SCHEDULE

14C DEFINITIVE INFORMATION STATEMENT

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

|

Check

the appropriate box:

|

|

|

|

☐

|

Preliminary

Information Statement

|

|

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

☒

|

Definitive

Information Statement

|

|

|

|

|

☐

|

Definitive

Additional Materials

|

|

|

|

|

☐

|

Soliciting

Material Under §240.14(a)(12)

|

REMSLEEP HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

|

☒

|

No fee

required.

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

1)

|

Title of each class

of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number

of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum

aggregate value of the transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

1)

|

Amount Previously

Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or

Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

REMSLEEP

HOLDINGS, INC.

2202

N. West Shore Blvd, Suite 200

Tampa,

FL 33607

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Regulation 14C

of

the Securities Exchange Act of 1934 as amended

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

RemSleep

Holdings, Inc. is referred to herein as the “Company,” “we, “our” or “us.”

This

Information Statement has been filed with the Securities and Exchange Commission (the “SEC”) and is being furnished,

pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders

(the “Stockholders”) of common stock, par value $0.001 per share (the “Common Stock”), of

RemSleep Holdings, Inc. a Nevada Corporation (the “Company”), to notify such Stockholders that on November

24, 2020, the Company received written consent from the holders of 58.43% of the voting power of our outstanding voting capital

stock (the “Majority Stockholders”), approving of the following corporate action (the “Corporate Action”):

|

|

●

|

To

amend to the Company’s Articles of Incorporation to increase the number of authorized

shares of Common Stock from 1 billion (1,000,000,000) to 3 billion (3,000,000,000) (the

“Amendment”).

|

On

November 24, 2020, our Board of Directors unanimously approved the Corporate Action, subject to Stockholder approval. The Majority

Stockholders approved the Corporate Action by written consent in lieu of a meeting on November 24, 2020. Accordingly, your consent

is not required and is not being solicited in connection with the approval of the Amendment. Our Board is not soliciting your

proxy or consent in connection with the Amendment. You are urged to read this Information Statement carefully and in its entirety

for a description of the corporate action taken by the Majority Stockholders. Stockholders who were not afforded an opportunity

to consent or otherwise vote with respect to the Corporate Actions taken have no right under Nevada corporate law or the Articles

or Bylaws to dissent or require a vote of all Stockholders.

The

Corporate Action will not become effective before a date which is twenty (20) calendar days after a definitive Information Statement

is first provided to Stockholders. The Information Statement will be provided to our Stockholders of record upon the filing of

the Definitive Information Statement on or about December 4, 2020. The Information Statement is being provided to Stockholders

of record as of November 24, 2020 (the “Record Date”). The entire cost of furnishing this Information Statement

will be borne by the Company. We anticipate that the Amendment will be effective on or about December 24, 2020.

PLEASE

NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER THE MATTERS

DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE

MATTERS DESCRIBED HEREIN PURSUANT TO SECTION 14(c) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION

14C.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS,

|

|

|

|

|

Date:

December 4, 2020

|

By:

|

/s/

Thomas Wood

|

|

|

|

Name:

|

Thomas

Wood

|

|

|

|

Title:

|

Chief

Executive Officer

|

AMENDMENT

TO THE ARTICLES OF INCORPORATION

TO

INCREASE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

FROM

1 BILLION TO 3 BILLION

Our

Board of Directors and the Majority Stockholders have approved to amend our Articles of Incorporation to increase the number of

our authorized shares of Common Stock from 1 billion (1,000,000,000) to 3 billion (3,000,000,000). We will file a Certificate

of Amendment with the Secretary State of Nevada to effect the increase in our authorized shares of Common Stock and the Amendment

will be effective approximately (but not less than) 20 days after the definitive information statement is mailed to stockholders.

We anticipate that the Amendment will be effective on or about [December 24, 2020]. The form of Certificate of Amendment to be

filed with the Secretary of State of the State of Nevada is set forth as Appendix A to this Information Statement.

