UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

þ ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to __________________________

Commission File Number 001-31921

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Compass Minerals International, Inc. Savings Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Compass Minerals International, Inc.

9900 West 109th Street, Suite 100

Overland Park, Kansas 66210

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of Compass Minerals International, Inc. Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Compass Minerals International, Inc. Savings Plan (the Plan) as of December 31, 2021 and 2020, and the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2021 and 2020, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedule Required by ERISA

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2021, (referred to as the “supplemental schedule”), has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 2005.

Kansas City, MO

June 27, 2022

| | | | | | | | |

| Compass Minerals International, Inc. Savings Plan | | |

| Statements of Net Assets Available for Benefits | | |

| | |

| December 31, |

| Assets | 2021 | 2020 |

Investments, at fair value (Notes 2 and 3) | $ | 166,694,542 | | $ | 145,479,051 | |

| | |

| Receivables | | |

| Employer contributions | 126,767 | 89,671 |

| Notes receivable from participants | 3,100,294 | 2,931,561 |

| Total receivables | 3,227,061 | 3,021,232 |

| Net assets available for benefits | $ | 169,921,603 | | $ | 148,500,283 | |

| | |

| The accompanying notes are an integral part of the financial statements. |

| | |

| | | | | | | | |

| Compass Minerals International, Inc. Savings Plan | | |

| Statements of Changes in Net Assets Available for Benefits | | |

| | |

| For the Year Ended |

| December 31, |

| 2021 | 2020 |

| Additions: | | |

| Investment income: | | |

| Net appreciation in fair value of investments | $ | 18,811,200 | | $ | 20,684,989 | |

Interest and dividend income | 2,180,278 | | 2,840,822 | |

| Net investment income | 20,991,478 | | 23,525,811 | |

Contributions: | | |

Participants | 8,261,710 | | 7,502,700 | |

Employer | 5,242,411 | | 4,966,460 | |

Rollovers | 2,392,451 | | 888,108 | |

Total contributions | 15,896,572 | | 13,357,268 | |

| Deductions: | | |

Benefits paid to participants | (15,327,652) | | (16,857,046) | |

Administrative expenses | (139,078) | | (107,913) | |

| Net increase in net assets available for benefits | 21,421,320 | | 19,918,120 | |

| Net assets available for benefits at beginning of year | 148,500,283 | | 128,582,163 |

| Net assets available for benefits at end of year | $ | 169,921,603 | | $ | 148,500,283 | |

|

| The accompanying notes are an integral part of the financial statements. |

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Note 1. Description of the Plan

The following description of the Compass Minerals International, Inc. Savings Plan (the “Plan”) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General: The Plan is a contributory, defined contribution plan covering eligible U.S. employees of Compass Minerals International, Inc. (the “Company” or “Compass Minerals”) and its participating subsidiaries. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Contributions: Participants are allowed to contribute, on either a pre-tax or after-tax (Roth) basis, a percentage of their eligible compensation, as defined by the Plan, up to the lesser of 75% of their eligible compensation or the annual limit allowed by the Internal Revenue Code, as amended (the “Code”) – $19,500 in 2021 and 2020. Participants who are age fifty or older, and who contribute the maximum federal limit, are eligible to make an additional “catch-up contribution.” The maximum catch-up contribution was $6,500 in 2021 and 2020. Participants may also elect to contribute to the Plan on an after-tax (non-Roth) basis. Participants may contribute from a minimum of 1% to a maximum of 100% of their eligible compensation on an after-tax basis, subject to the maximum allowed by Code rules. Newly-hired participants are automatically enrolled in the Plan at an initial, pre-tax contribution amount of 6% of their eligible compensation. Participants may terminate or change their contributions at any time subsequent to this automatic enrollment.

