FALSE000136270500013627052023-12-282023-12-2800013627052023-01-012023-09-30iso4217:USD0001362705us-gaap:ScenarioAdjustmentMember2023-01-012023-09-300001362705srt:ProFormaMember2023-01-012023-09-300001362705us-gaap:NonrelatedPartyMember2023-01-012023-09-300001362705us-gaap:NonrelatedPartyMemberus-gaap:ScenarioAdjustmentMember2023-01-012023-09-300001362705us-gaap:NonrelatedPartyMembersrt:ProFormaMember2023-01-012023-09-300001362705us-gaap:RelatedPartyMember2023-01-012023-09-300001362705us-gaap:ScenarioAdjustmentMemberus-gaap:RelatedPartyMember2023-01-012023-09-300001362705srt:ProFormaMemberus-gaap:RelatedPartyMember2023-01-012023-09-30iso4217:USDxbrli:sharesxbrli:shares00013627052022-01-012022-12-310001362705us-gaap:ScenarioAdjustmentMember2022-01-012022-12-310001362705srt:ProFormaMember2022-01-012022-12-310001362705us-gaap:NonrelatedPartyMember2022-01-012022-12-310001362705us-gaap:NonrelatedPartyMemberus-gaap:ScenarioAdjustmentMember2022-01-012022-12-310001362705us-gaap:NonrelatedPartyMembersrt:ProFormaMember2022-01-012022-12-310001362705us-gaap:RelatedPartyMember2022-01-012022-12-310001362705us-gaap:ScenarioAdjustmentMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001362705srt:ProFormaMemberus-gaap:RelatedPartyMember2022-01-012022-12-3100013627052023-09-300001362705us-gaap:ScenarioAdjustmentMember2023-09-300001362705srt:ProFormaMember2023-09-3000013627052022-12-310001362705us-gaap:ScenarioAdjustmentMember2022-12-310001362705srt:ProFormaMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December 28, 2023

Evolve Transition Infrastructure LP

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-33147 | 11-3742489 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

1360 Post Oak Blvd, Suite 2400 | |

Houston, TX | 77056 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 783-8000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

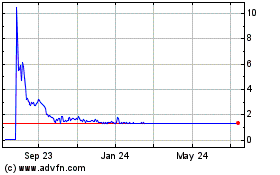

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units representing limited partner interests | SNMP | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 28, 2023, Evolve Transition Infrastructure LP (the “Partnership”) completed the sale of its 50% membership interest (the “Carnero Interest”) in Carnero G&P LLC (“Carnero”) to Targa LP Inc. (the “Buyer”) pursuant to a membership interest purchase agreement, dated as of December 28, 2023 (the “Agreement”), between the Partnership and the Buyer. The purchase price for the Carnero Interest was $27.0 million (the “Cash Consideration”). In addition to the Cash Consideration, the Buyer will make an additional cash payment to the Partnership, which will equal 20% of any cash award, less costs and expenses actually incurred by Carnero, received by Carnero with respect to claims asserted by Carnero pursuant to a third-party commercial agreement. The Partnership intends to use the net proceeds from the transaction to repay borrowings outstanding under the Partnership’s credit facility and for general working capital purposes. The Agreement contains customary representations, warranties, covenants and indemnification provisions, subject to specified limitations.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by the full text of the Agreement, a copy of which will be filed by the Partnership with its Annual Report on Form 10-K for the year ended December 31, 2023.

Item 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information

The following unaudited pro forma financial information of the Partnership is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference:

•unaudited pro forma condensed consolidated statements of operations for the nine months ended September 30, 2023, and the year ended December 31, 2022; and

•unaudited pro forma condensed consolidated balance sheets as of September 30, 2023, and December 31, 2022.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EVOLVE TRANSITION INFRASTRUCTURE LP |

