Milestone Scientific Inc. (NYSE: MLSS), a leading

developer of computerized drug delivery instruments that provide

painless and precise injections, today provided a business update

and announced financial results for the third quarter ended

September 30, 2023.

Arjan Haverhals, CEO and President of Milestone

Scientific, stated, “We achieved solid revenues of $2.1 million for

the third quarter of 2023. Most notably, domestic dental sales

increased 45%, due in part to the success of our direct sales model

through the new portal for selling and shipping the STA Single

Tooth Anesthesia System® (STA) and handpieces. This strategy has

provided us a closer and more direct relationship with our

customers, which has exceeded our expectations thus far. The new

direct selling model has also resulted in an increase in gross

profit for the third quarter of 2023. We achieved this growth

despite a small sales force, as we are focused on maximizing

profitability with a streamlined operating structure. Given the

domestic traction, we are now increasing our focus on expanding our

penetration within international markets. While sales to

international distributors can be uneven due to the timing and size

of orders, we expect our international sales to resume growth. We

also look forward to announcing the addition of new international

partners, which should support our global expansion strategy over

the coming quarters.”

“Turning to our medical division, we have made

significant progress rolling out our CompuFlo® Epidural System.

Specifically, we have added a new distributor and expanded adoption

of the CompuFlo® Epidural System in a prominent hospital system and

pain management clinics. Most recently, we commenced sales into

Island Ambulatory Surgery Center (ASC) in Brooklyn, New York,

representing the first commercial adoption of the CompuFlo®

Epidural System within an ambulatory surgery center. Additionally,

we are working closely with a major hospital system to expand use

of the CompuFlo® Epidural System beyond labor & delivery, to

now include use with neurostimulation spinal cord stimulator

implantation procedures.”

"On the heels of positive reimbursement from

commercial payers for patients who were involved in motor vehicle

accidents, we continue to make progress advancing our broader

reimbursement strategy by supporting clinicians’ utilization of the

CompuFlo® technology across a variety of additional use cases.

These physicians have reported back on claims activities from their

payers and we are encouraged by feedback from the insurance

providers to the clinicians. Moreover, the high level of claim

activity that is being generated by our advisory sites is providing

an opportunity to engage with the payers to directly educate them

on the CompuFlo Epidural System and the unmet patient need the

technology serves, including its ability to increase safety,

efficiency and predictability, thus improving healthcare.”

For the three months ended September 30, 2023

and 2022, revenues were approximately $2.1 million and $2.2

million, respectively, due to an increase in domestic dental sales

of $386 thousand, offset by a decrease in international dental

sales of $539 thousand. Gross profit for the third quarter ended

September 30, 2023, was $1.5 million, or 73% of revenue, versus

$1.5 million, or 66% of revenue, for the third quarter ended

September 30, 2022. The increase in gross profit was due to higher

margin sales with the launch of the new online store. Operating

loss for the three months ended September 30, 2023, was

approximately $(1.5) million versus approximately $(2.0) million

for the third quarter ended September 30, 2022. The reduction in

operating loss reflects the increase in gross profit and a decrease

in selling, general and administrative expenses. Net loss was

approximately $(1.5) million, or $(0.02) per share for the three

months ended September 30, 2023, versus net loss of $(2.0) million,

or $(0.03) per share, for the comparable period in 2022.

For the nine months ended September 30, 2023 and

2022, revenues were approximately $7.6 million, a 15% increase

compared to $6.6 million for the same period last year, driven by

an increase in domestic dental sales of $1.3 million, partially

offset by a decrease in international dental sales of $135

thousand. Gross profit for the first nine months of 2023 was $5.3

million, or 70% of revenue, versus $3.8 million, or 58% of revenue,

for the first nine months of 2022. Operating loss for the first

nine months of 2023 was approximately $(5.1) million versus

approximately $(6.8) million for the first nine months of 2022. Net

loss for the first nine months of 2023 was $(5.0) million, or

$(0.07) per share, versus net loss of $(6.8) million, or $(0.10)

per share, for the comparable period in 2022.

As of September 30, 2023, the Company had cash,

cash equivalents and short-term securities of approximately $4.6

million and working capital of approximately $6.7 million.

Conference Call

Milestone Scientific’s executive management team

will host a conference call today, Wednesday, November 15, 2023, at

8:30 AM Eastern Time to discuss the Company’s financial results for

the third quarter ended September 30, 2023, as well as the

Company’s corporate progress and other developments.

