FALSE000153743500015374352023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 9, 2023

TECOGEN INC. (OTCQX: TGEN)

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-36103 | | 04-3536131 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

| 45 First Avenue | | |

Waltham, Massachusetts | | 02451 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(781) 466-6400

(Registrant's telephone number, including area code)

_______________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act. | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2023, the registrant issued a press release with earnings commentary and supplemental information for the three and six months ended June 30, 2023. The press release is furnished as Exhibit 99.01 to this Current Report on Form 8-K.

The information in this Item 2.02 and Exhibit 99.01 to this Current Report on Form 8-K shall shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On August 10, 2023, the registrant will present the attached slides online in connection with an earnings conference call. The slides are being furnished as Exhibit 99.02 to this Current Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.02 to this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits relating to Items 2.02 and 7.01 shall be deemed to be furnished, and not filed:

| | | | | |

| Exhibit | Description |

| 99.01 | |

| 99.02 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized. | | | | | | | | |

|

| | |

| TECOGEN INC. |

| |

| | By: /s/ Abinand Rangesh |

| August 9, 2023 | | Abinand Rangesh, Chief Executive Officer |

Tecogen Announces Second Quarter 2023 Results

Q2 2023 revenue of $6.7 million, an increase of 5.2% QoQ

WALTHAM, Mass., August 9, 2023 - Tecogen Inc. (OTCQX:TGEN), a leading manufacturer of clean energy products, reported revenues of $6.7 million and a net loss of $0.8 million for the quarter ended June 30, 2023 compared to revenues of $6.4 million, and a net loss of $0.9 million in 2022. For the six months ended June 30, 2023 revenues were $12.1 million and the net loss was $2.3 million compared to revenues of $13.9 million, and net loss of $0.8 million for the same period in 2022.

"We saw an increase in revenues compared to both Q1 2023 and Q2 2022 of 25% and 5% respectively. Our sales backlog has increased from $7.1 million at the end of Q1 to $8.3 million at the end of Q2 to $11.3 million today. This backlog does not include our recurring service revenue. The Aegis service contract acquisition meant we had service revenues of almost $4 million this quarter or a 30% increase. We finished the quarter with $1.87 million in cash as we generated cash from operations in Q2 2023 and H1 2023. Overall we made substantial progress towards turning around the business and meeting the objectives we set out earlier in the year." commented Abinand Rangesh, Tecogen's Chief Executive Officer.

Key Takeaways

Net Income and Earnings Per Share

•Net loss in Q2 2023 was $0.8 million compared to net loss of $0.9 million in Q2 2022, a decrease of $0.1 million, primarily due to higher Services segment revenue and gross profit. EPS was a loss of $0.03/share in both Q2 2023 and Q2 2022, respectively.

•Net loss in H1 2023 was $2.3 million compared to net loss of $0.8 million in Q2 2022, an increase of $1.5 million, due primarily to lower Products segment revenue and gross profit and an increase in operating expenses. EPS was a net loss of $0.09/share and a net loss of $0.03/share in H1 2023 and H1 2022, respectively.

Loss from Operations

•Loss from operations for the three months ended June 30, 2023 was $0.8 million compared to a loss of $0.8 million for the same period in 2022.

•Loss from operations for H1 2023 was $2.2 million compared to a loss of $0.7 million for the same period in 2022, an increase of $1.5 million. The loss from operations increased due to lower revenue and gross profit margins in our Products segment and increased operating expenses.

Revenues

•Revenues for the quarter ended June 30, 2023 were $6.7 million compared to $6.4 million for the same period in 2022, a 5.2% increase.

◦Products revenue was $2.4 million in Q2 2023 compared to $3.0 million in the same period in 2022, a decrease of 18.8%, primarily due to decreased cogeneration and chiller sales into our key market segments including controlled environment agriculture.

◦Services revenue was $4.0 million in Q2 2023 compared to $3.1 million in the same period in 2022, an increase of 29.6%, primarily due to revenue from the acquired Aegis maintenance contracts and a 9.0% increase in revenue from existing contracts.