| By: | Evolve Transition Infrastructure GP LLC,

its general partner |

| | |

Date: January 2, 2024 | By: | /s/ Charles C. Ward |

| | Charles C. Ward |

| | Interim Chief Executive Officer, Chief Financial Officer and Secretary |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On December 28, 2023, Evolve Transition Infrastructure LP (the “Partnership”) completed the sale of its 50% membership interest (the “Carnero Interest”) in Carnero G&P LLC (“Carnero”) to Targa LP Inc. (the “Buyer”) pursuant to a membership interest purchase agreement, dated as of December 28, 2023 (the “Agreement”), between the Partnership and the Buyer. The purchase price for the Carnero Interest was $27.0 million (the “Cash Consideration”). In addition to the Cash Consideration, the Buyer will make an additional cash payment to the Partnership, which will equal 20% of any cash award, less costs and expenses actually incurred by Carnero, received by Carnero with respect to claims asserted by Carnero pursuant to a third-party commercial agreement. The Partnership intends to use the net proceeds from the transaction to repay borrowings outstanding under the Partnership’s credit facility and for general working capital purposes. The Agreement contains customary representations, warranties, covenants and indemnification provisions, subject to specified limitations.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by the full text of the Agreement, a copy of which will be filed by the Partnership with its Annual Report on Form 10-K for the year ended December 31, 2023.

The unaudited pro forma condensed consolidated statements of operations for each of the nine months ended September 30, 2023 and the year ended December 31, 2022 as if the sale had occurred on January 1, 2022. All adjustments shown on the unaudited pro forma condensed consolidated financial statements of operations are transaction accounting adjustments.

The following unaudited pro forma condensed consolidated balance sheets as of September 30, 2023 and December 31, 2022 is presented as if the sale had occurred on January 1, 2022.

EVOLVE TRANSITION INFRASTRUCTURE LP and SUBSIDIARIES

Unaudited Pro Forma Condensed Consolidated Statements of Operations

(In thousands, except unit data)

| | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, 2023 |

| As Reported | | Pro Forma Adjustments | | Pro Forma |

| Revenues | | | | | |

| Gathering and transportation lease revenues | $ | 18,332 | | | $ | — | | | $ | 18,332 | |

| Total revenues | 18,332 | | | — | | | 18,332 | |

| Expenses | | | | | |

| Operating expenses | | | | | |

| Transportation operating expenses | 7,450 | | | — | | | 7,450 | |

| General and administrative expenses | 6,313 | | | — | | | 6,313 | |

| General and administrative (benefit) expense - related entities | (1,163) | | | 42 | | (a) | (1,121) | |

| Unit-based compensation expense | 33 | | | — | | | 33 | |

| Depreciation and amortization | 13,296 | | | — | | | 13,296 | |

| Accretion expense | 340 | | | — | | | 340 | |

| Total operating expenses | 26,269 | | | 42 | | | 26,311 | |

| Other (income) expense | | | | | |

| Interest expense, net | 1,435 | | | (930) | | (b) | 505 | |

| Interest expense, net - related entities | 43,751 | | | — | | | 43,751 | |

| (Earnings) loss from equity investment | (1,436) | | | 1,436 | | (c) | — | |

| Other income | (2) | | | — | | | (2) | |

| Total other expenses | 43,748 | | | 506 | | | 44,254 | |

| Total expenses | 70,017 | | | 548 | | | 70,565 | |

| Loss before income taxes | (51,685) | | | (548) | | | (52,233) | |

| Income tax expense | 54 | | | — | | | 54 | |

| Net loss | $ | (51,739) | | | $ | (548) | | | $ | (52,287) | |

| Net loss per unit prior to conversion | | | | | |

| Common units - Basic and Diluted | $ | (0.23) | | | $ | — | | | $ | (0.23) | |

| Weighted Average Units Outstanding prior to conversion | | | | | |

| Common units - Basic and Diluted | 228,596,208 | | | 228,596,208 | | | 228,596,208 | |

Net loss per unit after conversion(1) | | | | | |

| Common units - Basic and Diluted | $ | (6.82) | | | $ | (0.07) | | | $ | (6.89) | |

Weighted Average Units Outstanding after conversion(1) | | | | | |

| Common units - Basic and Diluted | 7,589,082 | | | 7,589,082 | | | 7,589,082 | |

(1) Amounts adjusted for the Reverse Split on July 17, 2023.

