UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of January 2020

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as

specified in its charter)

National Steel Company

(Translation of registrant’s

name into English)

Av. Brigadeiro Faria Lima 3400, 20th Floor

São Paulo, SP, Brazil

04538-132

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F

_______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is

also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL

Corporate Taxpayer ID (CNPJ/MF): 33.042.730/0001-04

Company Registry (NIRE): 35300396090

Publicly-held Company

CERTAIN UPDATES TO 2018 ANNUAL REPORT

This report on Form 6-K presents certain updates to Companhia Siderúrgica Nacional’s (“CSN,” “we,” “us” or “our”) Annual Report on Form 20-F for its fiscal year ended December 31, 2018 (“2018 Annual Report”), as filed with the U.S. Securities and Exchange Commission and amended on April 5, 2019.

Exhibit A: Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Nine Months Ended September 30, 2019

São Paulo, January 17, 2020

COMPANHIA SIDERÚRGICA NACIONAL

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

Exhibit A

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition, results of operations and legal proceedings should be read in conjunction with our unaudited interim consolidated financial information as of September 30, 2019 and for the nine months ended September 30, 2018 and 2019, as furnished to the U.S. Securities and Exchange Commission on November 26, 2019, the information presented under the sections entitled “Item 3. Key Information—Selected Financial Data,” “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk” in our 2018 Annual Report, which includes our audited consolidated financial statements as of December 31, 2017 and 2018 and for the years ended December 31, 2016, 2017 and 2018.

The following discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those set forth under the section entitled “Item 3. Key Information—Risk Factors” in our 2018 Annual Report.

Consolidated Results of Operations

The following table presents certain financial information with respect to our operating results for the nine months ended September 30, 2018 and 2019:

|

|

Nine months ended September 30,

|

|

|

|

|

|

|

Income Statement Data

|

(in millions of R$, except per share data)

|

(in millions of US$, except per share data)

|

|

Net operating revenues

|

16,918.0

|

18,912.6

|

4,541.5

|

|

Cost of products sold

|

(12,107.2)

|

(12,834.1)

|

(3,081.9)

|

|

Gross profit

|

4,810.8

|

6,078.5

|

1,459.6

|

|

Operating expenses

|

|

|

|

|

Selling

|

(1,497.3)

|

(1,429.6)

|

(343.3)

|

|

General and administrative

|

(331.0)

|

(383.4)

|

(92.1)

|

|

Equity in results of affiliated companies

|

96.0

|

119.0

|

28.6

|

|

Other expenses

|

(710.8)

|

(1,636.6)

|

(393.0)

|

|

Other income

|

|

|

|

|

Total

|

784.8

|

(3,494.5)

|

(839.1)

|

|

Operating income

|

5,595.6

|

2,584.0

|

620.5

|

|

Non-operating income (expenses), net

|

|

|

|

|

Financial income

|

426.7

|

311.0

|

74.7

|

|

Financial expenses

|

(2,432.7)

|

(2,143.8)

|

(514.8)

|

|

Income before taxes

|

3,589.6

|

751.1

|

180.4

|

|

Income tax

|

(161.2)

|

359.4

|

86.3

|

|

Net income (loss) from continuing operations

|

3,428.3

|

1,110.6

|

266.7

|

|

Net income (loss) for the period

|

3,428.3

|

1,110.6

|

266.7

|

|

Net income (loss) attributable to noncontrolling interest

|

74.5

|

366.0

|

87.9

|

|

Net income (loss) attributable to Companhia Siderúrgica Nacional shareholders

|

3,353.8

|

744.6

|

178.8

|

|

Basic earnings per common share

|

2.45474

|

0.53949

|

0.12954

|

|

Diluted earnings per common share

|

2.45474

|

0.53949

|

0.12954

|

_________________

(1) Translated solely for the convenience of the reader at the rate of R$4.1644 to US$1.00, which was the U.S. dollar selling rate as reported by the Central Bank as of September 30, 2019.

