UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES

EXCHANGE ACT OF 1934

Filed

by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting

Material Pursuant to §240.14a-12

|

SILVERSUN

TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

|

No fee required. |

| |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following is a transcript of an interview of Brad Jacobs conducted

on the Odd Lots podcast made available on December 28, 2023. This transcript was prepared by a third party and has not been independently

verified and may contain errors.

Brad Jacobs has founded multiple multi-billion dollar companies

in his career. He turned United Waste into part of a major trash collection conglomerate. United Rentals has been a massive winner in

equipment rental for the construction industry. And XPO Logistics (which has spun out GXO and RXO) is a freight behemoth. Now, he’s

planning on doing it again. His new company, QXO, wants to be a billion-dollar player in the area of building products distribution. On

this episode, we speak to Jacobs — who is the author of the new book, How To Make A Few Billion Dollars — about why he chose

to go into this industry, his philosophy of building businesses, and how he plans to win in this space. This transcript has been lightly

edited for clarity.

Key insights from the pod:

What does the building supply industry look like today? — 4:41

What is the opportunity in building supplies? — 5:43

What part of the supply chain is QXO targeting? — 8:52

What types of assets will QXO be purchasing? — 13:45

What is the role of government infrastructure money? — 15:55

How QXO will leverage its scale — 25:52

Why Brad Jacobs is a fan of thought experiments — 28:05

How Brad picks his next industry to attack — 33:05

Why cheap assets exist in the energy space — 36:25

Joe Weisenthal (00:10):

Hello and welcome to another episode of the Odd Lots podcast.

I’m Joe Weisenthal.

Tracy Alloway (00:16):

And I’m Tracy Alloway.

Joe (00:17):

Tracy, obviously over the last few years we’ve done tons of episodes

about freight, logistics, trucking, warehousing, etc. One of the things that has always struck me is just all of this crucial stuff,

how sort of chaotic and held together with tape and glue these industries often seem to me.

Tracy (00:40):

Can I tell you something? My husband and I are rebuilding the shed

in Connecticut and just getting the lumber for the shed is this massive production that involves us renting a truck and having to negotiate

it from some lumber yard and then bring it back and forth piece by piece.

The industry of all the movements of these physical goods and products

seems so difficult at times, and it also seems sort of ripe for opportunity. But then you also hear stuff like Convoy going

out of business, the freight broker that was supposed to be using new technology to revolutionize trucking and things like that. And so,

I don’t know, there’s like this tension between moving physical products and then using tech to make the whole space more

efficient.

Joe (01:25):

It’s one of these areas where it seems like ‘Oh yeah, they

must be more simple.’ Like I remember one of our first sort of eye-opening episodes with Stinson Dean talking about how lumber

is distributed and so much of these communications just on sort of message boards or boards that might resemble Craigslist.

And then we talked about it with Craig Fuller and Rachel Premack at

FreightWaves and the idea that you look at how trucking brokerage works, these load boards, and this is all this crucial stuff that’s

sort of at the center of how the economy works. And it’s like they’re in WhatsApp groups and can anyone pick up a load in

Akron and bring it to El Paso next week? And this is how it all works.

Tracy (02:05):

It seems so informal. And then of course it leads to these inefficiencies

like trucks running around empty, basically, what’s it called? Deadheading. I guess the question is what is the sticking point here?

Is there something fundamental about moving physical goods that is, I guess, resistant to new technology? Or is there maybe something

about the industry where people are making, well, they were, people are making lots of money from lack of transparency in the industry,

and so they themselves are resistant to new technology. It kind of reminds me of the bond market sometimes and stocks.

Joe (02:41):

Absolutely. Tracy, it sounds like given the headaches you’ve

had with your new shed that you could really use some efficiency gains in the world of building products distribution, could you

not?

Tracy (02:52):

Yes, especially since I keep messing up the ridge board on the roof.

I can’t get it straight and then every time I mess it up, we have to go and get more lumber, so yes, please.

Joe (03:03):

Well, we do literally have the perfect guest, someone whose career

I think almost is so Odd Lots in all of the topics that we discuss over the years. He has started, depending on how you count,

between five and seven companies. Started an oil brokerage, the founder of United Waste Systems, which rolled up waste collection

companies, sold to Waste Management, United Rentals and the creator of the logistics conglomerate XPO, which also spun off a freight

brokerage, a logistics company, etc.

We are speaking obviously to Brad Jacobs, who just a few days before

this recording announced the creation of a new company called QXO, which intends to be a market leader in the space of building products

distribution. He plans to make billions of dollars and he’s the author of a new book: How to Make a Few Billion Dollars.

Tracy (03:58):

I like how in the press release for the new company QXO, he basically

says he aims to make billions of dollars. So it connects very well with the book.

Joe (04:06):

Well, he has a track record of making billions of dollars. I would

love to make billions of dollars. So maybe we’ll learn something. Brad, thank you so much for coming on Odd Lots.

Brad Jacobs (04:16):

The pleasure’s mine. Look, some people think in millions, some

people think in trillions, I think in billions.

Joe (04:22):

It seems like a very reasonable middle ground.

Brad (04:24):

It’s the middle ground here.

Joe (04:25):

So you say you’re going to build a market leader in building

products distribution. There’s a lot to get into, but let’s just start here. When you look at the industry right now of building

products, distribution in the pre-QXO world, what does it look like to you? What do you see when you look at that industry?

Brad (04:41):

Something that’s really big, first of all. It’s $800

billion between North America and Europe so it’s large and it’s very fragmented. You’ve got 7,000 distributors here

in North America. You have 13,000 in Europe. So it’s a lot of independent companies and a handful of public companies, but it’s

mostly privately-owned companies.

