|

|

Filed

pursuant to Rule 424(b)(3)

|

|

|

Registration

Statement No. 333-232746

|

You

should read this Prospectus Summary together with the more detailed information contained in this prospectus, including the risk

factors and financial statements. This prospectus contains forward-looking statements that involve risks and uncertainties. Our

actual results may differ materially from those discussed in the forward-looking statements. Factors that may cause such a difference

include those discussed in the Risk Factors section and elsewhere in this prospectus.

mPhase

Technologies, Inc.

10,477,800

Shares of Common Stock

This

prospectus relates to the resale of up to 10,477,800 shares (the “Common Stock”) of Common Stock, $0.01 value per

share, of mPhase Technologies, Inc. (“Company”), a New Jersey Corporation, by the Selling Stockholders set forth on

page 20. The Selling Stockholders may sell Common Stock from time to time in the principal market on which the stock is traded

at the prevailing market price or in negotiated transactions.

We

will not receive any of the proceeds from the sale of Common Stock by the Selling Stockholders.

Investment

in the Common Stock involves a high degree of risk. You should consider carefully the risk factors beginning on page 8 of

this prospectus before purchasing any of the shares offered by this prospectus.

Our

Common Stock is quoted on the Pink Sheets and trades under the symbol “XDSL”. The last reported sale price of our

Common Stock on the Pink Sheets on October 30, 2019, was $0.875 per share.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the

entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus is October 30, 2019.

mPhase

Technologies, Inc.

TABLE

OF CONTENTS

You

may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to

provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to

buy any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell

or a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither

the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any

implication that there has been no change in our affairs since the date of this prospectus or that the information contained by

reference to this prospectus is correct as of any time after its date.

Prospectus

Summary

This

summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully; including

the section entitled “Risk Factors” before deciding to invest in our Common Stock. This prospectus contains product

names, trade names and trademarks of ours as well as those of other organizations. All other brand names and trademarks appearing

in this prospectus are the property of their respective holders.

About

Us

mPhase

Technologies, Inc., a New Jersey corporation (the “Company”, “mPhase”, “we”, “us”,

or “our”) is a publicly-held New Jersey company founded in 1996 with approximately 23,000 shareholders and 11,689,078

shares of Common Stock outstanding as of June 30, 2019. The Company’s Common Stock is traded on the Pink Sheets under the

ticker symbol XDSL. The Company has offices in Gaithersburg, Maryland.

Historically

we have had net operating losses each year since our inception

As

of June 30, 2019, we have an accumulated deficit of $213,633,853 and a stockholder’s equity of $605,638. We generated a

net loss of $1,955,161 for the fiscal year ended June 30, 2019. As of June 30, 2018, we had an accumulated deficit of $211,678,692

and a stockholder’s deficit of $3,992,469. We generated net income of $313,904 for the fiscal year ended June 30, 2018.

The auditors’ report for the fiscal year ended June 30, 2019 includes the statement that “there is substantial

doubt of the Company’s ability to continue as a going concern”.

Business

of the Company

General

Description of the Business

mPhase

Technologies, Inc. (“mPhase” or the “Company”) is a publicly-held New Jersey corporation which was organized

on October 2, 1996. The Company has over 23,000 shareholders and 11,689,078 shares of common stock outstanding at June 30, 2019.

The Company’s common stock is traded on the Pink Sheets under the ticker symbol XDSL. The Company is headquartered in Gaithersburg,

Maryland. The Company employs three full-time employees, two of which are officers of the Company and two part-time consultants

who provide legal services and accounting services. Subsidiary companies in India employ a total of 40 software engineers and

data analysis experts.

As

of January 11, 2019, the Company underwent a major change in management and control. The Company entered into an Employment Agreement

with Mr. Anshu Bhatnagar to become the new President and Chief Executive Officer and a Director of the Company. Mr. Bhatnagar

is also the President and CEO of Verus International, Inc. (ticker symbol “VRUS”) a publicly-held company. Mr. Bhatnagar

replaced Mr. Ronald Durando who resigned as CEO. Mr. Durando remained a Director of the Company until his resignation from such

position effective March 20, 2019. Effective January 11, 2019 all of the other prior Officers and Directors of the Company resigned

their respective positions. On January 28, 2019, Mr. Smiley, the former CFO of the Company, was reappointed as interim CFO and

on June 6, 2019, Mr. Smiley resigned as CFO of the Company and was replaced by Christopher Cutchens. Under the terms of Mr. Bhatnagar’s

