FALSE000153743500015374352023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 9, 2023

TECOGEN INC. (OTCQX: TGEN)

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-36103 | | 04-3536131 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

| 45 First Avenue | | |

Waltham, Massachusetts | | 02451 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(781) 466-6400

(Registrant's telephone number, including area code)

_______________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act. | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

INFORMATION TO BE INCLUDED IN THE REPORT

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

On October 9, 2023, Tecogen Inc. (“registrant,” “we,” “our,” “us”) entered into an agreement with each of John N. Hatsopoulos, a director and principal shareholder of registrant, and Earl R. Lewis, III, a director of registrant, pursuant to which Mr. Hatsopoulos agreed to provide financing to us of up to $1 million, and Mr. Lewis agreed to provide financing to us of $500,000, and potentially an additional $500,000 at his discretion. We will determine the amount of the loans at the time of draw down, subject to the conditions in our agreements with each of Mr. Hatsopoulos and Mr. Lewis discussed below. The loans and terms of the loan agreements were unanimously approved by the members of our board of directors.

The following description of the loans is qualified in its entirety by reference to the Note Subscription Agreements and attached forms of Promissory Notes for Mr. Hatsopoulos and Mr. Lewis which are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated herein by this reference and made a part hereof.

Hatsopoulos’ Loan. Mr. Hatsopoulos has agreed to provide to us loans of up to $1 million in two separate tranches of $500,000. Each loan is to be made within ten days of Mr. Hatsopoulos’ receipt of notice from us setting out the amount of each such drawdown.

Lewis’ Loan. Mr. Lewis has agreed to provide to us a loan of $500,000 provided we have previously drawn down and have outstanding loans from Mr. Hastopoulos of $1 million dollars. The loan by Mr. Lewis is to be made within ten days of his receipt of notice from us. An additional loan of $500,000, or $1 million in the aggregate, may be made available to us on the same terms by Mr. Lewis at his discretion.

Other Loan Provisions. Each loan will bear interest on the outstanding principal at the Internal Revenue Service’s Applicable Federal Rate to be determined at the time we issue a promissory note in connection with a loan drawdown. The principal amount and accrued interest of each loan is repayable one year from the date of issuance of the applicable promissory note. A note may be prepaid by us at any time. The principal amount of each loan and accrued interest is subject to mandatory prepayment in the event of a change of control of the registrant. The promissory notes are subject to customary events of default and are transferable provided the conditions to transfer set forth in the promissory notes are satisfied by the noteholder.

The proceeds of the loans are expected to be used for general working capital purposes.

A copy of our press release announcing that we have entered into loan agreements with Mr. Hatsopoulos and Mr. Lewis is attached hereto as Exhibit 99.3. The press release is “furnished” and not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Section 7.01 – Regulation FD

Item 7.01. Regulation FD Disclosure.

On October 9, 2023, our board of directors authorized us to seek shareholder approval at a special meeting of our shareholders of amendments to our Amended and Restated Certificate of Incorporation (“certificate of incorporation”) to effect a combination of our outstanding shares of common stock into a lesser number of shares, or a reverse stock split. We intend to seek stockholder approval for three alternative amendments to our certificate of incorporation to effect the reverse stock split at the alternative ratios of 1 for 4, 1 for 5, or 1 for 6. The determination of the ratio, implementation, and timing of any reverse stock split will be subject to further approval by our board of directors following receipt of shareholder approval at a special meeting of our shareholders.

Under our certificate of incorporation, the amendments to our certificate of incorporation to effect the contemplated reverse stock split are subject to approval by the holders of a majority of our issued and outstanding shares and subsequent approval of the ratio for the reverse stock split by our board of directors.

We expect to announce in a press release or subsequently filed Form 8-K or Form 8-K amendment the date of our special meeting of shareholders at which the reverse stock split will be considered by our shareholders as well as the record date for the meeting.

