Unless the context otherwise requires, in this annual report on Form 20-F references to:

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2022, 2021 and 2020.

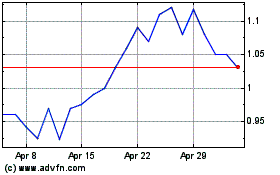

This annual report contains translations of certain Renminbi amounts into U.S. dollars at specified rates. Unless otherwise stated, the following exchange rates are used in this annual report:

We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated above, or at all. The PRC government imposes controls over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade.

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. Known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information—D. Risk Factors,” may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Other sections of this annual report include additional factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. You should read thoroughly this annual report and the documents that we refer to with the understanding that our actual future results may be materially different from, or worse than, what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This annual report contains certain data and information that we obtained from various government and private publications. Statistical data in these publications also include projections based on a number of assumptions. The education industry may not grow at the rate projected by market data, or at all. Failure of this market to grow at the projected rate may have a material and adverse effect on our business and the market price of the Ordinary Shares. In addition, the rapidly evolving nature of this industry results in significant uncertainties for any projections or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we refer to in this annual report and exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect.

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

China Liberal is a holding company incorporated in the Cayman Islands and not a Chinese operating company. As a holding company with no material operations of its own, China Liberal conducts its operations through its wholly owned PRC subsidiaries, China Liberal Beijing, China Liberal Fujian, Oriental Wisdom, and Fujian Wanzhong, as well as the affiliated entities. As more fully explained in the corporate structure chart and accompanying notes, we treat FMP and Strait College as our consolidated affiliated entities under U.S. GAAP and have consolidated the financial results of the affiliated entities in the consolidated financial statements in accordance with U.S. GAAP. We directly hold 100% of the equity interests in our subsidiaries, and receive the economic benefits of the affiliated entities.

Because we do not directly hold equity interests in the affiliated entities, we are subject to risks and uncertainties of the interpretations and applications of PRC laws and regulations. We are also subject to the risks and uncertainties about any future actions of the PRC government in this regard that could disallow this structure, which would likely result in a material change in our operations, and the value of our Ordinary Shares may depreciate significantly or become worthless. See “Risk Factors—Risks Relating to Our Corporate Structure” and “Risk Factors—Risks Relating to Doing Business in China.”

Our Ordinary Shares are the shares of the offshore holding company in the Cayman Islands, instead of shares of our operating companies in China. Therefore, holders of our Ordinary Shares do not directly hold any equity interests in our operating companies or the affiliated entities in China and investors are purchasing an interest in the Cayman Islands holding company.

In this annual report, we refer to (i) the holding company as “we,” “us”, “our” or “the Company,” and when describing the group’s consolidated financial information, also includes the Company’s subsidiaries and the affiliated entities, (ii) the subsidiaries as “the subsidiaries” or “our subsidiaries”; and (iii) FMP and Strait College collectively as the “affiliated entities.”

The following diagram illustrates our corporate structure as of the date of this annual report.

* Under PRC laws and regulations in effect as of the date of this annual report, most of the schools founded in the PRC, including FMP and Strait College, do not have equity interest holders. Instead, schools may be established by “founders”, which include government for public schools and private companies or individuals for private schools, and schools may receive contributions in cash or assets by “investors”, which may include private companies or individuals. The founders of FMP were Minjiang University and Melbourne Polytechnic, and the sole investor of FMP was Fujian Wanzhong. The founder of Strait College was Mingjiang University, and Fujian Wanzhong was the sole investor of Strait College. As a result, Fujian Wanzhong was regarded as the primary beneficiary of each of FMP and Strait College, and through Fujian Wanzhong, we treat FMP and Strait College as our consolidated affiliated entities under U.S. GAAP and have consolidated the financial results of these entities in the consolidated financial statements in accordance with U.S. GAAP.

Risks Associated with Doing Business in the PRC

We are subject to certain legal and operational risks associated with having the majority of our operations in China, which could significantly limit or completely hinder our ability to offer securities to investors and cause the value of our securities to significantly decline or be worthless. See “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China— The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our Ordinary Shares.”

Recently, the PRC government adopted a series of regulatory actions and issued statements to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this annual report, we, our subsidiaries or the affiliated entities have not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received any inquiry, notice or sanction. As of the date of this annual report, we have not received any notice from any authorities identifying the PRC subsidiaries or the affiliated entities as critical information infrastructure operators (“CIIOs”) or requiring us to go through cybersecurity review or network data security review by the Cyberspace Administration of China (the “CAC”). According to the Cybersecurity Review Measures, and if the Security Administration Draft is enacted as proposed, we believe that the operations of the PRC subsidiaries and the affiliated entities and our continued listing on the Nasdaq Stock Market LLC (“Nasdaq”) will not be affected and that we will not be subject to cybersecurity review by the CAC, given that the PRC subsidiaries and the affiliated entities possess personal data of fewer than one million individual clients and do not collect data that affects or may affect national security in their business operations as of the date of this annual report and do not anticipate that they will be collecting over one million users’ personal information or data that affects or may affect national security in the near future. Additionally, we believe that we are compliant with the regulations and policies that have been issued by the CAC to date. See “Item 3. Key Information— D. Risk Factors—Risks Relating to Doing Business in China - Recent greater oversight by the CAC over data security, particularly for companies seeking to list on a foreign exchange, could adversely impact our business and our offering.”

In addition, our securities may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act, or the HFCA Act, if the Public Company Accounting Oversight Board (United States), or the “PCAOB,” is unable to inspect our auditor for two consecutive years instead of three beginning in 2021, as amended. Our auditor, Audit Alliance LLP, is an independent registered public accounting firm with the PCAOB, and as an auditor of publicly traded companies in the U.S., is subject to laws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our auditor is not subject to the determination issued by the PCAOB on December 16, 2021. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was signed into law on December 29, 2022, amending the HFCA Act and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time period for triggering the delisting of our Company and the prohibition of trading in our securities if the PCAOB is unable to inspect our accounting firm at any future time. On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”) governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. See “—D. Risk Factors—Risks Relating to Doing Business in China—Recent joint statement by the SEC and Public Company Accounting Oversight Board, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued listing or future offerings of our securities in the U.S.”

