Current Report Filing (8-k)

April 19 2022 - 8:36AM

Edgar (US Regulatory)

FALSE000185574700018557472022-04-182022-04-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): April 18, 2022

Blend Labs, Inc.

(Exact name of Registrant, as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40599 | | 45-5211045 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

415 Kearny Street

San Francisco, California 94108

(Address of principal executive offices, including zip code)

(650) 550-4810

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value of $0.00001 per share | | BLND | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities

On April 18, 2022, Blend Labs, Inc. (the “Company” or “Blend”) committed to a workforce reduction plan (the “Plan”) as part of its broader efforts to improve cost efficiency and better align its operating structure with its business activities. The focus of the Plan is on streamlining the Company’s title operations as well as its general and administrative functions.

The Plan includes the elimination of approximately 200 positions across the Company, or approximately 10% of the Company’s current workforce. The Company estimates that it will incur approximately $6.7 million in charges in connection with the Plan, including approximately $6.5 million in cash expenditures for employee benefits, severance payments, payroll taxes and related facilitation costs and approximately $0.2 million in stock-based compensation. The Company expects that execution of the Plan including cash payments will be substantially complete in the second quarter of 2022. The eliminated positions represent annualized compensation expense of approximately $35.4 million. In addition to the elimination of certain positions, the Company is implementing non personnel related cost reductions.

The Company may incur other charges or cash expenditures not currently contemplated due to unanticipated events that may occur as a result of or in connection with the implementation of the Plan. The Company intends to exclude the charges associated with the Plan from its non-GAAP financial measures, including non-GAAP gross profit, non-GAAP operating expenses, non-GAAP loss from operations, and non-GAAP net loss.

Item 2.05 of this Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may relate to, but are not limited to, the number of positions affected by the Plan, and the estimated charges associated with, and the time frame for completion of, the Plan, and the estimates of annualized compensation expense for positions eliminated in connection with the Plan, as well as assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other comparable terminology that concern Blend’s expectations, strategy, plans or intentions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith beliefs and assumptions as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include the possibility that: there are impediments to our ability to execute the Plan or related initiatives as currently contemplated; the actual charges in implementing the Plan or related initiatives are higher than anticipated; there are changes to the assumptions on which the estimated charges associated with the Plan or related initiatives are based; we are unable to achieve projected cost savings in connection with the Plan or related initiatives; there are unintended consequences from the Plan or related initiatives that impact our business; we fail to retain our existing customers or to acquire new customers in a cost-effective manner; we are unable to compete in highly competitive markets; we are unable to make accurate predictions about our future performance due to our limited operating history in an evolving industry; we are unable to successfully integrate or realize the benefits of our acquisition of Title365; or changes in economic conditions, including market interest rates, adversely affect our business. Further information on these risks and other factors are set forth in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2021. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in Item 2.05 of this Current Report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. These factors could cause actual results, performance, or achievement to differ materially and adversely from those anticipated or implied in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in Item 2.05 of this Current Report. Except as required by law, Blend does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Item 7.01 Regulation FD Disclosure

On April 18, 2022, Blend posted certain information regarding the Plan on its blog (blend.com/blog). Blend announces material information to the public about Blend, its products and services and other matters through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, webcasts, the investor relations section of its website (investor.blend.com), its blog (blend.com/blog) and its Twitter account (@blendlabsinc) in order to achieve

broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

The information in Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Blend Labs, Inc. |

| Date: April 18, 2022 | | |

| | By: | /s/ Nima Ghamsari |

| | Name: | Nima Ghamsari |

| | Title: | Head of Blend (Principal Executive Officer) |

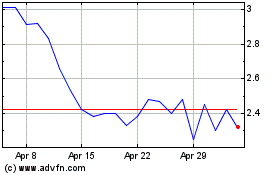

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Mar 2024 to Apr 2024

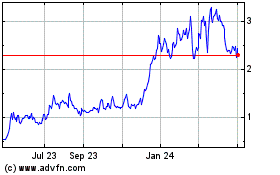

Blend Labs (NYSE:BLND)

Historical Stock Chart

From Apr 2023 to Apr 2024