EVOLVE TRANSITION INFRASTRUCTURE LP and SUBSIDIARIES

Unaudited Pro Forma Condensed Consolidated Statements of Operations

(In thousands, except unit data)

| | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2022 |

| As Reported | | Pro Forma Adjustments | | Pro Forma |

| Revenues | | | | | |

| Gathering and transportation lease revenues | $ | 36,109 | | $ | — | | $ | 36,109 |

| Total revenues | 36,109 | | — | | | 36,109 |

| Expenses | | | | | |

| Operating expenses | | | | | |

| Transportation operating expenses | 9,877 | | — | | | 9,877 |

| General and administrative expenses | 12,404 | | — | | | 12,404 |

| General and administrative benefit - related entities | (6,375) | | (110) | | (a) | (6,485) |

| Unit-based compensation expense | 53 | | — | | | 53 |

| Loss (gain) on sale of assets | 4,408 | | (6,802) | | (d) | (2,394) |

| Depreciation and amortization | 18,516 | | — | | | 18,516 |

| Accretion expense | 421 | | — | | | 421 |

| Total operating expenses | 39,304 | | (6,912) | | | 32,392 |

| Other (income) expense | | | | | |

| Interest expense, net | 1,924 | | (967) | | (b) | 957 |

| Interest expense, net - related entities | 53,306 | | — | | | 53,306 |

| (Earnings) loss from equity investment | (6,139) | | 6,139 | | (e) | — |

| Other expense | 719 | | | — | | | 719 | |

| Total other expenses | 49,810 | | 5,172 | | | 54,982 |

| Total expenses | 89,114 | | (1,740) | | | 87,374 |

| Loss before income taxes | (53,005) | | | 1,740 | | | (51,265) | |

| Income tax expense | 132 | | | 54 | | (f) | 186 | |

| Net loss | $ | (53,137) | | | $ | 1,686 | | | $ | (51,451) | |

| Net loss per unit prior to conversion | | | | | |

| Common units - Basic and Diluted | $ | (0.35) | | | $ | 0.01 | | | $ | (0.34) | |

| Weighted Average Units Outstanding prior to conversion | | | | | |

| Common units - Basic and Diluted | 152,638,640 | | | 152,638,640 | | | 152,638,640 | |

Net loss per unit after conversion(1) | | | | | |

| Common units - Basic and Diluted | $ | (10.44) | | | $ | 0.33 | | | $ | (10.11) | |

Weighted Average Units Outstanding after conversion(1) | | | | | |

| Common units - Basic and Diluted | 5,087,955 | | | 5,087,955 | | | 5,087,955 | |

(1) Amounts adjusted for the Reverse Split on July 17, 2023.

EVOLVE TRANSITION INFRASTRUCTURE LP and SUBSIDIARIES

Unaudited Pro Forma Condensed Consolidated Balance Sheets

(In thousands, except unit data)

| | | | | | | | | | | | | | | | | |

| September 30,

2023 |

| As Reported | | Pro Forma Adjustments | | Pro Forma |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 2,122 | | | $ | 1,897 | | (b) | $ | 4,019 | |

| Accounts receivable | 4,117 | | | — | | | 4,117 | |

| Prepaid expenses | 606 | | | — | | | 606 | |

| Deferred lease incentive | 1,122 | | | — | | | 1,122 | |

| Total current assets | 7,967 | | | 1,897 | | 9,864 | |

| Gathering and transportation assets, net | 83,962 | | | — | | | 83,962 | |

| Intangible assets, net | 98,541 | | | — | | | 98,541 | |

| Equity investments | 14,696 | | | (14,696) | | (c)(g) | — | |

| Deferred lease incentive, net | 8,972 | | | — | | | 8,972 | |

| Right of use assets, net | 3,938 | | | — | | | 3,938 | |

| Other non-current assets | 50 | | | — | | | 50 | |

| Total assets | $ | 218,126 | | | $ | (12,799) | | $ | 205,327 | |

| | | | | |

LIABILITIES AND PARTNERS’ DEFICIT | | | | | |

| Current liabilities | | | | | |

| Accounts payable and accrued liabilities | $ | 3,399 | | | $ | 54 | | (f) | $ | 3,453 | |

| Other current liabilities | 359 | | | — | | | 359 | |

| Short-term debt, net of debt issuance costs | — | | | — | | | — | |

| Class C preferred units - related entities | 442,157 | | | — | | | 442,157 | |

| Short-term lease liabilities | 2,286 | | | — | | | 2,286 | |

| Total current liabilities | 448,201 | | | 54 | | 448,255 | |

| Other liabilities | | | | | |

| Accrued shared services fees - related entities | 2,677 | | | (68) | | (a) | 2,609 | |

| Asset retirement obligation | 5,461 | | | — | | | 5,461 | |

| Long-term debt, net of discount and debt issuance costs | 17,049 | | | (13,923) | | (g) | 3,126 | |

