Alimera Sciences, Inc. (Nasdaq: ALIM) (Alimera), a global

pharmaceutical company that specializes in the commercialization

and development of prescription ophthalmic pharmaceuticals for the

treatment of retinal diseases, today announced financial results

for the fourth quarter and full year 2020. Alimera will host a

conference call on February 25, 2021, at 9:00 a.m. ET to discuss

these results and provide an update on corporate developments.

“While Alimera continues to experience challenges due to the

COVID-19 pandemic, we saw double digit sequential quarterly net

revenue growth after the second quarter of 2020 and we delivered

over $50 million in annual net revenue while maintaining positive

adjusted EBITDA,” said Rick Eiswirth, Alimera’s President and Chief

Executive Officer. “Additionally, we were able to advance our key

corporate objectives of continuing to execute our global expansion

strategy for ILUVIEN and initiating and enrolling patients in our

NEW DAY study, a landmark trial intended to position ILUVIEN as the

preferred first-line treatment for diabetic macular edema. With

this progress, and the benefit of retaining our workforce

throughout the pandemic, our primary objective is to resume our

prior growth trajectory later this year as the COVID-19 pandemic

begins to resolve.”

Fourth Quarter and Full Year 2020 Financial

Results

Net Revenue for Q4 2020

Consolidated net revenue was down 20% to approximately $13.8

million for Q4 2020, compared to $17.3 million for Q4 2019, but was

up 10% over Q3 2020.

U.S. net revenue decreased 22% to approximately $7.4 million for

Q4 2020 compared to U.S. net revenue of $9.5 million for Q4 2019

but increased 6% versus Q3 2020. End user demand, which represents

units purchased by physicians and pharmacies from our distributors,

decreased 26% to 867 units during Q4 2020 compared to 1,164 units

during Q4 2019 but increased 19% over Q3 2020.

The difference between GAAP revenue and end user demand is due

to the timing of distributor purchases from Q4 2020 versus Q4 2019.

During Q4 2019, our distributors purchased approximately the same

number of units that were sold to end users. During Q4 2020, our

distributors purchased approximately 6% more units than were sold

to end users.

International net revenue decreased 18% to approximately

$6.4 million for Q4 2020, compared to approximately

$7.8 million for Q4 2019. The decrease in international net

revenue in Q4 2020 was due to strong distributor sales in Q4

2019 and the negative effect of the COVID-19 pandemic in Q4 2020 on

both our direct and distributor markets.

Net Revenue for FY 2020

For 2020, consolidated net revenue decreased 6% to approximately

$50.8 million, compared to approximately $53.9 million in

2019.

For 2020, U.S. net revenue decreased 23%, or approximately $7.5

million, to $24.8 million compared to $32.3 million in 2019. The

decrease was primarily attributable to the negative effect of the

COVID-19 pandemic on our end user demand, which also decreased 23%

in 2020 to 3,075 units compared to 3,993 units for 2019.

For 2020, international net revenue increased 20% to

approximately $26.0 million for 2020, compared to approximately

$21.7 million in 2019. The growth of revenue in the international

segment was primarily due to expansion and growth into new and

existing markets through our distributors. Alimera also saw an

increased sales volume in the markets where we sell direct.

Prospective Changes to Segment Presentation

Historically, Alimera has had three segments consisting of a

U.S. Segment, an International Segment, and an Other Segment.

Beginning in 2021, Alimera and its chief operating decision maker

(Mr. Eiswirth, its CEO) have changed the way Alimera analyzes its

business and its respective segments to provide increased

transparency and comparability of the performance of the U.S. and

International segments.

In future SEC filings and press releases relating to periods

beginning January 1, 2021, Alimera will report segment results

using this new approach. In the Annual Report on Form 10-K for 2020

that Alimera intends to file soon, Alimera will present its 2020

and 2019 segment information under the historical approach and also

expects to provide pro forma information reflecting the new

methodology to provide a preview of how it will work in practice

when applied to periods beginning on January 1, 2021 and

thereafter.

Operating Expenses

Total operating expenses were approximately $11.6

million for Q4 2020, compared to approximately

$13.6 million for Q4 2019. Total operating expenses for 2020

were approximately $44.4 million compared to approximately $52.6

million in 2019. The decreases in total operating expenses were

mainly attributable to reduced spending associated with the impact

of the COVID-19 pandemic and included decreases in travel and

entertainment costs, medical congresses and other marketing costs,

and professional fees acrossall functional areas.

