your Notes. You must allow sufficient time for completion of the necessary DTC or Paying Agent procedures by withdrawing before 5:00 p.m., New York City time, on the Expiration Date.

5. Payment for Surrendered Notes.

We will forward to the Paying Agent, prior to 10:00 a.m., New York City time, on Thursday, February 15, 2024, which is the Repurchase Date, the appropriate amount of cash required to pay the Repurchase Price for your Notes, and the Paying Agent will promptly distribute the consideration to the DTC, the sole Holder of record of the Notes. The DTC will thereafter distribute the cash to its participants in accordance with its procedures. To the extent that you are not a DTC participant, your broker, dealer, commercial bank, trust company, or other nominee, as the case may be, will distribute the cash to you.

The total amount of consideration required by us to repurchase all of the Notes is US$230,000,000.00 (assuming all of the Notes are validly surrendered for repurchase and accepted for payment).

6. Notes Acquired.

Any Notes repurchased by us pursuant to the Repurchase Right will be cancelled by the Trustee, pursuant to the terms of the Indenture.

7. Plans or Proposals of the Company.

Except as publicly disclosed on or prior to the date of this Repurchase Right Notice, neither the Company nor its directors and executive officers currently has any plans, proposals, or negotiations that would be material to a Holder’s decision to exercise the Repurchase Right, which relate to or which would result in:

any extraordinary transaction, such as a merger, reorganization, or liquidation, involving the Company or any of its subsidiaries;

any purchase, sale, or transfer of a material amount of assets of the Company or any of its subsidiaries;

14

any material change in the present dividend rate or policy, or indebtedness or capitalization of the Company;

any change in the present board of directors or management of the Company, including, but not limited to, any plans or proposals to change the number or the term of directors or to fill any existing vacancies on the board or to change any material term of the employment contract of any executive officer;

any other material change in the Company’s corporate structure or business;

any class of equity securities of the Company to be delisted from a national securities exchange or cease to be authorized to be quoted in an automated quotations system operated by a national securities association;

any class of equity securities of the Company becoming eligible for termination of registration under Section 12(g)(4) of the Exchange Act;

the suspension of the Company’s obligation to file reports under Section 15(d) of the Exchange Act;

the acquisition by any person of additional securities of the Company, or the disposition of securities of the Company; or

any changes in the Company’s charter, bylaws, or other governing instruments or other actions that could impede the acquisition of control of the Company.

8. Interests of Directors, Executive Officers and Affiliates of the Company in the Notes.

Based on a reasonable inquiry by the Company:

none of the executive officers or directors of the Company or any associate of such executive officers or directors owns any Notes; and

during the 60 days preceding the date of this Repurchase Right Notice, none of the executive officers or directors of the Company has engaged in any transactions in the Notes.

The Company will not purchase any Notes from its affiliates or the executive officers or directors of the Company. Neither the Company nor any of its associates or majority-owned subsidiaries owns any Notes. During the 60 days preceding the date of this Repurchase Right Notice, neither the Company nor any of its subsidiaries has engaged in any transactions in the Notes.

9. Agreements Involving the Company’s Securities.

The Company has entered into the following agreement relating to the Notes:

the Indenture.

There are no agreements between the Company and any other person with respect to any other securities issued by the Company that are material to the Repurchase Right or the Notes. The Company is not aware of any agreements between any directors or executive officers of the Company and any other person with respect to any other securities issued by the Company that are material to the Repurchase Right or the Notes.

10. U.S. Federal Income Tax Considerations.

The following discussion is a summary of U.S. federal income tax considerations generally applicable to exercise of the Repurchase Right by a U.S. Holder (as defined below) that holds the Notes as “capital assets” (generally, property held for investment). This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations promulgated thereunder (“Regulations”), published positions of the Internal Revenue Service (the “IRS”), court decisions and other applicable authorities, all as currently in effect as of the date hereof and all of which are subject to change or differing interpretations (possibly with retroactive effect).

15

This discussion does not describe all of the U.S. federal income tax considerations that may be applicable to a U.S. Holder in light of its particular circumstances or U.S. Holders subject to special treatment under U.S. federal income tax law, such as:

banks, insurance companies, and other financial institutions;

tax-exempt entities;

real estate investment trusts;

regulated investment companies;

dealers or traders in securities;

certain former citizens or residents of the United States;

persons that elect to mark their securities to market;

persons holding the Notes as part of a “straddle,” conversion, or other integrated transaction;

persons that have a functional currency other than the U.S. dollar; and

persons that actually or constructively own 10% or more of our equity (by vote or value).