◦Energy Production revenue decreased 1.2%, to $350 thousand in Q2 2023 compared to $354 thousand in the same period in 2022.

•Revenues for H1 2023 were $12.1 million compared to $13.9 million for the same period in 2022, a 12.4% decrease.

◦Products revenue was $4.2 million in H1 2023 compared to $6.9 million in the same period in 2022, a decrease of 40.2%, primarily due to decreased cogeneration and chiller sales into our key market segments including controlled environment agriculture.

◦Services revenue was $7.1 million in H1 2023 compared to $6.0 million in the same period in 2022, an increase of 18.8%, primarily due to revenue from the acquired Aegis maintenance contracts and a 8.3% increase in revenue from existing contracts.

◦Energy Production revenue decreased 5.6%, to $0.88 million in H1 2023 compared to $0.94 million in the same period in 2022 due to temporary maintenance work on two sites.

Gross Profit and Gross Margin

•Gross profit for the second quarter of 2023 was $2.8 million compared to $2.7 million in the second quarter of 2022. Gross margin was 42.0% in the first quarter compared to 42.1% for the same period in 2022. Products margin increased to 33.8% from 33.0%, while Services margin decreased to 47.5% from 51.7%, due to higher labor and material costs. In particular, as supply chain constraints for engines eased, we performed significant engine related replacements and upgrades which negatively impacted Service margins.

•Gross profit for H1 2023 decreased to $4.9 million compared to $5.8 million in the same period in 2022, a decrease of $0.9 million. Gross margin decreased to 40.6% in the first half of 2023 compared to 41.8% for the same period in 2022 due to higher labor and material costs which reduced Products margin to 31.9% from 32.9% and Services margin to 46.2% from 52.4%. In particular, as supply chain constraints for engines eased, we performed a significant number of engine replacements in H2 2023 which negatively impacted Service margins. Energy Production margin deceased to 36.9% from 40.4% due to decreased runtime at the sites.

Operating Expenses

•Operating expenses increased by 2.7% to $3.6 million for the second quarter of 2023 compared to $3.5 million in the same period in 2022 due to increases in business insurance and consulting costs, attributable in part to the Aegis acquisition.

•Operating expenses increased by 9.6% to $7.2 million for the first half of 2023 compared to $6.5 million in the same period in 2022 due to increases in business insurance, travel, and consulting costs, attributable in part to the Aegis acquisition.

Adjusted EBITDA(1) was negative $592 thousand for the second quarter of 2023 compared to a negative $651 thousand for the second quarter of 2022. Adjusted EBITDA(1) was negative $1.9 million for the first half of 2023 compared to negative $448 thousand for the first half of 2022. (Adjusted EBITDA is defined as net income or loss attributable to Tecogen, adjusted for interest, income taxes, depreciation and amortization, stock-based compensation expense, unrealized gain or loss on equity securities, goodwill impairment charges and other non-cash non-recurring charges or gains including abandonment of intangible assets and the extinguishment of debt. See the table following the Condensed Consolidated Statements of Operations for a reconciliation from net income (loss) to Adjusted EBITDA, as well as important disclosures about the company's use of Adjusted EBITDA).

Conference Call Scheduled for August 10, 2023, at 9:30 am ET

Tecogen will host a conference call on August 10, 2023 to discuss the second quarter results beginning at 9:30 AM eastern time. To listen to the call please dial (877) 407-7186 within the U.S. and Canada, or (201) 689-8052 from other international locations. Participants should ask to be joined to the Tecogen Second Quarter 2023 earnings call. Please begin dialing 10 minutes before the scheduled starting time. The earnings press release will be available on the Company website at www.Tecogen.com in the "News and Events" section under "About Us." The earnings conference call will be webcast live. To view the associated slides, register for and listen to the webcast, go to https://ir.tecogen.com/ir-calendar. Following the call, the recording will be archived for 14 days.

