TIDMSWC

RNS Number : 5761Q

Summerway Capital PLC

28 October 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

This announcement is not an admission document or a prospectus

and does not constitute or form part of an offer to sell or issue

or a solicitation of an offer to subscribe for or buy any

securities nor should it be relied upon in connection with any

contract or commitment whatsoever. Investors should not purchase or

subscribe for any transferable securities referred to in this

announcement except in compliance with applicable securities laws

on the basis of the information in the admission document (the

"Admission Document") to be published by Summerway Capital Plc in

connection with the placing of ordinary shares by the Company and

the proposed admission of its issued and to be issued ordinary

shares to trading on AIM, a market operated by London Stock

Exchange Plc. Before any purchase of shares, persons viewing this

announcement should ensure that they fully understand and accept

the risks which will be set out in the Admission Document when

published. Copies of the Admission Document will, following

publication, be available during normal business hours on any day

(except Saturdays, Sundays and public holidays) from the registered

office of the Company and on the Company's website.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

28 October 2021

Summerway Capital Plc

("Summerway" or the "Company")

Proposed Acquisition

Proposed Placing

Summerway Capital Plc has today entered into a conditional

agreement to acquire the entire issued share capital of Vertigrow

Technology Ltd (t/as Celadon Pharmaceuticals "Vertigrow"), a UK

based pharmaceutical company specialising in the researching,

growing and supply of medicinal cannabis, for total consideration

of GBP80 million (the "Proposed Acquisition").

Highlights

-- Vertigrow is one of the first pharmaceutical companies in the

UK to receive a Home Office licence, following approval from the

MHRA to apply for the licence, to grow high tetrahydrocannabinol

("THC") cannabis, which is expected to be used in medicinal

products, initially focusing on the chronic pain market

-- Operates within a highly regulated market with substantial

growth potential, benefiting from positive tailwinds and strong

regulatory and operational barriers to entry

-- Experienced leadership, scientific and operational team

-- Majority owner of a clinically led business which aims to

undertake a major clinical study on the potential benefits of

medicinal cannabis in the field of chronic pain, with the long-term

intention of changing the NHS's approach towards reimbursement

-- At full capacity, Vertigrow's current facility could supply

up to 50,000 patients, which has the potential to generate revenue

of GBP90 million per annum with EBITDA margins of approximately 50

per cent.

-- Provides Summerway with a compelling foundation from which

accretive and complementary M&A opportunities could be executed

alongside Vertigrow's existing organic growth initiatives

-- GBP80 million consideration, payable through the issue of

approximately 48.5 million Ordinary Shares at 165 pence per

Summerway share

-- In support of the Proposed Acquisition, the Company has also

made available to Vertigrow a term loan of up to GBP4.25 million

ahead of completion of the Proposed Acquisition, which will be

principally applied to accelerate Vertigrow's capital expenditure

in its Midlands based facility

-- Proposed Placing to raise GBP7 million (before expenses) to

provide additional working capital for the Enlarged Group

-- Pro forma estimated equity value of approximately GBP100

million post completion of the Proposed Acquisition and Proposed

Placing, with the Enlarged Group intending to apply for

re-admission to AIM or another alternative exchange within the UK

or North America

Benjamin Shaw, Interim Chairman of Summerway, said:

"The Board of Summerway is delighted to announce the proposed

acquisition of Vertigrow and to be partnering with James Short and

his team. We believe the pharmaceutical medical cannabis market

will be substantial in the UK and internationally and Vertigrow is,

in our view, a clear leader in the sector."

James ("Jim") Short, Founder and Chief Executive Officer of

Vertigrow, said:

"I am delighted to have agreed terms with Summerway. I believe

there is a compelling opportunity to create a substantial

pharmaceutical business contributing to life changing treatments to

chronic pain sufferers, and other therapeutic areas that could

benefit from medicinal cannabis, and this transaction, and becoming

a public company are important corporate steps for us."

Enquiries:

Summerway Capital Plc

Tony Morris 020 7440 7520

Canaccord Genuity Limited (Nominated Adviser and Broker)

Andrew Potts 020 7523 8000

Acquisition Agreement

The Company has today entered into a conditional agreement to

acquire the issued share capital of Vertigrow for total

consideration of GBP80 million (the "Acquisition Agreement"). The

Proposed Acquisition will be subject, inter alia, to Summerway

shareholder approval at a general meeting, customary regulatory

approvals and re-admission of the share capital of Summerway (as

enlarged by the Proposed Acquisition and Proposed Placing) (the

"Enlarged Group") to AIM, or admission to another stock exchange

within the UK, North America or other certain territories.