I see an industry that’s growing. It’s been growing at

7% compounded annual growth on the top line for the last five years. I see an industry that is rich with acquisition targets, so

it’s an opportunity to scale up. And I also see an industry that could use more technology. There’s a handful of companies

doing some cool things in technology, but by and large, the industry as a whole is behind where logistics is. It’s not where the

logistics industry is.

Tracy (05:30):

This is exactly what I wanted to talk to you about. So in the press

release, you say, I think “tech-enabled company” or something like that. What does that mean exactly in this context? What

is the technological opportunity that you see here?

Brad (05:43):

It’s a few things. Number one, it’s how you interact with

the customer and right now, mid-single digits percent is done digitally and 90 something percent is done face-to-face. That really should

be reversed. I mean, eventually over time, not right away, you should see more and more penetration of digital on that. So that’s

number one, e-commerce penetration.

Number two, pricing. Pricing could be more methodical, could be done

electronically, could be done by AI, could be done by machine learning and be interactive and continuous.

And thirdly, the inventory. So this is a business that has a big transportation

logistics element to it because you’re buying a bunch of products wholesale, you’re storing them in DCs, distribution centers

— fancy word for warehouses and then you’re delivering them in delivery trucks to the end user.

So there’s a lot of transportation logistics here and the DCs

or warehouses that I visited so far, not a whole lot of automation and they should be highly automated. Now, a handful of companies aren’t

doing automation, but they’re the exception, not the rule. And it really should be the rule because as we know from GXO logistics

where we have a couple hundred million square feet of warehouses around the world, automation is where it’s at. That’s where

it’s going and that’s what customers want.

It takes out cost, increases safety, it’s faster, it’s

more accurate. There’s a thousand reasons why automation makes perfect sense for the inventory part and then it’s not just

the picking and packing that needs to be automated, it’s the actual inventory management. So these distributors have lots and lots

of SKUs and getting it just right, of not having too much and then tying up capital, but not having too little and then disappointing

customers so you can fulfill their demand.

This has to get right and GXO, for example, has had a client, Boeing

for years and years and years. It went back to the new breed before we bought them. They do the parts management for that all around the

world on a global basis and that’s done technologically. That’s done not by people figuring out that they think we need

this many parts of this here and we need that many parts there. It’s doing it methodically using lots and lots of data and using

algorithms to understand that, to get the inventory just right.

And here in the billing products distribution space, I think there’s

a big opportunity to optimize the inventory management. And then the last component of technology that excites me is basic route optimization.

Meaning you got delivery trucks and it’s still being done the way it was done in trucking like 15 years ago. For the most part,

again, there’s exceptions to the rule and fine companies doing good stuff, but by and large it’s not optimized in

a typical distribution company we have right now and I think we can bring that to the table pretty quickly.

Tracy (08:35):

So I have a billion questions already. Not a million or a trillion,

just a billion.

Brad (08:40):

Good, we’re on the right scale.

Tracy (08:41):

Just so we understand the business, what part of the supply chain are

you actually targeting here? Is it the wholesalers who supply lumber yards or lumber yards that supply builders, or both?

Brad (08:52):

We’re buying wholesale, we’re selling retail. But there’s

three different categories of end markets. There’s residential, there’s non-residential and there’s infrastructure.

So residential is like you, like your apartments, your houses, people who need floors and windows and doors and roofing tile

and so forth, HVAC. Then there’s commercial, commercial can be any kind of building that’s not a house. It could be a school,

it could be a church, it could be a factory, it could be a town hall. It could be just anything that’s not people living in it,

but has a roof protecting from the elements. And the third category would be infrastructure.

So infrastructure is roads, bridges, tunnels, all the pipes underneath

the ground. If you look at these three sectors, one thing that excites me about this is that all categories there are old. Houses are

over 40 years old, commercial facilities are 50 years old, a lot of the infrastructure underneath America is over a century old. I mean,

it really needs to be repaired and lots of activity has to be done here. This is an industry that’s not going to go into the metaverse.

This is an industry that’s not going to be disrupted by AI, it’s

going to be enabled by AI and that was important for me when I looked at 500 different opportunities because quite a lot of them

have serious questions about whether they’ll still exist in five or ten years.

Joe (10:16):

Can I ask you a question? So with XPO and that family of companies,

I guess why is QXO a separate company that needs to be in building supply distribution? If you have a freight company, if you have a logistics

company, if you have a freight broker, why can’t your existing companies simply move deeper into this space? Why is it important

for it to be focused on its own? Because when you say ‘Well, the transportation system is where trucking was 15 years ago and we’ll

get into sort of the state of trucking,’ why is it not that existing logistics-related companies can just offer services to

this industry?

Brad (10:58):

I mean, we could, but it wouldn’t be a real pure play focus company.

So, the XOs, the GXO, RXO, XPO, they’re very focused now. We divided the company up into three very carefully designed units. You

got GXO being a supply chain, being warehouses around the world. It’s got a thousand warehouses and that’s all it does really.

It really does warehousing and it’s an inch wide and a mile deep on warehousing, does it really well.

And then you have RXO, it’s an asset like transportation, it’s

the tech enabled brokerage model and it also has the last mile delivering right to people’s houses. And then thirdly, you have XPO,

which is primarily an LTL carrier, less than truckload carrier that’s mostly in North America. And we divided the company up into

those three categories because that’s what our owners told us, that’s what our shareholders told us.