Net (Loss) Income

Net loss for Q4 2020 was $(1.0) million, compared to net income

of approximately $0.5 million for Q4 2019. For 2020, net loss

totaled approximately $(5.3) million compared to a net loss of

approximately $(10.4) million in 2019.

Basic and diluted net loss per share for Q4 2020 was

approximately $(0.18) compared to basic and diluted net income per

share of $0.08 for Q4 2019.

Basic and diluted net loss per share for 2020 was $(1.04)

compared to basic and diluted net loss per share for 2019 of

$(2.19).

Adjusted EBITDA

“Adjusted EBITDA,” a non-GAAP financial measure defined below,

was approximately $1.1 million for Q4 2020, compared to

Adjusted EBITDA of approximately $2.6 million for Q4 2019. For

2020, Adjusted EBITDA was approximately $3.5 million compared to

Adjusted EBITDA of approximately $21,000 for 2019.

Cash and Cash Equivalents

As of December 31, 2020, Alimera had cash and cash equivalents

of approximately $11.2 million, compared to $11.3 million at

September 30, 2020 and $9.4 million at December 31, 2019.

Definition of Non-GAAP Financial MeasureFor

purposes of this press release, “Adjusted EBITDA” is defined as

earnings before interest, taxes, depreciation, amortization,

stock-based compensation expenses, net unrealized gains and losses

from foreign currency exchange transactions, losses on

extinguishment of debt and severance expenses. Please refer to the

sections of this press release entitled “Non-GAAP Financial

Measure” and “Reconciliation of GAAP Net Income or Loss to Non-GAAP

Adjusted EBITDA.”

Conference Call to Be Held February 25, 2021A

live conference call will be hosted on February 25, 2021 at 9:00

a.m. EST by Rick Eiswirth, president and chief executive officer,

and Phil Jones, chief financial officer, to discuss Alimera’s

financial results and provide an update on corporate developments.

Please refer to the information below for conference call dial-in

information and webcast registration.

Conference date: Thursday, February 25, 2021 9:00 a.m.

ESTConference dial-in: 866-777-2509International dial-in:

412-317-5413Conference Call Name: Alimera Sciences (Nasdaq: ALIM)

Fourth Quarter and Full Year 2020 Financial Results Conference

Call Conference Call

Pre-registration: Participants are asked to pre-register for

the call by navigating to:

https://dpregister.com/sreg/10152084/e204bf9050

Please note that registered participants will receive their

dial-in number upon registration and will dial directly into the

call without delay. All callers should dial in approximately 10

minutes prior to the scheduled start time and ask to be joined into

the Alimera Sciences call.

The conference call will also be available through a live

webcast which is also available through the company’s website.

Live Webcast URL:

https://services.choruscall.com/links/alimera210225.html

A replay will be available on Alimera’s

website, www.alimerasciences.com, under “Investor Relations”

one hour following the live call.

Conference Call replay: US Toll Free:

1-877-344-7529International Toll: 1-412-317-0088Canada Toll Free:

855-669-9658Replay Access Code: 10152084End Date: March 11,

2021

About Alimera Sciences, Inc.

www.alimerasciences.com

Alimera Sciences is a pharmaceutical company that specializes in

the commercialization and development of prescription ophthalmic

pharmaceuticals. Alimera is presently focused on diseases affecting

the back of the eye, or retina, because these diseases are not well

treated with current therapies and affect millions of people in our

aging populations. For more information, please visit

www.alimerasciences.com.

Non-GAAP Financial Measure

This press release contains a discussion of a non-GAAP financial

measure, as defined in Regulation G promulgated under the

Securities Exchange Act of 1934, as amended. Alimera reports its

financial results in compliance with GAAP but believes that the

non-GAAP measure of Adjusted EBITDA provides useful information to

investors regarding Alimera’s operating performance. Alimera uses

Adjusted EBITDA in the management of its business. Accordingly,

Adjusted EBITDA for the three and twelve months ended December 31,

2020 and 2019 has been presented in certain instances excluding

items identified in the reconciliations provided in the table

entitled “Reconciliation of GAAP Net Income or Loss to non-GAAP

Adjusted EBITDA.” GAAP net income or loss is the most directly

comparable GAAP financial measure to Adjusted EBITDA.