Nine Months Ended September 30, 2018 Compared to Nine Months Ended September 30, 2019

Our consolidated results for the nine months ended September 30, 2018 and 2019 by business segment are presented below:

|

|

Nine months ended September 30, 2018

|

|

Consolidated Results

|

|

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

Net operating revenues

|

11,866.4

|

4,142.1

|

194.3

|

1,107.7

|

307.8

|

443.0

|

(1,143.2)

|

16,918.0

|

|

Domestic market

|

7,610.7

|

672.2

|

194.3

|

1,107.7

|

307.8

|

443.0

|

(1,950.8)

|

8,384.7

|

|

Export market

|

4,255.7

|

3,469.9

|

-

|

-

|

-

|

-

|

807.6

|

8,553.2

|

|

Cost of products sold..

|

(9,556.1)

|

(2,531.6)

|

(141.8)

|

(774.1)

|

(209.4)

|

(395.3)

|

1,501.1

|

(12,107.2)

|

|

Gross profit

|

2,310.3

|

1,610.5

|

52.5

|

333.6

|

98.3

|

47.7

|

357.9

|

4,810.8

|

|

General and administrative expenses

|

(718.7)

|

(102.8)

|

(26.8)

|

(72.8)

|

(21.0)

|

(64.7)

|

(821.5)

|

(1,828.3)

|

|

Depreciation

|

459.5

|

278.2

|

14.7

|

193.1

|

12.9

|

88.7

|

(156.9)

|

890.3

|

|

Proportionate EBITDA of joint ventures

|

-

|

-

|

-

|

-

|

-

|

-

|

415.5

|

415.5

|

|

Adjusted EBITDA(1)

|

2,051.1

|

1,785.8

|

40.4

|

453.9

|

90.3

|

71.7

|

(205.0)

|

4,288.2

|

|

|

|

|

|

|

|

|

Nine months ended September 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

Net operating revenues

|

10,599.6

|

7,505.9

|

185.0

|

1,028.9

|

221.9

|

426,5

|

(1,055.2)

|

18,912.6

|

|

Domestic market

|

7,498.7

|

685.1

|

185.0

|

1,028.9

|

221.9

|

426.5

|

(1,856.0)

|

8,190.0

|

|

Export market

|

3,101.0

|

6,820.8

|

-

|

-

|

-

|

-

|

800.8

|

10,722.6

|

|

Cost of products sold.

|

(9,791.5)

|

(3,073.5)

|

(133,9)

|

(770.0)

|

(183.0)

|

(466.6)

|

1,584.4

|

(12,834.1)

|

|

Gross profit

|

808.1

|

4,432.4

|

51.0

|

258.9

|

38.8

|

(40.1)

|

529.2

|

6,078.5

|

|

General and administrative expenses

|

(605.5)

|

(143,0)

|

(26.0)

|

(78.1)

|

(21.6)

|

(67.1)

|

(871.7)

|

(1,813.0)

|

|

Depreciation

|

471.7

|

342.2

|

23.4

|

287.7

|

13.1

|

96.6

|

(244.7)

|

989.9

|

|

Proportionate EBITDA of joint ventures

|

-

|

-

|

-

|

-

|

-

|

-

|

415.6

|

415.6

|

|

Adjusted EBITDA(1)

|

674.3

|

4,631.6

|

48.5

|

468.6

|

30.3

|

(10.7)

|

(171.6)

|

5,671.1

|

_________________

(1) Adjusted EBITDA is a measurement which helps us to assess the performance of our operations and our capacity to generate recurring operating cash, consisting of net income (loss) for the year less net financial income (expenses), income tax and social contribution, depreciation and amortization, equity in results of affiliated companies, results of discontinued operations and other operating income (expenses), plus the proportionate EBITDA of joint ventures. Although Adjusted EBITDA is an indicator used for performance measurement purposes, it is not a measurement recognized under IFRS. Therefore, it has no standard definition and may not be comparable with measurements using similar names provided by other companies. For the reconciliation of net income to EBITDA and Adjusted EBITDA, see note 25 to our unaudited interim consolidated financial information as of September 30, 2019 and for the nine months ended September 30, 2018 and 2019, incorporated by reference in this offering memorandum.