The earnings conference call will be recorded and available for playback one hour after the end of the call. To listen to the playback, dial (877) 660-6853 within the U.S. and Canada, or (201) 612-7415 from other international locations and use Conference Call ID#: 13672659.

About Tecogen

Tecogen Inc. designs, manufactures, sells, installs, and maintains high efficiency, ultra-clean, cogeneration products including engine-driven combined heat and power, air conditioning systems, and high-efficiency water heaters for residential, commercial, recreational and industrial use. The company provides cost effective, environmentally friendly and reliable products for energy production that nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

In business for over 35 years, Tecogen has shipped more than 3,200 units, supported by an established network of engineering, sales, and service personnel across the United States. For more information, please visit www.tecogen.com or contact us for a free Site Assessment.

Tecogen, InVerde e+, Ilios, Tecochill, Tecopower, Tecofrost, Tecopack, and Ultera are registered or pending trademarks of Tecogen Inc.

Forward Looking Statements

This press release and any accompanying documents, contain “forward-looking statements” which may describe strategies, goals, outlooks or other non-historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements.

In addition to those factors described in our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and on our Form 8-K, under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth.

In addition to GAAP financial measures, this press release includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures.

Tecogen Media & Investor Relations Contact Information:

Abinand Rangesh

P: 781-466-6487

E: Abinand.Rangesh@tecogen.com

TECOGEN INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,871,063 | | | $ | 1,913,969 | |

| | | |

| Accounts receivable, net | 5,614,291 | | | 6,714,122 | |

| Unbilled revenue | 1,748,336 | | | 1,805,330 | |

| Employee retention credit receivable | 46,148 | | | 713,269 | |

| Inventories, net | 12,027,525 | | | 10,482,729 | |

| | | |

| | | |

| Prepaid and other current assets | 467,390 | | | 401,189 | |

| Total current assets | 21,774,753 | | | 22,030,608 | |

| Long-term assets: | | | |

| Property, plant and equipment, net | 1,352,318 | | | 1,407,720 | |

| Right of use assets | 920,690 | | | 1,245,549 | |

| Intangible assets, net | 2,421,379 | | | 997,594 | |

| | | |

| Goodwill | 3,129,147 | | | 2,406,156 | |

| | | |

| | | |

| Other assets | 201,898 | | | 165,230 | |

| TOTAL ASSETS | $ | 29,800,185 | | | $ | 28,252,857 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| | | |

| | | |

| | | |

| Accounts payable | 4,212,914 | | | 3,261,952 | |

| Accrued expenses | 2,554,000 | | | 2,384,447 | |

| Deferred revenue, current | 2,086,174 | | | 1,115,627 | |

| Lease obligations, current | 513,811 | | | 687,589 | |

| Acquisition liabilities, current | 649,241 | | | — | |

| | | |

| Unfavorable contract liability, current | 213,559 | | | 236,705 | |

| Total current liabilities | 10,229,699 | | | 7,686,320 | |

| | | |

| Long-term liabilities: | | | |

| | | |

| Deferred revenue, net of current portion | 154,149 | | | 371,823 | |

| Lease obligations, net of current portion | 459,372 | | | 623,452 | |

| Acquisition liabilities, net of current portion | 1,643,567 | | | — | |

| Unfavorable contract liability, net of current portion | 490,802 | | | 583,512 | |

| Total liabilities | 12,977,589 | | | 9,265,107 | |

| | | |

| | | |

| | | |

| | | |

| Stockholders’ equity: | | | |

| Tecogen Inc. shareholders’ equity: | | | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 24,850,261 issued and outstanding at June 30, 2023 and December 31, 2022 | 24,850 | | | 24,850 | |

| Additional paid-in capital | 57,456,945 | | | 57,351,008 | |

| | | |

| | | |

| Accumulated deficit | (40,551,687) | | | (38,281,548) | |

| Total Tecogen Inc. stockholders’ equity | 16,930,108 | | | 19,094,310 | |

| Non-controlling interest | (107,512) | | | (106,560) | |

| Total stockholders’ equity | 16,822,596 | | | 18,987,750 | |

| | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 29,800,185 | | | $ | 28,252,857 | |