| Long-term lease liabilities | 1,048 | | | — | | | 1,048 | |

| Stonepeak warrant - related entities | 1,328 | | | — | | | 1,328 | |

| Other liabilities | 303 | | | — | | | 303 | |

| Total other liabilities | 27,866 | | | (13,991) | | 13,875 | |

| Total liabilities | 476,067 | | | (13,937) | | 462,130 | |

| Commitments and contingencies | | | | | |

Partners’ deficit | | | | | |

Common units, 8,443,516(1) units issued and outstanding as of September 30, 2023 | (257,941) | | | 1,138 | | (h) | (256,803) | |

Total partners’ deficit | (257,941) | | | 1,138 | | | (256,803) | |

Total liabilities and partners’ deficit | $ | 218,126 | | | $ | (12,799) | | $ | 205,327 | |

(1) Amounts adjusted for the Reverse Split on July 17, 2023.

EVOLVE TRANSITION INFRASTRUCTURE LP and SUBSIDIARIES

Unaudited Pro Forma Condensed Consolidated Balance Sheets

(In thousands, except unit data)

| | | | | | | | | | | | | | | | | |

| December 31,

2022 |

| As Reported | | Pro Forma Adjustments | | Pro Forma |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 2,785 | | | $ | 967 | | (b) | $ | 3,752 | |

| Accounts receivable | 2,415 | | | — | | | 2,415 | |

| Prepaid expenses | 371 | | | — | | | 371 | |

| Deferred lease incentive | 1,122 | | | — | | | 1,122 | |

| Total current assets | 6,693 | | | 967 | | 7,660 | |

| Gathering and transportation assets, net | 87,478 | | | — | | | 87,478 | |

| Intangible assets, net | 106,752 | | | — | | | 106,752 | |

| Equity investments | 14,964 | | | (14,964) | | (d)(e)(i)(j) | — | |

| Deferred lease incentive, net | 9,813 | | | — | | | 9,813 | |

| Right of use assets, net | 5,899 | | | — | | | 5,899 | |

| Other non-current assets | 75 | | | — | | | 75 | |

| Total assets | $ | 231,674 | | | $ | (13,997) | | $ | 217,677 | |

| | | | | |

LIABILITIES AND PARTNERS’ DEFICIT | | | | | |

| Current liabilities | | | | | |

| Accounts payable and accrued liabilities | $ | 4,675 | | | $ | 54 | | (f) | $ | 4,729 | |

| Other current liabilities | 438 | | | — | | | 438 | |

| Short-term debt, net of debt issuance costs | 19,793 | | | (15,627) | | (d)(i)(j) | 4,166 | |

| Class C preferred units - related entities | 411,800 | | | — | | | 411,800 | |

| Short-term lease liabilities | 2,204 | | | — | | | 2,204 | |

| Total current liabilities | 438,910 | | | (15,573) | | 423,337 | |

| Other liabilities | | | | | |

| Accrued shared services fees - related entities | 3,839 | | | (110) | | (a) | 3,729 | |

| Asset retirement obligation | 5,121 | | | — | | | 5,121 | |

| Long-term lease liabilities | 2,773 | | | — | | | 2,773 | |

| Stonepeak warrant - related entities | 2,853 | | | — | | | 2,853 | |

| Other liabilities | 287 | | | — | | | 287 | |

| Total other liabilities | 14,873 | | | (110) | | 14,763 | |

| Total liabilities | 453,783 | | | (15,683) | | 438,100 | |

| Commitments and contingencies | | | | | |

Partners’ deficit | | | | | |

Common units, 7,510,186(1) units issued and outstanding as of December 31, 2022 | (222,109) | | | 1,686 | | (h) | (220,423) | |

Total partners’ deficit | (222,109) | | | 1,686 | | | (220,423) | |

Total liabilities and partners’ deficit | $ | 231,674 | | | $ | (13,997) | | $ | 217,677 | |

(1) Amounts adjusted for the Reverse Split on July 17, 2023.

NOTES TO THE UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The following items resulted in transaction accounting adjustments in the unaudited pro forma condensed consolidated financial information:

(a) Adjustment represents removal of Carnero JV from the shared services fee.

(b) Adjustment represents reduction of interest paid as a result of debt reduction.

(c) Adjustment represents income recorded during 2023 from the Targa JV.