Permissions Required from PRC Authorities

Based on PRC laws and regulations in effect as of the date of this annual report, and subject to different interpretations of these laws and regulations that may be adopted by PRC authorities, the PRC subsidiaries, their affiliates and the affiliated entities were required to and have obtained the following licenses and approvals necessary to operate in China as of the date of this annual report: (i) each of the Company’s PRC subsidiaries has obtained a business license from the governing local branches of State Administration for Market Regulations, which sets forth the scope of business operations each subsidiary is allowed to conduct; (ii) FMP has obtained a Legal Person Certificate of Public Institution from the Bureau of Public Institution of Fujian Province, which is an equivalent of business license for schools; and (iii) FMP has obtained a license for Chinese-foreign cooperative education, granted by the People's Government of Fujian Province, which authorizes FMP to operate Sino-foreign jointly managed academic programs. Currently, we, our subsidiaries and the affiliated entities are not required to obtain any other license or approval for our operations in China.

We believe that we, our subsidiaries and the affiliated entities have obtained all licenses and approvals necessary to operate in China and that we do not need any other license or approval for our operations in China or Hong Kong. We believe that we are not required to obtain approval from any PRC government authorities, including the CSRC, the CAC, or any other government entity, to issue of Ordinary Shares to foreign investors. Under the Cybersecurity Review Measures, if critical information infrastructure operators purchase network products and services, or network platform operators conduct data processing activities that affect or may affect national security, they will be subject to cybersecurity review. A network platform operator holding more than one million users/users’ individual information shall be subject to cybersecurity review before listing abroad. In the opinion of our PRC legal counsel, H&J Law Firm, our business operations do not currently involve the procurement of network products and services or data processing as network platform operators. H&J Law Firm has further advised us that the Cybersecurity Review Measures do not currently apply to our Company, and we are not required to conduct cybersecurity review. See “D. Risk Factors — Risks Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our Ordinary Shares.”

On February 17, 2023, the CSRC issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises (the “Trial Measures”) and five supporting guidelines (collectively, the “Overseas Listings Rules”), which became effective on March 31, 2023. These rules propose to establish a new filing-based regime to regulate overseas offerings and listings by Chinese domestic companies. Under the Overseas Listings Rules, Chinese domestic companies conducting overseas securities offering and listing activities, either in direct or indirect form, shall complete filing procedures with the CSRC pursuant to the requirements of the Trial Measures within three working days following its submission of initial public offering or listing application. Since the date of effectiveness of the Trial Measures, the domestic enterprises otherwise subject to filing that have been listed overseas or met the following circumstances are considered existing enterprises: the application of such enterprises for indirect overseas securities issuance and listing has been approved by the applicable overseas regulators or overseas stock exchanges (e.g., an applicable registration statement has been declared effective by the SEC) before the effectiveness of the Trial Measures, and are not required to re-perform issuance and listing supervision procedures with the overseas regulators or overseas stock exchanges, and the overseas issuance and listing of such enterprises will be completed by September 30, 2023. Existing enterprises are not required to file immediately, and filing should be made as required if they conduct refinancing activities or other matters requiring filings in the future. In the opinion of our PRC legal counsel, H&J Law Firm, as a domestic company listed on Nasdaq since May 2020, and not currently conducting refinancing or other activities that require filings, we are not required to file with the CSRC in accordance with the Trial Measures at this time. However, in the event that we conduct subsequent offerings, we could be subject to filing requirements with the CSRC. In the event that filings with the CSRC are required, we cannot assure you that we can complete the filing procedures, obtain the approvals or complete other compliance procedures in a timely manner, or at all, or that any completion of filing or approval or other compliance procedures would not be rescinded. Any such failure would subject us to sanctions by the CSRC or other PRC regulatory authorities. These regulatory authorities may impose restrictions and penalties on the operations in China, significantly limit or completely hinder our ability to launch any new offering of our securities, limit our ability to pay dividends outside of China, delay or restrict the repatriation of the proceeds from future capital raising activities into China, or take other actions that could materially and adversely affect our business, results of operations, financial condition and prospects, as well as the trading price of our Ordinary Shares. Furthermore, the PRC government authorities may further strengthen oversight and control over listings and offerings that are conducted overseas. Any such action may adversely affect our operations and significantly limit or completely hinder our ability to offer or continue to offer securities to you and cause the value of such securities to significantly decline or be worthless.

Since the recent regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations will have on our daily business operation, ability to accept foreign investments, and listing on the Nasdaq Stock Market. If we do not receive or maintain the approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, ordered to suspend our relevant business and rectify, prohibited from engaging in relevant business, or subject to an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. See ‘Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China— The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our Ordinary Shares.”

Cash Transfers Through Our Organization and Dividend Policy

As of the date of this annual report, there has been no transfer of cash or other assets, dividends or distributions between the holding company, its subsidiaries and the affiliated entities. As of the date of this annual report, we have not declared any dividends or made any distributions to our shareholders or U.S. investors.

We rely principally on dividends and other distributions on equity from our PRC subsidiaries and earnings from the affiliated entities for our cash requirements, including for services of any debt we may incur. Our PRC subsidiaries’ ability to distribute dividends and earnings is based upon their respective distributable earnings.

