Current Report Filing (8-k)

August 21 2020 - 4:56PM

Edgar (US Regulatory)

0001013871

false

0001013871

2020-08-20

2020-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13

or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 20, 2020

NRG ENERGY, INC.

(Exact name of Registrant as specified in

its charter)

Delaware

(State or other jurisdiction of

incorporation)

|

|

001-15891

(Commission File Number)

|

|

41-1724239

(IRS Employer Identification

No.)

|

804

Carnegie Center, Princeton, New Jersey 08540

(Address of principal executive offices, including zip code)

(609)

524-4500

(Registrant’s telephone number, including area code)

N/A

(Former name

or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, par value $0.01

|

|

NRG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On August 20, 2020,

NRG Energy, Inc. (“NRG”), as borrower, and certain subsidiaries of NRG, as guarantors, entered into the Fifth Amendment

to Credit Agreement and Third Amendment to Collateral Trust Agreement (the “Fifth Amendment”) with Citicorp

North America, Inc., as administrative agent and as collateral agent, Deutsche Bank Trust Company Americas, as collateral trustee,

and certain other lenders and financial institutions, which amended NRG’s Second Amended and Restated Credit Agreement, dated

as of June 30, 2016 (as amended, the “Amended Credit Agreement”), to (i) increase the existing revolving commitments

in an aggregate amount of $779,100,000 and (ii) provide for a new tranche of revolving commitments in an aggregate amount of $258,200,000

with a maturity date that is 30 months after the Acquisition Closing Date (as defined below). The maturity date of the new revolving

tranche of commitments may, upon request by NRG, at the option of each applicable lender under the tranche, be extended by a further

12 months, but not beyond May 28, 2024, which is the maturity date of the existing and increased commitments. Other than with respect

to the maturity date, the terms of all revolving commitments and loans made pursuant thereto are identical. The increase in the

existing commitments, and the commitments with respect to the new tranche, are effective on the date of the Fifth Amendment but

will only become available upon the date of closing (the “Acquisition Closing Date”) of the acquisition by NRG of Centrica

plc’s North American energy supply, services and trading business, Direct Energy, under the terms of the previously disclosed

Purchase Agreement entered into on July 24, 2020. Upon the Acquisition Closing Date, total revolving commitments available, subject

to usage, under the Amended Credit Agreement will equal $3,637,300,000. In addition, the Fifth Amendment includes changes to, among

other things, (i) permit the borrowing of up to the full amount of the revolving commitments in Canadian dollars, (ii) increase

the swingline facility from $50,000,000 to $100,000,000 and provide a $10,000,000 swingline facility in Canadian dollars, (iii)

increase the credit facilities lien basket from the greater of $6 billion and 30% of total assets to the greater of $10 billion

and 30% of total assets, (iv) increase the credit facilities debt basket from $6 billion to $10 billion, (v) increase the basket

for securitization indebtedness from $750,000,000 to $1,700,000,000, (v) provide an additional indebtedness basket equal to $600,000,000

for certain liquidity facilities and (vi) make certain other changes to the existing covenants and other provisions. The Fifth

Amendment also amended NRG’s Second Amended and Restated Collateral Trust Agreement, dated as of July 1, 2011, to among other

things, provide greater flexibility to secure commodity and other hedging arrangements.

The foregoing description

of the Fifth Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Fifth

Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

|

The disclosures under

Item 1.01 of this Current Report on Form 8-K are also responsive to Item 2.03 of this report and are incorporated by reference

into this Item 2.03.

On August 20, 2020,

NRG announced that its proposed acquisition of Direct Energy, a North American business owned by Centrica plc (“Centrica”),

pursuant to the previously disclosed Purchase Agreement, dated as of July 24, 2020, among NRG, Centrica and certain subsidiaries

of Centrica, was approved on August 20, 2020 by the requisite vote of Centrica’s shareholders at a general meeting of its

shareholders.

Closing for the previously

announced transaction (the “Transaction”) is expected by year end 2020. The transaction remains subject to other customary

closing conditions, consents and regulatory approvals, including approval by the Federal Energy Regulatory Commission (FERC). In

addition, NRG has submitted the transaction to the U.S. Department of Justice and the Federal Trade Commission under the Hart-Scott-Rodino

Act, and the Commissioner of Competition under the Canadian Competition Act.

Forward-Looking Statements

This

Current Report on Form 8-K contains “forward-looking statements” within the meaning of the federal securities laws.

Such statements generally include the words “believes,” “plans,” “intends,” “targets,”

“will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,”

or similar expressions. Forward-looking statements include, without limitation, statements about the Transaction and the anticipated

timing thereof and NRG’s ability to satisfy the conditions with respect to such acquisition;

NRG’s indebtedness, capital structure, plans, expectations, objectives and other future events, and views of economic

and market conditions. NRG cautions that these statements are based on current

estimates of future performance and are highly dependent upon a variety of factors, which could cause actual results to differ

from these estimates. Among other risks and factors, NRG’s results are subject to general economic conditions, variation

in demand from customers, the impact of geopolitical activity on the economy, continued market acceptance of NRG’s new product

introductions, uncertainties with respect to the timing and terms of any disposition (including the timing of the Transaction),

the successful integration of acquisitions, restructurings, operating margin risk due to competitive pricing and operating efficiencies,

supply chain risk, material and labor cost increases, tax reform, foreign currency fluctuations and interest rate risk. See NRG’s

Form 10-K for the fiscal year ended December 31, 2019 and Form 10-Qs for the quarters ended March 31, 2020 and June 30, 2020 filed

with the Securities and Exchange Commission for further information regarding risk factors. NRG disclaims any obligation to publicly

update or revise any forward-looking statements as a result of new information, future events or any other reason.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

|

|

|

|

10.1

|

|

Fifth Amendment to Credit Agreement and Third Amendment to Collateral Trust Agreement, dated as of August 20, 2020, by and among NRG Energy, Inc., its subsidiaries parties thereto, the lenders party thereto, Citicorp North America, Inc., as administrative agent and collateral agent, and Deutsche Bank Trust Company Americas, as collateral trustee.

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the iXBRL document contained in Exhibit 101.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: August 21, 2020

|

|

NRG Energy, Inc.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ Christine A. Zoino

|

|

|

|

Christine A. Zoino

|

|

|

|

Corporate Secretary

|

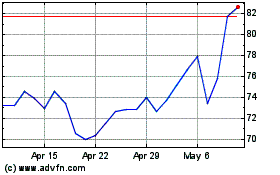

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

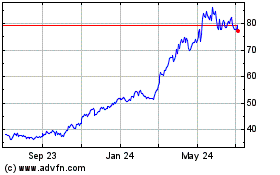

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024