UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2020

Commission File Number: 001-38206

TDH HOLDINGS, INC.

(Translation of registrant’s name

into English)

c/o Qingdao Tiandihui Foodstuffs Co.

Ltd.,

2521 Tiejueshan Road, Huangdao District,

Qingdao, Shandong Province

People’s Republic of China

Tel: +86-532-8615-7918

(Address of Principal Executive Office)

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check

mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to

the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): -.

EXPLANATORY NOTE

This Report of Foreign Private Issuer on

Form 6-K filed by TDH Holdings, Inc. (together with our subsidiaries, unless the context indicates otherwise, “we,”

“us,” “our,” or the “Company”) contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements

relate to future events or the Company’s future financial performance. The Company has attempted to identify forward-looking

statements by terminology including “anticipates,” “believes,” “expects,” “can,”

“continue,” “could,” “estimates,” “intends,” “may,” “plans,”

“potential,” “predict,” “should” or “will” or the negative of these terms or other

comparable terminology. These statements are only predictions, uncertainties and other factors may cause the Company’s actual

results, levels of activity, performance or achievements to be materially different from any future results, levels or activity,

performance or achievements expressed or implied by these forward-looking statements. The information in this Report on Form 6-K

is not intended to project future performance of the Company. Although the Company believes that the expectations reflected in

the forward-looking statements are reasonable, the Company does not guarantee future results, levels of activity, performance or

achievements. The Company expectations are as of the date this Form 6-K is filed, and the Company does not intend to update any

of the forward-looking statements after the date this Report on Form 6-K is filed to confirm these statements to actual results,

unless required by law.

Index to Unaudited Condensed Consolidated

Interim Financial Statements

TDH HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

|

|

|

June 30,

|

|

|

December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

499,276

|

|

|

$

|

5,114,175

|

|

|

Restricted cash

|

|

|

871,119

|

|

|

|

1,390,403

|

|

|

Short-term investments

|

|

|

8,227,559

|

|

|

|

-

|

|

|

Accounts receivable, net

|

|

|

54,085

|

|

|

|

21,657

|

|

|

Advances to suppliers

|

|

|

82,902

|

|

|

|

39,806

|

|

|

Inventories, net

|

|

|

234,172

|

|

|

|

473,216

|

|

|

Prepayments and other current assets

|

|

|

206,001

|

|

|

|

153,633

|

|

|

Total current assets

|

|

|

10,175,114

|

|

|

|

7,192,890

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

6,251,640

|

|

|

|

6,562,669

|

|

|

Land use rights, net

|

|

|

945,637

|

|

|

|

973,224

|

|

|

Long-term investments

|

|

|

71,757

|

|

|

|

71,757

|

|

|

Operating lease right-of-use assets - related parties

|

|

|

265,118

|

|

|

|

286,670

|

|

|

Total non-current assets

|

|

|

7,534,152

|

|

|

|

7,894,320

|

|

|

Total assets

|

|

$

|

17,709,266

|

|

|

$

|

15,087,210

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDER’S EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

3,051,935

|

|

|

$

|

3,436,939

|

|

|

Accounts payable - related parties

|

|

|

115,178

|

|

|

|

116,834

|

|

|

Notes payable

|

|

|

-

|

|

|

|

908,008

|

|

|

Advances from customers

|

|

|

146,100

|

|

|

|

116,155

|

|

|

Bank overdrafts

|

|

|

78,320

|

|

|

|

78,320

|

|

|

Short term loans

|

|

|

8,511,776

|

|

|

|

7,624,061

|

|

|

Short term loans - related parties

|

|

|

931,935

|

|

|

|

892,510

|

|

|

Taxes payable

|

|

|

56,989

|

|

|

|

57,521

|

|

|

Due to related parties

|

|

|

38,834

|

|

|

|

39,387

|

|

|

Operating lease liabilities - related parties, current

|

|

|

157,581

|

|

|

|

137,347

|

|

|

Other current liabilities

|

|

|

4,523,101

|

|

|

|

1,054,818

|

|

|

Total current liabilities

|

|

|

17,611,749

|

|

|

|

14,461,900

|

|

|

NON-CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Deferred tax liabilities

