NatWest Swung to 2Q Pretax Profit, Resumes Dividend, to Launch GBP750 Million Share Buyback -- Update

July 30 2021 - 3:01AM

Dow Jones News

By Sabela Ojea

NatWest Group PLC on Friday reported a swing to a pretax profit

ahead of market views for the second quarter of 2021 and said that

it intends to launch a significant share buyback program after

resuming its dividend.

The FTSE 100 listed bank said it aims to launch a share buyback

program of up to 750 million pounds ($1.05 billion) in the second

half of the year. It said it also intends to close the year with a

full year net release of provisions instead of an impairment

loss.

The board declared an interim dividend of 3 pence a share and

said it intends to distribute a minimum of GBP1 billion a year from

2021 to 2023 by declaring ordinary and special dividends.

The U.K. lender posted a pretax profit of GBP946 million

compared with a loss of GBP1.29 billion for the year-earlier period

and a profit of GBP1.68 billion for the same period in 2019.

Pretax profit was expected to reach GBP861 million pounds,

according to the lender's compiled consensus.

Total income declined to GBP2.66 billion from GBP2.68 billion

for the same period in 2020 and GBP4.08 billion in the same period

of 2019. It was expected to be GBP2.63 billion.

NatWest's common equity Tier 1 ratio--a key measure of

balance-sheet strength--was 18.2%.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

July 30, 2021 02:57 ET (06:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

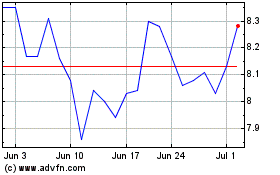

NatWest (NYSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

NatWest (NYSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024