Employment Agreement, he will receive a base salary of $275,000 per annum and was granted 2,620,899 shares of Common Stock, representing

20% of the Company’s Common Stock then outstanding at January 11, 2019. In addition, Mr. Bhatnagar, pursuant to the terms

of a Transition Agreement shall earn the right to be issued 4% of additional shares of the Company’s Common Stock for each

$1 million of gross revenues generated by the Company. Once the Company has achieved gross revenues of not less than $15,000,000

or is up-listed to a National Securities Exchange, Mr. Bhatnagar will have earned the remaining amount of the Company’s

Common Stock not to exceed 80% of the shares outstanding at January 11, 2019 as adjusted for the Reverse Split of the Company’s

Common Stock as described below.

The

new management of the Company is positioning the Company to become a leader in software relating to artificial intelligence and

machine learning to enable a more rapid commercial development of its patent portfolio and other intellectual property. Artificial

Intelligence is just simple math executed on an enormous scale. The more calculations a system can process, the more possible

it is for that system to emulate human-like cognitive abilities. With the advent of cloud infrastructure, GPU-accelerated processing

and deep learning architectures, it is now commercially viable to perform this math at such speeds and efficiency that Artificial

Intelligence (human-like cognitive abilities) can be embedded directly into business operations, platform architectures, business

services and customer experiences. The goal is to generate a faster growth of revenues for the Company.

The

Transition Agreement and Reserve Agreement as amended, provide for our new management to evaluate, formulate and implement a revised

plan of operation. The Company is implementing undertakings, initiated by outgoing management, to extinguish certain debts and

settle or reduce other liabilities outstanding at December 31, 2018, no later than March 31, 2020.

On

February 4, 2019, the Company announced the formation of mPhase Technologies India, Pvt, Ltd to focus on software and technology

development for new and existing projects. On February 6, 2019, the Company announced that it has commenced discussions with a

global pharmaceutical company to explore the use of mPhase’s “Smart Surface” technology for transdermal drug

delivery. mPhase’s current technology uses electronic or other external stimulus to dispense an unattended, predetermined

quantity of drug or medical agent through a smart surface membrane. On February 19, 2019, the Company announced that it will assemble

a team in India of highly qualified software and technology experts in the fields of artificial intelligence and machine learning

to work as part of its newly formed “Center of Excellence” India division.

On

March 7, 2019, the Company announced the acquisition of Travel Buddhi, a software platform to enhance travel via ultra-customization

tools that tailor a planned trip experience in ways not previously available. The Company is moving in a new strategic direction

of modification and modernization of its existing technology to make it “smart” and “connected” as part

of the internet of things.

On

March 19, 2019, Mr. Durando loaned the Company approximately $5,200 for general working capital purposes, under the terms of previous

agreements for officers’ loans. Separately Messrs. Durando and Bhatnagar each loaned the Company $25,000 on April 17, 2019

and April 24, 2019, respectively, providing an additional $50,000 for general working capital purposes, under the terms of new

notes, which generally provide for 6% interest and short-term repayment.

On

April 10, 2019, the Company filed a preliminary Schedule 14C information statement with the SEC in connection with a 5000/1 reverse

split of its common stock that had been approved by our Board of Directors in March of 2019. The Company under New Jersey law

is reducing its authorized shares of common stock to 25 million shares from the previously authorized 125,000,000,000 shares.

On

April 10, 2010 the Company repaid $3,000 that was accepted as payment, in full, of the convertible promissory note which had been

held by M.H Investment Trust II.

On

April 22, 2019 the Company filed a Definitive Schedule 14C information statement with the Securities and Exchange Commission in

connection with a 5000/1 reverse split of its common stock. The Company under New Jersey law is reducing its authorized shares

of common stock to 25 million shares from the currently authorized 125,000,000,000 shares.

On

April 22, 2019 we extended the obligations of the Company and the CEO to register shares of our Common Stock on a Registration

Statement on Form S-1, which at a minimum include shares held by prior management and strategic vendors referred to as “Related

Parties” as outlined in Section 1(d) of the Transition Agreement of January 11, 2019. The revised time to file a Registration

Statement with the SEC was amended in order to include certain participants in an ongoing private placement of its stock pursuant

to Section 4(a)(2) of the Securities Act of 1933. The Registration Statement was filed on July 19, 2019 and was declared effective

by the Securities and Exchange Commission on August 13, 2019.