Outstanding

Shares and Purpose of the Amendment

Our

Articles of Incorporation currently authorize us to issue a maximum of 1 billion (1,000,000,000) shares of Common Stock, par value

$0.001 per share. As of November 24, 2020, we had 308,304,891 shares of Common Stock issued and outstanding.

Our

Board believes that the increase in our authorized Common Stock will provide the Company greater flexibility with respect to the

Company’s capital structure for purposes including additional equity financings and stock based acquisitions. However, the

effect of the Amendment upon the market price for our Common Stock cannot be predicted. There can be no assurance that the market

price per share of our Common Stock after the Amendment will rise or fall. The market price of our Common Stock may also be based

on our performance and other factors, some of which may be unrelated to the number of shares authorized.

The

Amendment will not affect the par value of our Common Stock. As a result, on the effective date of the Authorized Shares, the

stated capital on our balance sheet attributable to our Common Stock will remain the same. The per share net income or loss and

net book value of our Common Stock will remain the same.

Effects

of the Increase in Authorized Common Stock

The

additional shares of Common Stock will have the same rights as the presently authorized shares, including the right to cast one

vote per share of Common Stock. Although the authorization of additional shares will not, in itself, have any effect on the rights

of any holder of our Common Stock, the future issuance of additional shares of Common Stock (other than by way of a stock split

or dividend) would have the effect of diluting the voting rights and could have the effect of diluting earnings per share and

book value per share of existing stockholders.

At

present, the Board has no plans to issue the additional shares of Common Stock authorized by the Amendment. However, it is possible

that some of these additional shares could be used in the future for various other purposes without further stockholder approval,

except as such approval may be required in particular cases by our charter documents, applicable law or the rules of any stock

exchange or other quotation system on which our securities may then be listed. These purposes may include: raising capital, providing

equity incentives to employees, officers or directors, establishing strategic relationships with other companies, and expanding

the Company’s business or product lines through the acquisition of other businesses or products.

We

could also use the additional shares of Common Stock that will become available pursuant to the Amendment to oppose a hostile

takeover attempt or to delay or prevent changes in control or management of the Company. Although the Board’s approval of

the Amendment was not prompted by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts

directed at the Company), nevertheless, stockholders should be aware that the Amendment could facilitate future efforts by us

to deter or prevent changes in control of the Company, including transactions in which Stockholders of the Company might otherwise

receive a premium for their shares over then current market prices.

BENEFICIAL

OWNERSHIP OF SECURITIES AND SECURITY OWNERSHIP OF MANAGEMENT

The

following table sets forth certain information concerning the number of shares of our Common Stock owned beneficially based on

308,304,891 issued and outstanding shares of Common Stock as of November 24, 2020 by: (i) each of our directors; (ii) each of

our named executive officers; and (iii) each person or group known by us to beneficially own more than 5% of our outstanding shares

of Common Stock.

Beneficial

ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities.

Other than as described in the notes to the table, we believe that all persons named in the table have sole voting and investment

power with respect to shares beneficially owned by them. All share ownership figures include shares issuable upon exercise of

options or warrants exercisable within 60 days of November 24, 2020, which are deemed outstanding and beneficially owned by such

person for purposes of computing his or her percentage ownership, but not for purposes of computing the percentage ownership of

any other person. Unless otherwise indicated below, beneficial ownership is calculated based on the 308,304,891 shares of Common

Stock, 5,000,000 shares of Series A Preferred Stock and 500,000 shares of Series B Preferred Stock issued and outstanding as of

the date hereof.

|

|

|

Common Stock

|

|

|

Series A

Preferred Stock

|

|

|

Series B

Preferred Stock

|

|

|

Total Votes (1)

|

|

|

Name and Address (2)