The total consideration of GBP80 million will be satisfied by

the issue of approximately 48.5 million new ordinary shares in the

capital of the Company ("Ordinary Shares") at 165 pence per

Ordinary Share to the shareholders of Vertigrow (the "Consideration

Shares"). The Consideration Shares issued to the founders of

Vertigrow will be subject to a lock in arrangement for a period of

12 months following completion of the Proposed Acquisition, and

customary orderly market provisions for a further 12 months

following the expiry of the lock in arrangement.

Information on Vertigrow Technology Ltd

Vertigrow owns a UK based pharmaceutical group that was

established in 2018 and is focused on growing highly controlled

indoor hydroponic, high THC cannabis for manufacture for

cannabis-derived medicinal products for use within products to

treat chronic pain. Vertigrow is also involved in planning research

into cannabinoids for use in chronic pain and the treatment of

other conditions such as autism and multiple sclerosis, within the

UK's highly regulated market.

Vertigrow has received a Home Office licence, following approval

from the Medicines and Healthcare products Regulatory Agency (the

"MHRA") to apply for the licence, allowing it to legally grow

medicinal cannabis in the UK for the purpose of producing test

batches of cannabis oil to support its application to the MHRA for

registration as a manufacturer of medicinal product APIs. The

process of obtaining this licensing is complex, has taken over two

years, required material investment and is technically extensive.

The directors of Summerway (the "Directors") believe this is one of

the first such licences granted in the UK. Following receipt of

MHRA registration and the grant of a further licence from the Home

Office permitting supply for manufacture into finished medicinal

products, the business will be able to supply medicinal cannabis

(in the form of an API, which in this case is an extracted oil used

in the finished pharmaceutical product) with a high THC content in

the UK, allowing it an opportunity to enter what is expected to be

a substantial (and extensively regulated) and fast-growing UK

market.

Vertigrow has a 100,000 square foot facility located in the

Midlands, UK, that comprises (i) a laboratory designed to meet

UK-GMP standards; and (ii) capacity for a large growing facility

that has received Home Office approval to legally grow high THC

cannabis. Once fully licensed, at full capacity, the facility can

expect to produce an estimated nine tonnes of dry flower per year,

which could supply up to circa 50,000 patients per annum, which has

the potential to generate annual revenues of approximately GBP90

million and EBITDA margins in the region of 50 per cent. per the

Company's business model.

Vertigrow has a majority shareholding in Harley Street (CPC)

Limited ("LVL"), a prospective private pain clinic business, that

is in the advanced stages of the approval process to be the sponsor

of a MHRA and Research Ethics Committee authorised clinical trial

for medicinal cannabis in the UK (the "Trial"). The Directors

believe the Trial would, once approved by the MHRA and the Research

Ethics Committee, be the only authorised medicinal cannabis trial

of its type in the UK. The aim of the Trial will be to document and

demonstrate the safety and efficacy of the studied cannabinoids, in

the form of a third party cannabis-based medicinal product, for the

treatment of chronic pain related conditions. Following the

successful completion of the Trial, Vertigrow expect to be in a

position to present the data from the Trial to NICE in a form that

may enable NICE to recommend the cannabis-based medicinal product

for prescription on the NHS for the uses studied in the Trial and,

as a result, further facilitate the legal use of medicinal cannabis

by the NHS in the UK. LVL has received conditional approval for the

Trial from the MHRA, subject to (among other things) approval by

the Research Ethics Committee. Ahead of the Trial being approved by

the Research

Ethics Committee, LVL will undertake a preliminary study to

evaluate the feasibility of the Trial regarding recruitment rates

and acceptability of the Trial.

Vertigrow and LVL have an experienced management team, including

leading experts in researching, cultivating and manufacturing

cannabis API, which should enable the business to optimise

cultivation for use in developing and manufacturing cannabinoid

derived medicines.

The Loan Agreement is classified as a substantial transaction

under the AIM Rules for Companies. In accordance with Schedule 4 of

the AIM Rules for Companies, Vertigrow's statutory accounts to 31

December 2020 as submitted to Companies House are micro-entity

accounts and therefore were unaudited and not consolidated and were

not required to contain a profit & loss statement. Vertigrow's

gross assets as at 31 December 2020 were GBP1,812,025.

Enlarged Group Strategy

In line with the amended investing policy of the Company as

announced on 20 October 2021, the Company is focused on investment

and acquisition opportunities across the healthcare and

pharmaceutical sectors, particularly in new and emerging

therapeutic areas. The Directors believe there are numerous

opportunities to invest in, or acquire, businesses that can be

organically or acquisitively grown to become leading healthcare and

pharmaceutical companies. In Vertigrow, the Directors believe they

have identified a business which meets the criteria and would

provide a compelling acquisition as part of the Company's growth

strategy.