(d) Adjustment represents the sale of the Targa JV on January 1, 2022.

(e) Adjustment represents income recorded during 2022 from the Targa JV.

(f) Adjustment reflects the income tax impact on the sale of the Targa JV.

(g) Adjustment represents distributions received during 2023 from the Targa JV.

(h) Represents the effect of adjustments in notes (a) through (f) on partners’ deficit.

(i) Adjustment represents distributions received during 2022 from the Targa JV.

(j) Adjustment represents contributions made during 2022 to the Targa JV.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.4

Condensed Consolidated Statements of Operations - USD ($)

$ in Thousands |

9 Months Ended |

12 Months Ended |

Sep. 30, 2023 |

Dec. 31, 2022 |

| Revenues |

|

|

|

| Gathering and transportation lease revenues |

|

$ 18,332

|

$ 36,109

|

| Total revenues |

|

18,332

|

36,109

|

| Operating expenses |

|

|

|

| Transportation operating expenses |

|

7,450

|

9,877

|

| General and administrative expenses |

|

6,313

|

12,404

|

| General and administrative (benefit) expense - related entities |

|

(1,163)

|

(6,375)

|

| Unit-based compensation expense |

|

33

|

53

|

| Loss (gain) on sale of assets |

|

|

4,408

|

| Depreciation and amortization |

|

13,296

|

18,516

|

| Accretion expense |

|

340

|

421

|

| Total operating expenses |

|

26,269

|

39,304

|

| Other (income) expense |

|

|

|

| (Earnings) loss from equity investment |

|

(1,436)

|

(6,139)

|

| Other income |

|

(2)

|

719

|

| Total other expenses |

|

43,748

|

49,810

|

| Total expenses |

|

70,017

|

89,114

|

| Loss before income taxes |

|

(51,685)

|

(53,005)

|

| Income tax expense |

|

54

|

132

|

| Net loss |

|

$ (51,739)

|

$ (53,137)

|

| Net loss per unit prior to conversion |

|

|

|

| Common units - Basic (in dollars per share) |

|

$ (0.23)

|

$ (0.35)

|

| Common units - Diluted (in dollars per share) |

|

$ (0.23)

|

$ (0.35)

|

| Weighted Average Units Outstanding prior to conversion |

|

|

|

| Common units - Basic (in shares) |

|

228,596,208

|

152,638,640

|

| Common units - Diluted (in shares) |

|

228,596,208

|

152,638,640

|

| Net loss per unit after conversion |

|

|

|

| Common units - Basic (in dollars per share) |

[1] |

$ (6.82)

|

$ (10.44)

|

| Common units - Diluted (in dollars per share) |

[1] |

$ (6.82)

|

$ (10.44)

|

| Weighted Average Units Outstanding after conversion |

|

|

|

| Common units - Basic (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Common units - Diluted (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Pro Forma Adjustments |

|

|

|

| Revenues |

|

|

|

| Gathering and transportation lease revenues |

|

$ 0

|

$ 0

|

| Total revenues |

|

0

|

0

|

| Operating expenses |

|

|

|

| Transportation operating expenses |

|

0

|

0

|

| General and administrative expenses |

|

0

|

0

|

| General and administrative (benefit) expense - related entities |

|

42

|

(110)

|

| Unit-based compensation expense |

|

0

|

0

|

| Loss (gain) on sale of assets |

|

|

(6,802)

|

| Depreciation and amortization |

|

0

|

0

|

| Accretion expense |

|

0

|

0

|

| Total operating expenses |

|

42

|

(6,912)

|

| Other (income) expense |

|

|

|

| (Earnings) loss from equity investment |

|

1,436

|

6,139

|

| Other income |

|

0

|

0

|

| Total other expenses |

|

506

|

5,172

|

| Total expenses |

|

548

|

(1,740)

|

| Loss before income taxes |

|

(548)

|

1,740

|

| Income tax expense |

|

0

|

54

|

| Net loss |

|

$ (548)

|

$ 1,686

|

| Net loss per unit prior to conversion |

|

|

|

| Common units - Basic (in dollars per share) |

|

$ 0

|

$ 0.01

|

| Common units - Diluted (in dollars per share) |

|

$ 0

|

$ 0.01

|

| Weighted Average Units Outstanding prior to conversion |

|

|

|

| Common units - Basic (in shares) |

|

228,596,208

|

152,638,640

|

| Common units - Diluted (in shares) |

|

228,596,208

|

152,638,640

|

| Net loss per unit after conversion |

|

|

|

| Common units - Basic (in dollars per share) |

[1] |

$ (0.07)