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| | June 30, 2023 | | June 30, 2022 | | | | |

| Revenues | | | | | | | |

| Products | $ | 2,445,631 | | | $ | 3,010,115 | | | | | |

| Services | 3,952,971 | | | 3,050,191 | | | | | |

| Energy production | 350,156 | | | 354,287 | | | | | |

| Total revenues | 6,748,758 | | | 6,414,593 | | | | | |

| Cost of sales | | | | | | | |

| Products | 1,618,456 | | | 2,015,466 | | | | | |

| Services | 2,075,869 | | | 1,473,586 | | | | | |

| Energy production | 220,007 | | | 222,092 | | | | | |

| Total cost of sales | 3,914,332 | | | 3,711,144 | | | | | |

| Gross profit | 2,834,426 | | | 2,703,449 | | | | | |

| | | | | | | |

| Operating expenses | | | | | | | |

| General and administrative | 2,917,283 | | | 2,824,832 | | | | | |

| Selling | 480,786 | | | 503,601 | | | | | |

| Research and Development | 236,556 | | | 194,853 | | | | | |

| Gain on disposition of assets | (19,950) | | | (2,500) | | | | | |

| | | | | | | |

| Total operating expenses | 3,614,675 | | | 3,520,786 | | | | | |

| Loss from operations | (780,249) | | | (817,337) | | | | | |

| | | | | | | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Interest and other income (expense), net | (21,061) | | | (1,265) | | | | | |

| Interest expense | (1,857) | | | (12,733) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Unrealized gain on investment securities | 37,497 | | | — | | | | | |

| Total other income (expense), net | 14,579 | | | (13,998) | | | | | |

| | | | | | | |

| Loss before provision for state income taxes | (765,670) | | | (831,335) | | | | | |

| Provision for state income taxes | 9,614 | | | 6,500 | | | | | |

| Consolidated net loss | (775,284) | | | (837,835) | | | | | |

| | | | | | | |

| Income attributable to the non-controlling interest | (4,826) | | | (18,383) | | | | | |

| Net loss attributable to Tecogen Inc. | $ | (780,110) | | | $ | (856,218) | | | | | |

| | | | | | | |

| Net loss per share - basic | $ | (0.03) | | | $ | (0.03) | | | | | |

| Net loss per share - diluted | $ | (0.03) | | | $ | (0.03) | | | | | |

| Weighted average shares outstanding - basic | 24,850,261 | | | 24,850,261 | | | | | |

| Weighted average shares outstanding - diluted | 24,850,261 | | | 24,850,261 | | | | | |

| | | | | | | | | | | |

| | | |

| |

| | | |

| Three Months Ended |

| June 30, 2023 | | June 30, 2022 |

Non-GAAP financial disclosure (1) | | | |

| Net loss attributable to Tecogen Inc. | $ | (780,110) | | | $ | (856,218) | |

| Interest expense, net | 1,857 | | | 12,733 | |

| Income taxes | 9,614 | | | 6,500 | |

| Depreciation & amortization, net | 185,175 | | | 95,985 | |

| EBITDA | (583,464) | | | (741,000) | |

| | | |

| | | |

| | | |

| Stock based compensation | 28,589 | | | 89,893 | |

| Unrealized gain on investment securities | (37,497) | | | — | |

| | | |

| Adjusted EBITDA | $ | (592,372) | | | $ | (651,107) | |

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| | June 30, 2023 | | June 30, 2022 |