The Company contributes a non-discretionary matching contribution of 100% of a participant’s contribution (either pre-tax or Roth) on up to 6% of eligible compensation. The Company may also make profit-sharing contributions to the Plan at the discretion of the Company’s Board of Directors. Participants must be employed on the last day of the Plan year to be eligible for discretionary profit-sharing contributions, except in the case of a participant’s death, disability or retirement, as defined by the Plan. For the years ended December 31, 2021 and 2020, there were no discretionary profit-sharing contributions to the Plan. In addition, the Company may designate a qualified non-elective contribution to be allocated to non-highly compensated employees to maintain compliance with the Code’s non-discrimination tests.

The Plan also allows participants to roll over part or all of an eligible distribution received by the participant from another qualified plan.

Participant accounts: Each participant’s account is credited with the participant’s contribution, the Company’s non-discretionary matching contribution, rollover contributions, allocation of the Company’s discretionary profit-sharing contribution (if applicable) and Plan earnings or losses. Allocations are based on earnings or account balances as defined by the Plan. A participant is entitled to receive only the vested portion of their account balance at the time of a distributable event.

Eligibility: All U.S. employees of the Company and its participating subsidiaries are eligible to participate in the Plan after 30 days of service, with the exception of employees who are citizens of Puerto Rico, certain non-resident aliens, leased employees, seasonal and temporary employees (including interns) and independent contractors, who are excluded from eligibility pursuant to the provisions of the Plan. Further, employees covered by a collective bargaining agreement are eligible only to the extent participation in the Plan is part of the negotiated collective bargaining agreement.

Participant investment options: Each participant is responsible for directing the investment of his or her existing account balances and all future contributions made on his or her behalf among the designated investment alternatives, including shares of Compass Minerals common stock. Participants may change their investment options at any time throughout the year. However, participants who are subject to trading window restrictions for transactions in Compass Minerals common stock may not have the ability to change their investment in Compass Minerals common stock during specified periods.

Vesting: All participants are immediately vested in the portion of their Plan account related to participant contributions, rollover deposits, fixed Company contributions of funds to purchase Compass Minerals common stock and earnings or losses thereon. Participants hired before January 1, 2018, were immediately vested for non-discretionary Company matching contributions, while those hired on or after January 1, 2018, require a two-year vesting period. During participants’ first five years of employment, participants vest in the Company discretionary profit-sharing contributions,

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

and any earnings or losses thereon, at a rate of 20% each year beginning on the participant’s first anniversary of employment.

Forfeitures: Forfeitures of terminated participants’ non-vested Company contributions are used to pay Plan administrative expenses and reduce employer contributions. The Plan used forfeitures of $66,063 and $9,375 to reduce employer contributions in 2021 and 2020, respectively. The Plan used forfeitures of $87,947 and $61,079 to pay Plan expenses in 2021 and 2020, respectively. The forfeiture balance, which was included in investments at fair value on the statements of net assets available for benefits and was available to apply to future Plan administrative expenses or employer contributions, was $381,356 and $228,264 as of December 31, 2021 and 2020, respectively.

Participant loans: Participants are able to borrow from their fund accounts a minimum of $1,000 and up to a maximum amount equal to the lesser of $50,000 (which may be reduced if the participant has Plan loans outstanding) or 50% of their vested account balance. The loans are for terms of one to five years for general purpose loans and one to ten years for residential loans. The loans must be adequately secured by the vested account balance and bear interest at a rate commensurate with local prevailing rates. Interest rates on outstanding loans as of December 31, 2021, ranged from 4.25% to 7.00%. Principal and interest are paid ratably through after-tax payroll deductions with maturity dates ranging from 2022 through 2031.