Adjusted EBITDA, as presented, may not be comparable to

similarly titled measures reported by other companies because not

all companies may calculate Adjusted EBITDA in an identical manner.

Therefore, Adjusted EBITDA is not necessarily an accurate measure

of comparison between companies.

The presentation of Adjusted EBITDA is not intended to be

considered in isolation or as a substitute for guidance prepared in

accordance with GAAP. The principal limitation of this non-GAAP

financial measure is that it excludes significant elements required

by GAAP to be recorded in Alimera’s financial statements. In

addition, Adjusted EBITDA is subject to inherent limitations as it

reflects the exercise of judgments by management in determining

this non-GAAP financial measure.

Forward Looking Statements

This press release contains, and the conference call in which

executives of Alimera will discuss this press release may include,

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, regarding, among other

things, Alimera’s expectations regarding resuming its prior growth

trajectory later this year as the COVID-19 pandemic begins to

resolve and the expected success of the NEW DAY study. Such

forward-looking statements are based on current expectations and

involve inherent risks and uncertainties, including factors that

could delay, divert or change these expectations, and could cause

actual results to differ materially from those projected in these

forward-looking statements. Meaningful factors that could cause

actual results to differ include, but are not limited to,

uncertainties associated with (a) the continued effects of COVID-19

on the ability or willingness of patients to visit their retina

specialists for ILUVIEN injections, including current and future

governmental orders and policies adopted by healthcare facilities

to address the COVID-19 pandemic, and the duration of these

limitations; (b) the recent resurgence of the pandemic in both

Europe and the U.S.; (c) the emergence of COVID-19 variants that

may increase the transmissibility of the coronavirus or be more

deadly, or both; (d) the success or failure of the vaccine

campaigns in Alimera’s markets; (e) when in fact the pandemic

will subside enough to permit Alimera’s operations to return to its

prior growth trajectory, and whether Alimera will be able to

achieve that goal when given that opportunity; and (f) the

possibility that the NEW DAY Study may (i) fail to demonstrate the

efficacy of ILUVIEN as baseline therapy in patients with early

diabetic macular edema (DME) or to generate data demonstrating the

benefits of ILUVIEN when compared to the current leading therapy

for DME, and (ii) take longer or be more costly to complete than we

currently anticipate, as well as the other factors discussed in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of (i)

Alimera’s Annual Report on Form 10-K for the year ended

December 31, 2019, and (ii) Alimera’s Quarterly Report on Form

10-Q for the quarter ended September 30, 2020, both of which are on

file with the SEC and are available on the SEC’s website at

http://www.sec.gov. Additional factors will also be described in

those sections, and in the Summary of Principal Risk Factors

section, of Alimera’s Annual Report on Form 10-K for the year ended

December 31, 2020, to be filed with the SEC soon. Alimera

undertakes no obligation to publicly update or revise any of the

forward-looking statements made in this press release, whether as a

result of new information, future events or otherwise, except as

required by law. Therefore, you should not rely on these

forward-looking statements as representing Alimera’s views as of

any date after today.

| For

investor inquiries: |

For

media inquiries: |

| Scott Gordon |

Jules Abraham |

| for Alimera Sciences |

for Alimera Sciences |

| scottg@coreir.com |

julesa@coreir.com |

ALIMERA SCIENCES, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands)