The conference call will be available via

telephone by dialing toll free 888-506-0062 for U.S. callers or +1

973-528-0011 for international callers and by entering the access

code: 164775. A webcast and replay of the call may be accessed at

https://www.webcaster4.com/Webcast/Page/2306/49471.

An audio replay of the call will be available

through November 29, 2023 and can be accessed by dialing

877-481-4010 for U.S. callers or +1 919-882-2331 for international

callers and by entering the access code: 49471.

About Milestone Scientific

Inc.Milestone Scientific Inc. (MLSS), a technology focused

medical research and development company that patents, designs and

develops innovative injection technologies and instruments for

medical and dental applications. Milestone Scientific’s

computer-controlled systems are designed to make injections

precise, efficient and increase the overall patient comfort and

safety. Their proprietary DPS Dynamic Pressure Sensing Technology®

instruments is the platform to advance the development of

next-generation devices, regulating flow rate and monitoring

pressure from the tip of the needle, through platform extensions of

subcutaneous drug delivery, including local anesthetic. To learn

more, view the MLSS brand video or visit

milestonescientific.com.

Safe Harbor Statement

This press release contains forward-looking

statements regarding the timing and financial impact of Milestone's

ability to implement its business plan, expected revenues, timing

of regulatory approvals and future success. These statements

involve a number of risks and uncertainties and are based on

assumptions involving judgments with respect to future economic,

competitive and market conditions, future business decisions and

regulatory developments, all of which are difficult or impossible

to predict accurately and many of which are beyond Milestone's

control. Some of the important factors that could cause actual

results to differ materially from those indicated by the

forward-looking statements are general economic conditions, failure

to achieve expected revenue growth, changes in our operating

expenses, adverse patent rulings, FDA or legal developments,

competitive pressures, changes in customer and market requirements

and standards, and the risk factors detailed from time to time in

Milestone's periodic filings with the Securities and Exchange

Commission, including without limitation, Milestone's Annual Report

for the year ended December 31, 2022. The forward-looking

statements in this press release are based upon management's

reasonable belief as of the date hereof. Milestone undertakes no

obligation to revise or update publicly any forward-looking

statements for any reason.

Contact:

Crescendo

Communications, LLCEmail: mlss@crescendo-ir.comTel:

212-671-1020

(tables follow)

|

|

|

MILESTONE SCIENTIFIC AND SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

| |

|

|

|

|

|

|

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

ASSETS |

|

|

(Unaudited) |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

2,170,593 |

|

|

$ |

8,715,279 |

|

| Marketable securities |

|

|

2,450,470 |

|

|

|

- |

|

| Accounts receivable, net |

|

|

591,012 |

|

|

|

693,717 |

|

| Prepaid expenses and other

current assets |

|

|

578,753 |

|

|

|

443,872 |

|

| Inventories |

|

|

2,482,630 |

|

|

|

1,792,335 |

|

| Advances on contracts |

|

|

1,699,153 |

|

|

|

1,325,301 |

|

| Total current assets |

|

|

9,972,611 |

|

|

|

12,970,504 |

|

| Furniture, fixtures and

equipment, net |

|

|

9,182 |

|

|

|

18,146 |

|

| Intangibles, net |

|

|

188,314 |

|

|

|

227,956 |

|

| Right of use assets finance

lease |

|

|

11,159 |

|

|

|

17,645 |

|

| Right of use assets operating

lease |

|

|

378,142 |

|

|

|

443,685 |

|

| Other assets |

|

|

24,150 |

|

|

|

24,150 |

|

| Total assets |

|

$ |

10,583,558 |

|

|

$ |

13,702,086 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,149,267 |

|

|

$ |

1,102,729 |

|

| Accounts payable, related

party |

|

|

636,637 |

|

|

|

803,492 |

|

| Accrued expenses and other

payables |

|

|

1,111,742 |

|

|

|

1,124,839 |

|

| Accrued expenses, related

party |

|

|

270,836 |

|

|

|

167,549 |

|

| Current portion of finance

lease liabilities |

|

|

10,031 |

|

|

|

9,365 |

|

| Current portion of operating

lease liabilities |

|

|

100,327 |

|

|

|

91,701 |

|

| Total current liabilities |

|

|

3,278,840 |

|

|

|

3,299,675 |

|

| Non-current portion of finance

lease liabilities |

|

|

3,088 |

|

|

|

10,698 |

|

| Non-current portion of

operating lease liabilities |

|

|

308,605 |

|

|

|

385,279 |

|

| Total liabilities |

|

$ |

3,590,533 |

|

|

$ |

3,695,652 |

|

| |

|

|

|

|

|

|

|

|

| Commitments |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

| Common stock, par value

$.001;authorized 100,000,000 shares; 70,893,748 shares issued and

70,860,415 shares outstanding as of September 30, 2023; shares;

