Current Report Filing (8-k)

March 10 2022 - 4:37PM

Edgar (US Regulatory)

0000932021

false

0000932021

2022-03-10

2022-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 10,

2022 (March 9, 2022)

GLOBAL

TECHNOLOGIES, LTD

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

000-25668 |

|

86-0970492 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

501

1st Ave N., Suite 901

St.

Petersburg, FL 44701

(Address

of Principal Executive Office) (Zip Code)

(727)

482-1505

(Registrant’s

Telephone Number, Including Area Code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

GTLL |

|

OTC

Markets “PINK” |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

As previously announced on November 17, 2021,

Global Technologies, Ltd (the “Company”) entered into a Letter of Intent to acquire Tersus Power, Inc. (“Tersus Power”).

On March 9, 2022, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with Tersus

Power and the Tersus Shareholders. Under the terms of the Exchange Agreement, at Closing the Company shall deliver to the Tersus Shareholders

a to-be-determined pro-rata number of shares of the Company’s Class A Common Stock for each one (1) share of Tersus common stock

held by the Tersus Shareholder (the “Exchange Ratio”). Such shares of the Company’s Class A Common Stock shall collectively

(i) be referred to as the “Exchange Shares”, and (ii) constitute 75% of the issued and outstanding shares of stock, of all

classes, of the Company immediately following the Closing. Conditions precedent to the Closing shall require the Company to complete

the following corporate actions: (i) the Company will have completed a merger with and into its wholly owned subsidiary sufficient to

change its name to “Tersus Power, Inc.”, a Delaware corporation, with an authorized capital of 500 million shares of common

stock (of one class), and 10 million shares of preferred stock (none of which will be authorized as a particular series), (ii) the Company

will have completed, and FINRA will have recognized and effectuated, a reverse split of its common stock in a range between 1-for-1,000

and 1-for-4,000, at a level that is acceptable to the Parties, (iii) all of the holders of the Company’s Series K Preferred Stock

and Series L Preferred Stock will have converted their preferred shares into Class A Common Stock of the Company, and (iv) certain nominees

by the Tersus Shareholders shall be appointed to the Company’s Board of Directors.

The

Exchange Agreement provides for mutual indemnification for breaches of representations and covenants.

Unless the Exchange Agreement

shall have been terminated and the transactions therein contemplated shall have been abandoned, the closing of the Exchange (the “Closing”)

will take place at 5:00 p.m. Pacific Time on the second business day following the satisfaction or waiver of the conditions (the “Closing

Date”). Either party may terminate the Exchange Agreement if a Closing has not occurred on or before June 30, 2022.

The

foregoing provides only a brief description of the material terms of the Exchange Agreement and does not purport to be a complete description

of the rights and obligations of the parties thereunder, and such description is qualified in its entirety by reference to the full text

of the Exchange Agreement filed as Exhibit 10.1, to this Current Report, and is incorporated herein by reference.

ITEM

2.01. COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

The

information included in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.01.

ITEM

3.02. UNREGISTERED SALE OF EQUITY SECURITIES.

The

information included in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.02.

The

Exchange Shares will be issued without prior registration in reliance upon the exemption from registration provided by Section 4(a)(2)

of the Securities Act, and Rule 506(b) of Regulation D thereunder.

Forward-Looking

Statements and Limitation on Representations

The

information contained in this Current Report and the exhibits hereto contain “forward-looking” statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements regarding the ongoing

obligations under the Purchase Agreement and other statements containing the words “intend,” “may,” “should,”

“would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential” or “continue” or the negative of these terms or other comparable terminology,

which are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

While the Company believes its plans, intentions and expectations reflected in those forward-looking statements are reasonable, these

plans, intentions or expectations may not be achieved. The Company’s actual results, performance or achievements could differ materially

from those contemplated, expressed or implied by the forward-looking statements. For information about the factors that could cause such

differences, please refer to the Company’s filings with the U.S. Securities and Exchange Commission. Given these uncertainties,

you should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update any forward-looking

statement.

The

Exchange Agreement included in this Current Report on Form 8-K is intended to provide shareholders and investors with information

regarding the terms of the Exchange Agreement, and not to provide shareholders and investors with any other factual information

regarding the Company, its subsidiaries or Tersus Power, Inc. You should not rely on the representations and warranties

in the Exchange Agreement or any descriptions thereof as characterizations of the actual state of facts or condition of the Company

or any of its subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may

change after the date of the Exchange Agreement, which subsequent information may or may not be fully reflected in the Company’s

public disclosures. Other than as disclosed in this Current Report on Form 8-K, as of the date of this Current Report on Form 8-K, the

Company is not aware of any material facts that are required to be disclosed under the federal securities laws that would contradict

the representations and warranties in the Exchange Agreement. The Company will provide additional disclosure in its public reports

to the extent that it is aware of the existence of any material facts that are required to be disclosed under federal securities laws

and that might otherwise contradict the representations and warranties contained in the Exchange Agreement and will update

such disclosure as required by federal securities laws. Accordingly, the Exchange Agreement should not be read alone, but

should instead be read in conjunction with the other information regarding the Company and its subsidiaries that has been, is or will

be contained in, or incorporated by reference into, the Forms 10-K, Forms 10-Q, Forms 8-K, proxy statements, registration statements

and other documents that the Company files with the SEC.

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

GLOBAL TECHNOLOGIES, LTD |

| |

|

|

| Date: March 10, 2022 |

By: |

/s/ Jimmy

W. Anderson |

| |

Name: |

Jimmy W. Anderson |

| |

Title: |

Chief Executive Officer |

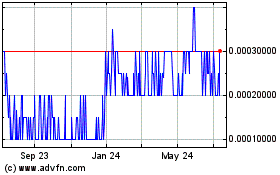

Global Technologies (PK) (USOTC:GTLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

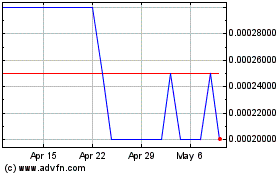

Global Technologies (PK) (USOTC:GTLL)

Historical Stock Chart

From Apr 2023 to Apr 2024