|

|

|

1,021

|

|

|

|

1,036

|

|

|

Operating lease liabilities - related party, non-current

|

|

|

268,765

|

|

|

|

286,875

|

|

|

Total liabilities

|

|

|

17,881,535

|

|

|

|

14,749,811

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

Common stock ($0.001 par value; 200,000,000 shares authorized; 45,849,995 shares issued and outstanding at June 30, 2020 and December 31, 2019)

|

|

|

45,850

|

|

|

|

45,850

|

|

|

Additional paid-in capital

|

|

|

21,963,678

|

|

|

|

21,963,678

|

|

|

Statutory reserves

|

|

|

160,014

|

|

|

|

160,014

|

|

|

Accumulated deficit

|

|

|

(22,578,659

|

)

|

|

|

(21,974,651

|

)

|

|

Accumulated other comprehensive income

|

|

|

236,856

|

|

|

|

142,516

|

|

|

Total TDH Holdings, Inc. stockholders’ equity (deficit)

|

|

|

(172,261

|

)

|

|

|

337,407

|

|

|

Noncontrolling interest

|

|

|

(8

|

)

|

|

|

(8

|

)

|

|

Total stockholders’ equity (deficit)

|

|

|

(172,269

|

)

|

|

|

337,399

|

|

|

Total liabilities and stockholders’ equity (deficit)

|

|

$

|

17,709,266

|

|

|

$

|

15,087,210

|

|

TDH HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

|

|

|

For The

Six Months

Ended

June 30,

2020

|

|

|

For The

Six Months

Ended

June 30,

2019

|

|

|

|

|

|

|

|

|

|

|

Net revenues

|

|

$

|

282,532

|

|

|

$

|

7,758,756

|

|

|

Net revenues - related parties

|

|

|

-

|

|

|

|

282,510

|

|

|

Total revenues

|

|

|

282,532

|

|

|

|

8,041,266

|

|

|

Cost of revenues

|

|

|

353,135

|

|

|

|

7,074,142

|

|

|

Cost of revenues - related parties

|

|

|

-

|

|

|

|

276,540

|

|

|

Total cost of revenues

|

|

|

353,135

|

|

|

|

7,350,682

|

|

|

Gross profit (loss)

|

|

|

(70,603

|

)

|

|

|

690,584

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling expense

|

|

|

63,577

|

|

|

|

658,494

|

|

|

General and administrative expense

|

|

|

835,177

|

|

|

|

1,263,312

|

|

|

Research and development expense

|

|

|

-

|

|

|

|

9,981

|

|

|

Total operating expenses

|

|

|

898,754

|

|

|

|

1,931,787

|

|

|

Loss from operations

|

|

|

(969,357

|

)

|

|

|

(1,241,203

|

)

|

|

Interest expense

|

|

|

(569,831

|

)

|

|

|

(507,355

|

)

|

|

Government subsidies

|

|

|

-

|

|

|

|

121,906

|

|

|

Other income

|

|

|

62,547

|

|

|

|

10,034

|

|

|

Investment income

|

|

|

879,520

|

|

|

|

-

|

|

|

Other expenses

|

|

|

(6,744

|

)

|

|

|

(53,129

|

)

|

|

Loss from equity method investment

|

|

|

-

|

|

|

|

(583

|

)

|

|

Total other income (expenses)

|

|

|

365,492

|

|

|

|

(429,127

|

)

|

|

Loss before income tax expense

|

|

|

(603,865

|

)

|

|

|

(1,670,330

|

)

|

|

Income tax expense

|

|

|

143

|

|

|

|

-

|

|

|

Net loss

|

|

|

(604,008

|

)

|

|

|

(1,670,330

|

)

|

|

Less: Net loss attributable to noncontrolling interest

|

|

|

-

|

|

|

|

-

|

|

|

Net loss attributable to TDH Holdings, Inc.