In addition, this discussion does not address any U.S. state or local or non-U.S. tax considerations or any U.S. federal estate, gift, alternative minimum tax or Medicare contribution tax considerations. Further, this discussion assumes that the Company is not, nor has ever been, a passive foreign investment company for U.S. federal income tax purposes while the Notes are outstanding. Each U.S. Holder is urged to consult its tax advisor concerning the U.S. federal income tax considerations to such U.S. Holder in light of its particular situation as well as any considerations arising under the laws of any other taxing jurisdiction.

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of the Notes that is for U.S. federal income tax purposes:

an individual who is a citizen or resident of the United States;

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia;

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

a trust that (i) is subject to the primary supervision of a court within the United States and the control of one or more U.S. persons or (ii) has a valid election in effect under applicable Regulations to be treated as a U.S. person.

If an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds the Notes, the U.S. federal income tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. A partner in a partnership holding the Notes is urged to consult its tax advisor regarding the tax considerations generally applicable to such partner of the exercise of the Repurchase Right.

Exercise of the Repurchase Right

Subject to the discussion below under “Market Discount,” a U.S. Holder that receives cash for the Notes on the exercise of the Repurchase Right generally will recognize capital gain or loss equal to the difference between (i) the amount of cash received on the exercise (including any non-US taxes withheld, if any) and (ii) such U.S. Holder’s adjusted tax basis in the Notes. A U.S. Holder’s adjusted tax basis in the Notes will generally equal the cost of such Notes, increased by any accrued market discount if such U.S. Holder has elected to include such

16

market discount as it accrued (as described below), and reduced (but not below zero) by any amortizable bond premium (generally, the excess, if any, of the tax basis of the Notes to such U.S. Holder immediately after the acquisition of such Notes (reduced by an amount equal to the value of the conversion option) over the principal amount of such Notes payable at maturity) allowed as an offset against interest income (if any) with respect to such Notes. Any capital gain or loss recognized by a U.S. Holder will generally be long-term if, on the Repurchase Date, such U.S. Holder has held such Notes for more than one year and will generally be U.S.-source capital gain or loss for U.S. foreign tax credit purposes. Individual and other non-corporate U.S. Holders will generally be eligible for beneficial rates on long-term capital gains. The deductibility of capital losses is subject to limitations. U.S. Holders should consult their tax advisors regarding the tax consequences if a non-US tax is imposed on the receipt of cash for Notes on the exercise of the Repurchase Right, including the availability of the foreign tax credit under their particular circumstances.

Market Discount

The Notes will have “market discount” if such Notes’ stated redemption price at maturity (as defined for purposes of the market discount rules) exceeds a U.S. Holder’s tax basis in the Notes immediately after the acquisition of such Notes, unless a statutorily defined de minimis exception applies. Any gain recognized by a U.S. Holder with respect to the Notes acquired with market discount generally will be subject to tax as ordinary income to the extent of the market discount accrued during the period such Notes were held by such U.S. Holder, unless such U.S. Holder previously elected to include market discount in income as it accrued for U.S. federal income tax purposes. Market discount is accrued on a ratable basis, unless a U.S. Holder elected to accrue market discount using a constant-yield method.

Information Reporting and Backup Withholding

Payments of cash for Notes on the exercise of the Repurchase Right may generally be subject to information reporting to the IRS and possible U.S. backup withholding. Backup withholding will not apply, however, to a U.S. Holder that furnishes a correct taxpayer identification number and makes any other required certification on IRS Form W-9 or that is otherwise exempt from backup withholding. U.S. Holders should consult their tax advisors regarding the application of the U.S. information reporting and backup withholding rules.

11. Additional Information.

The Company is subject to the reporting and other informational requirements of the Exchange Act and, in accordance therewith, files reports and other information with the SEC. Such reports and other information can be inspected and copied at the Public Reference Section of the SEC located at Station Place, 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained from the Public Reference Section of the SEC at prescribed rates. Such material may also be accessed electronically by means of the SEC’s home page on the Internet at http://www.sec.gov.

The Company has filed with the SEC a Tender Offer Statement on Schedule TO, pursuant to Section 13(e) of the Exchange Act and Rule 13e-4 promulgated thereunder, furnishing certain information with respect to the Repurchase Right. The Tender Offer Statement on Schedule TO, together with any exhibits and any amendments thereto, may be examined and copies may be obtained at the same places and in the same manner as set forth above.

The Schedule TO to which this Repurchase Right Notice relates does not permit forward “incorporation by reference.” Accordingly, if a material change occurs in the information set forth in this Repurchase Right Notice, we will amend the Schedule TO accordingly.

12. No Solicitation.

The Company has not employed any person to make solicitations or recommendations in connection with the Repurchase Right.

17

13. Definitions.

All capitalized terms used but not specifically defined in this Repurchase Right Notice shall have the meanings given to such terms in the Indenture and the Notes.

