Apollo Affiliate Makes Lead Bid for Bankrupt Stationery Retailer Paper Source

March 02 2021 - 4:51PM

Dow Jones News

By Jonathan Randles

Private equity-owned stationary and gifts retailer Paper Source

Inc. filed for bankruptcy, planning to permanently close some

stores and sell itself to an affiliate of asset manager Apollo

Global Management Inc. in exchange for debt relief, subject to

better offers.

Chicago-based Paper Source filed for chapter 11 protection

Tuesday in the U.S. Bankruptcy Court in Richmond, Va., becoming the

latest retail chain pushed into bankruptcy as a result of the

Covid-19 pandemic.

Paper Source said its business was strong and growing until it

was forced to temporarily close all of its nearly 160 stores last

March in response to Covid-19. Revenue then dropped from canceled

weddings and lost sales during the Mother's Day and Easter

holidays. The company closed stores weeks after Paper Source

acquired additional locations from a competitor, Papyrus Inc.,

which itself was in chapter 11 at the time.

"Unfortunately, the company never realized the benefits of the

Papyrus acquisition," Paper Source Chief Financial Officer Ronald

Kruczynski said in a declaration filed in bankruptcy court.

Paper Source, majority-owned by funds affiliated or managed by

Investcorp International Inc., comes to bankruptcy with an offer in

hand to sell its assets out of chapter 11 to an affiliate of MidCap

Financial Trust, the administrative and collateral agent on the

company's existing senior loan.

MidCap, a specialty finance firm managed by an Apollo

subsidiary, has also agreed to extend Paper Source a $16 million

bankruptcy loan to fund the chapter 11 case and proposed sale

process, according to court documents.

MidCap's offer will serve as a stalking-horse bid, setting the

floor on the price of Paper Source's assets. The lead bid is

subject to better bids, should the company receive any in the

coming weeks. MidCap's offer is in the form of a credit bid which

will allow the lender to use its debt claims as currency to acquire

Paper Source, court papers said.

The stalking horse is important to the company's employees and

vendors because it means the retail business will exit from chapter

11 in a relatively short amount of time and help generate interest

in the proposed sale process, Mr. Kruczynski said.

Paper Source has been marketing the business to potential buyers

since early November with the assistance of investment banker SSG

Capital Advisors LLC and intends to wrap up a chapter 11 sale

process in roughly 50 days, court papers said. MidCap's chapter 11

loan and stalking-horse bid must both be approved by a bankruptcy

judge.

While Paper Source's financial advisers run the sale process,

the company said it intends to use its time in bankruptcy to close

some of its stores for good and negotiate with landlords. Paper

Source is immediately closing 11 locations and will be negotiating

the terms of its remaining leases with landlords in an attempt to

get rent concessions, Mr. Kruczynski said. The company said it pays

about $3 million a month in rent and owes landlords roughly $15.8

million in deferred rent.

Forced store closures and other government-mandated Covid-19

restrictions had a significant impact on the company's sales. Paper

Source had $104 million in gross sales in 2020, down from $153.2

million in 2019, and filed chapter 11 with more than $103 million

in long-term debt, according to court papers.

Paper Source has filed customary motions to continue paying

employee wages and cover other ordinary business expenses as it

begins chapter 11. The retailer said it currently has about 1,700

employees. The company is scheduled to make its first appearance in

bankruptcy court on Wednesday.

Paper Source was founded in 1983 by Susan Lindstrom, who opened

the first store in Chicago and expanded the business to more than

two dozen locations. In 2007, Ms. Lindstrom sold a majority stake

in the retailer to Los Angeles-based private-equity firm Brentwood

Associates which later sold the business to Investcorp, court

papers said.

U.S. Bankruptcy Judge Keith Phillips has been assigned to the

chapter 11 case, number 21-30660.

Paper Source is represented in bankruptcy by the law firms

Willkie Farr & Gallagher LLP and Whiteford Taylor & Preston

LLP. In addition to investment banker SSG Capital Advisors, the

retailer has retained real estate adviser A&G Real Estate

Partners.

Write to Jonathan Randles at Jonathan.Randles@wsj.com

(END) Dow Jones Newswires

March 02, 2021 16:36 ET (21:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

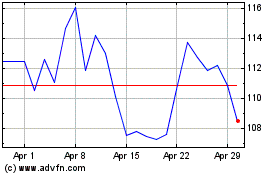

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Mar 2024 to Apr 2024

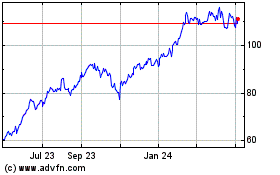

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Apr 2023 to Apr 2024