ServiceNow Shares Higher After Earnings Beat

January 27 2022 - 11:36AM

Dow Jones News

By Michael Dabaie

ServiceNow Inc. shares were up 10.7%, to $536.43, in late

morning trading after earnings came in above analyst views.

The digital workflow company after the bell Wednesday reported

fourth-quarter total revenue of $1.61 billion, up 29% and above

FactSet consensus for $1.6 billion. Subscription revenue was up

29%, to $1.52 billion.

Adjusted EPS came to $1.46, better than FactSet consensus of

$1.43.

ServiceNow guided for first quarter subscription revenue of

$1.61 billion to $1.615 billion for 25% growth and full year

subscription revenue of $7.02 billion to $7.04 billion for 26%

growth.

"In light of the recent software bear market, investors have

been worried that there would be a fall-off in fundamentals as we

move out of the pandemic. But the results at ServiceNow show what

our primary research across our coverage has indicated, and that is

that fundamentals remain very good," J.P. Morgan said in an analyst

note.

Truist Securities said core strength drove strong momentum into

2022.

"Despite FX headwinds stemming from their global presence, the

company continues to produce beat-and-raise quarters benefiting

from both new customers and significant upsell. While fundamental

performance on the quarter was driven largely from the strength of

their core offering, commentary on the call made us incrementally

optimistic about new product opportunities in the year ahead,"

Truist said.

Stifel said in a note that "Net/net we expect that ServiceNow's

rapidly expanding platform, growing pipeline, and large deal

momentum should enable the company to maintain 20%+ revenue growth

and significant margin expansion in coming years."

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

January 27, 2022 11:21 ET (16:21 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

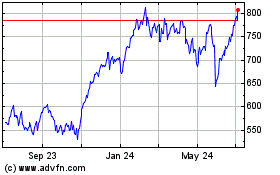

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

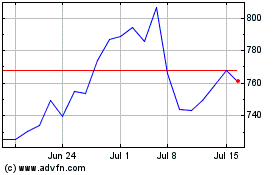

ServiceNow (NYSE:NOW)

Historical Stock Chart

From Apr 2023 to Apr 2024