During

the fiscal year ending June 30, 2019, the Company completed and announced the closing of a Private Placement of shares of its

common stock at $0.25 per share, raising gross proceeds of $193,000. The Private Placement was executed pursuant to Section 4(a)(2)

of the Securities Act of 1933, as amended, and the proceeds will be used by the Company for working capital and corporate acquisitions.

Effective

May 22, 2019 the Company completed a 5,000/1 reverse split of its Common stock reducing its authorized shares to 25 million shares

of Common Stock.

On

June 25, 2019, the Company entered into a Securities Purchase Agreement dated as of June 19, 2019 with Power Up Lending Group

(“Lender”) and issued an 8% Convertible Promissory Note in the principal amount of $78,000 to the Lender with a maturity

date of June 19, 2020. The Company received proceeds in the amount of $45,800 with $25,000 refinancing a prior convertible promissory

note due the Lender that had been in default.

On

June 30, 2019, Company entered into a Share Purchase Agreement (“SPA”) to acquire a controlling interest in Alpha

Predictions, LLP, (“Alpha Predictions”) an India-based technology company. Alpha Predictions has 15 professionals

comprised of a team of data specialist who developed a suite of commercial data analysis products for use across multiple industries.

The current product offering includes software covering eight categories: inventory, stock management, marketing optimization,

sentiment analysis, customer segmentation and behavior, agro-tech image detection, electrocardiogram automation, and a recommendation

engine with multiple uses. Pursuant to the terms of the SPA, the Company is acquiring 99% of the outstanding stock of Alpha Predictions

from Snehalkumar Santosh Kadam, Smita Dinakar Shinde, Anuj Kumar Saxena, and Dhananjay Rajendra Adik (collectively, the “Sellers”)

in exchange for approximately $1,400 (USD), (99,000 INR). Prior to being acquired by the Company, Alpha Predictions generated

revenue in excess of $2.0 million (USD) and will begin contributing to mPhase revenues on July 1, 2019.

Also,

on June 30, 2019, the Company announced a $2.5 million (USD) contract to provide software, training, and support services to an

IT solutions and services company located in India. The contract provides mPhase with an initial $2.5 million of revenue upon

delivery of the software license and also provides subsequent revenue for training, support, updates and maintenance services

as provided.

On

July 30, 2019, the Company, entered into a second Securities Purchase Agreement dated as of July 30, 2019 with Power Up Lending

Group, (“Lender”) and issued an 8% Convertible Promissory Note in the principal amount of $53,000 to the Lender with

a maturity date of July 30, 2020. The Company received net proceeds in the amount of $50,000 as a result of $3,000 being paid

to reimburse Lender for legal and due diligence fees incurred with respect to this Securities Purchase Agreement and Convertible

Promissory Note.

On

August 27, 2019, the Company’s Board of Directors approved the filing of an amendment (the “Amendment”) to the

Company’s Certificate of Incorporation to increase the authorized shares of common stock from 25 million shares to 100 million

shares pursuant to Section 14A:7-2(4) of the Business Corporation Law of the State of New Jersey. The Amendment was filed with

the State of New Jersey on September 4, 2019.

On

September 5, 2019, the Company entered into a third Securities Purchase Agreement dated as of September 5, 2019 with Power Up

Lending Group, (“Lender”) and issued an 8% Convertible Promissory Note in the principal amount of $53,000 to the Lender

with a maturity date of September 5, 2020. On September 9, 2019, the Company received net proceeds in the amount of $46,800 as

a result of $3,000 being paid to reimburse Lender for legal and due diligence fees incurred with respect to this Securities Purchase

Agreement and Convertible Promissory Note and $3,200 being paid to the Company’s Transfer Agent to satisfy an outstanding

balance.

On

September 24, 2019, the Company entered into another Securities Purchase Agreement with accredited investors and issued 8% Convertible

Promissory Notes in the aggregate principal amount of $124,200 (including an aggregate of $9,200 in original issuance discounts)

(the “Notes”) to the accredited investors with maturity dates of September 24, 2020. On September 27, 2019, the Company

received net proceeds in the amount of $112,000 as a result of $3,000 being paid to reimburse the accredited investors for legal

and due diligence fees incurred with respect to this Securities Purchase Agreement and Notes.

Description

of Operations

Platform

Technology

Artificial

Intelligence and Machine Learning

Through

its recent acquisition of Alpha Predictions located in India, the customer has acquired a team of 15 software engineers and data

analysis experts capable of enabling the Company to provide products in the artificial intelligence and machine learning areas.