Our shareholders told us, look, we don’t want all these things

all together. We want to have more defined pure plays that we can invest in the industrial comeback and then we’ll invest in

XPO for LTL, or we want to go more consumer, or we want to go make a play on e-commerce, which we’ll go more with with GXO and that’s

worked really well.

I mean, we were getting a conglomerate discount for our multiple, we’re

trading like eight times EBITDA. Today, those three different companies traded double digit multiples of EBITDA and that in addition

to improving the EBITDA, the multiple on EBITDA improved too. So it made sense to split those up. I think we would be going backwards

from a shareholder perspective if we started becoming more multifaceted and blended distribution together with the XOs.

Joe (12:48):

Let’s talk a little bit more about your plans for QXO and so

you mentioned that in the US there’s 7,000 companies and in Europe there’s 13,000 and, you know, you’re going to hit

the ground running, have billions of revenues, so you’re going to buy up a bunch of companies and roll it up.

My understanding, you know, going back to the United Waste days and

when you sort of started building that up, it was acquiring different types of assets. So distribution, but also landfills,

etc. And I think when people think about roll-ups in the traditional PE sense, they’re like ‘Oh, I’m going to go out

and I’m going to buy 20 HVAC companies and we’re going to unify their backend and take out some debt and make them all leaner

in operation and Six Sigma’ and all that stuff. It feels like you are thinking much more holistically in terms of buying different

parts of the supply chain to work together. Can you talk a little bit about what assets you need to buy to make QXO work?

Brad (13:45):

So you mentioned it correctly at United Waste, we bought landfills,

we bought transfer stations, we bought collection companies and that became one integrated supply chain. It worked really well because

we took out a lot of cost as a result of doing that. We had an end- to-end solution for customers and they loved it. And that’s

why our earnings compounded at 55% CAGR and not coincidentally, so did our stock price.

I get that. So you have to create a company that works for the customer,

that the customer appreciates the service that you’re providing so they wire money from their bank accounts to yours so it’s

very important to do that.

Here, in QXO, in our building products distribution company, we’re

going to stay very focused on distribution, meaning distributing building materials to the three segments that I was just talking about

with tracing in terms of residential, non-residential and infrastructure and I’m going to stay right on those three things, and

I’m going to toggle between them depending on opportunities as they arise, attractive opportunities we’re going to be opportunistic

and how we think the five to 10 year outlook looks for each one of those.

Tracy (14:55):

So you mentioned infrastructure and just connecting this back to the

landfill business that we were just discussing, reading your book, one of the things you talk about is the reason you were able to

buy up landfills at that time was partly because of new environmental regulations that made them more costly for the existing owners

to actually run. And so a lot of people wanted to get rid of their landfills, I guess, at reasonable prices and you snapped them

up.

When you talk about infrastructure spending, it seems like part of

your MO is maybe looking at what the government is doing, what the government is spending its money on, and taking that opportunity into

account. How much does that figure into your planning? And the other story you tell in the book is, at one point you bought up a

bunch of road rental companies in anticipation of $600 billion of infrastructure funding, but that didn’t really work out. So I

guess, like how are you evaluating the opportunity and the risk here?

Brad (15:55):

I’m not counting on government handouts. The government handouts

are the cherry on top. It’s extra and it’s great and we’ll take it. But that’s not what the business plan is based

on. The business plan is based on the fact that the infrastructure is very aging and there’s got to be spent about $2 trillion in

order to fix it up. Whether that happens at this pace or that pace or from this pocket or this pocket doesn’t really matter.

It’s going to have to happen because, as you mentioned, you have

a house in Connecticut, so you know what I’m talking about, driving from Connecticut to the city is a bumpy ride. These things have

to get fixed sooner or later. And then on residential, you look at residential, the average house is 42 years old. I mean, when I

was a kid, when I was 10 years old, that was an old house. So a lot of repairs and remodeling are going to happen there. Nothing to do

with the government. I don’t think the government’s going to pay Tracy Alloway to repair and remodel your house.

Joe (16:46):

They might pay to install heat pumps and other insulation and other

sort of clean energy advances.

Brad (16:53):

Yes, and there is one company, Watsco, who specializes in HVAC that’s

capitalizing on that and making a ton of money doing that. But I’m not counting on that, I’m not building a business plan

based on the government’s largesse. That’s nice and it’s an extra kicker, but that’s not the guts of the business

plan.

Joe (17:09):

I mentioned in the beginning that one of the big eye-opening things

as Tracy and I have learned more about these industries is how low tech communication is and freight brokerages where it’s still

based on the phone, I think we heard maybe faxes still or maybe in the last few years, there’s no more faxes. I’m not sure.

These websites and WhatsApp groups are super retro. In building supply

distribution, when you talk about how low tech it still is, let’s say Tracy works with some local provider of lumber or whatever

she needs. Like what is the process by which the current status quo, these goods are delivered to a regional distribution center or to

our house?

Brad (17:53):

So a couple things there. Let’s start with the beginning part

of your question about truck brokerage. Truck brokerage is not as old fuddy duddy as you may think. It’s evolved quite a bit in

the last 10 years. Now, in 2011, when I got into the truck brokerage business, it was just as you described, it wasn’t low tech,

it was no tech. It was a hundred percent people talking on phones to each other and in a very slow poke way. We didn’t have faxes,

it was still email, but it was not very machine to machine. Fast forward to today, RXO, which was the truck brokerage spinoff of

XPO that Drew Wilkinson runs, that business now, 97% of their orders are either sourced or covered electronically or digitally. So that’s

come a long, long way. Now, RXOs at the forefront of that, it’s been the leader of technology because we invested in that right

from the beginning, that was our vision.