14. Conflicts.

In the event of any conflict between this Repurchase Right Notice on the one hand and the terms of the Indenture or the Notes or any applicable laws on the other hand, the terms of the Indenture or the Notes or applicable laws, as the case may be, will prevail.

None of the Company, its board of directors, or its executive management is making any recommendation to any Holder as to whether to exercise the Repurchase Right or refrain from exercising the Repurchase Right pursuant to this Repurchase Right Notice. Each Holder must make such Holder’s own decision whether to exercise the Repurchase Right and, if so, the principal amount of Notes for which the Repurchase Right should be exercised.

18

MAKEMYTRIP LIMITED

Annex A

FORM OF REPURCHASE NOTICE

To: MAKEMYTRIP LIMITED

THE BANK OF NEW YORK MELLON, as Trustee

The undersigned registered owner of this Note hereby acknowledges receipt of a notice from MakeMyTrip Limited (the “Company”) regarding the right of Holders to elect to require the Company to repurchase the entire principal amount of this Note, or the portion thereof (that is US$1,000 principal amount or an integral multiple thereof) below designated, in accordance with the applicable provisions of the Indenture referred to in this Note, at the Repurchase Price to the registered Holder hereof.

In the case of certificated Notes, the certificate numbers of the Notes to be purchased are as set forth below:

Certificate Number(s):

Dated:

|

|

|

Signature(s) |

|

|

|

|

|

Social Security or Other Taxpayer Identification Number |

|

|

|

Principal amount to be repurchased (if less than all): US$ __________,000 |

|

|

|

NOTICE: The above signature(s) of the Holder(s) hereof must correspond with the name as written upon the face of the Note in every particular without alteration or enlargement or any change whatever. |

19

Exhibit (a)(5)(A)

MakeMyTrip Limited Announces Repurchase Right Notification for

0.00% Convertible Senior Notes due 2028

GURUGRAM, India, January 17, 2024 — (GLOBE NEWSWIRE) — MakeMyTrip Limited (“MakeMyTrip” or the “Company”) (NASDAQ: MMYT), a leading travel service provider in India, today announced that it had issued a Repurchase Right Notice (the “Repurchase Right Notice”) addressed to holders (each, the “Holder”) of its 0.00% Convertible Senior Notes due 2028 (CUSIP No. 56087F AB0) (the “Notes”). The Notes will mature on February 15, 2028, unless earlier repurchased, redeemed or converted. Pursuant to the terms of the Indenture dated as of February 9, 2021 (the “Indenture”) relating to the Notes by and between the Company and The Bank of New York Mellon, as trustee, it is the right of each Holder to require the Company to repurchase the Notes on February 15, 2024 and February 15, 2026 (which is, respectively, approximately three and five years after the Notes were initially issued) (the “Repurchase Right”). The Company is the issuer of the Notes and is obligated, on the Repurchase Date (as defined in the Indenture) occurring on February 15, 2024, to purchase at par all of the Notes, if properly tendered by the Holders in exercise of their Repurchase Right, subject to the terms and conditions set forth in the Company’s Repurchase Right Notice. The Holder’s Repurchase Right expires at 5:00 p.m., New York City time, on Tuesday, February 13, 2024.

As required by rules of the United States Securities and Exchange Commission (the “SEC”), the Company filed a Tender Offer Statement on Schedule TO. None of the Company, its board of directors or its employees has made or is making any representation or recommendation to any Holder as to whether to exercise or refrain from exercising its Repurchase Right.

The Repurchase Right entitles each Holder of the Notes to require the Company to repurchase, on February 15, 2024, all of such Holder’s Notes or any portion thereof that is an integral multiple of US$1,000 principal amount. The repurchase price for such Notes will be equal to 100% of the principal amount of the Notes to be repurchased, as per the terms and conditions of the Indenture and the Notes. As of the date hereof, no interest is payable on the Notes or is expected by the Company to be payable on the Repurchase Date. As of January 12, 2024 there was US$230,000,000.00 in aggregate principal amount of the Notes outstanding. If all outstanding Notes are surrendered for repurchase through exercise of the Repurchase Right, the aggregate cash purchase price will be US$230,000,000.00.

The opportunity for Holders of the Notes to exercise the Repurchase Right commences at 9:00 a.m., New York City time tomorrow, January 18, 2024, and will terminate at 5:00 p.m., New York City time, on Tuesday, February 13, 2024. In order to exercise the Repurchase Right, a Holder must follow the transmittal procedures described in the Repurchase Right Notice, which is available through the Depository Trust Company and The Bank of New York Mellon and is an exhibit to the filed Schedule TO referred to above. Holders may withdraw any previously tendered Notes pursuant to the terms of the Repurchase Right at any time prior to 5:00 p.m., New York City time, on Tuesday, February 13, 2024, which is the second business day immediately preceding the Repurchase Date, or as otherwise provided by applicable law.