| Revenues | | | |

| Products | $ | 4,155,767 | | | $ | 6,949,596 | |

| Services | 7,089,144 | | | 5,967,471 | |

| Energy production | 883,665 | | | 935,849 | |

| Total revenues | 12,128,576 | | | 13,852,916 | |

| Cost of sales | | | |

| Products | 2,831,024 | | | 4,660,221 | |

| Services | 3,813,471 | | | 2,840,338 | |

| Energy production | 557,746 | | | 558,119 | |

| Total cost of sales | 7,202,241 | | | 8,058,678 | |

| Gross profit | 4,926,335 | | | 5,794,238 | |

| Operating expenses | | | |

| General and administrative | 5,709,766 | | | 5,298,735 | |

| Selling | 1,000,856 | | | 1,004,692 | |

| Research and development | 465,658 | | | 334,988 | |

| Gain on disposition of assets | (19,950) | | | (36,445) | |

| Gain on termination of unfavorable contract liability | — | | | (71,375) | |

| Total operating expenses | 7,156,330 | | | 6,530,595 | |

| Loss from operations | (2,229,995) | | | (736,357) | |

| Other income (expense) | | | |

| Interest and other income (expense), net | (20,231) | | | (15,416) | |

| Interest expense | (2,272) | | | (13,561) | |

| | | |

| | | |

| | | |

| Unrealized gain on investment securities | 37,497 | | | 37,497 | |

| Total other income (expense), net | 14,994 | | | 8,520 | |

| Loss before provision for state income taxes | (2,215,001) | | | (727,837) | |

| Provision for state income taxes | 32,252 | | | 10,430 | |

| Consolidated net loss | (2,247,253) | | | (738,267) | |

| Income attributable to non-controlling interest | (22,886) | | | (28,542) | |

| Net loss attributable to Tecogen Inc. | $ | (2,270,139) | | | $ | (766,809) | |

| | | |

| | | |

| | | |

| Net income loss per share - basic | $ | (0.09) | | | $ | (0.03) | |

| Net income loss per share - diluted | $ | (0.09) | | | $ | (0.03) | |

| Weighted average shares outstanding - basic | 24,850,261 | | | 24,850,261 | |

| Weighted average shares outstanding - diluted | 24,850,261 | | | 28,250,261 | |

| | | | | | | | | | | |

| Six Months Ended |

| June 30, 2023 | | June 30, 2022 |

| Non-GAAP financial disclosure (1) | | | |

| Net loss attributable to Tecogen Inc. | $ | (2,270,139) | | | $ | (766,809) | |

| Interest expense, net | 2,272 | | | 13,561 | |

| Income taxes | 32,252 | | | 10,430 | |

| Depreciation & amortization, net | 291,095 | | | 217,718 | |

| EBITDA | (1,944,520) | | | (525,100) | |

| | | |

| Stock based compensation | 105,937 | | | 185,600 | |

| Unrealized gain on marketable securities | (37,497) | | | (37,497) | |

| | | |

| Gain on termination of unfavorable contract liability | — | | | (71,375) | |

| | | |

| Adjusted EBITDA | $ | (1,876,080) | | | $ | (448,372) | |

| | | |

(1) Non-GAAP Financial Measures

In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, this news release contains information about Adjusted EBITDA (net income (loss) attributable to Tecogen Inc adjusted for interest, income taxes, depreciation and amortization, stock-based compensation expense, unrealized gain or loss on investment securities, goodwill impairment charges and other non-cash non-recurring charges including abandonment of certain intangible assets and extinguishment of debt), which is a non-GAAP measure. The Company believes Adjusted EBITDA allows investors to view its performance in a manner similar to the methods used by management and provides additional insight into its operating results. Adjusted EBITDA is not calculated through the application of GAAP. Accordingly, it should not be considered as a substitute for the GAAP measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP measure. The use of any non-GAAP measure may produce results that vary from the GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| June 30, 2023 | | June 30, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Consolidated net loss | $ | (2,247,253) | | | $ | (738,267) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 291,095 | | | 217,718 | |