|

|

$

|

(604,008

|

)

|

|

$

|

(1,670,330

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(604,008

|

)

|

|

$

|

(1,670,330

|

)

|

|

Other comprehensive income (loss)

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

94,340

|

|

|

|

(134,060

|

)

|

|

Total comprehensive loss

|

|

|

(509,668

|

)

|

|

|

(1,804,390

|

)

|

|

Less: Comprehensive income attributable to noncontrolling interest

|

|

|

-

|

|

|

|

5

|

|

|

Comprehensive loss attributable to TDH Holdings, Inc.

|

|

$

|

(509,668

|

)

|

|

$

|

(1,804,395

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share attributable to TDH Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.01

|

)

|

|

$

|

(0.14

|

)

|

|

Diluted

|

|

$

|

(0.01

|

)

|

|

$

|

(0.14

|

)

|

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

45,849,995

|

|

|

|

12,174,121

|

|

|

Diluted

|

|

|

45,849,995

|

|

|

|

12,174,121

|

|

TDH HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

For The

Six Months

Ended

|

|

|

For The

Six Months

Ended

|

|

|

|

|

June 30,

2020

|

|

|

June 30,

2019

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(604,008

|

)

|

|

$

|

(1,670,330

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense

|

|

|

183,812

|

|

|

|

258,896

|

|

|

Fair value change of short-term investments

|

|

|

(879,520

|

)

|

|

|

-

|

|

|

Loss from equity method investment

|

|

|

-

|

|

|

|

583

|

|

|

Deferred income taxes

|

|

|

-

|

|

|

|

576

|

|

|

Loss on disposal of property, plant and equipment

|

|

|

-

|

|

|

|

32,969

|

|

|

Non-cash lease expense

|

|

|

17,577

|

|

|

|

37,903

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

(32,902

|

)

|

|

|

(673,817

|

)

|

|

Accounts receivable - related parties, net

|

|

|

-

|

|

|

|

112,465

|

|

|

Inventories, net

|

|

|

233,518

|

|

|

|

42,696

|

|

|

Operating lease liability

|

|

|

8,179

|

|

|

|

-

|

|

|

Due to related parties

|

|

|

-

|

|

|

|

10,282

|

|

|

Advances to suppliers

|

|

|

(43,882

|

)

|

|

|

(237,027

|

)

|

|

Prepayments and other current assets

|

|

|

(54,763

|

)

|

|

|

285,609

|

|

|

Accounts payable

|

|

|

(280,293

|

)

|

|

|

(2,569,050

|

)

|

|

Accounts payable - related parties

|

|

|

-

|

|

|

|

(6,827

|

)

|

|

Interest payable

|

|

|

518,559

|

|

|

|

96,855

|

|

|

Notes payable

|

|

|

-

|

|

|

|

(1,095,977

|

)

|

|

Taxes payable

|

|

|

143

|

|

|

|

5,584

|

|

|

Advances from customers

|

|

|

31,752

|

|

|

|

535,476

|

|

|

Advances from customers - related party

|

|

|

-

|

|

|

|

150,832

|

|

|

Other current liabilities

|

|

|

90,675

|

|

|

|

(34,104

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH USED IN OPERATING ACTIVITIES

|

|

$

|

(811,153

|

)

|

|

$

|

(4,716,406

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Purchases of short-term investments

|

|

|

(4,500,000

|

)

|

|

|

-

|

|

|

Proceeds from sales of short-term investments

|

|

|

26,826

|

|

|

|

-

|

|

|

Payments to acquire property, plant and equipment

|

|

|

(9,244

|

)

|

|

|

(28,751

|

)

|

|

Proceeds from disposal of property, plant and equipment

|

|

|

-

|

|

|

|

1,327

|

|

|

Loans to related parties

|

|

|

-

|

|

|

|

(7,370

|

)

|

|

Repayment from related parties

|

|

|

-

|

|

|

|

1,282

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES

|

|

$

|

(4,482,418

|

)