But even the whole industry, it’s not 97%, but it’s over

half, over half is done electronically. So that’s where brokerage has gone. Now, distribution is kind of where brokerage was 10

years ago, maybe eight years ago because like I said, there are a handful of companies that are starting to do this digitally, but overall

as an industry, it’s still single digits percent. So it’s going to penetrate much more than that. There’s so many things

depending on the type of product we’re talking about that should just be ordered on your phone or it should be on your website.

You should not have to go somewhere and stand in line. It’s just not necessary.

Tracy (19:17):

What are the sticking points to technology adoption in distribution?

Because I imagine, if you went to a company and you said ‘I can make your inventory management a lot more efficient using technology,’

it seems like a slam dunk for them. Maybe it costs a lot of money and that’s the issue, maybe on pricing, if you say ‘I can

make your pricing a lot more transparent,’ maybe there’s less of an incentive for them to improve that. But what are the major

hurdles that you see here?

Brad (19:45):

It’s really just doing it. It’s a question of companies

putting money there. This is a very low CapEx business, very low CapEx. The conversion from EBITDA to free cash flow is enormous.

In some companies the free cash flow is more than that income. So there’s very little investment in CapEx. I don’t mind

investing in CapEx for technology. In fact, I want to, and I will because that was the big driving force of our success at XPO was being

ahead of the curve on technology. So we’re definitely going to do that there. And that’s all that’s required.

Now you have a lot of companies that are private equity-owned, private

equity because of their structure, their nature, and they have to give the money back to their investors after seven or so years. Sometimes

it doesn’t make sense for them to invest hundreds of millions of dollars into technology because they’re going to be flipping

it.

So why should they do that? I get that and sometimes companies have

a lot of pressure on short-term earnings a quarter of the year, and they don’t have an investor base that’s got a long-term

view of, so my investors have always been the ones looking for the big kill. We’re not looking for just 200 basis points more than

more in the market. We’re looking for big returns so XPO is 32X and United Rentals today is more than a hundred X.

Tracy (20:59):

100-bagger, that’s pretty good.

Brad (20:59):

We have a 100+ bagger actually and that’s the kind of investors

that invest in me. Ones that want big, big returns and are patient money that can hold a stock for a few years and make a big bet on that.

And those kinds of investors totally get it. That you have to invest in technology in order to have the J curve so that in years 3, 4,

5, you’re a category killer and you have a big competitive advantage against companies who haven’t been investing in technology.

So I’m definitely going to invest significantly in technology.

Joe (21:31):

The United Rentals chart is absolutely insane. It was a $4 stock in

2009. It looks like it’s basically at an all time high right now, but over 500. So extremely well done on that.

Brad (21:44):

I can’t take full credit for that. I’ve been gone for a

while.

Joe (21:47):

Your original investors, the ones that just buy and hold, are very

pleased with you, I’m sure. On freight brokerage though, I want to get back to that because I know there’s like different

models and you mentioned that it’s way more digital than it used to be. But on the other hand, there are still big basically freight

trading floors or things that resemble a trading floor.

And I went to the headquarters of Arrive Logistics in Austin, Texas

and we talked to their CEO and there’s a lot of ex-Big 10 or Big 12 or SEC athletes working the phones in those places. It looks

kind of like a stock brokerage and on one side of the room they’re talking to shippers and on the other side, they’re talking

to carriers, etc.

Like there’s still a lot of humans involved in the process of

freight brokerage. And then when people think it’s like ‘Oh, why can’t we just have Uber?’ And Uber of course

also is a freight business and then Tracy mentioned Convoy, which I think was going to try and Uberize the industry and it recently failed.

It recently had to sell for basically nothing, is my understanding. Why are there still so many humans involved in the business of connecting

shippers and carriers?

Brad (23:02):

There’s fewer number of humans now per revenue, per dollars per

shipment than there were two years ago and five years ago and 10 years ago and that’s the trend. I bought a company called

NLM from Landstar back in 2014 or so and it specialized in freight brokers mostly for the automobile industry, but other industries too

that had expedited requirements.

Like a factory floor was going to close down unless they had a

machine or a part and they needed it in like two hours, like right away and they were willing to pay premium prices for that because the

cost of not getting it was really quickly. This business blew my mind because I went out to go and visit it and it was moving over a billion

dollars of freight a year. It was a pretty sizable firm and it was totally quiet.

There were like a few dozen people there and they were basically taking

care of the computers and there was none of what you just described. It wasn’t like the old fashioned New York Stock Exchange trading

floor from trading places 30 years ago. It was very automated and I said, “this is the future of brokerage.” This is

where brokerage is going, where it’s more machine to machine, automatic, automated, tech driven, tech forward, not dependent on

human beings. Now there still is a role for human beings in almost any business because of human relationships and that’s important

but the actual transactions increasingly in almost every industry and including truck brokerage should be done digitally.

Joe (24:31):

But they’re not right now, right? There’s an email and

they say, ‘Hey, we need this in North Carolina’ I mean, I see it all the time where it may be digital, but it’s an email

and a human reading the email.

Brad (24:40):

At RXO, 97% of the shipments are either covered or sourced digitally

and they’re growing at three times the industry average. And that’s why they’re growing at three times the industry

average because it’s tech powered. It’s done by technology, not by us mere mortals.