69,306,497 shares issued and 69,273,164 shares outstanding as of

December 31, 2022 |

|

|

70,894 |

|

|

|

69,306 |

|

| Additional paid in

capital |

|

|

129,487,592 |

|

|

|

127,478,325 |

|

| Accumulated deficit |

|

|

(121,400,682 |

) |

|

|

(116,410,405 |

) |

| Treasury stock, at cost,

33,333 shares |

|

|

(911,516 |

) |

|

|

(911,516 |

) |

| Total Milestone Scientific,

Inc. stockholders' equity |

|

|

7,246,288 |

|

|

|

10,225,710 |

|

| Noncontrolling interest |

|

|

(253,263 |

) |

|

|

(219,276 |

) |

| Total stockholders’

equity |

|

|

6,993,025 |

|

|

|

10,006,434 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

|

$ |

10,583,558 |

|

|

$ |

13,702,086 |

|

| |

|

MILESTONE SCIENTIFIC AND SUBSIDIARIESCONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(UNAUDITED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30, 2023 |

|

|

For the three months ended September 30, 2022 |

|

|

For the nine months ended September 30, 2023 |

|

|

For the nine months ended September 30, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product sales, net |

|

$ |

2,059,284 |

|

|

$ |

2,215,699 |

|

|

$ |

7,566,848 |

|

|

$ |

6,564,969 |

|

| Cost of products sold |

|

|

555,850 |

|

|

|

762,964 |

|

|

|

2,284,730 |

|

|

|

2,749,160 |

|

| Gross profit |

|

|

1,503,434 |

|

|

|

1,452,735 |

|

|

|

5,282,118 |

|

|

|

3,815,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

2,823,765 |

|

|

|

3,282,378 |

|

|

|

9,834,781 |

|

|

|

9,681,326 |

|

| Research and development

expenses |

|

|

170,478 |

|

|

|

166,191 |

|

|

|

524,472 |

|

|

|

897,218 |

|

| Depreciation and amortization

expense |

|

|

15,896 |

|

|

|

16,661 |

|

|

|

49,798 |

|

|

|

50,121 |

|

| Total operating expenses |

|

|

3,010,139 |

|

|

|

3,466,230 |

|

|

|

10,409,051 |

|

|

|

10,628,665 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(1,506,705 |

) |

|

|

(2,013,495 |

) |

|

|

(5,126,933 |

) |

|

|

(6,812,856 |

) |

| Interest income |

|

|

30,600 |

|

|

|

28,012 |

|

|

|

102,669 |

|

|

|

28,819 |

|

| Loss before provision for

income taxes |

|

|

(1,476,105 |

) |

|

|

(1,985,483 |

) |

|

|

(5,024,264 |

) |

|

|

(6,783,037 |

) |

| Provision for income

taxes |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

- |

|

| Net loss |

|

|

(1,476,105 |

) |

|

|

(1,985,483 |

) |

|

|

(5,024,264 |

) |

|

|

(6,783,037 |

) |

| Net loss attributable to

noncontrolling interests |

|

|

(9,811 |

) |

|

|

(13,680 |

) |

|

|

(33,987 |

) |

|

|

(54,030 |

) |

| Net loss attributable to

Milestone Scientific Inc. |

|

$ |

(1,466,294 |

) |

|

$ |

(1,9718,803 |

) |

|

$ |

(4,990,277 |

) |

|

$ |

(6,732,007 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share applicable

to common stockholders— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

(0.02 |

) |

|

|

(0.03 |

) |

|

|

(0.07 |

) |

|

|

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding and to be issued— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

|

73,730,921 |

|

|

|

70,975,420 |

|

|

|

72,374,693 |

|

|

|

70,480,706 |

|

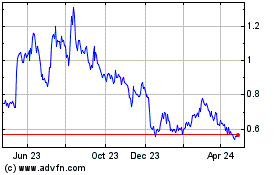

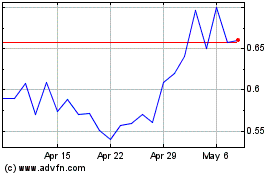

Milestone Scientific (AMEX:MLSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Milestone Scientific (AMEX:MLSS)

Historical Stock Chart

From Apr 2023 to Apr 2024