A copy of our press release dated October 10, 2023 that also announces that our board has provided authorization for us to seek shareholder approval of a reverse stock split is attached hereto as Exhibit 99.3. The press release is “furnished” and not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit | Description |

| 99.01 | |

| 99.02 | |

| 99.03 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | |

|

| | |

| TECOGEN INC. |

| |

| | By: /s/ Abinand Rangesh |

| October 10, 2023 | | Abinand Rangesh, Chief Executive Officer |

NOTE SUBSCRIPTION AGREEMENT This Note Subscription Agreement, dated as of the 9th day of October, 2023 (this “Agreement”), is entered into by and between Tecogen Inc., a Delaware corporation with offices located at 45 First Ave., Waltham, MA 02451 (the “Company”), and Earl R. Lewis, III, with a business address at 45 First Ave., Waltham, MA 02451 (the “Noteholder”). RECITALS On the terms and subject to the conditions set forth herein, the Noteholder is willing to purchase from the Company, and the Company is willing to sell to such Noteholder, Promissory Notes in the form of Exhibit A hereto (each, a “Note”) in the principal amount described in Section 1(a) hereof. AGREEMENT NOW THEREFORE, in consideration of the foregoing, and the representations, warranties, and conditions set forth below, the parties hereto, intending to be legally bound, hereby agree as follows: 1. The Notes. (a) Issuance of Notes. Subject to all of the terms and conditions hereof, the Noteholder agrees to lend to the Company up to the aggregate principal amount of One Million Dollars ($1,000,000) provided, however, that the Company shall not seek any loan contemplated hereby unless the Company has first borrowed and has outstanding loans from John N. Hatsopoulos in the amount of One Million Dollars, and, provided further that the Company’s right to borrow more than Five Hundred Thousand Dollars ($500,000) hereunder shall be subject to the further agreement of Noteholder which may be withheld in Noteholder’s discretion. Noteholder’s agreement to provide the loans described herein on the terms set forth herein shall remain in place for the one-year period following the date hereof. (b) Execution and Delivery of Notes. The purchase and sale of Notes hereunder shall take place within ten (10) days after delivery of a notice by the Company to Noteholder identifying the amount to be borrowed hereunder. On a date agreed by the Company and Noteholder, the Noteholder will deliver the funds requested by the Company, and the Company will deliver to Noteholder a Note in the original principal amount requested by the Company and identified in the Note. 2. Representations and Warranties of the Company. The Company represents and warrants to Noteholder that: (a) Due Incorporation, Qualification, etc. The Company (i) is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware; (ii) has the power and authority to own, lease and operate its properties and carry on its business as now conducted; and (iii) is duly qualified, licensed to do business and in good standing as a foreign corporation in each jurisdiction where the failure to be so qualified or licensed could reasonably be expected to have a material adverse effect on the Company. (b) Authority. The execution, delivery and performance by the Company of each document executed by the Company and the consummation of the transactions contemplated thereby (i) are within the power of the Company and (ii) have been duly authorized by all necessary actions on the part of the Company. DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

(c) Enforceability. Each Transaction Document executed, or to be executed, by the Company has been, or will be, duly executed and delivered by the Company and constitutes, or will constitute, a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity. (d) Compliance with Other Instruments. Neither the authorization, execution and delivery of this Agreement, nor the issuance and delivery of the Note, will constitute or result in a material default or violation of any law or regulation applicable to the Company or any material term or provision of the Company's current Certificate of Incorporation or bylaws or any material agreement or instrument by which it is bound or to which its properties or assets are subject. (e) No “Bad Actor” Disqualification. The Company has exercised reasonable care, in accordance with Securities and Exchange Commission rules and guidance, to determine whether any Covered Person (as defined below) is subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) under the Securities Act (“Disqualification Events”). To the Company’s knowledge, no Covered Person is subject to a Disqualification Event, except for a Disqualification Event covered by Rule 506(d)(2) or (d)(3) under the Securities Act. The Company has complied, to the extent applicable, with any disclosure obligations under Rule 506(e) under the Securities Act. “Covered Persons” are those persons specified in Rule 506(d)(1) under the Securities Act, including the Company; any predecessor or affiliate of the Company; any director, executive officer, other officer participating in the offering, general partner or managing member of the Company; any beneficial owner of 20% or more of the Company’s outstanding voting equity securities, calculated on the basis of voting power; any promoter (as defined in Rule 405 under the Securities Act) connected with the Company in any capacity at the time of the sale of the Note; and any person that has been or will be paid (directly or indirectly) remuneration for solicitation of purchasers in connection with the sale of the Note (a “Solicitor”), any general partner or managing member of any Solicitor, and any director, executive officer or other officer participating in the offering of any Solicitor or general partner or managing member of any Solicitor. 3. Representations and Warranties of Noteholder. Noteholder represents and warrants to the Company upon the acquisition of each Note as follows: (a) Binding Obligation. Noteholder has full legal capacity, power and authority to execute and deliver this Agreement and to perform Noteholder’s obligations hereunder. This Agreement constitutes a valid and binding obligation of Noteholder, enforceable in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity. (b) Securities Law Compliance. Noteholder has been advised that the Note has not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws and, therefore, cannot be resold unless registered under the Securities Act and applicable state securities laws or unless an exemption from such registration requirements is available. Noteholder is aware that the Company is under no obligation to effect any such registration with respect to the Note or to file for or comply with any exemption from registration. Noteholder is making this investment and purchasing the Note to be acquired by Noteholder hereunder for Noteholder’s own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof, and Noteholder has no present intention of selling, granting any participation in, or otherwise distributing the same. Noteholder has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of such investment, able to incur a complete loss of such investment without impairing Noteholder’ financial condition, and able to bear the economic risk of such investment for an indefinite period of time. Noteholder is an “accredited investor” as such term is defined in Rule 501 DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