| Stock-based compensation | 105,937 | | | 185,600 | |

| Provision for doubtful accounts | 44,000 | | | 46,000 | |

| | | |

| | | |

| Gain on disposition of assets | (19,950) | | | (36,445) | |

| | | |

| Unrealized gain on investment securities | (37,497) | | | (37,497) | |

| Gain on termination of unfavorable contract liability | — | | | (71,375) | |

| | | |

| | | |

| Changes in operating assets and liabilities | | | |

| (Increase) decrease in: | | | |

| Accounts receivable | 755,831 | | | (444,541) | |

| Employee retention credit receivable | 667,121 | | | 562,752 | |

| Unbilled revenue | 56,994 | | | 1,117,057 | |

| Inventory | (1,133,618) | | | (438,102) | |

| | | |

| | | |

| Prepaid assets and other current assets | (66,201) | | | (22,618) | |

| Other assets | 325,688 | | | 308,282 | |

| Increase (decrease) in: | | | |

| Accounts payable | 839,784 | | | (247,876) | |

| Accrued expenses and other current liabilities | 178,241 | | | (74,490) | |

| Deferred revenue | 752,873 | | | (589,158) | |

| Other liabilities | (359,369) | | | (316,217) | |

| Net cash provided by (used in) operating activities | 153,676 | | | (579,177) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment | (19,607) | | | (209,034) | |

| Payment for business acquisition | (170,000) | | | — | |

| Purchases of intangible assets | — | | | (29,505) | |

| Proceeds from disposition of assets | 16,863 | | | 67,169 | |

| | | |

| Distributions to non-controlling interest | (23,838) | | | (32,809) | |

| | | |

| | | |

| Net cash used in investing activities | (196,582) | | | (204,179) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | — | | | — | |

| Change in cash and cash equivalents | (42,906) | | | (783,356) | |

| Cash and cash equivalents, beginning of the period | 1,913,969 | | | 3,614,463 | |

| Cash and cash equivalents, end of the period | $ | 1,871,063 | | | $ | 2,831,107 | |

OTCQX: TGEN Q2 2023 EARNINGS CALL AUGUST 10, 2023 1

MANAGEMENT Abinand Rangesh – CEO & CFO Robert Panora – COO & President Roger Deschenes – CAO Jack Whiting – General Counsel & Secretary 2

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, Income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

AGENDA Progress Update 2Q 2023 Results Q&A 4

PROGRESS UPDATE Q2 23 Revenue was 5% higher than Q2 22 and 25% higher than Q1 2023 Expect every subsequent quarter in 2023 to have higher revenue than the previous quarter Generated cash from operations during the quarter Cash position stable at $1.87m at quarter end. Cash position ~$1.2m today and expecting >$3m in customer deposits and receivables in the next 30 days Marketing strategy is working - Backlog at end of Q1 was $7.1m, Q2 was $8.2m and is currently at $11.3m Service revenue increased 29.6% QoQ Next focus for company is improving margins. Multi-Family Residential 20% Controlled Environment Agriculture 69% Other 11% Backlog by Customer Type 5

POWER GENERATION + RESILIENCY CLEAN COOLING Hybrid and Engine Driven Chillers with lower operating cost and lower greenhouse gas footprint compared to competing solutions LONG TERM MAINTENANCE & ENERGY ASSET MANAGEMENTModular microgrids for energy savings, greenhouse gas (GHG) reductions and resiliency to grid outages Helping customers achieve predictable energy savings with comprehensive maintenance services

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements through 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN POWER, COOLING AND HEAT Sales of combined heat and power, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and indoor cultivation. PRODUCT SALES We sell electrical energy and thermal energy produced by our equipment onsite at customer facilities. ENERGY SALES 7