Current PRC regulations permit the companies in the PRC to pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, each of the companies in the PRC is required to set aside 10% of its after-tax profits to fund a statutory reserve until such reserve reaches 50% of its registered capital if it distributes its after-tax profits for the current financial year. In addition, cash transfers from our Cayman Islands holding company are subject to applicable PRC laws and regulations on loans and direct investment. See “Item 3. Key Information — D. Risk Factors — Risk Related to Doing Business in China — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.”

In addition, cash transfers from our PRC subsidiaries to entities outside of China are subject to PRC government controls on currency conversion. To the extent cash in our business is in the PRC or a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC due to restrictions and limitations imposed by the governmental authorities on the ability of us, our PRC subsidiaries to transfer cash outside of the PRC. Shortages in the availability of foreign currency may temporarily delay the ability of our PRC subsidiaries to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. In view of the foregoing, to the extent cash in our business is held in China or by a PRC entity, such cash may not be available to fund operations or for other use outside of the PRC. For risks relating to the fund flows of our operations in China, see “Item 3.D. Risk Factors - Risks Related to Doing Business in China - To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash or assets.”

As of the date of this annual report, we have not declared any dividends or made any distributions to our shareholders or U.S. investors. For details, see our consolidated financial statements and their related notes included elsewhere in this annual report. Our board of directors has complete discretion on whether to distribute dividends, subject to applicable laws. We do not have any current plan to declare or pay any cash dividends on our Ordinary Shares in the foreseeable future. See “Item 3. Key Information — D. Risk Factors — Risks Related to the Trading Market—Because we do not expect to pay dividends in the foreseeable future, you must rely on a price appreciation of our Ordinary Shares for a return on your investment.” Subject to certain contractual, legal and regulatory restrictions, cash and capital contributions may be transferred among our Cayman Islands holding company and our subsidiaries. U.S. investors will not be subject to Cayman Islands, British Virgin Islands, or Hong Kong taxation on dividend distributions, and no withholding will be required on the payment of dividends or distributions to them, while they may be subject to U.S. federal income tax for receiving dividends, to the extent that the distribution is paid out of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. See “Item 10, Additional Information — E. Taxation.” Additionally, a withholding tax rate of 10% on dividends may be payable by our PRC subsidiaries to their non-PRC enterprise shareholders. See “Item 3. Key Information — D. Risk Factors — Risk Related to Doing Business in China — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.”

In addition, the PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive substantially all of our revenues in Renminbi. Under our current corporate structure, we may rely on dividend payments from our PRC subsidiaries to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval of SAFE by complying with certain procedural requirements. However, approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. As a result, we need to obtain SAFE approval to use cash generated from the operations of our PRC subsidiaries to pay off their respective debt in a currency other than Renminbi owed to entities outside China, or to make other capital expenditure payments outside China in a currency other than Renminbi. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our Ordinary Shares. See “Item 3. Key Information — D. Risk Factors — Risk Related to Doing Business in China — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay us from using the proceeds of our offerings to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.” Therefore, to the extent that cash is located in the PRC or within a PRC domiciled entity and may need to be used to fund operations outside of the PRC, the funds may not be available due to limitations placed to us by the PRC government.

Restrictions on Foreign Exchange and the Ability to Transfer Cash Between Entities, Across Borders and to U.S. Investors

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our income is received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE, as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders.

Relevant PRC laws and regulations permit the companies in the PRC to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, our PRC subsidiaries and the affiliated entities can only distribute dividends after they have met the PRC requirements for appropriation to the statutory reserves. As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries and the affiliated entities are restricted to transfer a portion of their net assets to us either in the form of dividends, loans or advances. Even though we currently do not require any such dividends, loans or advances from the PRC subsidiaries for working capital and other funding purposes, we may in the future require additional cash resources from our PRC subsidiaries due to changes in business conditions or to fund future acquisitions and developments.

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

Investing in our Ordinary Shares involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. The following list summarizes some, but not all, of these risks.

Risks Related to Our Business

| · | We operate two colleges and our revenues are highly concentrated from them. If we are not able to continue to generate significant revenues from FMP or Strait College, our results of operations and financial condition may be materially and adversely affected. |

| · | We rely heavily on the continuous reputation of the colleges that we operate in order to attract and maintain a significant number of student enrollment. |

| · | If either of the colleges were to lose their Sino-foreign program permits, our results of operations and financial condition may suffer substantially. |

| · | If FMP or Strait College fail to increase student enrollments, our net revenues may decline, and we may not be able to maintain growth. |

| · | If we fail to implement and maintain an effective system of internal controls, we may be unable to accurately or timely report our results of operations or prevent fraud, and investor confidence and the market price of our Ordinary Shares may be materially and adversely affected. |

Risks Related to Our Corporate Structure

| · | In the event we are presented with business combination opportunities, we may be unable to complete such transactions efficiently or on favorable terms due to complicated merger and acquisition regulations and certain other PRC regulations. |

| · | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

| · | Certain judgments obtained against us by our shareholders may not be enforceable. |

| · | The Cooperation Agreements between Fujian Wanzhong and Minjiang University may not be effective in providing control over the affiliated entities. |

Risks Related to Doing Business in China

| · | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, and it is highly uncertain what the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. For details, see “— Risks Related to Doing Business in China — Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations.” |

| · | Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in China, which could change quickly with little advance notice, could result in a material adverse change in our operations and the value of our Ordinary Shares. For details, see “— Risks Related to Doing Business in China — Uncertainties with respect to the PRC legal system could adversely affect us.” |

| · | PRC government has significant authority in regulating our operations. The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our Ordinary Shares and significantly limit or completely hinder our ability to offer or continue to offer securities to investors or cause the value of such securities to decline or become worthless. For details, see “— Risks Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business activities and may intervene or influence our operations at any time, which could result in a material change in our operations and the value of our Ordinary Shares.” |

| · | We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business. |

| · | If we are classified as a PRC resident enterprise for PRC enterprise income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. |

| · | To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong Kong entity, the funds or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us, our subsidiaries, or the affiliated entities by the PRC government to transfer cash or assets. |

Risks Related to the Trading Market

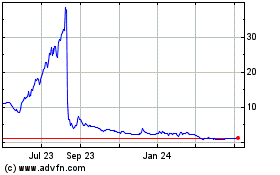

| · | The trading price of our Ordinary Shares is likely to be volatile, which could result in substantial losses to investors. |

| · | Because we do not expect to pay dividends in the foreseeable future, you must rely on a price appreciation of our Ordinary Shares for a return on your investment. |

| · | We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies. |

Risks Related to Our Business

We operate two colleges and our revenues are highly concentrated from them. If we are not able to continue to generate significant revenues from FMP or Strait College, our results of operations and financial condition may be materially and adversely affected.