Recognising the embryonic nature of the cannabis sector within

the UK and the Company's current pipeline of investment and

acquisition opportunities, the Directors remain cognisant of other

markets and stock exchanges other than AIM which are available to

the Enlarged Group as part of its re-admission process. These such

opportunities may be within the UK or North America, or certain

other territories.

In considering the most appropriate listing venue, the Directors

will consider what is in the best interests of the Enlarged Group

in terms of access to liquidity and will be most conducive for

accelerating the Enlarged Group's growth strategy, and the delivery

of value for its current and prospective shareholders.

The Company will make a further announcement in due course.

Loan Agreement

Concurrently with signing of the Acquisition Agreement, the

Company has also entered into a loan agreement under which it has

agreed to provide Vertigrow with a GBP4.25 million short term, term

loan facility in order to fund its growth plans pending completion

of the Proposed Acquisition (the "Loan Agreement"). The entry into

the Loan Agreement is in accordance with the Company's amended

investing policy.

Under the terms of the Loan Agreement, Vertigrow is entitled to

draw up to GBP2.125 million on an unsecured basis, with any

subsequent drawings being conditional upon Vertigrow granting the

Company security over the assets of Vertigrow and its wholly owned

subsidiaries.

The term loan facility is subject to customary information

covenants and is repayable on the earlier of 7 months from signing

and admission to trading of the Enlarged Group on a stock exchange

which may include AIM, other UK markets, North America, or certain

other territories. The term loan interest charge is 10 per cent.

per annum, which is accrued and payable at maturity with the

principal borrowings.

Proposed Placing

In order to provide additional working capital for the Enlarged

Group following the Proposed Acquisition, the Company is proposing

to raise approximately GBP7 million (before expenses) through a

placing of new Ordinary Shares (the "Placing Shares") (the

"Proposed Placing").

The net proceeds of the Proposed Placing, plus Summerway's

existing cash of GBP6.75 million (prior to any amounts advanced

under the Loan Agreement), will be used to provide working capital

for the Enlarged Group.

Further details of the Proposed Placing will be provided in due

course.

Admission

The Company's enlarged share capital will comprise the Company's

existing ordinary shares in issue, the Placing Shares and the

Consideration Shares (the "Enlarged Share Capital"). The Proposed

Acquisition constitutes a reverse takeover under rule 14 of the AIM

Rules for Companies (the "AIM Rules"). Admission of the Enlarged

Share Capital to trading on AIM ("Admission") will therefore be

conditional upon, inter alia, shareholder approval at a general

meeting and completion of the Proposed Placing. The Company's

Ordinary Shares will remain suspended from trading on AIM until

such time as the Company publishes a combined shareholder circular

and AIM admission document (the "Circular") or confirmation is

given that the Proposed Acquisition is not proceeding.

As a result of the Proposed Acquisition, it is anticipated that

certain of the current shareholders in Vertigrow will be deemed to

be acting in concert for the purposes of the City Code on Takeovers

and Mergers (the "Takeover Code") and that this concert party would

control more than 30 per cent. of the Enlarged Share Capital. This

would normally result in a requirement to make a general offer to

all the remaining shareholders of the Company to acquire their

shares under Rule 9 of the Takeover Code. Accordingly, the Company

intends to apply to the Takeover Panel for a waiver of Rule 9 of

the Takeover Code in order to permit the Proposed Acquisition

without triggering an obligation on the part of those Vertigrow

shareholders who are deemed to be acting in concert to make a

general offer to the Company's shareholders. Any such waiver is

expected to be subject to the approval of the Company's

shareholders who are independent of Vertigrow and its shareholders.

Completion of the Proposed Acquisition and Admission will therefore

be conditional on the passing of any such resolution.

As such, there can be no certainty that the Proposed Acquisition

will proceed. If Admission is pursued by the Company, the Company

will publish a Circular in relation to the Proposed Acquisition and

details of the Enlarged Group in due course.

Management and Board

Following completion of the Proposed Acquisition, James Short,

Founder and Chief Executive Officer of Vertigrow will join the

Board of Directors of Summerway as Chief Executive Officer of the

Enlarged Group.

Further executive and non-executive Director appointments will

be announced by the Company as part of the Enlarged Group's

re-admission process and will be tailored according to the proposed

market and exchange that the Enlarged Group deems the most

appropriate to seek re-admission to.