2Q 2023 RESULTS Key Points • Net loss of $0.03/share Q2 2023 • Net loss $0.8m • Cash and equivalents balance of $1.87 million Revenues = $6.7 million, up 5% from Q2 22 Gross Profit = $2.8 million, up 5% from Q2 22 Op Ex = $3.6 million – attributable in part to Aegis acquisition 8 $ in thousands 2Q'23 2Q'22 QoQ Change % Revenues Products $ 2,446 $ 3,010 $ (564) Services 3,953 3,050 903 Energy Production 350 354 (4) Total Revenue 6,749 6,415 334 5.2% Gross Profit Products 827 995 (167) Service 1,877 1,577 300 Energy Production 130 132 (2) Total Gross Profit 2,834 2,703 131 4.8% Gross Margin: % Products 34% 33% 1% Service 47% 52% -4% Energy Production 37% 37% 0% Total Gross Margin 42% 42% 0% Operating Expenses General & administrative 2,917 2,825 92 Selling 481 504 (23) Research and development 237 195 42 Gain on disposition of assets (20) (3) (17) Total operating expenses 3,615 3,521 94 2.7% Operating loss (780) (817) 37 -4.5% Net loss $ (780) $ (856) $ 76 -8.9%

2Q 2023 ADJUSTED EBITDA RECONCILIATION EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization EBITDA and adjusted EBITDA were both negative at $0.58m and $0.74m respectively EBITDA Non-cash adjustments • Stock based compensation • Unrealized and realized (gain) loss on investment securities *Adjusted EBITDA is defined as net Income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt 9 Non-GAAP financial disclosure (in thousands) 2023 2022 Net loss attributable to Tecogen Inc. (780)$ (856)$ Interest expense, net 2 13 Income tax expense 10 7 Depreciation & amortization, net 185 96 EBITDA (583) (740) Stock based compensation 28 90 Unrealized gain on marketable securities (37) - Adjusted EBITDA* (592)$ (651)$ Quarter Ended, June 30

2Q 2023 PERFORMANCE BY SEGMENT Products Chiller margin has recovered to >37% Cogeneration margin ~32% Services Service contracts revenue increased 29.6% Existing service contract revenue increased 9.0% Aegis acquired contract revenue $629K Service margin lower in Q2 23 due to timing of engine replacements across the service fleet. Energy Production Revenue decreased 1% QoQ 10 2Q Revenues ($ thousands) 2023 2022 QoQ Change % Revenues Cogeneration 428$ 954$ -55% Chiller 1,688 1,738 -3% Engineered accessories 330 318 4% Total Product Revenues 2,446 3,010 -19% Services 3,953 3,050 30% Energy Production 350 354 -1% Total Revenues 6,749 6,415 5% Cost of Sales Products 1,619 2,015 -20% Services 2,076 1,474 41% Energy Production 220 222 -1% Total Cost of Sales 3,915 3,711 5% Gross Profit 2,834 2,703 5% Net loss (780)$ (856)$ Gross Margin Products 34% 33% Services 47% 52% Energy Production 37% 37% Overall 42% 42% QTD Gross Margin 2023 2022 Target Overall 42% 42% >40%

PLANS TO INCREASE MARGIN 11 Product Sale Service Year 1 Service Year 5 Service Year 10 Service Year 15 Service Year 20 Cost Operating Segment Profit Product Margin Further increase in prices for some products Improve commonality of parts across products to improve purchasing power Redesign where necessary to reduce complexity Service Margin Increased prices on contract renewals Increased billable contract work to improve site performance Increase service intervals with larger oil reservoirs, engine cylinder head improvements and better runtime algorithms to reduce wear and tear

Priorities SUMMARY AND Q&A Company Information Tecogen Inc. 45 First Ave Waltham, MA 02451 www.Tecogen.com Contact information Abinand Rangesh, CEO 781.466.6487 Abinand.rangesh@Tecogen.com 12 ✓ Cashflow ✓ Grow revenue and backlog ✓ Increase margin for both Services and Products

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

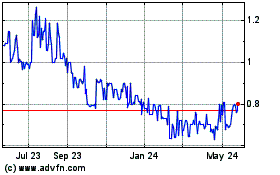

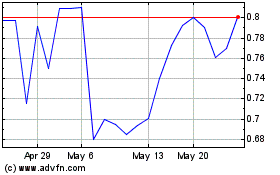

Tecogen (QX) (USOTC:TGEN)

Historical Stock Chart

From Apr 2024 to May 2024

Tecogen (QX) (USOTC:TGEN)

Historical Stock Chart

From May 2023 to May 2024