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

December 31, |

| |

2020 |

|

|

2019 |

|

| |

(unaudited) |

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

11,208 |

|

|

$ |

9,426 |

|

|

Restricted cash |

|

34 |

|

|

|

33 |

|

|

Accounts receivable, net |

|

17,200 |

|

|

|

19,331 |

|

|

Prepaid expenses and other current assets |

|

3,718 |

|

|

|

2,565 |

|

|

Inventory |

|

2,746 |

|

|

|

1,390 |

|

|

Total current assets |

|

34,906 |

|

|

|

32,745 |

|

| NON-CURRENT ASSETS: |

|

|

|

|

|

|

Property and equipment, net |

|

1,638 |

|

|

|

940 |

|

|

Right of use assets, net |

|

720 |

|

|

|

1,107 |

|

|

Intangible asset, net |

|

12,838 |

|

|

|

14,783 |

|

|

Deferred tax asset |

|

753 |

|

|

|

734 |

|

| TOTAL ASSETS |

$ |

50,855 |

|

|

$ |

50,309 |

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

7,461 |

|

|

$ |

7,077 |

|

|

Accrued expenses |

|

3,197 |

|

|

|

4,716 |

|

|

Paycheck Protection Program (PPP) loan |

|

1,481 |

|

|

|

— |

|

|

Finance lease obligations |

|

209 |

|

|

|

255 |

|

|

Total current liabilities |

|

12,348 |

|

|

|

12,048 |

|

| NON-CURRENT LIABILITIES: |

|

|

|

|

|

|

Notes payable |

|

42,408 |

|

|

|

38,658 |

|

|

Finance lease obligations — less current portion |

|

514 |

|

|

|

94 |

|

|

Other non-current liabilities |

|

3,563 |

|

|

|

3,954 |

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

| STOCKHOLDERS’ DEFICIT: |

|

|

|

|

|

|

Preferred stock: |

|

|

|

|

|

|

Series A Convertible Preferred Stock |

|

19,227 |

|

|

|

19,227 |

|

|

Series C Convertible Preferred Stock |

|

— |

|

|

|

11,117 |

|

|

Common stock |

|

57 |

|

|

|

50 |

|

|

Additional paid-in capital |

|

365,830 |

|

|

|

350,117 |

|

|

Common stock warrants |

|

370 |

|

|

|

3,707 |

|

|

Accumulated deficit |

|

(392,909 |

) |

|

|

(387,570 |

) |

|

Accumulated other comprehensive loss — foreign currency translation

adjustments |

|

(553 |

) |

|

|

(1,093 |

) |

| TOTAL STOCKHOLDERS’