Net Operating Revenues

Net operating revenues increased R$1,994.6 million, or 11.8%, from R$16,918.0 million in the nine months ended September 30, 2018 to R$18,912.6 million in the nine months ended September 30, 2019, due to an increase in sales volume and in prices.

Net revenues of exports and sales abroad increased R$2,169.4 million, or 25.4%, from R$8,553.2 million in the nine months ended September 30, 2018 to R$10.722.6 million in the nine months ended September 30, 2019, driven by higher realized iron ore and steel prices and sales volume, which effect was partially offset by a decrease in net domestic revenues of R$194.7 million, or 2.3%, from R$8,384.7 million in the nine months ended September 30, 2018 to R$8,190.0 million in the nine months ended September 30, 2019.

Steel

Steel net operating revenues decreased R$1,266.8 million, or 10.7%, from R$11,866.4 million in the nine months ended September 30, 2018 to R$10.599.6 million in the nine months ended September 30, 2019. Sales

volume decreased 12.4% from 3.9 million tons in the nine months ended September 30, 2018 to 3.4 million tons in the nine months ended September 30, 2019 and prices also decreased. Steel net domestic revenues decreased R$112 million, or 1.5%, from R$7,610.7 million in the nine months ended September 30, 2018 to R$7,498.7 million in the nine months ended September 30, 2019. Steel net revenues of exports decreased R$1,154.7 million, or 27.1%, from R$4,255.7 million in the nine months ended September 30, 2018 to R$3,101.0 million in the nine months ended September 30, 2019.

Mining

Mining net operating revenues increased R$3,363.8 million, or 81.2%, from R$4,142.1 million in the nine months ended September 30, 2018 to R$7,505.9 million in the nine months ended September 30, 2019, due to an increase in iron ore prices and an increase of 13.3% in sales volume from 24.9 million tons in the nine months ended September 30, 2018 to 28.2 million tons in the nine months ended September 30, 2019.

In the nine months ended September 30, 2019, iron ore production reached 25,167.1 million tons, which represented a 22.8% increase over the same period in 2018 and our highest iron ore production volume achieved in a nine-month period.

Logistics

In the nine months ended September 30, 2018, net operating revenues from railway logistics were R$1,107.7 million and net operating revenues from port logistics were R$194.3 million, while in the nine months ended September 30, 2019, net operating revenues from railway logistics were R$1,028.9 million and net operating revenues from port logistics were R$185.0 million. In the nine months ended September 30, 2019, port logistics handled 193,000 tons of steel products, 1,000 tons of general cargo, 41,000 containers and 181,000 tons of bulk.

Energy

Our net operating revenues from the energy segment decreased R$85.9 million, or 27.9%, from R$307.8 million in the nine months ended September 30, 2018 to R$221.9 million in the nine months ended September 30, 2019, mainly due to the decrease in electricity consumption in Brazil, according to the Energy Research Company, or EPE, and a decrease in the volume of traded energy.

Cost of Products Sold

Cost of products sold increased R$726.9 million, or 6.0%, from R$12,107.2 million in the nine months ended September 30, 2018 to R$12,834.1 million in the nine months ended September 30, 2019, mainly due to operating costs of blast furnace no.3 at Volta Redonda and increased sales volume in the mining segment.

Steel

Steel costs of products sold increased R$235.4 million, or 2.5%, from R$9,556.1 million in the nine months ended September 30, 2018 to R$9,791.5 million in the nine months ended September 30, 2019, mainly due to operating costs of blast furnace no.3 at Volta Redonda.