Our revenues generated under Sino-foreign Jointly Managed Academic Programs represented 55.2%, 68.5% and 28.8% of our net revenues for the years ended December 31, 2020, 2021 and 2022, respectively. For 2020, 2021 and 2022, we generated a vast majority of our Sino-foreign Jointly Managed Academic Program revenues from two major partners, FMP and Minjiang University. Wanwang through its indirect wholly owned subsidiary, Fujian Wanzhong, controls FMP and Strait College. After the completion of the acquisition of Wanwang on August 31, 2022, revenue from this line of business are accounted for as transactions between Wanwang and China Liberal Beijing, and are eliminated upon consolidation. Revenue generated from Sino-foreign Jointly Managed Academic Programs is now categorized as school fees generated from FMP and Minjiang University. Although we continue to diversify our core business, this line of revenue still generated a majority of our net revenues for the fiscal years ended December 31, 2020, 2021 and 2022. As other lines of business are making significant progress contributing to the annual net revenue, the contribution of annual net revenue from this line of business, as a percentage of annual net revenue, may proportionately reduce. Although in absolute term, we expect the annual net revenue contribution to remain consistent. We cannot assure you that we will be able to continue generating the same level of revenue from FMP and Strait College, and therefore, our results of operations and financial condition may be materially and adversely affected.

The affiliated entities may be subject to regulatory and policy changes, as well as the continuous approval of and supervision by relevant PRC authorities.

We operate the affiliated entities, FMP and Strait College, which offer Sino-foreign Jointly Managed Academic Programs. According to PRC laws and regulations, schools offering Sino-foreign Jointly Managed Academic Programs are required to obtain permits to operate schools from the relevant education authorities or the authorities that regulate labor and social welfare in the PRC, depending on the type of diploma or degrees granted. The Sino-foreign Jointly Managed Academic Programs the affiliated entities operate are subject to approvals by the Ministry of Education, or MOE. Additionally, these programs are subject to continuous supervision by relevant PRC authorities, including the MOE, the Ministry of Human Resources and Social Security and their local counterparts. Such supervision may include a verification system for the foreign degrees / diplomas awarded by Sino-foreign Jointly Managed Academic Programs, and an annual report system and periodic evaluation system for those Sino-foreign institutions and programs that offer undergraduate or higher degrees.

In 2018, the MOE approved the termination of certain Sino-foreign Jointly Managed Academic Programs as a move to improve quality, tighten regulatory control, and promote reforms in China’s educational systems. Such actions were taken because problems had appeared in institutions and projects (none of which we service) that were previously approved by the relevant authorities. These problems included insufficient utilization of high-quality educational resources, low instructional quality, weak specialized capabilities in academic departments, lack of content-based development mechanisms, low student satisfaction and poor attractiveness of programs. These problems made it difficult for those institutions and projects to continue operating and they were therefore closed down. This action by the MOE was taken to close down institutions and projects that were originally approved but at the time of termination did not have enrolled students any more. Thus, this action was also taken to improve the overall quality of the industry. In light of this, Fujian Province, the province where both of the Sino-foreign Jointly Managed Academic Programs are located, set a minimum score for English (as a subject) for those students who are applying for any four-year Sino-foreign joint programs that offer undergraduate degrees. As a result of these new regulatory controls and policy adjustments, even though neither of the programs were terminated by MOE, overall student recruiting and enrollment under the Sino-foreign Jointly Managed Education Programs hosted by FMP or Strait College could be negatively impacted because some potential candidates could not meet the minimum score for English. Even though student enrollments under the joint education programs of Strait College increased by 145 students from 1,263 students in 2021 to 1,408 students in 2022, we cannot assure you that the local government in Fujian Province or the MOE will not set an even higher eligibility standard for students to enroll in these joint education programs in the future, in which case our student enrollment numbers, result of operations and financial conditions may be negatively impacted.

We rely heavily on the continuous reputation of the colleges that we operate in order to attract and maintain a significant number of student enrollment.

We operate FMP, a three-year college and Strait College, a four-year university, which provide education services to enrolled students. We receive tuition fees from students enrolled at the colleges. If these colleges experience a decrease in the number of their enrolled students due to student or parent dissatisfaction, negative publicity, poor track records, or other disruption of their reputation out of our control, they may experience withdrawals of currently enrolled students and a decrease in the enrollment of perspective students, which could in turn materially and adversely affect our results of operations and financial condition.

If either of the colleges were to lose their Sino-foreign program permits, our results of operations and financial condition may suffer substantially.

Universities or colleges who host Sino-foreign programs in the PRC are required to obtain and maintain Sino-foreign program permits from the appropriate education authorities at the PRC central government, provincial, municipal or local level, depending on the certifications required to offer these programs. As of the date of this annual report, both FMP and Strait College offer Sino-foreign Jointly Managed Academic Programs to their students. We cannot assure you that the Sino-foreign Jointly Managed Academic Programs the affiliated entities operate will maintain their permits in good standing within the permit periods, or that these permits will be renewed or extended after the permit periods. If one or more of the colleges were to lose their Sino-foreign program permits and we are not able to regain those permits in due course, our results of operations and financial condition may suffer substantially.