The company has in place and is developing proprietary software to enable customers to enhance their business capabilities by

providing sophisticated digital analysis of large volumes of data to provide sophisticated solutions to complex problems. The

current product offering includes software covering eight categories: inventory, stock management, marketing optimization, sentiment

analysis, customer segmentation and behavior, agro-tech image detection, electrocardiogram automation, and a recommendation engine

with multiple uses.

About

This Offering

Common

stock offered: Up to 10,477,800 shares of common stock, of which 12,685,737 shares are issued and outstanding as of October 25,

2019.

Common

Stock to be outstanding after this offering: 12,685,737 shares of common stock.

Use

of proceeds: We will not receive any proceeds from the sale and issuance of the common stock included in this offering.

Risk

Factors: An investment in our common stock is subject to significant risks. You should carefully consider the information set

forth in the “Risk Factors” section of this prospectus as well as other information set forth in this prospectus,

including our financial statements and related notes.

Dividend

policy: We do not expect to pay dividends on our common stock in the foreseeable future. We anticipate that all future earnings,

if any, generated from operations will be retained to develop and expand our business.

Plan

of Distribution: The shares of common stock (OTC pink sheet symbol: XDSL.OB) offered for resale may be sold by the selling stockholders

pursuant to this prospectus in the manner described under “Plan of Distribution.”

Estimated

use of proceeds

This

prospectus relates to shares of our Common Stock that may be offered and sold from time to time by the selling stockholders. We

will not receive any of the proceeds resulting from the sale of Common Stock.

Summary

of Shares offered by the Selling Shareholders.

The

following is a summary of the Shares being offered by each of the Selling Shareholders:

Common

Stock outstanding prior to the offering: 11,698,078 based upon the total amount of shares issued as of June 30, 2019.

Common

Stock outstanding after the offering is 12,685,737 shares as of October 25, 2009.

Use

of Proceeds: We will not receive any proceeds from sales of stock by the Selling Shareholders.

SUMMARY

FINANCIAL AND OTHER DATA

The

following table sets forth the summary financial and operating data as of the dates and for the periods indicated. The consolidated

statements of operations data for the fiscal years ended June 30, 2019 and 2018, and the consolidated balance sheet data as of

June 30, 2019 and 2018, have been derived from the audited financial statements of the Company, which are included elsewhere in

this prospectus. Our historical results are not necessarily indicative of the results that may be expected in any future period,

and our interim results are not necessarily indicative of the results to be expected for the full fiscal year.

You

should read the following financial and other data in conjunction with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this

prospectus.

|

Balance

Sheet Data

|

|

June

30, 2019

|

|

|

June

30, 2018

|

|

|

Cash

|

|

$

|

33,996

|

|

|

$

|

261

|

|

|

Total Assets

|

|

$

|

5,614,898

|

|

|

$

|

1,061

|

|

|

Total Liabilities

|

|

$

|

5,009,260

|

|

|

$

|

3,993,530

|

|

|

Total Stockholders’ Equity (Deficit)

|

|

$

|

605,638

|

|

|

$

|

(3,992,469

|

)

|

|

Statement

of Operations

|

|

Year

Ended

June

30, 2019

|

|

|

Year

Ended

June

30, 2018

|

|

|

Revenue

|

|

$

|

2,500,000

|

|

|

$

|

-

|

|

|

Net (Loss) Income

|

|

|

(1,955,161

|

)

|

|

$

|

313,904

|

|

RISK

FACTORS

Risks

Relating to the Company’s Complete Dependence upon the Development of New Products

Prior

to the Company’s change in management on January 11, 2019, the Company has been forced to curtail development of all products

and it is unknown whether the Company will be successful in acquiring and developing products in the fields of artificial intelligence

and machine learning except its Smart NanoBattery in order to conserve financial resources

The

Company has been forced to focus on commercialization of only one of its products. No assurance can be given that the Company

will have sufficient resources to develop new products in the areas of artificial intelligence and machine learning. The Company’s

lack of financial resources to simultaneously develop multiple products could increase its overall risk profile as a company.

Our

current “smart surface technology” is at an early stage of development and we may not develop products that can be

commercialized.

We

have derived very limited revenues from a Phase I Army Grant of approximately $100,000 and a Phase II Army Grant of approximately

$750,000 with respect to our Smart NanoBattery product from inception of development in February 2004 through the date hereof.

Other material revenue was derived from our series of battery “Jump Starters” in the fiscal years ended 2014 and 2015;

products that the Company discontinued beginning in April 2016 owing to contracting margins and increased competition,

We

have limited manufacturing, marketing, distribution and sales capabilities which may limit our ability to generate revenues.