of Regulation D under the Securities Act and shall submit to the Company such further assurances of such status as may be reasonably requested by the Company. Noteholder’s business address is correctly identified on the first page of this Agreement. (c) Access to Information. Noteholder acknowledges that the Company has given Noteholder access to the corporate records and accounts of the Company and to all information in its possession relating to the Company, has made its officers and representatives available for interview by Noteholder, and has furnished Noteholder with all documents and other information required for Noteholder to make an informed decision with respect to the purchase of the Note. (d) No “Bad Actor” Disqualification Events. Noteholder is not subject to any Disqualification Event (as defined in Section 2(e)), except for Disqualification Events covered by Rule 506(d)(2) or (d)(3) under the Securities Act and disclosed reasonably in advance of the Closing in writing in reasonable detail to the Company. 4. Miscellaneous. (a) Waivers and Amendments. Any provision of this Agreement and the Note may be amended, waived or modified only upon the written consent of the Company and Noteholder. (b) Governing Law. This Agreement and all actions arising out of or in connection with this Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts, without regard to the conflicts of law provisions of the Commonwealth of Massachusetts or of any other state. (c) Survival. The representations, warranties, covenants and agreements made herein shall survive the execution and delivery of this Agreement. (d) Successors and Assigns. The rights and obligations of the Company and Noteholder shall be binding upon and benefit the successors, assigns, heirs, administrators and transferees of the parties. (e) Entire Agreement. This Agreement together with the Notes to be issued hereunder constitute and contain the entire agreement between the Company and Noteholder and supersedes any and all prior agreements, negotiations, correspondence, understandings and communications among the parties, whether written or oral, respecting the subject matter hereof. (f) Notices. All notices, requests, demands, consents, instructions or other communications required or permitted hereunder shall in writing and faxed, mailed or delivered to each party as follows: (i) if to the Noteholder, at such Noteholder’s address or facsimile number set forth on the signature page hereto, or at such other address as such Noteholder shall have furnished the Company in writing, or (ii) if to the Company, at Tecogen Inc., Attn: CEO: Abinand Rangesh, 45 First Ave., Waltham, MA 02451, or at such other address as the Company shall have furnished to Noteholder in writing. All such notices and communications will be deemed effectively given the earlier of (i) when received, (ii) when delivered personally, (iii) one business day after being delivered by facsimile (with receipt of appropriate confirmation), (iv) one business day after being deposited with an overnight courier service of recognized standing or (v) four days after being deposited in the U.S. mail, first class with postage prepaid. (g) Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same agreement. Facsimile copies of signed signature pages will be deemed binding originals. DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

The foregoing Note Subscription Agreement is hereby confirmed and accepted by the Company and the Noteholder as of the date first written above. TECOGEN INC. By: _____________________________ Name: Abinand Rangesh Title: Chief Executive Officer NOTEHOLDER: __________________________________ Earl R. Lewis, III DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