|

|

$

|

(33,512

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common shares

|

|

|

-

|

|

|

|

1,000,000

|

|

|

Proceeds from short term loans

|

|

|

104,798

|

|

|

|

1,046,275

|

|

|

Repayments of short term loans

|

|

|

(4,149

|

)

|

|

|

(1,350,304

|

)

|

|

Proceeds from short term loans - related parties

|

|

|

49,350

|

|

|

|

4,791,403

|

|

|

Repayments of short term loans - related parties

|

|

|

-

|

|

|

|

(190,070

|

)

|

|

|

|

|

|

|

|

|

|

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

|

$

|

149,999

|

|

|

$

|

5,297,304

|

|

|

|

|

|

|

|

|

|

|

|

|

Effects on changes in foreign exchange rate

|

|

|

9,389

|

|

|

|

(98,364

|

)

|

|

Net change in cash, cash equivalents, and restricted cash

|

|

|

(5,134,183

|

)

|

|

|

449,022

|

|

|

Cash, cash equivalents, and restricted cash - beginning of the period

|

|

|

6,504,578

|

|

|

|

2,700,505

|

|

|

Cash, cash equivalents, and restricted cash - end of the period

|

|

$

|

1,370,395

|

|

|

$

|

3,149,527

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

37,640

|

|

|

$

|

419,809

|

|

|

Income taxes paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash Investing and Financing Activities

|

|

|

|

|

|

|

|

|

|

Accrued interest added to short term loans - related parties

|

|

$

|

-

|

|

|

$

|

126,697

|

|

|

Operating expenses paid by related parties

|

|

$

|

-

|

|

|

$

|

5,990

|

|

|

Liabilities assumed in connection with purchase of property, plant and equipment

|

|

$

|

7,023

|

|

|

$

|

87,421

|

|

|

Receivables from related parties settled with payables to related parties

|

|

$

|

-

|

|

|

$

|

26,976

|

|

|

Liabilities settled with sale of property, plant and equipment

|

|

$

|

65,422

|

|

|

$

|

-

|

|

|

Notes payable reclassified to short term loans

|

|

$

|

899,693

|

|

|

$

|

-

|

|

|

Liabilities assumed in connection with purchase of short-term investments

|

|

$

|

347,107

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

499,276

|

|

|

$

|

1,957,952

|

|

|

Restricted cash

|

|

$

|

871,119

|

|

|

$

|

1,191,575

|

|

|

Total cash, cash equivalents, and restricted cash

|

|

$

|

1,370,395

|

|

|

$

|

3,149,527

|

|

First Half 2020 Financial Results

Revenues

Historically, the Company

generated its revenues from product sales, mainly including sales for pet chews, dried pet snacks and wet canned pet foods in overseas

markets, domestic markets and through its e-commerce platform. Revenue consists of the invoiced value for the sales, net of value-added

tax (“VAT”), business tax, and applicable local government levies. For the first half of 2020, total revenues decreased

by $7.76 million, or 96.5%, to $0.28 million from $8.04 million as compared with the same period of the prior year. The decrease

in total revenues was mainly due to reduced sales orders when we temporarily closed our facilities in response to the outbreak

and spread of the COVID-19 pandemic, as discussed in details below:

Beginning in late 2019,

there were reports of the COVID-19 (coronavirus) outbreak originating in China, prompting government-imposed quarantines, cessation

of certain travel and business closures. On March 11, 2020, the World Health Organization categorized it as a pandemic. To contain

the spread of the COVID-19, the government took stringent measures, including restricting access to provinces and cities, reducing

gathering events, and postponing non-essential business activities. Following this outbreak and other operational difficulties,

the Company temporarily shut down its main office and its remaining production facilities until May 2020. Following the temporary

cessation of its production capabilities and the negative impact of the COVID-19 pandemic, the Company continued to incur significant

delays, reductions in revenue. In addition, due to the COVID-19 outbreak, some of our customers or suppliers experience financial

distress, delay or default on their payments, reduce the scale of their business, or suffer disruptions in their business due to

the outbreak. Any increased difficulty in collecting accounts receivable, delayed raw materials supply, bankruptcy of small and

medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact our results

of operations. We resumed our work under the guidance and support of the government in May 2020.