Due

to the relatively early stage of our products, we have recent, but very limited, investments in software platform, marketing,

distribution or product sales resources. We cannot assure you that we will be able to invest or develop any of these resources

successfully or as expediently as necessary. The inability to do so may inhibit or harm our ability to generate revenues or operate

profitably.

We

have a history of operating losses and we have never generated an operating profit in our history.

If

we continue to suffer losses as we have in the past, investors may not receive any return on their investment and may lose their

entire investment. Our prospects must be considered speculative in light of the risks, expenses and difficulties frequently encountered

by companies with new products in their early stages of development, particularly in light of the uncertainties relating to the

new, competitive and rapidly evolving markets in which we anticipate we will operate. To attempt to address these risks, we must,

among other things, further develop our technologies, products and services, successfully implement our research, development,

marketing and commercialization strategies, respond to competitive developments and attract, retain and motivate qualified personnel.

A substantial risk is involved in investing in us because, as a company we have fewer resources than an established company, our

management may make mistakes with respect to development of new products, and we may be more vulnerable operationally and financially

to any mistakes that may be made, as well as to external factors beyond our control.

We

have limited resources to manage development activities.

Our

limited resources in conducting and managing development activities might prevent us from successfully designing or implementing

new products. If we do not succeed in conducting and managing our development activities, we might not be able to commercialize

our product candidates, or might be significantly delayed in doing so, which will materially harm our business.

Our

ability to generate revenues from our entry into the fields of artificial intelligence and machine learning as well as from our

Smart Nano Battery will depend on a number of factors, including our ability to successfully complete and implement our commercialization

strategy. In addition, even if we are successful in bringing our Smart Nano Battery to market, we will be subject to the risk

that the marketplace will not accept such product. We may, and anticipate that we will need to, transition from a company with

a research and development focus to a company capable of supporting commercial activities and we may not succeed in such a transition.

Because

of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to

predict the extent of our future losses or when or if we will become profitable.

Our

failure to successfully commercialize our new products in the fields of machine learning and artificial intelligence as well as

our Smart Nano Battery or to become and remain profitable could depress the market price of our Common Stock and impair our ability

to raise capital, expand our business, diversify our product offerings and continue our operations.

Because

of the numerous risks and uncertainties associated with our product development and commercialization efforts, we are unable to

predict the extent of our future losses or when or if we will become profitable.

Our

failure to successfully commercialize our products to be developed in the fields of artificial intelligence and machine learning

as well as our Smart Nano Battery or to become and remain profitable could depress the market price of our Common Stock and impair

our ability to raise capital, expand our business, diversify our product offerings and continue our operations.

Risks

Relating to Technology

We

are dependent on new and unproven technologies.

Our

risks as an early stage company are compounded by our heavy dependence on emerging and sometimes unproven technologies such artificial

intelligence and machine learning as well as our Smart Nanobattery. If these technologies do not produce satisfactory results,

our business may be harmed.

We

may not be able to commercially develop our technologies and proposed product lines, which, in turn, would significantly harm

our ability to earn revenues and result in a loss of investment.

Our

ability to commercially develop our technologies will be dictated in, large part, by forces outside our control which cannot be

predicted, including, but not limited to, general economic conditions. Other such forces include the success of our research and

field testing, the availability of collaborative partners to finance our work in pursuing applications of artificial intelligence,

machine learning and “smart surfaces” or other developments in the field which, due to efficiencies or technological

breakthroughs may render one or more areas of commercialization more attractive, obsolete or competitively unattractive. It is

possible that one or more areas of commercialization will not be pursued at all if a collaborative partner or entity willing to

fund research and development cannot be located. Our decisions regarding the ultimate products and/or services we pursue could

have a significant adverse effect on our ability to earn revenue if we misinterpret trends, underestimate development costs and/or

pursue wrong products or services. Any of these factors either alone or in concert could materially harm our ability to earn revenues

or could result in a loss of any investment in us.

If

we are unable to keep up with rapid technological changes in our field or compete effectively, we will be unable to operate profitably.

We

are engaged in activities in the artificial intelligence, machine learning, nanotechnology and microfluidics field, which is characterized

by extensive research efforts and rapid technological progress. If we fail to anticipate or respond adequately to technological

developments, our ability to operate profitably could suffer. We cannot assure you that research and discoveries by other companies

will not render our technologies or potential products or services uneconomical or result in products superior to those we develop

or that any technologies, products or services we develop will be preferred to any existing or newly-developed technologies, products

or services.