DEFICIT |

|

(7,978 |

) |

|

|

(4,445 |

) |

| TOTAL LIABILITIES AND

STOCKHOLDERS’ DEFICIT |

$ |

50,855 |

|

|

$ |

50,309 |

|

ALIMERA SCIENCES, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

FOR THE THREE AND TWELVE MONTHS ENDED

DECEMBER 31, 2020 AND 2019

(in thousands, except share and per share

data)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, |

|

December 31, |

| |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

NET REVENUE |

$ |

13,774 |

|

|

$ |

17,348 |

|

|

$ |

50,820 |

|

|

$ |

53,943 |

|

| COST OF GOODS SOLD, EXCLUDING

DEPRECIATION AND AMORTIZATION |

|

(1,992 |

) |

|

|

(2,273 |

) |

|

|

(6,941 |

) |

|

|

(6,626 |

) |

| GROSS PROFIT |

|

11,782 |

|

|

|

15,075 |

|

|

|

43,879 |

|

|

|

47,317 |

|

| RESEARCH, DEVELOPMENT AND

MEDICAL AFFAIRS EXPENSES |

|

2,506 |

|

|

|

2,670 |

|

|

|

9,668 |

|

|

|

10,992 |

|

| GENERAL AND ADMINISTRATIVE

EXPENSES |

|

3,458 |

|

|

|

3,527 |

|

|

|

11,652 |

|

|

|

13,271 |

|

| SALES AND MARKETING

EXPENSES |

|

4,985 |

|

|

|

6,784 |

|

|

|

20,384 |

|

|

|

25,687 |

|

| DEPRECIATION AND

AMORTIZATION |

|

660 |

|

|

|

667 |

|

|

|

2,676 |

|

|

|

2,641 |

|

| OPERATING EXPENSES |

|

11,609 |

|

|

|

13,648 |

|

|

|

44,380 |

|

|

|

52,591 |

|

| NET INCOME (LOSS) FROM

OPERATIONS |

|

173 |

|

|

|

1,427 |

|

|

|

(501 |

) |

|

|

(5,274 |

) |

| INTEREST EXPENSE AND

OTHER |

|

(1,452 |

) |

|

|

(1,173 |

) |

|

|

(5,380 |

) |

|

|

(4,869 |

) |

| UNREALIZED FOREIGN CURRENCY

GAIN (LOSS), NET |

|

179 |

|

|

|

51 |

|

|

|

474 |

|

|

|

(84 |

) |

| NET (LOSS) INCOME BEFORE

TAXES |

|

(1,100 |

) |

|

|

305 |

|

|

|

(5,407 |

) |

|

|

(10,227 |

) |

| BENEFIT (PROVISION) FOR

TAXES |

|

123 |

|

|

|

193 |

|

|

|

68 |

|

|

|

(216 |

) |

| NET (LOSS) INCOME |

$ |

(977 |

) |

|

$ |

498 |

|

|

$ |

(5,339 |

) |

|

|

(10,443 |

) |

| NET (LOSS) INCOME PER SHARE —

Basic |

$ |

(0.18 |

) |

|

$ |

0.08 |

|

|

$ |

(1.04 |

) |

|

$ |

(2.19 |

) |

| WEIGHTED AVERAGE SHARES

OUTSTANDING — Basic |

|

5,387,937 |

|

|

|

4,897,005 |

|

|

|

5,117,656 |

|

|

|

4,770,204 |

|

| WEIGHTED AVERAGE PARTICIPATING

SHARES – Basic |

|

— |

|

|

|

1,278,170 |

|

|

|

— |

|

|

|

— |

|

| TOTAL WEIGHTED AVERAGE SHARES

OUTSTANDING — Basic |

|

5,387,937 |

|

|

|

6,175,175 |

|

|

|

5,117,656 |

|

|

|

4,770,204 |

|

| NET (LOSS) INCOME PER SHARE —

Diluted |

$ |

(0.18 |

) |

|

$ |

0.08 |

|

|

$ |

(1.04 |

) |

|

$ |

(2.19 |

) |

| WEIGHTED AVERAGE SHARES

OUTSTANDING — Diluted |

|

5,387,937 |

|

|

|

4,920,794 |

|

|

|

5,117,656 |

|

|

|

4,770,204 |

|

| WEIGHTED AVERAGE PARTICIPATING

AND DILUTIVE SHARES – Diluted |

|

— |

|

|

|

1,278,170 |

|

|

|

— |

|

|

|

— |

|

| TOTAL WEIGHTED AVERAGE SHARES

OUTSTANDING — Diluted |

|

5,387,937 |

|

|

|

6,198,964 |

|

|

|

5,117,656 |

|

|

|

4,770,204 |

|

RECONCILIATION OF GAAP MEASURES TO

NON-GAAP ADJUSTED MEASURES

GAAP NET INCOME OR LOSS TO NON-GAAP

ADJUSTED EBITDA

(in thousands)

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

| |

(unaudited) |

|

GAAP NET (LOSS) INCOME |

$ |

(977 |

) |

|

|

$ |

498 |

|

|

|

$ |

(5,339 |

) |

|

|

$ |

(10,443 |

) |

|

| Adjustments to net (loss)

income: |

|

|

|

|

|

|

|

| Interest expense and

other |

1,452 |

|

|

|

1,173 |

|

|

|

5,380 |

|

|

|

4,869 |

|

|

| (Benefit) provision for

taxes |

(123 |

) |

|

|

(193 |

) |

|

|

(68 |

) |

|

|

216 |

|

|

| Depreciation and

amortization |

660 |

|

|

|

667 |

|

|

|

2,676 |

|

|

|

2,641 |

|

|

| Stock-based compensation

expenses |

255 |

|

|

|

553 |

|

|

|

1,318 |

|

|

|

2,456 |

|

|

| Unrealized foreign currency

exchange (gains) losses |

(179 |

) |

|

|

(51 |

) |

|

|

(474 |

) |

|

|

84 |

|

|

| Severance expenses |

— |

|

|

|

— |

|

|

|

— |

|

|

|

198 |

|

|

| NON-GAAP ADJUSTED EBITDA |

$ |

1,088 |

|

|

|

$ |

2,647 |

|

|

|

$ |

3,493 |

|

|

|

$ |

21 |

|

|

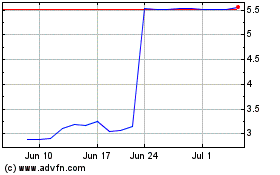

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

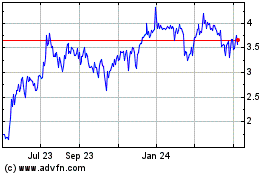

Alimera Sciences (NASDAQ:ALIM)

Historical Stock Chart

From Apr 2023 to Apr 2024