|

|

Nine months ended September 30,

|

|

|

|

|

|

|

Steel Production Cost

(Parent Company)

|

(R$ million)

|

(R$/ ton)

|

(R$ million)

|

(R$/ ton)

|

(R$ million)

|

(R$/ ton)

|

|

Raw materials

|

3,907

|

1,319

|

5,180

|

1,894

|

1,273

|

575

|

|

Iron ore

|

602

|

203

|

613

|

224

|

11

|

21

|

|

Coal

|

1,138

|

384

|

900

|

329

|

(238)

|

(55)

|

|

Coke

|

896

|

303

|

1,008

|

368

|

112

|

65

|

|

Coils

|

-

|

-

|

440

|

161

|

440

|

161

|

|

Metals

|

594

|

200

|

555

|

203

|

(39)

|

3

|

|

Outsourced slabs

|

15

|

5

|

975

|

357

|

960

|

352

|

|

Pellets

|

355

|

120

|

394

|

144

|

39

|

24

|

|

Scrap

|

141

|

48

|

164

|

60

|

23

|

12

|

|

Other(1)

|

166

|

56

|

131

|

48

|

(35)

|

(8)

|

|

Labor

|

676

|

228

|

729

|

266

|

53

|

38

|

|

Other production costs

|

1,891

|

639

|

1,944

|

711

|

53

|

72

|

|

Energy/fuel

|

905

|

306

|

1,070

|

391

|

165

|

85

|

|

Services and maintenance

|

390

|

132

|

242

|

88

|

(148)

|

(44)

|

|

Tools and supplies

|

260

|

88

|

271

|

99

|

11

|

11

|

|

Depreciation

|

295

|

99

|

310

|

113

|

15

|

14

|

|

Other

|

|

|

|

|

|

|

|

Total

|

6,474

|

2,187

|

7,853

|

2,871

|

1,379

|

684

|

Mining

Our mining costs of products sold increased R$541.9 million, or 21.4%, from R$2,531.6 million in the nine months ended September 30, 2018 to R$3,073.5 million in the nine months ended September 30, 2019, mainly due to an increase in iron ore sales.

Logistics

Cost of services attributable to our logistics segment decreased R$12.0 million, or 1.3%, from R$915.9 million in the nine months ended September 30, 2018 to R$903.9 million in the nine months ended September 30, 2019, mainly due to adjustments in fuel prices.

Energy

Cost of products sold attributable to our energy segment decreased R$26.4 million, or 12.6%, from R$209.4 million in the nine months ended September 30, 2018 to R$183.0 million in the nine months ended September 30, 2019.

Gross Profit

Gross profit increased R$1,267.7 million, or 26.4%, from R$4,810.8 million in the nine months ended September 30, 2018 to R$6,078.5 million in the nine months ended September 30, 2019, due to an increase of R$1,994.6 million in net revenues, which was partially offset by an increase of R$726.9 million in cost of products sold, as discussed above.

Selling, General and Administrative Expenses

Selling, general and administrative expenses decreased R$15.3 million, or 0.8%, from R$1,828.3 million in the nine months ended September 30, 2018 to R$1,813.0 million in the nine months ended September 30, 2019. Selling expenses decreased R$67.7 million, or 4.5%, from R$1,497.3 million in the nine months ended September 30, 2018

to R$1,429.6 million in the nine months ended September 30, 2019, mainly due to a decrease in freight costs for shipments of our products. General and administrative expenses increased R$52.4 million, or 15.8%, from R$331.0 million in the nine months ended September 30, 2018 to R$383.4 million in the nine months ended September 30, 2019, mainly due to an increase in costs related to employees and third-party service providers.

Other Operating Income (Expenses)

Other operating income (expenses) decreased R$4,317.6 million from a net operating income of R$2,517.1 million in the nine months ended September 30, 2018 to a net operating expense of R$1,800.5 million in the nine months ended September 30, 2019.

Other operating income decreased R$3,391.8 million, from an operating income of R$3,227.9 million in the nine months ended September 30, 2018 to an operating loss R$163.9 million in the nine months ended September 30, 2019. This decrease was mainly due to (i) R$1,541.9 million in accumulated appreciation of our shares in Usiminas, which we had recorded in other comprehensive income in shareholders’ equity until December 31, 2017 and, upon adoption of IFRS 9 as of January 1, 2018, we reclassified and recorded as other operating income in the nine months ended September 30, 2018, (ii) R$1,164.3 million in income related to the sale of our U.S. subsidiary, CSN LLC, in 2018 and (iii) our recognition of R$446 million in PIS and COFINS tax credits in 2018. As of September 30, 2019, accumulated depreciation of our shares in Usiminas was R$380.7 million and we recorded an operating loss of R$1,883.4 million.