Tracy (25:12):

How much does pricing power matter, for instance, in the new distribution

business that you’re starting? Like how much of the strategy depends on consolidating and then being able to get pricing power in

the market? And the reason I ask is because if you look at something like freight brokerage, I mean, one of the criticisms of that market

was that a lot of people lowered their prices in order to get market share, to get people to start using their apps or whatever. Then

when they started raising prices in order to actually make money, people just switched platforms, it was very easy to switch. So I guess

how do you manage those things, like the scale and the pricing power?

Brad (25:52):

In billing products distribution, the business plan is not to raise

prices to the end customer. However, the business plan is to lower our cost of sourcing, of procurement. That’s not a difficult

thing because as you get bigger and scale up, you’re a bigger buyer, you’re a bigger customer, and you get a better break.

A lot of these products are sold on a rate card and it’s not much to negotiate.

It’s a rate card so if you buy this price this amount, this is

what your price is, you buy a larger amount, you get a lower price, you buy an even larger amount, you get an even lower amount. And that’s

part of the business model is to scale up and get the procurement savings and then actually pass along some of that to the end user and

keep some of that for ourselves.

Joe (26:35):

How big do you have to get then? So again, going back to your ambition

to be a multi-billion dollar company in Europe and the US and to have that sort of power to get good prices from the original the sellers,

like how much do you have to buy in order to get the scale that you want to sort of hit the trajectory you’re aiming for?

Brad (26:54):

We’re going to buy, we’re also going to grow. So the industry’s

growing at 7% and I would hope to grow more than the industry organically. You’re right, the main growth is going to come from M&A

and we’ve already put out revenue targets, we should be at a billion dollar, at least a billion dollars revenue run rate after the

end of year one. We should be at least five billion revenue run rate after two or three years. And my vision is to be at tens of

billions of dollars in revenue over the next decade and I see a very clear path to do those numbers.

Tracy (27:25):

So Joe and I both read your book, How to Make a Few Billion Dollars,

and I enjoyed it. I have to say it’s not what I was expecting. I was expecting a biography, but actually it’s sort of conceptual

in many ways. So at the very end, for instance, you have a list of thought experiments, including one that’s very similar to imagining

yourself as a banana or imagining that you’re related to a banana and that human DNA is 50% related to banana DNA. What inspired

that direction in the book? Because again, it seems kind of unusual. You don’t get many billionaires writing lists of thought experiments,

and there’s also a timeline of technology advancement.

Brad (28:05):

So let’s start with the thought experiments. The purpose of the

book, as you can tell from the title, is how to make a few billion dollars and in my experience, I’ve met so many very successful

people, many people who are much more successful than I am. They’re very different from each other in many different ways

and they’re identical in one trait. They think differently than most people do and I think that’s a big insight that

if you want to create something big, something amazing, something very successful.

It doesn’t have to be just making money, by the way, making money

is just one thing in life. But if you want to accomplish anything huge in life or in business, you have to figure out a way to think

differently because If you think the same way everyone else thinks, you’re going to get the same results that everyone gets,

which is like the average results.

If you want super average results, you need to think differently.

And I’ve made it my discipline, my hobby, my passion, my pastime to think differently and use different techniques of

self-hypnosis, and meditation and cognitive therapy and mindfulness and thought experiments. I came up with all these things. I mix and

match all these different schools of consciousness, so to speak and I come up with my own thing. It helps me get out of my little

way of thinking and it helps me think in a more unbounded way. That helps me think big and move fast, which is the mantra of making a

lot of money in business.

Tracy (29:36):

So speaking of thinking differently, there was one part of your

book where you talk about doing due diligence on companies. You’ve spoken about this a lot before, you do a lot of research before

you make these decisions. But you also mentioned that you have been working or have worked with a guy who was a 25-year investigator and

polygraph examiner for the CIA. So you have him interviewing the executives of companies that you’re going to take over?

Brad (30:05):

Absolutely and so we could have a whole podcast just on Phil Houston.

Joe (30:08):

That would be fun.

Brad (30:11):

I’ll introduce you to him. He is the world’s expert in

detecting deception.

Joe (30:18):

We’re definitely going to have him on.

Brad (30:19):

I think he’ll do it. He’s actually written two books on

it and it’s right out there. It’s right there on how to spy the lie and find the truth and get the truth. They’re

very interesting books. So he was a polygrapher, he was the most senior polygrapher in the CIA and everyone in the CIA has to get wired

up every year to make sure they’re not a spy.

He learned that you ask the question, which is the stimulus, and then

there was a response. Now the polygraph measures your galvanic skin response, your stress response, your heartbeat, your sweating, and

so forth. He also noticed that there were other things besides that. There was body language, there was language language. It was the

language that people used in order to answer a question.

There were clusters of traits that were the hallmarks of deception

and he created a whole method of detecting deception. And it’s a very disarming technique. He’s a great conversationalist.

You would never think he’s a difficult guy or an interrogator or anything like that. And I’ve studied him very carefully

and I’ve worked with him for, oh, a decade and a half now. I’m still not as good as he is at that but I’ve studied how

to detect deception and so is my senior management team.

They’ve all taken his courses, they’ve all taken his training

and we find it so beneficial. We find it beneficial in due diligence on companies because guess what, sometimes people

don’t tell you the truth when they’re selling their companies, they exaggerate a little bit. And guess what? And job interviews,

when we’re interviewing people, people sometimes spin. They don’t tell you the straight story and if you can figure out

what’s baloney and what’s true, wow, you can save a lot of aggravation and a lot of money and you can avoid a lot of mistakes.

So I do believe that learning the art and science of detecting deception and we’ve used Phil Houston, his nickname is Dick, Dick

Houston, to do that, to teach us, that’s really helped us a huge amount.