Important Notice

This announcement is for information purposes only and is not

intended to and does not constitute, or form part of, any offer or

invitation to purchase, subscribe for or otherwise acquire or

dispose of, or any solicitation to purchase or subscribe for or

otherwise acquire or dispose of, any securities in the United

States, Republic of South Africa, Australia, Canada or Japan or any

other jurisdiction in which such an offer or solicitation may lead

to a breach of any applicable legal or regulatory requirements.

Persons needing advice should consult with an independent financial

adviser authorised under the Financial Services and Markets Act

2000, as amended ("FSMA"), who specialises in advising on the

acquisition of shares and other securities, if that person is in

the United Kingdom, or any appropriately authorised person under

applicable laws, if that person is located in any other

jurisdiction. The information contained in this announcement is not

for release, publication or distribution to persons in any

jurisdiction where to do so might constitute a violation of local

securities laws or regulations. This announcement has been issued

by and is the sole responsibility of the Company. The information

contained in this announcement is for background purposes only and

does not purport to be full or complete. The information in this

announcement is subject to change without notice. Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain. If you have any queries on this, then please contact

Benjamin Shaw, Interim Chairman of the Company (responsible for

arranging release of this announcement) via Tony Morris, Adviser to

the Company.

This announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

affiliates operate, the effect of volatility in the equity, capital

and credit markets on the Company's profitability and ability to

access capital and credit, a decline in the Company's credit

ratings; the effect of operational risks; and the loss of key

personnel. As a result, the actual future financial condition,

performance and results of the Company may differ materially from

the plans, goals and expectations set forth in any forward-looking

statements. Any forward-looking statements made in this

announcement by or on behalf of the Company speak only as of the

date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based. The distribution of this

announcement in certain jurisdictions may be restricted by law. No

action has been taken by the Company or Canaccord Genuity Limited

("Canaccord") that would permit an offering of such shares or

possession or distribution of this announcement or any other

offering or publicity material relating to such shares in any

jurisdiction where action for that purpose is required, other than

the United Kingdom. Persons into whose possession this announcement

comes are required by the Company and Canaccord to inform

themselves about, and to observe, such restrictions. The

information contained in this announcement may not be distributed,

published, reproduced, transmitted or otherwise made available in

whole or in part or disclosed by recipients to any other person and

may not be reproduced in any manner whatsoever. Any forwarding,

distribution, reproduction, or disclosure of any information

contained in this announcement in whole or in part is unauthorised.

Failure to comply with these restrictions may constitute a

violation of the US Securities Act of 1933, as amended or the

applicable laws of other jurisdictions. Subject to certain

exemptions, the securities referred to in this announcement may not

be offered or sold in the United States, Australia, Canada, Japan,

South Africa or certain other jurisdictions or for the account or

benefit of any national resident or citizen of certain

jurisdictions. No prospectus will be made available in connection

with the matters contained in this announcement and no such

prospectus is required to be published. Persons needing advice

should consult an independent financial adviser.

Canaccord, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority is acting as nominated

adviser and broker to Summerway in connection with the Proposed

Acquisition and the Proposed Placing. Canaccord is acting

exclusively for Summerway and no one else in connection with the

Proposed Acquisition and the Proposed Placing and will not be

responsible to anyone other than Summerway for providing the

protections afforded to clients of Canaccord or for providing

advice in relation to the Proposed Acquisition and the Proposed

Placing or the contents of this announcement or any transaction,

arrangement or matter referred to herein. Apart from the

responsibilities and liabilities, if any, which may be imposed on

Canaccord by the FSMA or the regulatory regime established

thereunder, Canaccord does not accept any responsibility whatsoever

for the contents of this announcement, and makes no representation

or warranty, express or implied, for the contents of this

announcement, including its accuracy, completeness or verification,

or for any other statement made or purported to be made by it, or

on its behalf, in connection with the Company or the Placing Shares

or the Proposed Placing, and nothing in this announcement is or

shall be relied upon as, a promise or representation in this

respect whether as to the past or future. Canaccord accordingly

disclaims to the fullest extent permitted by law all and any

liability whether arising in tort, contract or otherwise (save as

referred to above) which it might otherwise have in respect of this

announcement or any such statement.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPPGPGUUPGURR

(END) Dow Jones Newswires

October 28, 2021 04:15 ET (08:15 GMT)

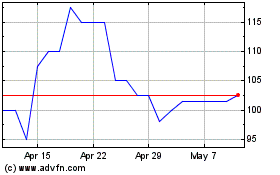

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Apr 2023 to Apr 2024