Payment of benefits: Upon disability, retirement or other termination of service, participants, or their designated beneficiaries in case of death, are eligible to request a distribution of their vested account balance. If a participant’s vested account balance exceeds $5,000, a participant or designated beneficiary may elect to receive a lump sum payment or defer distributions to a later date. Vested account balances of less than $5,000 but greater than $1,000 will be rolled-over into an investment retirement account while vested account balances of $1,000 or less will be distributed in one lump sum payment, unless the participant or designated beneficiary elects otherwise. Withdrawals other than for disability, retirement or other termination of service are also permitted under certain circumstances provided by the Plan. Distributions are made in accordance with Plan provisions in the form of lump sum distributions or installment distributions. An annuity form of payment is also available to certain participants.

Administrative expenses: Certain administrative functions are performed by officers or employees of the Company or its subsidiaries. No such officer or employee receives compensation from the Plan. Expenses incurred in the administration of the Plan, which consist primarily of trustee and record keeping fees, may be paid from Plan assets and, therefore, deducted from participant accounts, may be paid from forfeitures of non-vested Company contributions to the Plan or may be paid by the Company, in its discretion, on behalf of participants.

Note 2. Significant Accounting Policies

The Plan’s significant accounting policies are as follows:

Basis of accounting: The financial statements of the Plan are presented on the accrual basis of accounting, in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Investment valuation and income recognition: Investments held by the Plan are stated at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). See Note 3 for further discussion of fair value measurements.

Purchases and sales of securities are accounted for on a trade-date basis. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Use of estimates: The preparation of financial statements in conformity with U.S. GAAP requires the Company, as Plan administrator, to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates.

Payment of benefits: Benefits are recorded when paid.

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

Notes receivable from participants: Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned and is included in interest and dividend income. Any related fees are recorded as administrative expenses and expensed when incurred. No allowance for losses has been recorded as of December 31, 2021 or 2020. If a participant ceases to make loan repayments and the Plan administrator deems the participant loan to be a distribution, the remaining participant loan balance is recorded as a benefit payment.

Note 3. Fair Value Measurements

As required by U.S. GAAP, the Plan’s investments are measured and reported at their estimated fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction. The following provides a description of the fair value hierarchy of inputs that may be used to measure fair value.

Level 1 – Quoted market prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than Level 1 that are either directly or indirectly observable; and

Level 3 – Unobservable inputs developed using estimates and assumptions developed by the Company.

The Plan’s investments are measured using the following valuation methods:

Interest-bearing cash: The carrying amount of the Plan’s cash accounts approximates fair value.

Mutual funds: The fair value of these funds is determined using the net asset value based upon observable market quotations as of the close of business on the last trading day of the year.

Self-directed brokerage accounts: These accounts primarily consist of interest-bearing cash, for which the carrying amount approximates fair value, and mutual funds and common stock, which are valued based upon observable market quotations as of the close of business on the last trading day of the year.

Compass Minerals common stock: The fair value is based upon observable market quotations as of the close of business on the last trading day of the year.

Common collective trusts: The fair value of common collective trust funds is based on the net asset value per share (“NAV”) reported by the administrator of the respective common collective trust funds. The NAV is calculated daily and is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. The underlying assets are traded on an active market. There are no restrictions on redemptions related to the common collective trust funds.

As described above, each of the investments in the Plan portfolio have a readily determinable fair value based on the active market for identical assets and, therefore, each meet the criteria to be classified as a Level 1 investment.

The fair values of investments as of December 31, 2021 and 2020 are included in the tables below:

| | | | | | | | | | | | | | |

| December 31, 2021 | Level 1 | Level 2 | Level 3 |

| Interest-bearing cash | $ | 4,452,759 | | $ | 4,452,759 | | $ | — | | $ | — | |

| Mutual funds | 55,962,746 | | 55,962,746 | | — | | — | |

| Self-directed brokerage account | 1,311,623 | | 1,311,623 | | — | | — | |

| Common collective trusts | 101,038,295 | | 101,038,295 | | — | | — | |

| Compass Minerals common stock | 3,929,119 | | 3,929,119 | | — | | — | |

| Investments at fair value | $ | 166,694,542 | | $ | 166,694,542 | | $ | — | | $ | — | |