Exhibit A FORM OF PROMISSORY NOTE (form starts on next page) DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR UNDER THE SECURITIES LAWS OF CERTAIN STATES. THIS NOTE MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR AN EXEMPTION THEREFROM. THE ISSUER OF THIS NOTE MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE OR TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS. TECOGEN INC. PROMISSORY NOTE $____________ _____ __, 202_ FOR VALUE RECEIVED, Tecogen Inc. a Delaware corporation (the “Company”) promises to pay to ______________________ (the “Noteholder”) in lawful money of the United States of America the principal sum of ______________________ Dollars ($_______), or such lesser amount as shall equal the outstanding principal amount hereof, together with interest from the date of this Promissory Note (this “Note”) on the unpaid principal balance at a rate equal to [insert Applicable Federal Rate] Percent (__%) per annum, computed on the basis of the actual number of days elapsed and a year of 365 days. All unpaid principal, together with any then unpaid and accrued interest and other amounts payable hereunder, shall be due and payable on the earlier of (i) the first anniversary of the date of this Note (the “Maturity Date”) following written demand by the Noteholder, or (ii) when, upon the occurrence and during the continuance of an Event of Default, such amounts are declared due and payable by Noteholder or made automatically due and payable, in each case, in accordance with the terms hereof. The following is a statement of the rights of Noteholder and the conditions to which this Note is subject, and to which Noteholder, by the acceptance of this Note, agrees: 1. Payments. (a) Interest. Accrued interest on this Note shall be payable at maturity. (b) Voluntary Prepayment. This Note may be prepaid at the election of the Company. (c) Mandatory Prepayment. In the event of a Change of Control, the outstanding principal amount of this Note plus all accrued and unpaid interest shall be due and payable immediately prior to the closing of such Change of Control. 2. Events of Default. The occurrence of any of the following shall constitute an “Event of Default” under this Note: (a) Failure to Pay. The Company shall fail to pay (i) when due any principal payment on the due date hereunder or (ii) any interest payment or other payment required under the terms of this Note on the date due and such payment shall not have been made within twenty (20) Business Days of the Company’s receipt of written notice to the Company of such failure to pay; or DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

(b) Voluntary Bankruptcy or Insolvency Proceedings. The Company shall (i) apply for or consent to the appointment of a receiver, trustee, liquidator or custodian of itself or of all or a substantial part of its property, (ii) admit in writing its inability to pay its debts generally as they mature, (iii) make a general assignment for the benefit of its or any of its creditors, (iv) be dissolved or liquidated, (v) commence a voluntary case or other proceeding seeking liquidation, reorganization or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or consent to any such relief or to the appointment of or taking possession of its property by any official in an involuntary case or other proceeding commenced against it, or (vi) take any action for the purpose of effecting any of the foregoing; or (c) Involuntary Bankruptcy or Insolvency Proceedings. Proceedings for the appointment of a receiver, trustee, liquidator or custodian of the Company, or of all or a substantial part of the property thereof, or an involuntary case or other proceedings seeking liquidation, reorganization or other relief with respect to the Company or any of its Subsidiaries, if any, or the debts thereof under any bankruptcy, insolvency or other similar law now or hereafter in effect shall be commenced and an order for relief entered or such proceeding shall not be dismissed or discharged within 45 days of commencement. 3. Rights of Noteholder upon Default. Upon the occurrence of any Event of Default (other than an Event of Default described in Sections 2(b) or 2(c)) and at any time thereafter during the continuance of such Event of Default, Noteholder may by written notice to the Company, declare all outstanding Obligations payable by the Company hereunder to be immediately due and payable without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived, anything contained herein to the contrary notwithstanding. Upon the occurrence of any Event of Default described in Sections 2(b) and 2(c), immediately and without notice, all outstanding Obligations payable by the Company hereunder shall automatically become immediately due and payable, without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived, anything contained herein to the contrary notwithstanding. In addition to the foregoing remedies, upon the occurrence and during the continuance of any Event of Default, Noteholder may exercise any other right power or remedy granted to Noteholder or otherwise permitted by law, either by suit in equity or by action at law, or both. 4. Definitions. As used in this Note, the following capitalized terms have the following meanings: (a) “Change of Control” shall mean (i) any “person” or “group” (within the meaning of Section 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended), becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), directly or indirectly, of more than 50% of the outstanding voting securities of the Company having the right to vote for the election of members of the Board of Directors, (ii) any reorganization, merger or consolidation of the Company, other than a transaction or series of related transactions in which the holders of the voting securities of the Company outstanding immediately prior to such transaction or series of related transactions retain, immediately after such transaction or series of related transactions, at least a majority of the total voting power represented by the outstanding voting securities of the Company or such other surviving or resulting entity or (iii) a sale, lease or other disposition of all or substantially all of the assets of the Company. (b) “Event of Default” has the meaning given in Section 2 hereof. (c) “Noteholder” shall mean the Person specified in the introductory paragraph of this Note or any Person who shall at the time is the registered holder of this Note. DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