Joe (32:19):

So all of these industries that you’ve worked in, like, I don’t

know if it was always the case, but these days there’s something like, I guess I would say sexy about a lot of these sort of like

I see people on Twitter like talking about like...

Tracy (32:32):

Supply chain’s so hot right now!

Joe (32:33):

No, like for real, like self storage or I want to buy up HVAC and you

hear stories about ex- Wharton MBAs and the first thing they want to do is get some friends together and roll up the local pool management

company or HVAC or whatever, or a chain of laundromats or whatever these physical things that exist in the world that aren’t going

to disappear or go anywhere. You spent a year figuring out which industry you’d attack next, building product distribution.

Is there a system for identifying industries or types of companies that you use to go after next?

Brad (33:07):

I have a system and I write about it in the book. I put the process

that I use in order to study an industry and in order to study a specific company. To make a long story short, I get a lot of the

important information and I don’t waste time on the unimportant information. I’ve been doing this long enough. I know what’s

important and what’s not important. We do a lot of diligence online before we even meet people and then we try to use the time of

the people we’re talking to very politely, very judiciously, so we’re not wasting their time and asking them things that we

can find out from other sources. But we want to know all the important stuff. When we’re looking at an industry, we’re

looking at a company, what are we trying to figure out?

At the core we’re trying to figure out whether it’s

an industry or a company. Fast forward five years, seven years, 10 years, what’s the revenue going to be? What’s

the profit going to be and what’s the cash flow, whether it’s inflows or outflows over that period of

time? All the hundreds of other questions that we’re using for due diligence are all important, but they distill down to those three

questions. How do I figure out over the next half a decade, decade, what’s the revenue that’s going to grow?

What’s the profit going to grow and how much cash is it

going to generate or use up? And in the end it comes down to how much money would we put in and how much money would we get back? It’s

no more complicated than that and if you stick to that basic concept that I just mentioned, you will make a lot of money, you will create

alpha. If you deviate from that, if you don’t pay attention to that, you say, well, the return on capital isn’t so great,

but no, there’s no but, you’re going to have a finite amount of money. Then five, 10 years later, you’re going

to have created a revenue stream and a profit stream and you’ll have generated cash flow between now and then that’s

going to determine what your stock price is and how valuable your company is and all the due diligence ends up being about that.

Tracy (35:00):

You do seem to have a connection with the physical space though, which

I mean, Joe and I clearly share.

Brad (35:07):

And I take issue that it’s not sexy.

Tracy (35:09):

Oh no, we agree.

Joe (35:11):

We agree, that’s why we spent the last three years talking about

this stuff.

Tracy (35:14):

The other thing I was going to say is when I first went into financial

journalism, I wanted to be a commodities correspondent because there was a romanticism with this idea of moving large amounts of stuff

around the world. So I guess my question is, what is the attraction there? Like, is there something innate about the physical space that

attracts you to it? Or is it more about the market opportunity? You mentioned this earlier, the idea that people are always going to have

to move things. This isn’t a business that is going to disappear overnight.

Brad (35:46):

It’s more opportunistic than conceptual and abstract. It’s

more concrete. It’s here are industries that my playbook, the Brad Jacobs playbook, is applicable. And that playbook involves a

lot of M&A and a lot of integration and a lot of optimization of what we buy. Those techniques apply to the industries I’ve

been in. Some of the industries, that’s really not the play, that’s not fragmented enough. You really can’t buy enough.

Bigger isn’t necessarily better. Maybe the long-term trend is not so fantastic. So I looked into many other things, but I dismissed

them because they didn’t check all the boxes. This one happened to check all the boxes. But I looked at many other things. I looked

at many other industries.

Joe (36:27):

Like what?

Brad (36:28):

Well, I spent a lot of time going back to my roots. As you probably

know, my first 10 years in business were in energy, it was in oil and gas. So I spent a lot of time down in Texas looking at oil

and gas properties and there are some really cheap properties for sale at like two or three times cash flow and they have 20, 30

year lives. So you can get your money back in a couple years, three years, and then you have just pure profit year after year after

year for a long, long time. So I got really excited about that as generally I’m a value person, so I said, “wow, this is really,

really deep value.”

But I talked to the 17 or so sovereign wealth funds and pension plans

that have invested in XPO in the past, and we have a great relationship with. Almost all of them said, ‘Hey, I get it, but we’re

not going to invest in that and because ESG and because the oil and gas business went through a bad patch there for a while.’ But

I like going industries that have gone through a bad patch and get better values there, but I couldn’t see a way that I could raise

many billions of dollars to finance energy.

In fact, I even read in the lobby waiting to come up here in Bloomberg.

I saw a new fund is being raised by a couple guys, talented guys who left Warburg and they were in their energy department and they’re

raising a $750 million fund. They could probably deploy $20 billion. They’re not going to raise $20 billion, they’re going

to raise $750 million. That’s my point. So part of my strategy is to go to my good old friends in Singapore and Canada and the Middle

East and get funding to go out and do M&A and I don’t see how I could do that in energy, for example.

Joe (38:02):

Last question for me. So you mentioned that you have to start with

the nuts and bolts. What is the cash that this company is going to throw off over the next three, five, 10 years, etc.? And

then you said people come up with a ‘but’ to justify something that’s not bad. What are the lies that investors tell

themselves or entrepreneurs tell themselves that cause them to make mistakes?