If FMP or Strait College fail to increase student enrollments, our net revenues may decline, and we may not be able to maintain growth.

It is critical for FMP and Strait College to enroll prospective students in a cost-effective manner. Some of the factors, many of which are largely beyond our control, could prevent us from successfully increasing enrollments of new students in a cost-effective manner, or at all. These factors include, among other things, (i) reduced interest in the degrees, professions or schools, especially in areas of art and computer science; (ii) improved quality and number of art schools in the PRC; (iii) the inability of students to pay tuition; (iv) increasing market competition, particularly price reductions by competitors that we are unable or unwilling to match; and (v) adverse changes in relevant government policies or general economic conditions. If one or more of these factors reduce market demand for education services provided by FMP or Strait College, our student enrollments could be negatively affected, or our costs associated with student acquisition and retention could increase, or both, any of which could materially affect our ability to grow our gross billings and net revenues. These developments could also harm our brand and reputation, which would negatively impact our ability to expand our business.

Significant uncertainties exist in relation to the interpretation and implementation of, or proposed changes to, the PRC laws, regulations and policies regarding the private education industry, which could adversely affect our business.

The PRC private education industry, especially the after-school tutoring sector, has experienced intense scrutiny and has been subject to significant regulatory changes. In particular, the Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education jointly promulgated by the General Office of State Council and the General Office of Central Committee of the Communist Party of China on July 24, 2021, sets out a series of operating requirements on after-school tutoring institutions.

The Standing Committee of the National People’s Congress amended the Private Education Law on December 29, 2018 (the “2018 Private Education Law”), which took effect immediately. Under the 2018 Private Education Law, on April 7, 2021, the State Council promulgated the Amended Implementation Rules for the Private Education Law, or the 2021 Implementation Rules, which became effective on September 1, 2021. The Amended Implementation Rules prohibit social organizations and individuals from controlling a private school that provides compulsory education or a non-profit private school that provides pre-school education through mergers and acquisitions and control agreements, and a private school providing compulsory education is prohibited from conducting transactions with its related party. Relevant government authorities will enhance the supervision on the agreements entered into between non-profit private schools and its related party and shall review such transaction on an annual basis. In addition, online education activities using internet technology are encouraged by the regulatory authorities and shall comply with laws and regulations related to internet management. A private school engaging in online education activities using internet technology shall obtain the relevant private school operating permit. It shall also establish and implement internet security management systems and take technical security measures. Upon discovery of any information whose release or transmission is prohibited by applicable laws or regulations, the private school engaged in online education activities shall immediately cease the transmission of that information and take further remedial actions, such as deleting that information, to prevent it from spreading. Records pertaining to the situation shall be kept and reported to the appropriate authorities.

Our business operations do not currently involve the tutoring for students in compulsory education. Additionally, our business operations involving art and language training courses have been terminated and discontinued. Therefore, as advised by H&J Law Firm, our PRC counsel, we do not believe that we are subject to the above-mentioned policies and regulations.

We face risks related to natural disasters, extreme weather conditions, health epidemics including the COVID-19 pandemic, and other catastrophic incidents, which could significantly disrupt our operations.

In the past, China has experienced significant natural disasters, including earthquakes, extreme weather conditions, as well as health scares related to epidemics, and any similar event could materially impact our business in the future. If a disaster or other disruption were to occur in the future that affects the regions where we operate our business, our operations could be materially and adversely affected due to loss of personnel, damages to property and insufficient student enrollments. Even if we are not directly affected, such a disaster or disruption could affect the operations or financial condition of our ecosystem participants, which could harm our results of operations.

Our business could be affected by public health epidemics. If any of our employees or if one or more of our students who receive our services in person (for example, those students who enrolled in our one-on-one consulting services program) is suspected of having contracted a contagious disease, we may be required to apply quarantines or suspend our operations. Furthermore, any future outbreak may restrict economic activities in affected regions, resulting in reduced business volume, temporary closure of our offices or other disruptions of our business operations and adversely affect our results of operations.

The COVID-19 pandemic has significantly affected business and other activities within China, including government mandated travel restrictions or quarantines within China. The Company’s operations have been affected by the COVID-19 pandemic. During the fiscal years 2021 and 2022, our revenue from Sino-foreign jointly managed academic programs was not significantly impacted by the COVID-19 pandemic. The Company’s revenue from study abroad consulting services for the fiscal years 2021 and 2022 was significantly affected because application of student visa for some of these countries was suspended and, according to the administration guidelines issued by General Office of the Ministry of Education in December 2021, universities and colleges shall cease projects and cooperation with external parties and, as a result, after all existing contracts with Beijing Foreign Studies University came to completion, we discontinued our overseas study consulting services since January 2023. Additionally, in fiscal years 2021 and 2022, Chinese universities / colleges further limited their budget for smart campus solutions, and as a result, we experienced significant decrease in revenue from Technological Consulting Services for Smart Campus Solutions in the fiscal years 2021 and 2022 compared to the fiscal year 2020.

Beginning in January 2023, China no longer conducted nucleic acid tests and centralized quarantines for all inbound travelers, and measures to control the number of international passenger flights were lifted. However, there are still uncertainties regarding the COVID-19’s future impact. Therefore, while we do not expect the COVID-19 pandemic to negatively impact our business, results of operations, and financial position, the related financial impact cannot be reasonably estimated at this time.

Our smart campus solutions may not be accepted by the intended users of our products, which could harm our future financial performance.