|

|

Number

|

|

|

Percent of

Class

|

|

|

Number

|

|

|

Percent of

Class

|

|

|

Number

|

|

|

Percent of

Class

|

|

|

Votes

|

|

|

Percent of

Votes

|

|

|

Directors and Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas Wood

-Chief Executive Officer and Director

|

|

|

25,969,494

|

|

|

|

8.42

|

%

|

|

|

2,500,000

|

|

|

|

50

|

%

|

|

|

250,000

|

|

|

|

50

|

%

|

|

|

138,469,494

|

|

|

|

32.96

|

%

|

Russell Bird

-Chairman of the Board

|

|

|

26,129,494

|

|

|

|

8.50

|

%

|

|

|

2,500,000

|

|

|

|

50

|

%

|

|

|

250,000

|

|

|

|

50

|

%

|

|

|

113,719,494

|

|

|

|

25.24

|

%

|

John B. Lane

-Chief Operating Officer

|

|

|

1,000,000

|

|

|

|

0.32

|

%

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

1,000,000

|

|

|

|

0.23

|

%

|

|

All Officers and Directors as a Group (3 Persons)

|

|

|

53,188,988

|

|

|

|

17.25

|

%

|

|

|

5,000,000

|

|

|

|

100

|

%

|

|

|

500,000

|

|

|

|

100

|

%

|

|

|

253,188,988

|

|

|

|

58.43

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Beneficial Owners

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

None

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

|

--

|

|

|

(1)

|

Based on an aggregated of 253,188,988 votes, consisting of 308,304,891

votes for our Common Stock, 125,000,000 votes for our 5,000,000 shares of Series A Preferred Stock, and 50,000,000 votes for our

Series B Preferred Stock outstanding as of the Record Date. Each shares of Common Stock is entitled to one vote on the Corporate

Action. Each share of Series A Preferred Stock and Series B Preferred Stock is entitled to 25 and 100 votes, respectively, per

share, and vote together with the shares of Common Stock, as a group unless otherwise required by law.

|

|

(2)

|

Unless otherwise indicated, the address for each beneficial owner

is c/o RemSleep Holdings, Inc., 2202 N. West Shore Blvd, Suite 200, Tampa, FL 33607.

|

DESCRIPTION

OF SECURITIES

General

The authorized capital stock of our Company

consists of 505,000,000 shares of capital stock, consisting of 1,000,000 shares of Common Stock and 5,000,000 shares of preferred

stock, 5,000,000 of which have been designated Series A Preferred Stock, 5,000,000 of which have been designated as Series B Preferred

Stock and 5,000,000 have been designated as Series C Preferred Stock. As of the Record Date, there were 308,304,891 shares of Common

Stock, 5,000,000 shares of Series A Preferred Stock and 500,000 shares of Series B Preferred Stock and Series C Preferred Stock

issued and outstanding.

Common

Stock

Holders

of Common Stock are entitled to one vote for each share on all matters submitted to a shareholder vote. Holders of Common Stock

do not have cumulative voting rights. Therefore, holders of a majority of the shares of Common Stock voting for the election of

directors can elect all of the directors. Holders of Common Stock representing a majority of the voting power of our capital stock

issued and outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting

of our shareholders. A vote by the holders of a majority of the outstanding shares is required to effectuate certain fundamental

corporate changes, such as liquidation, merger or an amendment to the Articles of Incorporation. Holders of Common Stock are entitled

to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event

of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that

remain after payment of liabilities and after providing for each class of stock, if any, having preference over the Common Stock.

Holders of the Common Stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable

to the Common Stock.

Series

A Preferred Stock

The

Company is currently authorized to issue 5,000,000 shares of Series A Preferred Stock, par value $0.001 per share value with 1:25

voting rights. The Series A Preferred Stock ranks equal to the Common Stock on liquidation, pays no dividend and is convertible

to Common Stock for one share of common for one share of Series A Preferred Stock at any time from and after the date the Company’s

net income exceeds $1,000,000. Except as provided by law or by other provisions of our Articles of Incorporation, holders of Series

A Preferred shall vote together with holders of our Common Stock as a single class.

Series

B Preferred Stock

The

Company is currently authorized to issue 5,000,000 shares of Series B Preferred Stock, par value $0.001 per share. Each share

of Series B Preferred Stock has a 1:100 voting right and is convertible into 100 shares of Common Stock. No dividends will be

paid and in the event of liquidation all shares of Series B Preferred Stock will automatically convert into Common Stock. There

are no shares of Series B Preferred Stock issued and outstanding. Except as provided by law or by other provisions of our Articles

of Incorporation, holders of Series B Preferred Stock shall vote together with holders of our Common Stock as a single class.