Other operating expenses increased R$925.8 million, from R$710.8 million in the nine months ended September 30, 2018 to R$1,636.6 million in the nine months ended September 30, 2019, mainly due to realization under hedge accounting of exchange rate variation on our debt in the amount of R$632.7 million.

Equity in Results of Affiliated Companies

Equity in results of affiliated companies increased by R$23.0 million or 24%, from R$96.0 million in the nine months ended September 30, 2018 to R$119.0 million in the nine months ended September 30, 2019.

Operating Income

Operating income decreased R$3,011.6 million, or 54%, from R$5,595.6 million in the nine months ended September 30, 2018 to R$2,584.0 million in the nine months ended September 30, 2019, due to the reasons discussed above.

Financial Income (Expenses)

Financial income (expenses) decreased R$173.2 million, or 8.6%, from net financial expenses of R$2,006.0 million in the nine months ended September 30, 2018 to net financial expenses of R$1,832.8 million in the nine months ended September 30, 2019, mainly due to a decrease of R$551.9 million in foreign exchange losses in the nine months ended September 30, 2019 as compared to the same period in 2018, which effect was partially offset by an increase of R$218.4 million in interest expense and a decrease of R$123.7 million in other financial income from PIS and COFINS tax credits in the nine months ended September 30, 2019 as compared to the same period in 2018.

Income Taxes

Income tax expense in Brazil refers to federal income tax and social contribution. The statutory rates for these taxes applicable to the periods presented were 25% for federal income tax and 9% for social contribution. Adjustments are made to income in order to reach the effective tax expense or benefit for each fiscal year. As a result, our effective tax rate is volatile among fiscal periods.

At statutory rates, we had a tax expense of R$1,220.5 million in the nine months ended September 30, 2018 and R$255.4 million in the nine months ended September 30, 2019, which represents 34% of our income before taxes. After adjustments to meet the effective income tax rates, we recorded an expense for income tax and social contribution of R$161.2 million in the nine months ended September 30, 2018 and a tax revenue of R$359.4 million in the nine months ended September 30, 2019. Expressed as a percentage of pretax income, our effective income tax rate was 4% in the nine months September 30, 2018 and (48)% in the nine months ended September 30, 2019. In the nine months ended September 30, 2019, in order to meet the effective income tax rate, we had a positive net

adjustment of R$614.8 million, mainly due to the recognition of R$780.0 million in income tax credits in the period, as well as additional items that comprise our reconciliation of our statutory income tax rate to our effective income tax rate, including adjustments related to equity results, results of subsidiaries taxed at different rates or not taxed, transfer price adjustments and tax incentives, among others, which net tax result was a benefit of R$359.4 million. In the nine months ended September 30, 2018, we had a positive net adjustment of R$1,059.3 million mainly due to the recognition of R$1,205.9 million in income tax credits, partially offset by R$84 million in results of subsidiaries taxed at different rates. For further information, see note 15 to our unaudited interim consolidated financial information as of September 30, 2019 and for the nine months ended September 30, 2018 and 2019, incorporated by reference in this offering memorandum.

It is not possible to predict future adjustments to federal income tax and social contribution statutory rates, as they depend on interest on shareholders’ equity, tax incentives and non-taxable factors, including income from offshore operations and tax losses from offshore operations.

Net Income (Loss) for the Period

In the nine months ended September 30, 2019, we recorded net income of R$1,110.6 million, as compared to R$3,428.3 million in the nine months ended September 30, 2018. The decrease of R$2,317.7 million was due to the reasons discussed above.

Liquidity and Capital Resources

Cash Flows

Cash and cash equivalents decreased R$416.3 million in the nine months ended September 30, 2018, compared to a decrease of R$352.1 million in the nine months ended September 30, 2019.