There can be no assurance that our smart campus solutions systems will achieve wide acceptance by our intended users, including management, teachers, and students of our current and future partnering schools. The degree of acceptance for products and services based on our technology will also depend upon a number of factors, such as whether we are able to meet and exceed the expectation of our uses in speed and safety, availability of various functions, user-friendliness and the ability to integrate different user platforms and data. Long-term subscription of our products and services will also depend, in part, on the capabilities and operating features of our products and technologies as compared to those of other available products and services. As a result, there can be no assurance that currently available solutions will be able to achieve revenue growth or profitability, which could harm our future financial performance.

We depend upon the development of new solutions and enhancements to existing solutions for our current and future partnering schools. If we fail to predict and respond to emerging technological trends and clients’ and intended users’ changing needs, our operating results and market share may suffer.

The market for our smart campus solutions is characterized by rapidly changing technology, evolving industry standards, new product introductions, and evolving methods of building and maintaining our products. Our operating results depend on our ability to develop and introduce innovative products and to maintain the integrated system we have implemented. The process of developing new technology, including Software as a Service, or SaaS model cloud computing technology, more programmable, flexible and virtual networks, and technology related to other market transitions, such as security, digital transformation and IoT and IoE (Internet of Everything), and cloud, is complex and uncertain, and if we fail to accurately predict clients’ and intended end users’ changing needs and emerging technological trends our business could be harmed.

We may need to commit significant resources, including monetary investments and developer personnel to developing new products before knowing for sure whether such investments will result in products the intended end users will accept. Similarly, our business could be harmed if we fail to develop, or fail to develop in a timely fashion, offerings to address other evolving needs, or if the offerings addressing these other transitions that ultimately succeed are based on technology, or an approach to technology, different from ours. In addition, our business could be adversely affected in periods surrounding the launch of new products if customers delay their purchasing decisions to evaluate the new product offerings.

Furthermore, we may not execute successfully on our vision or strategy because of challenges with regard to product planning and timing, technical hurdles that we fail to overcome in a timely fashion, or a lack of necessary resources. This could result in competitors, some of which are technology giants in the PRC, providing those solutions before we do, which in turn, causes us loss of market share, revenue, and earnings.

We provide our smart campus solutions to a limited number of universities, and if we are not able to continue to secure agreements with some or all of these universities, or secure new agreements with other universities, our results of operations and financial condition may be materially and adversely affected.

For the years ended December 31, 2022, 2021 and 2020, we provided our smart campus solutions to six, eighteen and fourteen universities, respectively, for hardware and software build-out, equipment procurement and installment services. However, one or more of these universities may decide to terminate their agreements with us for reasons such as dissatisfaction of our services, a change of programs or curriculum, hiring of in-house tech support personnel, or simply not to choose us as their service provider after a project is completely. If any of these situations occur, we cannot assure you that we will be able to timely secure other service agreements with other universities, if at all, and therefore, our results of operations and financial condition may be materially and adversely affected.

Our reputation in the job readiness training market relies heavily upon the student-employees trained by us remaining in their respective positions and performing in a satisfactory manner, which is not within our control. If these student-employees are not able to stay in their respective positions for a reasonable amount of time or are consistently not able to meet the employers’ criteria, our reputation in the job readiness training market may suffer.

While our job readiness training services are highly tailored in order to train the student-employees to meet the specific requirements of our contracted employers, there may be situations not within our control which may lead to a student-employee’s leaving his/her position before the end of required length of services. Such situations may include a student-employee’s voluntary resignation without good reason or his/her violation of the employer’s internal guidelines and rules. Although such situations are not within our control, our reputation may be damaged if similar situations occur repeatedly.

We experienced net loss in fiscal years 2022 and 2021 and prior to that, we had experienced growth in our business. We expect to continue to invest in our operations for the foreseeable future. If we fail to turn profitable in the future, the success of our business model will be compromised.

We experienced a net loss in fiscal years 2022 and 2021 and prior to that, we had experienced growth in our business, primarily driven by the diversifying of our core business while leveraging our network of trusted schools. Our net loss was $1.0 million and $1.2 million for fiscal years 2022 and 2021, respectively, compared to net income of $1.2 million for fiscal year 2020. Our net revenues were $5.0 million in 2020, decreased by 22.2% to $3.9 million in 2021, and grew by 196.8% to $11.6 million in 2022.

Any business growth may place a significant strain on our sales and marketing capacities, administrative and operating infrastructure, facilities and other resources. To effectively change the state of net loss in the past two fiscal years and turn profitable, we need to continue to acquire more Sino-foreign programs or institutes, enroll more students, increase our academic and administrative faculty, expand our customer base for technical support services, as well as further developing and strengthening our software and systems. We will also be required to refine our operational, financial and management controls and reporting systems and procedures. If we fail to efficiently expand our business, our costs and expenses may increase more than anticipated and we may not successfully attract a sufficient number of students and qualified academic and administrative faculty in a cost-effective manner, respond to competitive challenges, or otherwise execute our business plans. In addition, we may, as part of carrying out our growth strategies, adopt new initiatives to offer additional course packages and educational content and to implement new pricing models and strategies. We cannot assure you that these initiatives may achieve the anticipated results. These proposed changes may not be well received by our existing and prospective students, in which case their experience with our education services may suffer, which could damage our reputation and business prospect.

Our ability to effectively implement our strategies will depend on a number of factors, including our ability to: (i) effectively market our products and services to potential partners and students with sufficient growth potential; (ii) develop and improve educational content to appeal to existing and prospective partners and students; (iii) maintain and increase our student enrollments; (iv) effectively recruit, train and motivate a large number of new employees, including our faculty members, foreign teachers and sales and marketing personnel; (v) successfully implement enhancements and improvements to our software and systems; (vi) continue to improve our operational, financial and management controls and efficiencies; (vii) protect and further develop our intellectual property rights; and (viii) make sound business decisions in light of the scrutiny associated with operating as a public company. These activities require significant capital expenditures and investment of valuable management and financial resources, and our growth will continue to place significant demands on our management. There are no guarantees that we will be able to effectively grow our business in an efficient, cost-effective and timely manner, or at all. Our growth in a relatively short period of time is not necessarily indicative of results that we may achieve in the future. If we do not effectively grow our business and operations, our reputation, results of operations and overall business and prospects could be negatively impacted.