|

|

|

For the Six Months Ended June 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Y/Y Change

|

|

|

|

|

Revenues

($’000)

|

|

|

% of

Total

|

|

|

Revenues

($’000)

|

|

|

% of

Total

|

|

|

Amount

($’000)

|

|

|

%

|

|

|

Overseas

|

|

$

|

61

|

|

|

|

21.60

|

%

|

|

$

|

6,278

|

|

|

|

78.10

|

%

|

|

$

|

(6,217

|

)

|

|

|

-99

|

%

|

|

Domestic

|

|

|

222

|

|

|

|

78.40

|

%

|

|

|

1,644

|

|

|

|

20.40

|

%

|

|

|

(1,423

|

)

|

|

|

-86.60

|

%

|

|

E-commerce

|

|

|

-

|

|

|

|

-

|

%

|

|

|

153

|

|

|

|

1.90

|

%

|

|

|

(153

|

)

|

|

|

-100

|

%

|

|

less: sales tax and additional surcharge

|

|

|

-

|

|

|

|

-

|

%

|

|

|

(34

|

)

|

|

|

-0.40

|

%

|

|

|

34

|

|

|

|

100

|

%

|

|

Total

|

|

$

|

283

|

|

|

|

100.00%

|

|

|

$

|

8,041

|

|

|

|

100.00%

|

|

|

$

|

(7,759

|

)

|

|

|

-96.50

|

%

|

Overseas sales decreased

by $6.22 million, or 99%, to $0.06 million for the first half of 2020 from $6.28 million for the same period of the prior year.

Domestic sales decreased by $1.42 million, or 86.6%, to $0.22 million for the first half of 2020 from $1.64 million for the same

period of the prior year. Sales from the e-commerce channel decreased by $0.15 million, or 100%, to $0 million for the first half

of 2020 from $0.15 million for the same period of the prior year.

Cost of revenues

Cost of revenues consists

primarily of raw materials, labor and factory overhead expenses necessary to manufacture finished goods. Cost of revenues decreased

by $7 million, or 95.2%, to $0.35 million for the first half of 2020 from $7.35 million for the same period of the prior year.

The decrease in cost of revenues was in line with the decrease in revenue. However, even when we temporarily closed our facilities

until May 2020, we still carried certain fixed overhead costs, which led to higher than our total revenue cost of revenues. Cost

of revenues was 125.0% for the first half of 2020, compared to 91.4% for the same period of the prior year.

Gross profit (loss) and gross profit

(loss) margin

Gross loss was $0.07

million for the first half of 2020, compared to gross profit of $0.69 million for the same period of the prior year. Gross loss

margin was negative 25% for the first half of 2020, compared to gross profit margin of 8.6% for the same period of the prior year.

The decrease of gross margin is mainly due to the substantial decrease of production orders and the increase of fixed cost allocation

thereafter.

Operating expense

Operating expense consists

of selling expense, general and administrative expense and research and development expense.

Selling expense decreased

by $0.6 million, or 90.4%, to $0.06 million for the first half of 2020 from $0.66 million for the same period of the prior year.

The decrease in selling expense was mainly due to decrease in revenue. Accordingly, distribution costs, sales promotion and marketing

campaign related costs, and sales commissions decreased in the first half of 2020 as compared to the same period of last year.

General and administrative

expense decreased by $0.43 million, or 33.9%, to $0.84 million for the first half of 2020 from $1.26 million for the same period

of the prior year. The decrease in general and administrative expense was mainly attributable to the decrease in payroll expense

due to the reduction of administrative employees and cost control strategy during COVID-19 pandemic.

As a result, total

operating expenses decreased by $1.03 million, or 53.5%, to $0.90 million for the first half of 2020 from $1.93 million for the

same period of the prior year.