(d) “Note” shall mean this promissory note. (e) “Obligations” shall mean and include all loans, advances, debts, liabilities and obligations, howsoever arising, owed by the Company to Noteholder of every kind and description, now existing or hereafter arising under or pursuant to the terms of this Note, including, all interest, fees, charges, expenses, attorneys’ fees and costs and accountants’ fees and costs chargeable to and payable by the Company hereunder and thereunder, in each case, whether direct or indirect, absolute or contingent, due or to become due, and whether or not arising after the commencement of a proceeding under Title 11 of the United States Code (11 U. S. C. Section 101 et seq.), as amended from time to time (including post-petition interest) and whether or not allowed or allowable as a claim in any such proceeding. (f) “Person” shall mean and include an individual, a partnership, a corporation (including a business trust), a joint stock company, a limited liability company, an unincorporated association, a joint venture or other entity or a governmental authority. (g) “Securities Act” shall mean the Securities Act of 1933, as amended. 5. Miscellaneous. (a) Successors and Assigns; Transfer of this Note; No Transfers to Bad Actors; Notice of Bad Actor Status. (i) Subject to the restrictions on transfer described in this Section 6(a), the rights and obligations of the Company and Noteholder shall be binding upon and benefit the successors, assigns, heirs, administrators and transferees of the parties. (ii) With respect to any offer, sale or other disposition of this Note Noteholder will give written notice to the Company prior thereto, describing briefly the manner thereof, together with a written opinion of Noteholder’s counsel, or other evidence if reasonably satisfactory to the Company, to the effect that such offer, sale or other distribution may be effected without registration or qualification (under any federal or state law then in effect). Upon receiving such written notice and reasonably satisfactory opinion, if so requested, or other evidence, the Company, as promptly as practicable, shall notify Noteholder that Noteholder may sell or otherwise dispose of this Note in accordance with the terms of the notice delivered to the Company. If a determination has been made pursuant to this Section 6(a) that the opinion of counsel for Noteholder, or other evidence, is not reasonably satisfactory to the Company, the Company shall so notify Noteholder promptly after such determination has been made. This Note thus transferred shall bear a legend as to the applicable restrictions on transferability in order to ensure compliance with the Securities Act, unless in the opinion of counsel for the Company such legend is not required in order to ensure compliance with the Securities Act. The Company may issue stop transfer instructions to its transfer agent in connection with such restrictions. Subject to the foregoing, transfers of this Note shall be registered upon registration books maintained for such purpose by or on behalf of the Company. Prior to presentation of this Note for registration of transfer, the Company shall treat the registered holder hereof as the owner and holder of this Note for the purpose of receiving all payments of principal and interest hereon and for all other purposes whatsoever, whether or not this Note shall be overdue and the Company shall not be affected by notice to the contrary. (iii) Noteholder agrees not to sell, assign, transfer, pledge or otherwise dispose of this Note or any beneficial interest therein to any person (other than the Company) unless and until the proposed transferee confirms to the reasonable satisfaction of the Company that neither the proposed transferee nor any of its directors, executive officers, other officers that may serve as a director or officer of any company in which it invests, general partners or managing members nor any person that would be DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

deemed a beneficial owner of thereof (in accordance with Rule 506(d) of the Securities Act) is subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) under the Securities Act, except as set forth in Rule 506(d)(2) or (d)(3) under the Securities Act and disclosed, reasonably in advance of the transfer, in writing in reasonable detail to the Company. Noteholder will promptly notify the Company in writing if Noteholder or, to Noteholder’s knowledge, any person specified in Rule 506(d)(1) under the Securities Act becomes subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) under the Securities Act. (b) Waiver and Amendment. Any provision of this Note may be amended, waived or modified upon the written consent of the Company and Noteholder. (c) Notices. All notices, requests, demands, consents, instructions or other communications required or permitted hereunder shall be in writing and faxed, mailed or delivered to each party at the respective addresses of the parties as set forth herein, or at such other address or email address as the Company shall have furnished to Noteholder in writing. All such notices and communications will be deemed effectively given the earlier of (i) when received, (ii) when delivered personally, (iii) one business day after being delivered by facsimile (with receipt of appropriate confirmation), (iv) one business day after being deposited with an overnight courier service of recognized standing or (v) four days after being deposited in the U.S. mail, first class with postage prepaid. Notice to Tecogen: Tecogen Inc. 45 First Ave. Waltham, MA 02451 Attn: CEO Notice to Noteholder: _________________ _________________ _________________ (d) Payment. Payment shall be made in lawful tender of the United States of America. (e) Usury. In the event any interest is paid on this Note which is deemed to be in excess of the then legal maximum rate, then that portion of the interest payment representing an amount in excess of the then legal maximum rate shall be deemed a payment of principal and applied against the principal of this Note. (f) Waivers. The Company hereby waives notice of default, presentment or demand for payment, protest or notice of nonpayment or dishonor and all other notices or demands relative to this instrument. (g) Governing Law. This Note and all actions arising out of or in connection with this Note shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts, without regard to the conflicts of law provisions of the Commonwealth of Massachusetts, or of any other state. DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

