SMCP Says it's Safe as Struggling Parent Worries Investors

September 17 2021 - 6:45AM

Dow Jones News

By Joshua Kirby

SMCP SAS said a possible default by its main shareholder won't

affect it, after minority investors in the French fashion group

voiced concerns over the future of the company under Chinese parent

Shandong Ruyi Technology Group, which has struggled with debt

problems.

In a letter dated Sept. 13 and addressed to recently appointed

Chief Executive Isabelle Guichot, shareholder representative

Fabrice Remon raised the issue of convertible bonds worth 250

million euros ($295.4 million) due for repayment by a

Luxembourg-based subsidiary of Shandong Ruyi, a company called

European TopSoho. It holds just under 54% of SMCP's capital,

according to FactSet. "The situation is alarming for the future of

SMCP, its minority shareholders, its employees and all other

stakeholders," Mr. Remon said in the letter, which was also sent to

the French capital-markets authority.

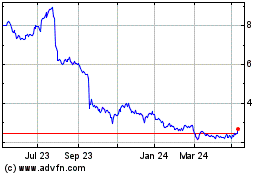

Mr. Remon also raised concerns over SMCP's share price, which

has fallen from EUR22 at the company's listing in 2017 to EUR5.65

as of Friday morning. Mr. Remon suggested that this has to do with

fears over the future of Shandong Ruyi, "and the measures it might

take regarding SMCP in order to protect itself."

In response, SMCP told The Wall Street Journal that the group

has its own strategy and resources, and that its financial

situation is "very healthy." SMCP had EUR240 million in cash as of

the end of June, and recently returned to positive operating

earnings, the company said.

Mr. Remon meanwhile noted that following the 2018 issue of the

bonds, which are exchangeable for shares in SMCP, European TopSoho

paid a dividend worth a total EUR176 million, instead of

reinvesting the proceeds into SMCP. In its response, SMCP said it

had undertaken to not pay any dividends as a condition of taking a

state loan in the context of the coronavirus pandemic.

"SMCP is always committed to listening to its shareholders," the

company said, adding that Ms. Guichot had responded to the

investors' letter, reiterating her commitment to continuing

profitable growth at the group.

Shandong Ruyi has struggled financially after buying up fashion

businesses including Swiss apparel maker Bally and U.S. activewear

firm The Lycra Co., as well as SMCP. In late 2019, Moody's

Investors Service cuts its credit rating on the company, putting it

deep in "junk" territory. More recently in June, Moody's said

Shandong's rating reflected its high refinancing risk, with large

amount of upcoming maturities, weak liquidity and limited progress

on refinancing plans.

Shandong Ruyi Technology Group and European TopSoho didn't

respond to requests for comment.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

September 17, 2021 06:30 ET (10:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

SMCP (EU:SMCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

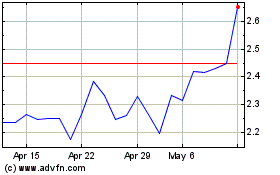

SMCP (EU:SMCP)

Historical Stock Chart

From Apr 2023 to Apr 2024