Operating Activities

Cash provided by operating activities decreased R$533.0 million, or 14.1%, from R$3,772.3 million in the nine months ended September 30, 2018 to R$3,239.3 million in the nine months ended September 30, 2019, mainly due to a decrease of R$2,317.7 million in net income and an increase of R$2,694.7 million in working capital accounts, mainly suppliers, accounts receivable and value-added taxes, in the nine months ended September 30, 2019 as compared to the same period in 2018.

Investing Activities

Cash used in investing activities increased R$1,841.6 million, or 350.7%, from cash inflows of R$525.1 million in the nine months ended September 30, 2018 to cash outflows of R$1,316.5 million in the nine months ended September 30, 2019, mainly due to (i) acquisition of tangible assets in the amount of R$1,376.9 million in the nine months ended September 30, 2019 as compared to R$810.1 million in the nine months ended September 30, 2018 and (ii) receipt in 2018 of R$1,670.4 million from the sale of our U.S. subsidiary, CSN LLC.

Financing Activities

Cash used in financing activities increased R$275.8 million, or 11.0%, from R$2,514.0 million in the nine months ended September 30, 2018 to R$2,789.8 million in the nine months ended September 30, 2019. This was mainly due to (i) payment of dividends in the amount of R$1,821.2 million in the nine months ended September 30, 2019 as compared to R$502.0 million in the same period in 2018, and (ii) an increase of R$6,292.4 million in debt amortization payments in the nine months ended September 30, 2019 as compared to the same period in 2018. These effects were partially offset by an increase of R$7,573.0 million in new borrowings and financing in the nine months ended September 30, 2019 as compared to the nine months ended September 30, 2018.

Trade Accounts Receivable Turnover Ratio

Our trade accounts receivable turnover ratio, which is the ratio between our trade accounts receivable and our annualized net operating revenues, measured in days of sales, increased by two days from 29 days as of September 30, 2018 to 31 days as of September 30, 2019.

Inventory Turnover Ratio

Our inventory turnover ratio, which we measure by dividing our inventories by our annualized cost of products sold, measured in days of cost of products sold, was 94 days as of September 30, 2018 and 111 days as of September 30, 2019.

Trade Accounts Payable Turnover Ratio

Our trade accounts payable turnover ratio, which we measure by dividing our trade accounts payable by our annualized cost of products sold, measured in days of cost of products sold, was 68 days as of September 30, 2018 and 91 days as of September 30, 2019.

Liquidity Management

Given the capital intensive and cyclical nature of our industry and the generally volatile Brazilian macroeconomic environment, we retain sufficient cash on hand to run our operations and to meet our short-term financial obligations. As of September 30, 2018, cash and cash equivalents were R$2,995.2 million, as compared to R$1,895.9 million as September 30, 2019.

As of September 30, 2019, our short-term and long-term indebtedness accounted for 19% and 81%, respectively, of our total debt, and the average life of our existing debt was equivalent to approximately eight years, considering a 40-year term for the perpetual bonds issued in September 2010.

Capital Expenditures and Investments

We invested R$1,377.4 million in the nine months ended September 30, 2019, mainly in:

· R$777.2 million in our steel segment: sustaining investments, principally in blast furnace no. 3 at Volta Redonda;

· R$481.3 million in our mining segment: renovation of mine equipment and tailings filtering plants to process 100% of our production without the use of dams; and

· R$118.9 million in other segments: sustaining investments in our Arcos cement plant, TECON container terminal and FTL railroad.

Debt and Derivative Instruments

As of September 30, 2019, our total debt, which comprises current and non-current portions of borrowings and financing, was R$29,277.3 million (including transactions costs), which represents 291% of shareholders’ equity as of September 30, 2019. As September 30, 2019, our short-term debt, which comprises current borrowings and financing and includes current portions of long-term debt, was R$5,603.1 million and our long-term debt, which comprises non-current borrowings and financing, was R$23,674.2 million.

As of September 30, 2019, approximately 38.9% of our debt was denominated in reais and substantially all of the remaining balance was denominated in U.S. dollars.

Our policy is to protect ourselves against foreign exchange losses and interest rate losses on our debt, which we do through hedge accounting.