This press release is for information only and is not an offer to purchase, a solicitation of an offer to purchase, or a solicitation of an offer to sell the Notes or any other securities of the Company. The offer to purchase the Notes will be only pursuant to, and the Notes may be tendered only in accordance with, the Repurchase Right Notice dated January 17, 2024 and related documents.

Holders of the Notes should refer to the Indenture and the Repurchase Right Notice for a description of the terms, conditions and repurchase procedures and direct any questions concerning the mechanics of repurchase to the Trustee by contacting CT REORG, The Bank of New York Mellon (Email: CT_Reorg_Unit_Inquiries@bnymellon.com). Holders of Notes may request the Company’s Repurchase Right Notice from the paying agent, at 111 Sanders Creek Pkwy, E. Syracuse, NY 13057, Attention: CT REORG, BNY Mellon, CT_Reorg_Unit_Inquiries@bnymellon.com.

HOLDERS OF NOTES AND OTHER INTERESTED PARTIES ARE URGED TO READ THE COMPANY’S SCHEDULE TO, REPURCHASE RIGHT NOTICE AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT MAKEMYTRIP LIMITED AND THE REPURCHASE RIGHT.

Materials filed with the SEC will be available electronically without charge at the SEC’s website, http://www.sec.gov. Documents filed with the SEC may also be obtained without charge at the Company’s website, https://investors.makemytrip.com/investors/financials.

About MakeMyTrip Limited

MakeMyTrip Limited is India's leading travel group operating well-recognized travel brands including MakeMyTrip, Goibibo and redBus. Through our primary websites www.makemytrip.com, www.goibibo.com, www.redbus.in, and mobile platforms, travellers can research, plan and book a wide range of travel services and products in India as well as overseas. Our services and products include air ticketing, hotel and alternative accommodations bookings, holiday planning and packaging, rail ticketing, bus ticketing, car hire and ancillary travel requirements such as facilitating access to third-party travel insurance, visa processing and foreign exchange.

We provide our customers with access to all major domestic full-service and low-cost airlines operating in India and all major airlines operating to and from India, a comprehensive set of domestic accommodation properties in India and a wide selection of properties outside of India, Indian Railways and all major Indian bus operators. For more information, visit https://www.makemytrip.com/about-us/company_profile.php.

For investor and media inquiries, please contact:

MakeMyTrip Limited

Investor Relations

Tel: 1-800-962-4284 (Toll Free US); 781-575-3120 (Outside of US)

Email: vipul.garg@go-mmt.com

Source: MakeMyTrip

2

|||

Exhibit 107

Calculation of Filing Fee Tables

Schedule TO

(Form Type)

MakeMyTrip Limited

(Name of Issuer)

Table 1 – Transaction Valuation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction

Valuation |

|

Fee Rate |

|

Amount of

Filing Fee |

|

|

|

|

|

|

|

|

|

|

|

Fees to Be Paid |

|

$ |

230,000,000.00 |

(1) |

|

|

0.01476 |

%(2) |

|

$ |

33,948.00 |

(2) |

Fees Previously Paid |

|

|

— |

|

|

|

|

|

|

|

— |

|

Total Transaction Valuation |

|

$ |

230,000,000.00 |

|

|

|

|

|

|

|

|

|

Total Fees Due for Filing |

|

|

|

|

|

|

|

|

|

$ |

33,948.00 |

(2) |

Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

— |

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

— |

|

Net Fee Due |

|

|

|

|

|

|

|

|

|

$ |

33,948.00 |

(2) |

|

|

|

|

(1) |

Calculated solely for purposes of determining the filing fee. The purchase price of the 0.00% Convertible Senior Notes due 2028 (the “Notes”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of January 12, 2024, there was US$230,000,000.00 aggregate principal amount of Notes outstanding, resulting in an aggregate maximum purchase price of US$230,000,000.00 (excluding any accrued and unpaid special interest, if and to the extent such special interest is payable pursuant to the terms of the Indenture). |

|

|

|

|

(2) |

The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and equals US$147.60 for each US$1,000,000 of the value of the transaction. |

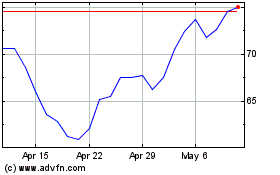

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Apr 2024 to May 2024

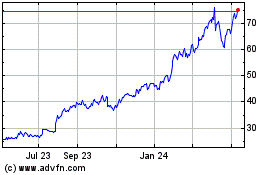

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From May 2023 to May 2024