| | | | |

Compass Minerals International, Inc. Savings Plan

Notes to Financial Statements

| | | | | | | | | | | | | | |

| December 31, 2020 | Level 1 | Level 2 | Level 3 |

| Interest-bearing cash | $ | 3,525,193 | | $ | 3,525,193 | | $ | — | | $ | — | |

| Mutual funds | 47,279,310 | | 47,279,310 | | — | | — | |

| Self-directed brokerage account | 1,066,411 | | 1,066,411 | | — | | — | |

| Common collective trusts | 88,998,099 | | 88,998,099 | | — | | — | |

| Compass Minerals common stock | 4,610,038 | | 4,610,038 | | — | | — | |

| Investments at fair value | $ | 145,479,051 | | $ | 145,479,051 | | $ | — | | $ | — | |

Note 4. Related Party and Parties-in-Interest Transactions

Plan investments include mutual funds and common collective trusts, which are managed by Fidelity Management Trust Company. Fidelity Management Trust Company is the trustee as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions.

The Company, as Plan administrator and sponsor, is a party-in-interest to the Plan. At December 31, 2021 and 2020, the Plan held 76,921 and 74,692 shares, respectively, of Compass Minerals common stock with market values of $3,929,119 and $4,610,038, respectively. During 2021 and 2020, the Plan purchased $475,255 and $354,432, respectively, of Compass Minerals common stock and sold $359,488 and $671,083, respectively, of Compass Minerals common stock. The Company declared and paid dividends of $2.31 and $2.88 per share on Compass Minerals common stock during 2021 and 2020, respectively.

Note 5. Income Tax

The underlying prototype plan has received an opinion letter from the Internal Revenue Service (IRS) dated June 30, 2020, stating that the written form of the underlying prototype document is qualified under Section 401 of the Internal Revenue Code (the Code). Any employer adopting this form of the plan will be considered to have a plan qualified under Section 401 of the Code, and, therefore, the related trust is tax-exempt. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax-exempt.

Accounting principles generally accepted in the United States require plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. Plan management has analyzed the tax positions taken by the Plan and has concluded that there are no uncertain positions taken or expected to be taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Note 6. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market volatility and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect a participant’s account balance and the amounts reported in the statements of net assets available for benefits.

Note 7. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions and to terminate the Plan at any time, subject to the provisions of ERISA. In the event of Plan termination, participants would become 100% vested in their accounts.

Compass Minerals International, Inc. Savings Plan

| | | | | | | | | | | | | | | | | |

| Compass Minerals International, Inc. Savings Plan | | |

| Employer Identification Number 36-3972986, Plan 001 | | |

| Form 5500 Schedule H, Line 4i | | | |

| Schedule of Assets (Held at end of Year) | | |

| As of December 31, 2021 | | |

| | | | |

| Identity of issuer, borrower, lessor or similar party | Description of investment including maturity date, collateral, par or maturity value | Number of Shares/Units | Current Value |

| Columbia | Columbia Dividend Income Inst - Mutual Fund | 174,644.78 | | $ | 5,623,562 | |

| American Century | Inflation-Adj. Bond Fund Class R6 – Mutual Fund | 161,708.90 | | 2,077,959 | |

| T. Rowe Price | International Discovery Fund – Mutual Fund | 24,915.84 | | 2,096,668 | |

| BlackRock | Total Return Fund Class 6 – Common Collective Trust | 140,812.88 | | 1,693,979 | |

| * | Compass Minerals International, Inc. | Common Stock | 76,920.89 | | 3,929,119 | |

| Principal Trust | Principal LifeTime Hybrid Income U - Common Collective Trust | 9,747.44 | | 206,548 | |

| Principal Trust | Principal LifeTime Hybrid 2010 U - Common Collective Trust | 47,783.13 | | 1,282,021 | |

