UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 Under

the

Securities Exchange Act of 1934

For

the month of June 2022

Commission

File Number: 001-38304

DOGNESS

(INTERNATIONAL) CORPORATION

(Registrant’s

name)

Tongsha

Industrial Estate, East District

Dongguan,

Guangdong 523217

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ☐

The

Registrant hereby incorporates the information contained in this Report by reference into the Registration Statement on Form F-3, File

No. 333-229505.

Cautionary

Note Regarding Forward-Looking Statements

This

Report, including the exhibits included herein, may contain forward-looking statements. We have based these forward-looking statements

on our current expectations and projections about future events. Our actual results may differ materially from those discussed herein,

or implied by, these forward-looking statements. Forward-looking statements are generally identified by words such as “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “plan,” “project”

and other similar expressions. In addition, any statements that refer to expectations or other characterizations of future events or

circumstances are forward-looking statements. Forward-looking statements included in this Report are subject to significant risks and

uncertainties, including, but not limited to: risks and uncertainties regarding lingering effects of the Covid-19 pandemic on our customers’

businesses and end purchasers’ disposable income, our ability to raise capital on any particular terms, fulfillment of customer

orders, fluctuations in earnings, fluctuations in foreign exchange rates, our ability to manage growth, our ability to realize revenue

from expanded operation and acquired assets in China and the U.S., our ability to attract and retain highly skilled professionals, client

concentration, industry segment concentration, reduced demand for technology in our key focus areas, our ability to successfully complete

and integrate potential acquisitions, and unauthorized use of our intellectual property and general economic conditions affecting our

industry. Additional risks that could affect our future operating results are more fully described in our United States Securities and

Exchange Commission filings. These forward-looking statements involve certain risks and uncertainties that are subject to change based

on various factors (many of which are beyond the Company’s control). The Company undertakes no obligation to publicly update any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Entry

into a Material Definitive Agreement.

On

June 1, 2022, Dogness (International) Corporation (the “Company”) and certain institutional investors entered into a securities

purchase agreement (the “Purchase Agreement”) for a registered direct offering (the “Offering”) of approximately

$12 million of Class A common shares and warrants at a price of $3.30 per unit. The units will each consist of 1 Class A common share

and 0.6 warrants to purchase 1 Class A common share. The units will not trade and will separate into Class A common shares and warrants.

The Company will issue (i) an aggregate of 3,636,365 Class A common shares and (ii) warrants to purchase an aggregate of 2,181,819 Class

A common shares to the investors. The aggregate gross proceeds from the sale of the securities, before deducting fees payable to the

placement agent and other estimated offering expenses payable by the Company will be approximately $12 million. This amount does not

include any proceeds from the exercise of the warrants being offered.

The

investor warrants will be exercisable immediately as of the date of issuance at an exercise price of $4.20 per share and expire thirty-six

(36) months from the date of issuance. The exercise price of the investor warrants is subject to adjustment in the case of future issuances

or deemed issuances of common shares at a price per share below the exercise price, as well as for stock splits, stock dividends, combinations

of shares and similar recapitalization transactions. A holder of the warrants also will have the right to exercise its warrants on a

cashless basis if a registration statement or prospectus contained therein is not available for the issuance of the Class A Common Shares

issuable upon exercise of the warrants. The warrants contain a forced exercise right for the Company to force a cash exercise of the

warrants if the volume weighted average price of the common shares exceeds 250% of the exercise price of the warrants (or $10.50) for

10 consecutive trading days commencing six (6) months after issuance.

The

exercisability of the warrants may be limited if, upon exercise, the holder or any of its affiliates would beneficially own more than

4.99% or 9.99%, as elected by the holder, of the Company’s common shares.

Under

the Purchase Agreement, the Company has agreed with each of the purchasers that, subject to certain exceptions, it will not, within the

ninety (90) calendar days following the closing of the Offering (which period may be extended in certain circumstances), enter into any

agreement to issue or announce the issuance or proposed issuance of any equity security or equity-linked or related security.

The

Company has also agreed with each of the purchasers that while the warrants are outstanding, it will not effect, or enter into an agreement

to effect, a “Variable Rate Transaction,” which means a transaction in which the Company:

| ● |

issues

or sells any convertible securities either (A) at a conversion, exercise or exchange rate or other price that is based upon and/or

varies with the trading prices of, or quotations for, of the Company’s common shares at any time after the initial issuance

of such convertible securities, or (B) with a conversion, exercise or exchange price that is subject to being reset at some future

date after the initial issuance of such convertible securities or upon the occurrence of specified or contingent events directly

or indirectly related to the business of the Company or the market for the Company’s common shares, other than pursuant to

a customary “weighted average” anti-dilution provision; or |

| |

|

| ● |

enters

into any agreement (including, without limitation, an equity line of credit) whereby the Company may sell securities at a future

determined price (other than standard and customary “preemptive” or “participation” rights). |

The Company has also agreed

with each of the purchasers of at least $2 million in the Offering that if the Company issues securities within the twelve (12) months

following the closing of the Offering, the purchasers as a group shall have the prorated right to purchase 30% of the securities on the

same terms, conditions and price provided for in the proposed issuance of securities.

The

Company has also agreed to indemnify each of the purchasers against certain losses resulting from its breach of any of its representations,

warranties, or covenants under agreements with each of the purchasers, as well as under certain other circumstances described in the

Purchase Agreement.

The

net proceeds to the Company from the Offering, after deducting placement agent fees and the estimated offering expenses borne by the

Company, are expected to be approximately $11 million. This amount does not include any proceeds from the exercise of the warrants being

offered. The Offering is expected to close on or around June 3, 2022. After giving effect to the Offering, but without giving effect

to the exercise of the warrants being offered, the Company will have 30,205,259 Class A and 9,069,000 Class B common shares outstanding.

The

Offering was effected as a takedown off the Company’s shelf registration statement on Form F-3 (File No. 333-229505), which became

effective on February 13, 2019, pursuant to a prospectus supplement filed with the Securities and Exchange Commission.

In

connection with the Offering, on June 1, 2022, the Company entered into a placement agency agreement (the “Placement Agency Agreement”)

with FT Global Capital, Inc. (the “Placement Agent”) pursuant to which the Placement Agent agreed to act as the exclusive

placement agent on a best efforts basis in the Offering. The Placement Agent will be entitled to a cash fee of 6.5% of the gross proceeds

paid to the Company for the securities the Company sells in this Offering, reimbursement of expenses not to exceed $40,000, and indemnification

against specified liabilities, including liabilities arising under the Securities Act.

The

foregoing summaries of the terms of the form of warrant, the Placement Agency Agreement and the Purchase Agreement to be issued to each

of the purchasers and are subject to, and qualified in their entirety by, such documents attached hereto as Exhibits 4.1, 10.1 and 10.2

respectively, which are incorporated herein by reference.

Other

Events.

On

June 1, 2022, the Company issued a press release announcing the execution of the Purchase Agreement. A copy of the press release is attached

as Exhibit 99.1 hereto and incorporated by reference herein.

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Dogness

(International) Corporation |

| |

|

|

| Date:

June 2, 2022 |

By: |

/s/

Silong Chen |

| |

Name: |

Silong

Chen |

| |

Title: |

Chief

Executive Officer

(Principal

Executive Officer) and

Duly

Authorized Officer |

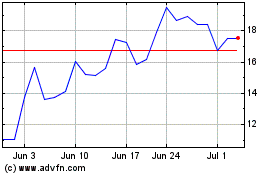

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dogness (NASDAQ:DOGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024