Brad (38:23):

They go for the shiny object of the moment. What happens to be, to

go back to the sexy theme, sexy at the moment. And what is sexy at the moment may not be very sexy in five or 10 years. You have

to look at what’s the real business here and what’s the demand going to be over time and what’s the supply of that service

or product over that period of time. And you have to just look at it in a very elementary fundamental way like that and then you can predict

how much value you’re going to create. Many investors and many business people, many boards even, don’t even think like that.

And it’s shocking really, because it’s so fundamental to value creation.

Tracy (39:03):

I have a completely self-interested topic as my last question.

Brad (39:07):

You want that lumber?

Joe (39:07):

It’s going to be about the shed that you’re building.

Tracy (39:10):

No, actually it was going to be about journalism, which is, the book

and a lot of your businesses to date have been about technological opportunity and disruption. And you have a sort of throwaway line in

the book about AI and how it’s going to mean that many jobs in journalism are likely to become obsolete. Which, fair enough. I won’t

necessarily argue with that, but as a thought experiment, what would be your play on AI’s impact on journalism? Like if you had

to do something in the journalism space right now, what would it be?

Brad (39:44):

I looked at the media. I looked at it, but couldn’t find

the right thing. I looked at a handful of companies actually that were doing media ads, advertising and media. But I got nervous about

what’s going to happen from a regulatory front when some of the European rules, which are much more stringent about the advertising,

the cookies and the sharing information when that comes over here and maybe that business would get disrupted. So I got nervous about

that. I didn’t see the right ending for that.

Tracy (40:14):

Can I have the lumber?

Brad (40:16):

Yes. You’re going to be customer number one, Tracy.

Tracy (40:19):

I probably will.

Joe (40:20):

Brad Jacobs, thank you so much for coming on Odd Lots, that

was a blast.

Brad (40:23)

My pleasure, thank you.

Joe (40:37):

Tracy, I think I know how to make a billion dollars now. I’m

going to call up my friends in Singapore. I’m going to call up my friends at some Middle East Sovereign Wealth fund and I’m

going to talk to the people that I know who have built incredible software technology for the world of physical distribution and then

find a new industry to take over.

Tracy (40:55):

No excuses, Joe. Now you have to do it.

Joe (40:57):

I got the playbook.

Tracy (40:58):

You’re going to hire a CIA investigator as well?

Joe (41:02):

I got it. I feel this is it.

Tracy (41:04):

Well great, I’m glad we’ve solved that. No, that was such

a fun conversation and it is interesting, like Brad has clearly done a lot of businesses five or seven depending on how you count

as you mentioned, but there does seem to be this common thread throughout all of them. So A) a lot of them have been in the physical space

and again, like it seems like there is that perpetual opportunity there in that the business of moving stuff, getting rid of stuff

isn’t going to go away. And Brad was talking about that, but also the idea of all of, I guess because of the way it developed is

just so fractured to the point and localized. So that’s a place in the economy where there are still opportunities for scale and

efficiency. So even though the businesses sort of range across a large variety of things, it does seem there is this commonality.

Joe (41:57):

It’s super interesting too to think about, I guess the unequal

distribution of technology today. The idea that there are some warehouses around the country that are very automated and very up-to-date

and others that have never felt perhaps the competitive pressure to need to do so. Or even in freight brokers, the idea that there’s

some brokers that resemble giant trading floors and some not. I find that to be really fascinating. Also, this idea of just

like, if you have access to the capital, you can get scale from day one. And obviously so many entrepreneurs are like what is it going

to take to get scale? Well, in theory, if you have the money, you can be big from day one and get the best prices from the vendors.

Tracy (42:37):

And we have to have, what was his name? Dick Houston on the show.

Joe (42:41):

Also, just one other thing that is interesting is just this idea that

there’s some businesses that are very attractive, but the capital isn’t there and so that comment at the end about certain

energy assets being cheap, but no one wants to put up the money for them. Like someone is going to capture that alpha, I assume.

Tracy (42:57):

Yes, except in the media business, I guess.

Joe (43:00):

Well, there’s none there.

Tracy (43:02):

There’s no hope. Shall we leave it there?

Joe (43:05):

Let’s leave it there.

Cautionary statement regarding forward-looking

statements

This communication contains forward-looking

statements. Statements that are not historical facts, including statements about beliefs or expectations, are forward-looking statements.

These statements are based on plans, estimates, expectations and projections at the time the statements are made, and readers should

not place undue reliance on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms

such as “may,” “will,” “should,” “expect,” “opportunity,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward-looking

statements involve inherent risks and uncertainties and readers are cautioned

that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statements.

Factors that could cause actual results to differ materially from those described herein include, among others:

| ● | uncertainties

as to the completion of the equity investment, the separation by SilverSun Technologies,

Inc. (the “Company”) of its existing business into SilverSun Technologies Holdings,

Inc. (the “spin-off”) and the other transactions contemplated by the investment

agreement by and among Jacobs Private Equity II, LLC, the Company and the other parties thereto