|

$ 0.33

|

| Common units - Diluted (in dollars per share) |

[1] |

$ (0.07)

|

$ 0.33

|

| Weighted Average Units Outstanding after conversion |

|

|

|

| Common units - Basic (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Common units - Diluted (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Pro Forma |

|

|

|

| Revenues |

|

|

|

| Gathering and transportation lease revenues |

|

$ 18,332

|

$ 36,109

|

| Total revenues |

|

18,332

|

36,109

|

| Operating expenses |

|

|

|

| Transportation operating expenses |

|

7,450

|

9,877

|

| General and administrative expenses |

|

6,313

|

12,404

|

| General and administrative (benefit) expense - related entities |

|

(1,121)

|

(6,485)

|

| Unit-based compensation expense |

|

33

|

53

|

| Loss (gain) on sale of assets |

|

|

(2,394)

|

| Depreciation and amortization |

|

13,296

|

18,516

|

| Accretion expense |

|

340

|

421

|

| Total operating expenses |

|

26,311

|

32,392

|

| Other (income) expense |

|

|

|

| (Earnings) loss from equity investment |

|

0

|

0

|

| Other income |

|

(2)

|

719

|

| Total other expenses |

|

44,254

|

54,982

|

| Total expenses |

|

70,565

|

87,374

|

| Loss before income taxes |

|

(52,233)

|

(51,265)

|

| Income tax expense |

|

54

|

186

|

| Net loss |

|

$ (52,287)

|

$ (51,451)

|

| Net loss per unit prior to conversion |

|

|

|

| Common units - Basic (in dollars per share) |

|

$ (0.23)

|

$ (0.34)

|

| Common units - Diluted (in dollars per share) |

|

$ (0.23)

|

$ (0.34)

|

| Weighted Average Units Outstanding prior to conversion |

|

|

|

| Common units - Basic (in shares) |

|

228,596,208

|

152,638,640

|

| Common units - Diluted (in shares) |

|

228,596,208

|

152,638,640

|

| Net loss per unit after conversion |

|

|

|

| Common units - Basic (in dollars per share) |

[1] |

$ (6.89)

|

$ (10.11)

|

| Common units - Diluted (in dollars per share) |

[1] |

$ (6.89)

|

$ (10.11)

|

| Weighted Average Units Outstanding after conversion |

|

|

|

| Common units - Basic (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Common units - Diluted (in shares) |

[1] |

7,589,082

|

5,087,955

|

| Nonrelated Party |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

$ 1,435

|

$ 1,924

|

| Nonrelated Party | Pro Forma Adjustments |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

(930)

|

(967)

|

| Nonrelated Party | Pro Forma |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

505

|

957

|

| Related Party |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

43,751

|

53,306

|

| Related Party | Pro Forma Adjustments |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

0

|

0

|

| Related Party | Pro Forma |

|

|

|

| Other (income) expense |

|

|

|

| Interest expense, net |

|

$ 43,751

|

$ 53,306

|

|

|

| X |

- DefinitionRepresents the aggregate amount of expenses, including operating and nonoperating.

| Name: |

snmp_ExpensesOperatingAndNonoperating |

| Namespace Prefix: |

snmp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionCost incurred related to the gas activities, such as transportation, marketing and processing crude oil, natural gas and refined petroleum products.

| Name: |

snmp_GasGatheringTransportationMarketingAndProcessingCosts1 |

| Namespace Prefix: |

snmp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionNet Income (Loss), Net of Tax, Per Outstanding Limited Partnership Unit, Basic, After Conversion

| Name: |

snmp_NetIncomeLossNetOfTaxPerOutstandingLimitedPartnershipUnitBasicAfterConversion |

| Namespace Prefix: |

snmp_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionNet Income (Loss), Net of Tax, Per Outstanding Limited Partnership Unit, Diluted, After Conversion

| Name: |

snmp_NetIncomeLossNetOfTaxPerOutstandingLimitedPartnershipUnitDilutedAfterConversion |

| Namespace Prefix: |

snmp_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate amount of income or expense from ancillary business-related activities and interest.

