Current Report Filing (8-k)

December 14 2022 - 8:31AM

Edgar (US Regulatory)

0001119190

false

0001119190

2022-12-08

2022-12-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 8, 2022

HUMBL,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-31267

|

|

91-2948019 |

| (State

of other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 600

B Street |

|

|

| Suite

300 |

|

|

| San

Diego, CA |

|

92101 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (786) 738-9012

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HMBL |

|

OTCQB

|

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

December 12, 2022, HUMBL, Inc. (“HUMBL”) entered into an Equity Financing Agreement (“EFA”) and a Registration

Rights Agreement (“Rights Agreement”) with GHS Investments, LLC (“GHS”). Pursuant to the EFA, HUMBL has the right,

subject to certain conditions, to sell up to $20,000,000 in shares of its common stock to GHS. Pursuant to the Rights Agreement, HUMBL

agreed to file a registration statement to register the common stock issuable under the EFA. Following the registration of the securities

under the EFA, HUMBL has the right to cause GHS to purchase its common stock at 80% of the average of the three lowest closing trade

prices in the previous 10 trading days by submitting a put notice to GHS. HUMBL may choose the dollar amount of each put notice; provided,

however, the maximum dollar amount of any put cannot exceed 200% of HUMBL’s average daily trading volume in the previous 10 trading

days. In addition, the amount of the put notice must not be less than $10,000 or greater than $500,000. HUMBL may only deliver one put

notice to GHS in any given 10 trading day period. Following an uplist to Nasdaq or an equivalent national exchange, the conversion rate

would increase from 80% to 90%. The amount of HUMBL shares owned by GHS cannot exceed 4.99% of the issue and outstanding shares of HUMBL

common stock following the purchase by GHS of HUMBL shares under a put notice. The foregoing description of the EFA and Rights Agreement

does not purport to be complete and is qualified in its entirety by reference to the EFA which is filed as Exhibit 10.1 to this Current

Report on Form 8-K and the Rights Agreement which is filed as Exhibit 10.2 to this Current Report on Form 8-K.

On

December 8, 2022, HUMBL issued an 8% Convertible Redeemable Note Due September 8, 2023 in the original principal amount of $222,000 (the

“Note”) to GS Capital Partners, LLC. The Note contains an original issue discount of $14,500 and legal fees of $7,500. The

Note bears interest at the rate of 8% and is due on September 8, 2023. The Note is convertible into shares of HUMBL common stock at $0.012

per share. Following an event of default, the Note becomes convertible at 70% of the lowest trading price of the common stock during

the fifteen (15) prior trading days. The Note is subject to: (a) a 5% prepayment premium if paid within 60 days of issuance; (b) a 15%

prepayment premium if paid between 60 and 120 days of issuance; and (c) 30% if paid between 120 and 180 days of issuance. The Note may

not be prepaid after the 180th day. The foregoing description of the Note does not purport to be complete and is qualified

in its entirety by reference to the Note which is filed as Exhibit 10.3 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

| |

Exhibits |

|

|

| |

|

|

|

| |

10.1 |

|

Equity Financing Agreement dated December 12, 2022 between HUMBL, Inc. and GHS Investments, LLC |

| |

10.2 |

|

Registration Rights Agreement dated December 12, 2022 between HUMBL, Inc. and GHS Investments, LLC |

| |

10.3 |

|

8% Convertible Redeemable Note Due September 8, 2023 issued by HUMBL, Inc. to GS Capital Partners, LLC on December 8, 2022 |

| |

104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

December 14, 2022 |

HUMBL,

Inc. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

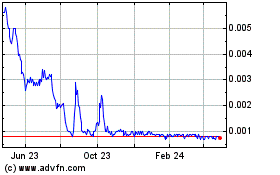

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

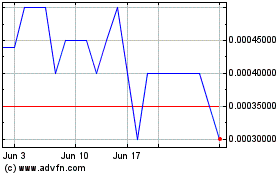

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024