(the “Investment Agreement”), including the risk that one or more of the transactions

may involve unexpected costs, liabilities or delays; |

| ● | the

risks associated with the Company’s relatively low public float, which may result in

its common stock experiencing significant price volatility; |

| ● | the

possibility that competing transaction proposals may be made; |

| ● | the

risks associated with raising additional equity or debt capital from public or private markets

to pursue acquisitions or other strategic investments, including in an amount that may significantly

exceed the initial equity investment, and the effects that raising such capital may have

on the Company’s business and the trading price of the Company’s common stock,

including the possibility of substantial dilution; |

| ● | the

possibility that additional future financings may not be available to the Company on acceptable

terms or at all; |

| ● | the

effects that the announcement, pendency or consummation of the equity investment, the spin-off

and the other transactions contemplated by the Investment Agreement may have on the Company

and its current or future business and on the price of the Company’s common stock;

|

| ● | the

possibility that an active, liquid trading market for the Company’s common stock may

not develop or, if developed, may not be sustained; |

| ● | the

possibility that the warrants, if issued, may not be exercised; |

| ● | the

possibility that various closing conditions for the equity investment, the spin-off and the

other transactions contemplated by the Investment Agreement may not be satisfied or waived,

or any other required consents or approvals may not be obtained within the expected timeframe,

on the expected terms, or at all, including the possibility that the Company may fail to

obtain stockholder approval for the transactions contemplated by the Investment Agreement;

|

| ● | the

effects that a termination of the Investment Agreement may have on the Company, including

the risk that the price of the Company’s common stock may decline significantly if

the equity investment is not completed; |

| ● | the

risk that the spin-off may be more difficult, time-consuming or costly than expected or the

possibility that the anticipated benefits of the spin-off may not be realized; |

| ● | uncertainties

regarding the Company’s focus, strategic plans and other management actions; |

| ● | the

risk that the Company, following the closing of the equity investment, is or becomes highly

dependent on the continued leadership of Jacobs as chairman and chief executive officer and

the possibility that the loss of Jacobs in these roles could have a material adverse effect

on the Company’s business, financial condition and results of operations; |

| ● | the

risk that Jacobs’ past performance may not be representative of future results; |

| ● | the

risk that the Company is unable to attract or retain world-class talent; |

| ● | the

risk that the Company may be unable to identify suitable acquisition candidates or expeditiously

consummate any particular acquisition candidate on acceptable terms or at all; |

| ● | the

risk that the failure to consummate an acquisition expeditiously, or at all, could have a

material adverse effect on the Company’s business prospects, financial condition, results

of operations or the price of the Company’s common stock; |

| ● | the

risk that the Company may fail to satisfy the ongoing requirements of Nasdaq if it is unable

to expeditiously consummate an acquisition following the consummation of the spin-off; |

| ● | the

risks associated with cybersecurity and technology, including attempts by third parties to

defeat the security measures of the Company and its business partners, and the loss of confidential

information and other business disruptions; |

| ● | the

possibility that new investors in any future financing transactions could gain rights, preferences,

and privileges senior to those of the Company’s existing stockholders; |

| ● | the

risks associated with the uncertain nature of the building products distribution industry

in which Jacobs, upon becoming chairman and chief executive officer of the Company, plans

to pursue acquisitions after consummation of the transactions contemplated by the Investment

Agreement; |

| ● | the

possibility that industry demand may soften or shift substantially due to the cyclicality

and seasonality of the building products distribution industry and its dependence on general

economic conditions, including inflation or deflation, interest rates, consumer confidence,

labor and supply shortages, weather and commodity prices; |

| ● | the

possibility that regional or global barriers to trade or a global trade war could increase

the cost of products in the building products distribution industry, which could adversely

impact the competitiveness of such products and the financial results of businesses in the

industry; |

| ● | the

risks associated with potential litigation related to the transactions contemplated by the

Investment Agreement or related to any possible subsequent financing transactions or acquisitions

or investments; |

| ● | uncertainties

regarding general economic, business, competitive, legal, regulatory, tax and geopolitical

conditions; and |

| ● | other

factors, including those set forth in the Company’s filings with the U.S. Securities

and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 and subsequent Quarterly Reports on Form 10-Q. |

Forward-looking

statements herein speak only as of the date each statement is made. Neither the Company nor any person undertakes any obligation to update

any of these statements in light of new information or future events, except to the extent required by applicable law.

Additional information and where to find

it

In connection with the proposed equity investment,

the Company will prepare a proxy statement to be filed with the U.S. Securities and Exchange Commission (the “SEC”). When

completed, a definitive proxy statement and a form of proxy will be mailed to the stockholders of the Company. THE COMPANY’S STOCKHOLDERS

ARE URGED TO READ THE PROXY STATEMENT REGARDING THE PROPOSED TRANSACTIONS BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. The Company’s

stockholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed

with the SEC from the SEC’s website at http://www.sec.gov. The Company’s stockholders will also be able to obtain, without

charge, a copy of the proxy statement and other relevant documents (when available) from the Company’s website at https://www.silversuntech.com

or by written request to the Company at 120 Eagle Rock Avenue, East Hanover, New Jersey 07936.

Participants in the solicitation

Jacobs Private Equity II, LLC and the Company

and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders with

respect to the proposed equity investment and the other transactions contemplated by the Investment Agreement. Information about the Company’s

directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s

2023 Annual Meeting of Stockholders, which was filed with the SEC on November 27, 2023. The interests of the Company and its directors

and executive officers with regard to the proposed equity investment may differ from the interests of the Company’s stockholders

generally, and stockholders may obtain additional information by reading the proxy statement and other relevant documents regarding the

proposed equity investment and the other transactions contemplated by the Investment Agreement, when filed with the SEC.

17

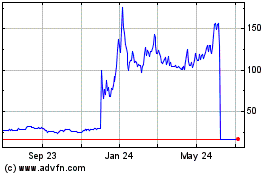

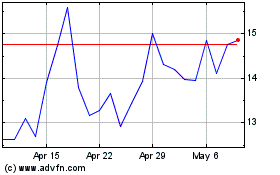

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

SilverSun Technologies (NASDAQ:SSNT)

Historical Stock Chart

From Apr 2023 to Apr 2024