| Name: |

snmp_NonoperatingIncomeExpenseAndInterest |

| Namespace Prefix: |

snmp_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionWeighted Average Limited Partnership Units Outstanding, Basic, After Conversion

| Name: |

snmp_WeightedAverageLimitedPartnershipUnitsOutstandingBasicAfterConversion |

| Namespace Prefix: |

snmp_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionWeighted Average Limited Partnership Units Outstanding, Diluted, After Conversion

| Name: |

snmp_WeightedAverageLimitedPartnershipUnitsOutstandingDilutedAfterConversion |

| Namespace Prefix: |

snmp_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of expense for award under share-based payment arrangement. Excludes amount capitalized. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 718

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SAB Topic 14.F)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479830/718-10-S99-1

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 718

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 2

-Subparagraph (h)(1)(i)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480429/718-10-50-2

| Name: |

us-gaap_AllocatedShareBasedCompensationExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of accretion expense recognized during the period that is associated with an asset retirement obligation. Accretion expense measures and incorporates changes due to the passage of time into the carrying amount of the liability. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 410

-SubTopic 20

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481879/410-20-45-1

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 410

-SubTopic 20

-Name Accounting Standards Codification

-Section 50

-Paragraph 1

-Subparagraph (c)(3)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481850/410-20-50-1

| Name: |

us-gaap_AssetRetirementObligationAccretionExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionTotal costs of sales and operating expenses for the period. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

| Name: |

us-gaap_CostsAndExpenses |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate expense recognized in the current period that allocates the cost of tangible assets, intangible assets, or depleting assets to periods that benefit from use of the assets. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Section 45

-Paragraph 28

-Subparagraph (b)

-SubTopic 10

-Topic 230

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482740/230-10-45-28

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (e)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

| Name: |

us-gaap_DepreciationDepletionAndAmortization |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_EarningsPerGeneralPartnershipUnitAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_EarningsPerUnitAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of gain (loss) on sale or disposal of assets, including but not limited to property plant and equipment, intangible assets and equity in securities of subsidiaries or equity method investee. Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 230

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 28

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482740/230-10-45-28

| Name: |

us-gaap_GainLossOnDispositionOfAssets1 |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate total of expenses of managing and administering the affairs of an entity, including affiliates of the reporting entity, which are not directly or indirectly associated with the manufacture, sale or creation of a product or product line. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-07(2)(a))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483575/946-220-S99-1

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03.4)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

| Name: |

us-gaap_GeneralAndAdministrativeExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of income (loss) for proportionate share of equity method investee's income (loss). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Section 45

-Paragraph 28

-Subparagraph (b)

-SubTopic 10

-Topic 230

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482740/230-10-45-28

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-04(10))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483586/944-220-S99-1

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481664/323-10-45-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (g)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 5: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03(12))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

Reference 6: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-04(13)(f))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483589/942-220-S99-1

| Name: |

us-gaap_IncomeLossFromEquityMethodInvestments |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of the cost of borrowed funds accounted for as interest expense. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section 45

-Paragraph 3

-Subparagraph (i)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483581/946-220-45-3

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-07(3))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483575/946-220-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 5: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 835

-SubTopic 30

-Section 45

-Paragraph 3

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482925/835-30-45-3

Reference 6: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-04.9)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483589/942-220-S99-1

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (210.5-03(11))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 835

-SubTopic 20

-Name Accounting Standards Codification

-Section 50

-Paragraph 1

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483013/835-20-50-1

| Name: |

us-gaap_InterestExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

duration |

|

| X |

- DefinitionThe portion of profit or loss for the period, net of income taxes, which is attributable to the parent. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 6

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482765/220-10-50-6

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-3

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 1

-Subparagraph (b)(2)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-1

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 815

-SubTopic 40

-Name Accounting Standards Codification

-Section 65

-Paragraph 1

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480175/815-40-65-1

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 8

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-8

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 9

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-9

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 11

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-11

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 11

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-11

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 250

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 4

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483443/250-10-50-4

Reference 13: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480167/946-830-55-10

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section 45

-Paragraph 7

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483581/946-220-45-7

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483586/944-220-S99-1

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-07(9))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483575/946-220-S99-1

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 3

-Subparagraph (SX 210.6-09(1)(d))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483575/946-220-S99-3

