Current Report Filing (8-k)

November 26 2019 - 4:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 26, 2019

OCWEN

FINANCIAL CORPORATION

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

1-13219

|

|

65-0039856

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

1661

Worthington Road, Suite 100

West

Palm Beach, Florida 33409

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (561) 682-8000

Not

applicable.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.01 Par Value

|

|

OCN

|

|

New

York Stock Exchange (NYSE)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

On

November 26, 2019, Ocwen Financial Corporation (“Ocwen” or “the Company”) and its wholly-owned subsidiary,

PHH Mortgage Corporation (“PMC”), entered into a series of financing arrangements as described below.

On

November 26, 2019, PMC PLS ESR Issuer LLC (“PLS Issuer”), a wholly owned special purpose subsidiary of PMC, issued

notes secured by certain of PMC’s private label mortgage servicing rights (“PLS MSRs”) pursuant to a credit

agreement. PLS Issuer’s obligations under the facility are secured by a lien on the related PLS MSRs. PMC has sold to PLS

Issuer a participation certificate representing certain economic interests in the PLS MSRs and in order to secure its obligations

under the participation certificate, it has granted a security interest to PLS Issuer in the PLS MSRs. The PLS Issuer assigned

the security interest in the PLS MSRs to the collateral agent for the noteholders. The Company guarantees the obligations of PLS

Issuer under the facility. The Class A Notes issued pursuant to the credit agreement have an initial principal amount of $100

million and amortize in accordance with a pre-determined schedule subject to modification under certain events. The notes have

a stated coupon rate of 5.07% and a final maturity date of November 2024. Proceeds from the note issuance are to be used

for general corporate purposes, including potential pay down of existing indebtedness.

In

addition, on November 26, 2019, PMC entered into a financing facility that is secured by certain Ginnie Mae mortgage servicing

rights (“GNMA MSRs”). In connection with the facility, PMC entered into a repurchase agreement pursuant to which PMC

has sold a participation certificate representing certain economic interests in the GNMA MSRs and has agreed to repurchase such

participation certificate at a future date at the repurchase price set forth in the repurchase agreement. PMC’s obligations

under the facility are secured by a lien on the related GNMA MSRs. The Company guarantees the obligations of PMC under the facility.

The maximum amount available to be borrowed pursuant to the facility is $100 million. The facility has an interest rate of one-month

LIBOR plus 395 basis points and terminates in November 2021 unless the parties mutually agree to extend the facility. PMC borrowed

$71.4 million under the facility at closing. Proceeds from borrowings under the facility are to be used for general corporate

purposes.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned, hereunto duly authorized.

|

|

OCWEN

FINANCIAL CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

November 26, 2019

|

By:

|

/s/

June C. Campbell

|

|

|

|

June

C. Campbell

|

|

|

|

Chief

Financial Officer

|

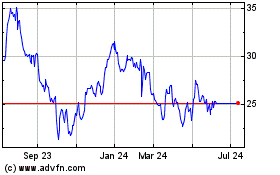

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

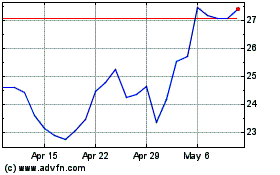

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024