(h) Waiver of Jury Trial. By acceptance of this Note, Noteholder and the Company hereby agree to waive their respective rights to a jury trial of any claim or cause of action based upon or arising out of this Note. IN WITNESS WHEREOF, the Company has caused this Promissory Note to be issued as of the date first written above. TECOGEN INC. By: ___________________________________ Name: Abinand Rangesh Title: Chief Executive Officer DocuSign Envelope ID: DBEBF374-DD6F-4E11-8596-6DE1688C8A0A

Tecogen Inc. 45 First Avenue, Waltham, MA 02451 • ph: 781-466-6400 • fax: 781-466-6466 • www.tecogen.com Tecogen Announces Obtaining $1.5m Credit Facility WALTHAM, MA, October 10th, 2023 – Tecogen Inc. (OTCQX: TGEN) a leading provider of clean energy products and services, is pleased to announce the signing of a $1.5 million Credit Agreement provided by our directors John Hatsopoulos and Earl Lewis. The line of credit has no fees or interest unless drawn upon and matures 12 months from date of agreement. Interest on the line is at the minimum Federally Applicable Rate and will be paid on maturity. The minimum drawdown on the facility is $500,000. The board has also authorized the company to prepare the filings necessary to hold a special meeting of the stockholders to vote on a reverse split with a view to listing Tecogen’s shares on a national securities exchange. “This line of credit provides additional liquidity for the company at favorable terms and helps strengthen our balance sheet. As we look to grow our revenue and ship our backlog, having additional working capital will help accelerate our path to profitability.” Commented Abinand Rangesh, CEO of Tecogen. Forward Looking Statements This press release contains “forward-looking statements” which may describe strategies, goals, outlooks or other non-historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "likely" or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to the Risk Factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors,” factors that could cause our actual results to differ materially from past and projected future results include the impact of the coronavirus pandemic on demand for our products and services, the availability of incentives, rebates and tax benefits relating to our products, changes in the regulatory environment relating to our products, competing technological developments, and the availability of financing to fund our operations and growth. About Tecogen Tecogen Inc. designs, manufactures, sells, installs, and maintains high efficiency, ultra-clean, cogeneration products including combined heat and power, air conditioning systems and high-efficiency water heaters for residential, commercial, recreational and industrial use. The company’s cost efficient, reliable, and environmentally friendly products for energy production nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

Tecogen Inc. 45 First Avenue, Waltham, MA 02451 • ph: 781-466-6400 • fax: 781-466-6466 • www.tecogen.com In business for over 35 years, Tecogen has shipped more than 3,150 units, supported by an established network of engineering, sales and service personnel throughout North America. Aggregate run hours on Tecogen’s InVerde cogeneration systems exceed 6 million hours. For more information, please visit www.tecogen.com or contact us for a free Site Assessment. Tecogen, InVerde e+, Ilios, Tecochill, Tecofrost, Tecopack, Tecopower, and Ultera are registered or pending trademarks of Tecogen Inc. Tecogen Media & Investor Relations Contact Information: Abinand Rangesh, CEO P: (781) 466-6487 E: Abinand.Rangesh@Tecogen.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

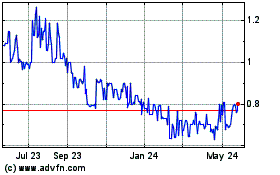

Tecogen (QX) (USOTC:TGEN)

Historical Stock Chart

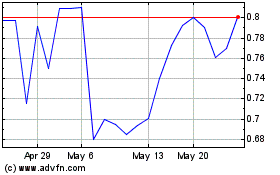

From Apr 2024 to May 2024

Tecogen (QX) (USOTC:TGEN)

Historical Stock Chart

From May 2023 to May 2024