Operating loss

Loss from operations

was $0.97 million for the first half of 2020, compared to $1.24 million for the same period of the prior year. The decrease in

loss from operations was the combined result of declined business scale during COVID-19 and decrease in operating expenses.

Investment income

Affected by COVID-19,

the Company was unable to operate normally. In order to improve capital utilization, the Company invested idle funds in the stock

markets. During the first half of 2020, the investments generated a total of $0.88 million net returns.

Net loss and loss per share

Net loss was $0.60

million, or loss per share of $0.01, for the first half of 2020, compared to net loss of $1.67 million, or loss per share of $0.14,

for the same period of the prior year.

Financial Conditions

As of June 30, 2020,

the Company had cash, cash equivalents and restricted cash of $1.37 million, compared to $6.50 million at December 31, 2019. Accounts

receivable and inventories were $0.05 million and $0.23 million, respectively, as of June 30, 2020, compared to $0.02 million and

$0.47 million, respectively, at the end of 2019. Total working capital deficit was $7.44 million as of June 30, 2020, compared

to $7.27 million at the end of 2019.

Net cash used in operating

activities was $0.81 million for the first half of 2020, compared to $4.72 million for the same period of the prior year. Net cash

used in investing activities was $4.48 million for the first half of 2020, compared to $0.03 million for the same period of the

prior year. Net cash provided by financing activities was $0.15 million for the first half of 2020, compared to $5.30 million for

the same period of the prior year.

Going Concern

Impact of COVID-19

Pandemic on the Company’s operations

In light of the current

circumstances and available information, we estimate that for the year of 2020, our revenues could be significant lower as compared

to the same period of last year. At the same time, our employee salaries and benefits have decreased due to company restructuring

started November 2019. We expect that our net loss could be lower as compared to the same period of last year. Our assets primarily

include cash, restricted cash, short-term investments, accounts receivable, inventory, prepaid expense and other current assets,

property, plant and equipment, intangible assets and operating lease right-pf-use assets. Although we resumed our business activities

since May 2020, the extent of the impact of COVID-19 on the Company’s results of operations and financial condition for the

remaining months in our fiscal year 2020 will depend on future developments, including the duration and spread of the outbreak

and the impact on the Company’s overseas customers and COVID-19 control in all the countries including China, which are still

uncertain and cannot be reasonably estimated at this point of time. The Company’s revenues remain negligible following the

gradual resumption of its operations in May 2020. Moreover, the Company expects that the impact of the COVID-19 outbreak on the

domestic and global economic environment will have a material adverse effect on the demand for its products and its ability to

generate revenue going forward. Any and all of the foregoing could have a material adverse impact on its business, operating results

and financial condition. Due to the effects of the outbreak of COVID-19 discussed above, to the extent we experience a further

adverse operating environment or incur unanticipated capital expenditure requirements, or if we decide to accelerate our growth,

then additional financing may be required. Such financing may include the use of additional debt or the sale of additional equity

securities. We cannot guarantee, however, that additional financing, if required, would be available at all or on favorable terms.

Notice

Rounding amounts and

percentages: Certain amounts and percentages included in this press release have been rounded for ease of presentation. Percentage

figures included in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis

of such amounts prior to rounding. For this reason, certain percentage amounts in this press release may vary from those obtained

by performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear

in this press release may not sum due to rounding.

Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

Dated: November 25, 2020

|

|

|

|

|

|

|

|

|

TDH Holdings, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Dandan Liu

|

|

|

Name:

|

Dandan Liu

|

|

|

Title:

|

Chief Executive Officer

|

9

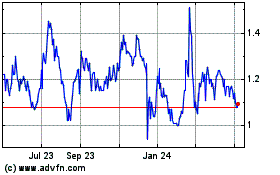

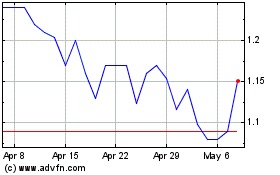

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Apr 2023 to Apr 2024