| Principal Trust | Principal LifeTime Hybrid 2015 U - Common Collective Trust | 45,709.97 | | 1,358,043 | |

| Principal Trust | Principal LifeTime Hybrid 2020 U - Common Collective Trust | 157,942.05 | | 5,224,723 | |

| Principal Trust | Principal LifeTime Hybrid 2025 U - Common Collective Trust | 422,465.39 | | 15,267,899 | |

| Principal Trust | Principal LifeTime Hybrid 2030 U - Common Collective Trust | 462,553.62 | | 18,058,093 | |

| Principal Trust | Principal LifeTime Hybrid 2035 U - Common Collective Trust | 418,751.75 | | 17,453,573 | |

| Principal Trust | Principal LifeTime Hybrid 2040 U - Common Collective Trust | 283,779.52 | | 12,426,705 | |

| Principal Trust | Principal LifeTime Hybrid 2045 U - Common Collective Trust | 172,980.96 | | 7,906,960 | |

| Principal Trust | Principal LifeTime Hybrid 2050 U - Common Collective Trust | 153,005.99 | | 7,097,948 | |

| Principal Trust | Principal LifeTime Hybrid 2055 U - Common Collective Trust | 105,904.74 | | 5,003,999 | |

| Principal Trust | Principal LifeTime Hybrid 2060 U - Common Collective Trust | 105,057.45 | | 2,390,057 | |

| Principal Trust | Principal LifeTime Hybrid 2065 U - Common Collective Trust | 21,591.84 | | 341,583 | |

| * | Fidelity | Fidelity Growth Company Fund Class K6 - Mutual Fund | 1,079,710.45 | | 24,703,775 | |

| * | Fidelity | Fidelity Government Money Market Fund Class K6 | 4,451,982.45 | | 4,451,982 | |

| * | Fidelity | Fidelity Small Cap Index Fund – Mutual Fund | 76,764.49 | | 2,115,629 | |

| * | Fidelity | Fidelity 500 Index – Mutual Fund | 62,466.84 | | 10,327,017 | |

| * | Fidelity | Fidelity Extended Market – Mutual Fund | 42,691.67 | | 3,723,140 | |

| * | Fidelity | Fidelity International Index – Mutual Fund | 46,621.25 | | 2,297,962 | |

| * | Fidelity | Fidelity Managed Income Portfolio – Common Collective Trust | 5,326,163.68 | | 5,326,164 | |

| * | Fidelity | Fidelity U.S. Bond Index – Mutual Fund | 98,463.61 | | 1,179,594 | |

| Fidelity** | Brokeragelink (self-directed) | — | | 1,311,623 | |

| PIMCO | PIMCO High Yield A - Mutual Fund | 201,266.85 | | 1,817,440 | |

| * | Plan Participants | Participant loans receivable (4.25% - 7.0%) maturing 2022 through 2031 | — | | 3,100,294 | |

| | | | $ | 169,794,059 | |

* Represents a party-in-interest.

** Includes Fidelity investments.

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description of Exhibit |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Compass Minerals International, Inc., as Plan administrator for the Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | COMPASS MINERALS INTERNATIONAL, INC. SAVINGS PLAN |

| | | | |

| | | By: | COMPASS MINERALS INTERNATIONAL, INC.,

as Plan Administrator |

| | | | |

| | | | |

| Date: | June 27, 2022 | | By: | /s/ Mary L. Frontczak |

| | | | Name: Mary L. Frontczak |

| | | | Title: Chief Legal and Administrative Officer and Corporate Secretary |

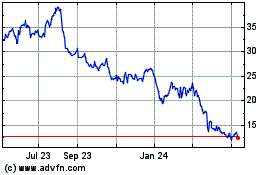

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

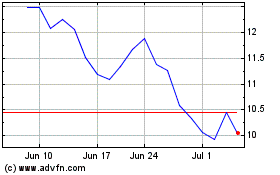

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Apr 2023 to Apr 2024