Current Report Filing (8-k)

December 31 2020 - 4:01PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): December 3, 2020

QSAM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-55148

|

|

20-1602779

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

|

420

Royal Palm Way, #100, Palm Beach, Florida

|

|

33480

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

|

Registrant’s

telephone number, including area code

|

|

(561)

693-1423

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On

December 9, 2020, Tristan Peitz resigned as Director of the Company. The resignation was for personal reasons.

On

December 30, 2020, the Company issued to its Chief Executive Officer, Executive Chairman, General Counsel, Vice President of Operations,

and Senior Clinical Advisor, an aggregate of 7,650 shares of the Company’s Series E-1 Incentive Preferred Stock (the

“Series E-1 Preferred Shares”), pursuant to five separate Issuance Agreements. The shares of Series E-1 Preferred

Stock vest between six months and two years from the date of issuance. Terms of the Series E-1 Preferred Shares are described

in Item 5.3 below.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The

Company filed an amendment to its Articles of Incorporation to authorize the issuance of up to 8,500 shares of Series E-1 Preferred

Stock on December 3, 2020 pursuant to a Certificate of Designation. The Series E-1 Preferred Shares are incentive-based vesting

and forfeitable securities that provide the holders the right in the aggregate to receive an “earnout” equal to 20%

of the total considerable received by the Company in the instance of a sale or sub-license of its core licensed radiopharmaceutical

technology, or sale or merger of the Company, which is paid on a priority, senior basis. In addition, the holders of the Series

E-1 Preferred Shares can convert their preferred stock at anytime or after an event leading to the earnout into an aggregate of

8.5 million common shares. The holders of the Series E-1 Preferred Stock have the right to vote along with the common stockholders

based on the common conversion amount of their holdings, and have the right to nominate two members of the Board of Directors.

Additional rights and protections with respect to approval of a sale of the Company or its assets, increasing the Board size,

issuance of more senior securities and other typical preferred stock protections also are provided in the Certificate of

Designation.

On

December 29, 2020, the Company filed an amendment to its Articles of Incorporation to authorize the issuance of up to 2,500 shares

of Series B Convertible Preferred Stock (the “Series B Preferred Shares”) pursuant to a Certificate of Designation.

The Series B Preferred Shares are expected to be issued to accredited investors in connection with a private placement of up to

$2.5 million. The Series B Preferred Shares provide the holders a 10% annual PIK dividend, a liquidation preference equal to the

par value of the shares ($1,000 per share) followed by the right to participate with the common stockholders in the instance of

a liquidation or other exit event, and provide the holders the right to vote along with the common holders based on the common

conversion amount of their holdings. The Series B Preferred Shares are convertible into common stock at a price of $0.16 per share,

subject to anti-dilution protections in the case of certain issuances of securities below that conversion price. The Series B

Preferred Shares are not redeemable.

The

above represents a summary of the Series B Preferred Shares and the Series E-1 Preferred Shares and Issuance Agreement, and are

qualified in their entirety by reference to the full documents filed as Exhibits 3.1, 3.2 and 10.1, respectively, to this Report

on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

QSAM

Biosciences, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/

Christopher Nelson

|

|

|

|

|

Christopher

Nelson

|

|

|

|

|

General

Counsel

|

|

|

|

|

|

|

Date:

|

December

31, 2020

|

|

|

Exhibit

Index

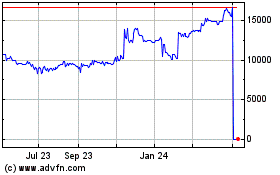

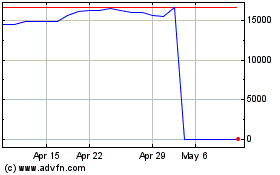

Common Stock (QB) (USOTC:QSAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Common Stock (QB) (USOTC:QSAM)

Historical Stock Chart

From Apr 2023 to Apr 2024