Reference 19: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 20: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 21: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 22: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 23: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 24: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 25: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 26: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 27: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 28: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 29: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 30: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 31: http://www.xbrl.org/2003/role/disclosureRef

-Topic 260

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 60B

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482689/260-10-45-60B

Reference 32: http://www.xbrl.org/2003/role/exampleRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 31

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-31

Reference 33: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 34: http://www.xbrl.org/2003/role/disclosureRef

-Topic 205

-SubTopic 20

-Name Accounting Standards Codification

-Section 50

-Paragraph 7

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483499/205-20-50-7

Reference 35: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 230

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 28

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482740/230-10-45-28

Reference 36: http://www.xbrl.org/2003/role/disclosureRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1A

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-1A

Reference 37: http://www.xbrl.org/2003/role/disclosureRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 1B

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-1B

Reference 38: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03(20))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

Reference 39: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 942

-SubTopic 220

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-04(22))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483589/942-220-S99-1

| Name: |

us-gaap_NetIncomeLoss |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionPer unit of ownership amount after tax of income (loss) available to limited partnership (LP) unit-holder and units that would have been outstanding assuming the issuance of limited partner units for dilutive potential units outstanding. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 505

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 5

-Subparagraph (SAB Topic 4.F)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480008/505-10-S99-5

| Name: |

us-gaap_NetIncomeLossNetOfTaxPerOutstandingLimitedPartnershipUnitDiluted |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPer unit of ownership amount after tax of income (loss) available to outstanding limited partnership (LP) unit-holder. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 505

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 5

-Subparagraph (SAB Topic 4.F)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480008/505-10-S99-5

| Name: |

us-gaap_NetIncomeLossPerOutstandingLimitedPartnershipUnitBasicNetOfTax |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

dtr-types:perShareItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_OperatingExpensesAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of operating lease income from lease payments and variable lease payments paid and payable to lessor. Includes, but is not limited to, variable lease payments not included in measurement of lease receivable. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 842

-SubTopic 30

-Name Accounting Standards Codification

-Section 50

-Paragraph 5

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479773/842-30-50-5

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 270

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 6A

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482964/270-10-50-6A

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 842

-SubTopic 30

-Name Accounting Standards Codification

-Section 45

-Paragraph 3

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479016/842-30-45-3

| Name: |

us-gaap_OperatingLeaseLeaseIncome |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of income (expense) related to nonoperating activities, classified as other. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03.9)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

| Name: |

us-gaap_OtherNonoperatingIncomeExpense |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_OtherNonoperatingIncomeExpenseAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAmount of revenue recognized from goods sold, services rendered, insurance premiums, or other activities that constitute an earning process. Includes, but is not limited to, investment and interest income before deduction of interest expense when recognized as a component of revenue, and sales and trading gain (loss). Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 2

-Subparagraph (SX 210.5-03(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147483621/220-10-S99-2

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 6: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 7: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 8: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 9: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1A

-Subparagraph (SX 210.13-01(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1A

Reference 10: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(i))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 11: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(A))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 12: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iii)(B))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 13: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(4)(iv))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 14: http://www.xbrl.org/2003/role/disclosureRef

-Topic 470

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1B

-Subparagraph (SX 210.13-02(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480097/470-10-S99-1B

Reference 15: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 30

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-30

Reference 16: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 42

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-42

Reference 17: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 18: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (b)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 19: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 40

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-40

Reference 20: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 22

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-22

Reference 21: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 32

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-32

Reference 22: http://www.xbrl.org/2003/role/disclosureRef

-Topic 280

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 41

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482810/280-10-50-41

Reference 23: http://www.xbrl.org/2003/role/disclosureRef

-Topic 942

-SubTopic 235

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.9-05(b)(2))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479557/942-235-S99-1

| Name: |

us-gaap_Revenues |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_RevenuesAbstract |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionWeighted average number of limited partnership units outstanding determined by relating the portion of time within a reporting period that limited partnership units have been outstanding to the total time in that period. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 505

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 5

-Subparagraph (SAB Topic 4.F)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480008/505-10-S99-5

| Name: |

us-gaap_WeightedAverageLimitedPartnershipUnitsOutstanding |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionWeighted average number of limited partnership units outstanding determined by relating the portion of time within a reporting period that limited partnership units have been outstanding to the total time in that period. Used in the calculation of diluted net income or loss per limited partnership unit. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 505

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 5