The following table sets forth our borrowings, financing and debentures, which we record at amortized cost:

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

Debt Agreements in the International Market

|

|

|

|

Variable interest:

|

|

|

|

US$

|

|

|

|

Prepayment

|

2,115.4

|

2,924.9

|

|

Fixed interest:

|

|

|

|

US$

|

|

|

|

Bonds, Perpetual Bonds and ACC

|

2,103.6

|

10,515.1

|

|

EUR

|

|

|

|

Others

|

|

|

|

|

|

|

|

|

|

|

|

Debt Agreements in Brazil

|

|

|

|

Variable interest:

|

|

|

|

R$

|

|

|

|

BNDES/FINAME, Debentures, NCE and CCB

|

1,254.9

|

10,165.1

|

|

Fixed interest:

|

|

|

|

R$

|

|

|

|

Prepayment

|

|

|

|

|

|

|

|

Total borrowings and financing

|

|

|

|

Transaction costs and issue premiums

|

|

|

|

Total borrowings and financing + transaction costs

|

|

|

The following table sets forth the average interest rate of our borrowings and financing:

|

|

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

US$

|

6.83%

|

17,659.0

|

|

R$

|

7.13%

|

11,420.0

|

|

EUR

|

3.88%

|

|

|

|

|

|

_________________

(1) In order to determine the average interest rates for our borrowings and financing agreements with floating rates, we used rates as of September 30, 2019.

Debt Maturity Schedule

The following chart sets forth our debt maturity profile as of September 30, 2019:

Debt Reprofiling Initiatives

In the nine months ended September 30, 2019, we took the following steps to extend the amortization profile of our debt:

· in April, we issued US$600.0 million in aggregate principal amount of 7.625% notes due 2026;

· in April and July, we issued US$400.0 million and US$175.0 million, respectively, in aggregate principal amount of additional 7.625% notes due 2023;

· in May, we settled tender offers for US$300.0 million in aggregate principle amount of notes due 2019 and US$673.9 million in aggregate principal amount of 6.50% notes due 2020;

· in September, we entered into an exchange rate swap agreement in the amount of US$67.0 million with Banco Bradesco that will mature in 2023; and

· in September, we rolled over US$100.0 million in debt maturing in 2020 with Bank of China to mature in 2024 and we entered into a financing agreement for US$37.0 million maturing in September 2020.

For further information on our indebtedness, see note 12 to our unaudited interim consolidated financial information as of September 30, 2019 and for the nine months ended September 30, 2018 and 2019, incorporated by reference in this offering memorandum.

Tax Proceedings

On October 16, 2019, the Brazilian revenue service (Receita Federal) issued an administrative tax assessment of approximately R$1,033.0 million against us related to profits from foreign subsidiaries in 2014. We have filed our defense, which, as of the date of this offering memorandum, is pending judgment at the first administrative level. While we have assessed our chance of loss at the administrative level as possible, we understand our chance of loss upon appeal at the judicial level is remote.

On December 23, 2019, the Brazilian Mining Agency (Agência Nacional de Mineração – ANM) issued tax assessments of approximately R$689.0 million against us related to payments on extractions of mineral resources (Compensação Financeira pela Exploração de Recursos Minerais – CFEM) allegedly due from July 2009 to July 2017. We have filed our defenses, which, as of the date of this offering memorandum, are pending judgment at the first administrative level. We have assessed our chance of loss at the administrative and judicial levels as possible.

SIGNATURES

Pursuant to the requirements of the U.S. Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

January 17, 2020

|

Companhia Siderúrgica Nacional

|

|

|

By:

|

Benjamin Steinbruch

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

By:

|

/s/ Marcelo Cunha Ribeiro

Marcelo Cunha Ribeiro

|

|

|

|

Title:

|

Chief Financial and Investor Relations Officer

|

|

|

|

|

|

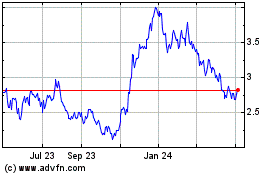

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

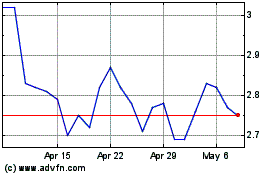

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024