Current Report Filing (8-k)

June 30 2020 - 4:19PM

Edgar (US Regulatory)

false0000895126New York Stock Exchange

0000895126

2020-06-29

2020-06-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 29, 2020

|

|

|

|

|

|

|

|

|

|

|

|

CHESAPEAKE ENERGY CORPORATION

|

|

(Exact name of Registrant as specified in its Charter)

|

|

Oklahoma

|

|

1-13726

|

|

73-1395733

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

|

6100 North Western Avenue

|

Oklahoma City

|

OK

|

|

73118

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

(405)

|

848-8000

|

|

|

|

|

|

(Registrant’s telephone number, including area code)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

CHKAQ*

|

New York Stock Exchange*

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

|

|

|

Emerging growth company

|

|

☐

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

☐

|

|

|

|

|

|

* On June 28, 2020, the New York Stock Exchange (“NYSE”) notified Chesapeake Energy Corporation (“Chesapeake”) that it would apply to the Securities and Exchange Commission (the “SEC”) to delist the common stock of Chesapeake upon completion of all applicable procedures. The delisting will be effective 10 days after a Form 25 is filed with the SEC by the NYSE. The deregistration of the common stock under section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) will be effective 90 days, or such shorter period as the SEC may determine, after filing of the Form 25. Upon deregistration of the common stock under Section 12(b) of the Exchange Act, the common stock will remain registered under Section 12(g) of the Exchange Act.

|

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on June 28, 2020, Chesapeake Energy Corporation (“Chesapeake”) and certain of its subsidiaries (together with Chesapeake, the “Company”), filed voluntary petitions for reorganization under Chapter 11 of the Bankruptcy Code (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). On June 29, 2020, Chesapeake was notified by the New York Stock Exchange (the “NYSE”) that, as a result of the Chapter 11 Cases, and in accordance with Section 802.01D of the NYSE Listed Company Manual, the NYSE has determined to commence proceedings to delist Chesapeake’s common stock (the “Common Stock”) from the NYSE. The NYSE also indefinitely suspended trading of Chesapeake’s Common Stock on June 29, 2020. The NYSE will apply to the Securities and Exchange Commission (the “SEC”) to delist the Common Stock upon completion of all applicable procedures.

Chesapeake does not intend to appeal the determination and, therefore, it is expected that the Common Stock will be delisted. Trading of Chesapeake’s Common Stock has commenced, effective as of June 30, 2020, on the OTC Pink Market or “pink sheets” market under the symbol “CHKAQ”. The transition does not affect Chesapeake’s operations or business and does not change its reporting requirements under SEC rules.

Item 3.03 Material Modification of Rights of Security Holders.

The information set forth below in Item 8.01 of this Form 8-K regarding the Order (I) Approving Notification and Hearing Procedures for Certain Transfers of Common Stock and Preferred Stock, and (II) Granting Related Relief, is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

In connection with Chesapeake’s receipt of the notification from NYSE described in Item 3.01 above, Chesapeake issued a press release on June 29, 2020, a copy of which is attached to this Form 8-K as Exhibit 99.1.

The information included in this Form 8-K under Item 7.01 and Exhibit 99.1 are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference into a filing under the Exchange Act or the Securities Act of 1933, as amended.

Item 8.01 Other Events.

As previously reported, on June 28, 2020, the Company filed the Chapter 11 Cases in the Bankruptcy Court. The Chapter 11 Cases are being jointly administered under the caption In re Chesapeake Energy Corporation, Case No. 20-33233 (DRJ).

The Company received certain “first day relief” from the Bankruptcy Court that will allow the Company to continue to operate in the ordinary course of business, including access to a $925 million senior secured superpriority debtor-in-possession credit facility and the consensual use of cash collateral to fund the Company’s normal course operations.

In addition, on June 29, 2020, the Bankruptcy Court entered the Order (I) Approving Notification and Hearing Procedures for Certain Transfers of Common Stock and Preferred Stock, and (II) Granting Related Relief Docket No. 144 (the “Order”). The Order sets forth the procedures (including notice requirements) that certain shareholders and potential shareholders must comply with regarding transfers of the Company’s Common Stock and Preferred Stock (as defined in the Order), as well as certain obligations with respect to notifying the Company with respect to current share ownership (“Procedures”). The terms and conditions of the Procedures were immediately effective and enforceable upon entry of the Order by the Bankruptcy Court.

Any actions in violation of the Procedures (including the notice requirements) are null and void ab initio, and the person or entity making such a transfer will be required to take remedial actions specified by the Company to appropriately reflect that such transfer of the Company’s Common Stock or Preferred Stock is null and void ab initio.

The foregoing description of the Order is qualified in its entirety by reference to the Order, filed as Exhibit 99.2 hereto and incorporated herein by reference.

Item 9.01 Exhibits.

(d)

|

|

|

|

|

|

|

Exhibit No.

|

|

Document Description

|

|

|

|

Chesapeake Energy Corporation press release dated June 29, 2020.

|

|

|

|

Order (I) Approving Notification and Hearing Procedures for Certain Transfers of Common Stock and Preferred Stock, and (II) Granting Related Relief.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CHESAPEAKE ENERGY CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ JAMES R. WEBB

|

|

|

James R. Webb

|

|

|

Executive Vice President — General Counsel and Corporate Secretary

|

Date: June 30, 2020

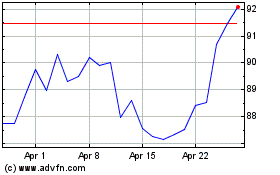

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

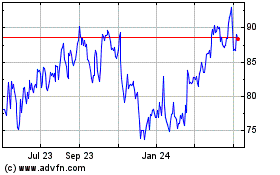

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024