Series

C Preferred Stock

The Company is currently authorized to

issue 5,000,000 shares of Series C Preferred Stock, par value $0.001 per share value. Each share of Series C Preferred Stock has

a 1:50 voting right and is convertible into 50 shares of Common Stock. No dividends will be paid and in the event of liquidation

all shares of Series C will automatically convert into Common Stock. There are no shares of Series C Preferred Stock issued and

outstanding. Except as provided by law or by other provisions of our Articles of Incorporation, holders of Series C Preferred

Stock shall vote together with holders of our Common Stock as a single class.

DISSENTER’S

RIGHTS

Under

the Nevada Revised Statutes, holders of shares of Common Stock are not entitled to dissenters’ rights with respect to any

aspect of the Amendment, and we will not independently provide holders with any such right.

INTEREST

OF CERTAIN PERSONS IN THE AMENDMENT

No

director, executive officer, associate of any director or executive officer or any other person has any substantial interest,

direct or indirect, by security holdings or otherwise, in the Amendment which is not shared by all other holders of the shares

of Common Stock.

AVAILABLE

INFORMATION

We

are subject to the information and reporting requirements of the Exchange Act and in accordance with such Act we file periodic

reports, documents and other information with the Securities and Exchange Commission relating to our business, financial statements

and other matters. Such reports and other information may be inspected and are available for copying at the public reference facilities

of the Securities and Exchange Commission at 100 F Street, N.E., Washington D.C. 20549 or may be accessed free of charge at www.sec.gov.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR INFORMATIONAL PURPOSES

ONLY.

|

|

BY

ORDER OF THE BOARD OF DIRECTORS,

|

|

|

|

|

Date:

December 4, 2020

|

By:

|

/s/

Thomas Wood

|

|

|

|

Name:

|

Thomas

Wood

|

|

|

|

Title:

|

Chief

Executive Officer

|

Appendix

A

AMENDMENT

TO ARTICLES OF INCORPORATION

OF

REMSLEEP HOLDINGS, INC.

Pursuant

to the provisions of Chapter 78 of the Nevada Revised Statutes (the “Nevada Corporations Act”), the undersigned

corporation adopts the following Amendment to Articles of Incorporation.

|

|

1.

|

NAME

OF CORPORATION. The name of the corporation is RemSleep Holdings, Inc. (the “Corporation”).

|

|

|

2.

|

AMENDMENT

TO ARTICLES OF INCORPORATION. The amendment adopted by the Corporation is set out in full as follows:

|

The Articles of Incorporation are amended by the

addition of the article stated in its entirety below and identified or referenced as follows:

Article

Four. The authorized common stock, par value $0.001 per share, of the Corporation is hereby increased from 1 billion (1,000,000,000)

to 3 billion (3,000,000,000) shares.

|

|

3.

|

STOCKHOLDER

APPROVAL. This Certificate of Amendment to the Articles of Incorporation has been approved by the Stockholders holding 58.43%

of the voting power of the outstanding voting capital stock of the Corporation pursuant to the Nevada Corporations Act.

|

|

|

4.

|

EFFECTIVE

DATE OF FILING. This Certificate of Amendment to the Articles of Incorporation shall be effective on December 24, 2020.

|

IN

TESTIMONY HEREOF, the undersigned has executed this Certificate of Amendment to the Articles of Incorporation as of December

4, 2020.

Date:

December 4, 2020

/s/

Thomas Wood

Name:

Thomas Wood

Title:

Chief Executive Officer

A-1

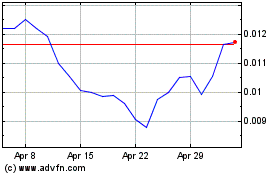

RemSleep (QB) (USOTC:RMSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

RemSleep (QB) (USOTC:RMSL)

Historical Stock Chart

From Apr 2023 to Apr 2024