Aviva Investors Lines Up More Job Cuts as Equities Chief Exits -- Financial News

June 14 2021 - 8:45AM

Dow Jones News

By David Ricketts

Of Financial News

Aviva Investors has begun redundancy consultations with fund

managers across its equities division as the 365 billion-pound

($514.87 billion) investment houses focuses more attention on areas

where it has "a competitive edge."

David Cumming, one of the City's best-known fund managers and

chief investment officer for the equities team at Aviva Investors,

is among the first casualties.

The asset manager said in a statement that the veteran investor

is leaving "to pursue other opportunities."

Mr. Cumming joined Aviva Investors in 2018, having been poached

by then Aviva Investors Chief Executive Euan Munro, who was also a

former colleague at Standard Life Investments.

Mr. Cumming's appointment coincided with Aviva Investors opening

a new office in Edinburgh, which acts as its second U.K. hub

outside of London.

His departure was first reported by The Mail on Sunday. Among

other high profile fund managers believed to be at risk from job

cuts is Mikhail Zverev, who heads up global equities at Aviva

Investors.

"Since taking over as CEO of Aviva Investors in January, Mark

Versey has been clear on the need to focus on areas where we have a

competitive edge and are winning business," said an Aviva Investors

spokesperson.

Aviva Investors will focus on building its position in real

assets, credit, multi-asset and wealth and retirement solutions, as

well as responsible investing "to build a market-leading

sustainable outcomes franchise, including net-zero aligned

propositions," the spokesperson added.

"We have taken the decision to focus our equities business on

sustainable outcomes and core strategies where there is clear

client demand, namely U.K. and global equities, while retaining

sufficient coverage to support our multi-asset strategies," they

said.

"A number of roles have been put at risk in our equities team,

and we have begun consultations with the impacted individuals. We

are unable to provide further details while we go through the

consultation process."

The redundancy consultations come a week after it emerged that

activist investor Cevian Group had built a 5% stake in Aviva

Investors' listed insurance parent Aviva, calling on it to cut

costs and return GBP5 billion of excess capital to

shareholders.

Website: www.fnlondon.com

(END) Dow Jones Newswires

June 14, 2021 08:37 ET (12:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

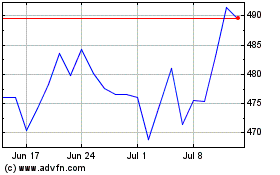

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024