Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

October 06 2022 - 6:07AM

Edgar (US Regulatory)

GLOBAL BLUE RELEASES FRESH INSIGHTS ON THE TAX FREE SHOPPING BUSINESS IN SEPTEMBER 2022 Signy, Switzerland, October 6, 2022 New data from Global Blue shows that dynamic recovery for Tax Free Shopping has been accelerating across Continental Europe and Asia Pacific. In Continental Europe, issued Sales in Store like-for-like has further accelerated with a recovery of 108%1 in September vs. the same period in 2019. US and Gulf Corporation Council citizens are fueling these developments. In Asia Pacific, the overall dynamic has remained stable over the last three months and it reached 51%1 in September vs. the same period in 2019. Recovery in Continental Europe surpasses 100% September was a significant month for Continental Europe. Recovery further accelerated to reach 108%1 vs. 2019. Within reopened travel corridors2, recovery reached 151%1. With regards to origin markets, US and Gulf Cooperation Council citizens fueled the solid developments across Europe. US nationals continued to lead the recovery in most destinations with a monthly recovery of 253%1 vs. the same period in 2019. Recovery amongst Gulf Cooperation Council citizens significantly increased with a monthly recovery of 247%1 vs. the same period in 2019. For both nationalities, a solid recovery of traffic and strong currencies against the euro are driving this trend. Recovery for Chinese nationals remains low with a recovery of 11%1 due to remaining travel and sanitary restrictions. Despite the absence of Chinese nationals, most destination markets in Europe have recovered to 2019 levels. The recovery1 was particularly led by Greece at 170%, Portugal at 159%, and France at 129%. Recovery in Asia Pacific remains stable In Asia Pacific, the overall dynamic has remained stable over the last three months. In September, recovery reached 51%1 vs. the same period in 2019. Within reopened travel corridors2, the recovery reached 73%1. 1 Recovery rate is equal to 2022 Issued Sales In Store divided by 2019 Issued Sales In Store, like-for-like (ie: at constant merchant scope and exchange rates) 2 Open corridor is defined as a travel line between 2 countries, where there is no more sanitary or visa restrictions to go in the destination country and to come back in the origin country.

Regarding destination markets, Singapore continues to lead the recovery at 61%1 vs. 2019. This was followed by South Korea at 47%1 and Japan at 42%1. Travel corridors and restrictions news Japan and South Korea plan to lift all restrictions in October. Taiwan and Hong Kong plan to loosen their quarantine restrictions for return travelers. APPENDIX Glossary - Gulf Cooperation Council countries include: Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Bahrain, Oman - South East Asia include: Indonesia, Thailand, Cambodia, Phil ippines, Vietnam, Malaysia, Singapore - North East Asia include: Japan, Korea YTD Data Issued SIS L/L recovery3 ( in % of 2019) Q3 2022 September 2022 August 2022 July 2022 Q2 2022 Q1 2022 Continental Europe 100% 108% 97% 95% 75% 53% Asia Pacific 51% 51% 49% 52% 39% 16% TOTAL 87% 93% 85% 85% 65% 40% MEDIA CONTACTS Virginie Alem – SVP Marketing & Communications Mail: valem@globalblue.com INVESTOR RELATIONS CONTACTS Frances Gibbons – Head of Investor Relations Mob: +44 (0)7815 034 212 Mail: fgibbons@globalblue.com ABOUT GLOBAL BLUE Globa l Blue pioneered the concept of Tax Free Shopping 40 years ago. Through continuous innovation, we have become the leading strategic technology and payments par tner, empowering retai lers to improve their per formance and shoppers to enhance their experience. Globa l Blue offers innovative solutions in three different fie lds: • Tax Free Shopping: Helping retai lers at over 300,000 points of sale to e ffic ie nt ly manage 35 mil l i on Tax Free Shopping transactions a year, thanks to i ts fu l ly in tegrated in -house technology plat form. Meanwhi le , i ts industry -leading digi tal Tax Free shopper so lutions create a better , more seamless customer experience . • Payment serv ices: Providing a ful l suite of foreign exchange and Payments technology so lutions that a l low acquirers, hote ls, and retai lers to offer value -added services and improve the cus tomer experience during 31 mi l l ion payment transactions a year at 130,000 points o f interaction . • Complementary Reta ilTech: Offer ing new technology so lution s to retai lers, including digi tal receipts and eCommerce returns , that can be eas i ly integrated with their core systems and al low them to optimize and digita l ize their processes throu ghout the omni -channe l customer journey, both in -store and online. In addi t ion, our data and advisory serv ices offer a strategic advisory to help retai lers identify opportunit ies for growth, whi le our shopper exper ience and engagement solut ions provide data -dr i ven solutions to increase footfal l, convert footfa ll to revenue and enhance performance. For more in formation, vis i t http://www.globalblue.com/corporate/ Global Blue Monthly Speaker Notes Data, September 2022, Source: Global Blue 3 Recovery rate is equal to 2022 Issued Sales In Store divided by 2019 Issued Sales In Store, like-for-like (ie: at constant merchant scope and exchange rates)

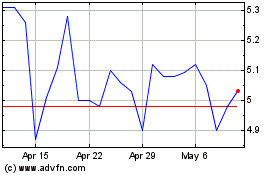

Global Blue (NYSE:GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

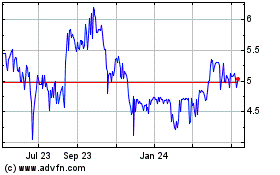

Global Blue (NYSE:GB)

Historical Stock Chart

From Apr 2023 to Apr 2024