If we are unable to conduct sales and marketing activities cost-effectively, our results of operations and financial condition may be materially and adversely affected.

We rely heavily on our sales and marketing efforts to increase student enrollment. Our sales and marketing expenses consist primarily of employee salaries and student enrollment. We incurred approximately $229,656, $152,759 and $0.4 million, respectively, in selling expenses in 2020, 2021 and 2022. We expect our selling expenses to increase in the future if we further expand our operations.

Our sales and marketing activities may not be well received by the market and may not result in the levels of sales that we anticipate. We also may not be able to retain or recruit a sufficient number of experienced sales and marketing personnel, or to train newly hired sales and marketing personnel, which we believe is critical to implementing our sales and marketing strategies cost-effectively. Further, sales and marketing approaches and tools in China’s private education market are evolving rapidly. This requires us to continually enhance our sales and marketing approaches and experiment with new methods to keep pace with industry developments and student preferences.

Failure to engage in sales and marketing activities in a cost-effective manner may reduce our market share, cause our revenues and gross billings to decline, negatively impact our profitability, and materially harm our business, financial condition and results of operation.

We have a limited history of operating some of our business lines.

We provided services to the Sino-foreign Jointly Managed Academic Programs from 2011 to August 2022 and have been operating FMP and Strait College since September 2022, which offer Sino-foreign Jointly Managed Academic Programs. However, we have only been offering one-on-one consulting services and technological consulting services for smart campus solutions since 2017, and tailored job readiness training services since late 2019. Our limited history of operating part or all of our business may not serve as an adequate basis for evaluating our future prospects and operating results, including gross billings, net revenue, cash flows and profitability.

We may not be able to continue to recruit, train and retain a sufficient number of qualified faculty members.

Our faculty members are key to the quality of our educational services, as well as our brand and reputation. Our ability to continue to attract faculty members with the necessary experience and qualifications is a key driver in the success of our business. We seek to recruit qualified faculty members who are dedicated to teaching and are able to stay up-to-date with ever-changing teaching methods and approaches.

Additionally, given that our services are provided to students with goals to study abroad, we tend to hire teachers with strong education background and qualifications. The market for the recruitment of faculty members in the PRC is competitive. In order to attract and recruit talents, we must provide candidates with competitive compensation packages and offer attractive career development opportunities. Although we have not experienced major difficulties in recruiting or training qualified teachers in the past, we cannot guarantee that we will be able to continue to recruit, train and retain a sufficient number of qualified faculty members in the future as we continue to expand our business, which may have a material adverse effect on our business, financial condition and results of operations.

Our failure to obtain and maintain permit related to human resources services could have a material adverse impact on our business, financial conditions and results of operations.

Pursuant to the Interim Regulations on Human Resources Market, effective as of October 1, 2018, any for-profit human resources service provider shall obtain approval from the administrative department of human resources and social security to conduct human resources services. We used to recommend foreign teachers based on certain standards found in China Liberal Beijing’s agreements with partner universities or programs. We recommended three foreign teachers in 2016, three foreign teachers in 2017 and one foreign teacher in 2018, which may subject us to the qualification requirements of a human resources services provider. However, we have ceased to recommend new foreign teachers since 2019. Besides, as of the date of this annual report, we have not been subject to any fines or other form of regulatory or administrative penalties or sanctions due to the lack of such approval or permit. Nevertheless, due to the broad provisions and discretionary implementation of the PRC laws, we cannot guarantee that the government authorities will not impose any penalties or sanctions on us in the future for any incompliance in the past, which may include fines, mandates to remedy any violations, confiscation of the gains derived from the services for which approval or permit is required, and/or an order to cease to provide such services, in which case, we could be subject to operational disruption and our financial condition and results of operations could be adversely affected.

Failure to adequately and promptly respond to changes in the exams our students must take or in the requirements our students must meet to pursue their desired degrees or schools could cause our education services to be less attractive to our students.

There have been continuous changes in the curriculum requirements associated with, and the format of, the exams our existing and prospective students must take to pursue their desired degrees or schools, the manner in which the exams are administered, topics frequently tested in the exams, as well as the materials and documents students must submit for admission. These changes require us to continually update and enhance our course offerings, our educational and consultancy content and our teaching methods. Any inability to track and respond to these changes in a timely and cost-effective manner would make our education services less attractive to students, which may materially and adversely affect our reputation and ability to continue to attract students without a significant decrease in our tuition.

Delays or failures in responding to issues raised by end users of our SaaS platform could harm our operations.

Our proprietary SaaS platform offers comprehensive smart campus solutions, including teaching, student affairs, human resources, office and financial management. The performance and reliability of our SaaS platform used by management, teachers and students is critical to our operations and reputation. We rely on our end users to promptly give us feedback regarding their user experience as well as any issues in connection with such platforms. However, there may be delay in feedback from these end users, or delay or failure on our end to address such issues. These could damage our reputation, decrease end user satisfaction, negatively impact our current coopering relationships, adversely impact our ability to attract new partners, and materially disrupt our operations. If any of these occur, our business operations, reputation and prospects could be harmed.

Our business depends on the continued success of our brand “China Liberal,” and if we fail to maintain and enhance recognition of our brand, we may face difficulty enrolling new students, and our reputation and operating results may be harmed.

We believe that market awareness of our brand “China Liberal” has contributed significantly to the success of our business. Maintaining and enhancing our brand are critical to our efforts to grow our business. Failure to maintain and enhance our brand recognition could have a material and adverse effect on our business, operating results and financial condition. We have devoted significant resources to our brand promotion efforts in recent years, but we cannot assure you that these efforts will be successful. If we are unable to further enhance our brand recognition, or if we incur excessive marketing and promotion expenses, or if our brand image is negatively impacted by any negative publicity, our business and results of operations may be materially and adversely affected.

If we fail to effectively identify, pursue and consummate strategic alliances or acquisitions, our ability to grow and to achieve profitability could be impacted.

We may from time to time engage in evaluations of, and discussions with, possible domestic and international acquisition or alliance candidates. We may not be able to identify suitable strategic alliances or acquisition opportunities, complete such transactions on commercially favorable terms, or successfully integrate business operations, infrastructure and management philosophies of acquired businesses and companies. There may be particular complexities, regulatory or otherwise, associated with our expansion into new markets, and our strategies may not succeed beyond our current markets. If we are unable to effectively address these challenges, our ability to execute acquisitions as a component of our long-term strategy will be impaired, which could have an adverse effect on our growth.

We face intense competition in our industry, which could divert students to our competitors, lead to pricing pressure and loss of market share, and significantly reduce our gross billings and net revenues.

China’s education market targeting students going overseas is intensely competitive. We compete with other Chinese education service providers, including universities and colleges, for student enrollments and acquisition, high-quality academic and administrative faculty, and sales and marketing personnel, among other things. Some of our current and future competitors may have substantially greater name recognition and financial and other resources than we do, which may enable them to compete more effectively for potential students and decrease our market share. We also expect to face competition as a result of new entrants particularly those who provide consultancy services targeting art students.

We may not be able to compete successfully against current or future competitors and may face competitive pressures that could adversely affect our business or results of operations. The increasingly competitive landscape may also result in longer and more complex sales cycles with a prospective student or a decrease in our market share, any of which could negatively affect our gross billings and net revenues and our ability to grow our business.

We rely heavily on Aliyun, a cloud-based server provider to provide server service to us. Any interruption to such service could significantly disrupt our operations.

A vast majority of our data, codes and solutions is stored on the cloud-based service platform, Aliyun, we subscribe to. Although the use of such service is perceived to have lower risks than a conventional physical server, we may still face risks such as closure or discontinuity of services without adequate notice, financial difficulties (such as bankruptcy) faced by the server provider or their contractor(s), or any system vulnerability or security risk that are not timely fixed by Aliyun, which may have negative effects on our business, the nature and extent of which are difficult to predict.

Privacy concerns could limit our ability to collect and leverage our user data and disclosure of user data could adversely impact our business and reputation.

In the ordinary course of our business and in particular in connection with the technological consulting services provided under smart campus solutions, we collect and utilize data supplied by our users. We may face legal obligations regarding the manner in which we treat such information. Increased regulation of data utilization practices, including self-regulation or findings under existing laws that limit our ability to collect, transfer, integrate and use data, could have an adverse effect on our business. Failure to comply with these obligations could subject us to liability, and to the extent that we need to alter our business model or practices to adapt to these obligations, we could incur additional expenses.

Our success depends on the continuing efforts of our senior management team and other key employees.

We depend on the continued contributions of our senior management and other key employees. The loss of the services of any of our senior management or other key employees could harm our business. Competition for qualified talents in the PRC is intense. If one or more of our senior management or other key employees are unable or unwilling to continue in their present positions, we may not be able to find replacements in a timely manner, or at all, and our business may be disrupted. Moreover, if any member of our senior management team or any of our other key personnel joins a competitor or forms or invests in a competing business, we may lose student enrollment, qualified teaching faculty members and other key sales and marketing personnel to our competitors. Our future success is also dependent on our ability to attract a significant number of qualified employees and retain existing key employees. If we are unable to do so, our business and growth may be materially and adversely affected. Our need to significantly increase the number of our qualified employees and retain key employees may cause us to materially increase compensation-related costs, including share-based compensation.

We may from time to time be subject to infringement claims relating to intellectual properties of third parties.

We cannot assure you that our course offerings, educational contents, textbooks, software and platforms do not or will not infringe upon copyrights or other intellectual property rights held by third parties. We may encounter disputes from time to time over rights and obligations concerning intellectual properties, and we may not prevail in those disputes.

We have adopted policies and procedures to prohibit our users, students and employees from infringing upon third-party copyright or intellectual property rights. However, we cannot ensure that they will not, against our policies, use third-party copyrighted materials or intellectual property without proper authorization. We may incur liability for unauthorized duplication or distribution of materials posted used in our classes or posted on our platforms. Any intellectual property infringement claim could result in costly litigation and divert our management attention and resources, which in turn could negatively affect our business, financial condition and prospect.

If we fail to protect our intellectual property rights, our brand and business may suffer.

We rely on a combination of copyright, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. Although we seek to obtain copyright or trademark protection for our intellectual property when applicable, it is possible that we may not be able to do so successfully or that the copyright or trademark we have obtained may not be sufficient to protect all of our intellectual property rights. In particular, we rely, to a significant extent, upon our educational content developed in-house, including textbooks and teaching materials, course syllabi and outlines, quiz banks, and teaching notes, to provide high-quality education services. Additionally, we have developed and will continue to develop and maintain our copyrighted software offered within our smart campus solution. Despite our efforts to protect our intellectual property rights, unauthorized parties may attempt to copy or duplicate our intellectual property or otherwise use our intellectual properties without obtaining our consent. For example, unauthorized third parties may use our “China Liberal” brand to operate similar businesses, or to make illegal copies of our textbooks and teacher materials for market resale. Monitoring unauthorized use of our intellectual property is difficult and costly, and we cannot be certain that the steps we have taken will effectively prevent misappropriation of our intellectual properties. If we are not successful in protecting our intellectual property rights, our business and results of operations may be adversely affected.

Our end users may engage in intentional or negligent misconduct or other improper activities or misuse our software and systems, which could harm our brand and reputation.