Risks

Related to Intellectual Property

Certain

aspects of our technology are not protectable by patent or copyright.

Certain

parts of our know-how and technology are not patentable. To protect our proprietary position in such know-how and technology,

we require all employees, consultants, advisors and collaborators with access to our technology to enter into confidentiality

and invention ownership agreements with us. We cannot assure you; however, that these agreements will provide meaningful protection

for our trade secrets, know-how or other proprietary information in the event of any unauthorized use or disclosure. Further,

in the absence of patent protection, competitors who independently develop substantially equivalent technology may harm our business.

Patent

litigation presents an ongoing threat to our business with respect to both outcomes and costs.

It

is possible that litigation over patent matters with one or more competitors could arise. We could incur substantial litigation

or interference costs in defending ourselves against suits brought against us or in suits in which we may assert our patents against

others. If the outcome of any such litigation is unfavorable, our business could be materially adversely affected. To determine

the priority of inventions, we may also have to participate in interference proceedings declared by the United States Patent and

Trademark Office, which could result in substantial cost to us. Without additional capital, we may not have the resources to adequately

defend or pursue this litigation.

We

may not be able to protect our proprietary technology, which could harm our ability to operate profitably.

Patent

and trade secret protection is critical for the new technologies we utilize, artificial intelligence, machine learning and nanotechnology

and microfluidics, as well as the products and processes derived through them. Our success will depend, to a substantial degree,

on our ability to obtain and enforce patent protection for our products, preserve any trade secrets and operate without infringing

the proprietary rights of others. We cannot assure you that:

|

|

●

|

we

will succeed in obtaining any patents in a timely manner or at all, or that the breadth or degree of protection of any such

patents will protect our interests,

|

|

|

|

|

|

|

●

|

the

use of our technology will not infringe on the proprietary rights of others,

|

|

|

|

|

|

|

●

|

patent

applications relating to our potential products or technologies will result in the issuance of any patents or that, if issued,

such patents will afford adequate protection to us or not be challenged, invalidated or infringed,

|

|

|

|

|

|

|

●

|

patents

will not issue to other parties, which may be infringed by our potential products or technologies, and

|

|

|

|

|

|

|

●

|

we

will continue to have the financial resources necessary to prosecute our existing patent applications, pay maintenance fees

on patents and patent applications, or file patent applications on new inventions.

|

The

fields in which we operate have been characterized by significant efforts by competitors to establish dominant or blocking patent

rights to gain a competitive advantage, and by considerable differences of opinion as to the value and legal legitimacy of competitors’

purported patent rights and the technologies they actually utilize in their businesses.

Patents

obtained by other persons may result in infringement claims against us that are costly to defend and which may limit our ability

to use the disputed technologies and prevent us from pursuing research and development or commercialization of potential products.

If

third party patents or patent applications contain claims infringed by either our technology or other technology required to make

and use our potential products and such claims are ultimately determined to be valid, there can be no assurance that we would

be able to obtain licenses to these patents at a reasonable cost, if at all, or be able to develop or obtain alternative technology.

If we are unable to obtain such licenses at a reasonable cost, we may not be able to develop some products commercially. We may

be required to defend ourselves in court against allegations of infringement of third-party patents. Patent litigation is very

expensive and could consume substantial resources and create significant uncertainties. Any adverse outcome in such a suit could

subject us to significant liabilities to third parties, require disputed rights to be licensed from third parties, or require

us to cease using such technology.

We

may not be able to adequately defend against piracy of intellectual property in foreign jurisdictions.

Considerable

research in the areas of micro fluid dynamics is being performed in countries outside of the United States, and a number of potential

competitors are located in these countries. The laws protecting intellectual property in some of those countries may not provide

adequate protection to prevent our competitors from misappropriating our intellectual property. Several of these potential competitors

may be further along in the process of product development and also operate large, company-funded research and development programs.

As a result, our competitors may develop more competitive or affordable products, or achieve earlier patent protection or product

commercialization than we are able to achieve. Competitive products may render any products or product candidates that we develop

obsolete.

We

may incur substantial expenditures in the future in order to protect our intellectual property.

We

believe that our intellectual property with respect to our Smart NanoBattery and our proprietary rights with respect to the Company’s

permeable membrane design consisting of both micro and nano scale silicon features that are coated with a monolayer chemistry

used to repel liquids is critical to our future success. The Company’s current battery related patent portfolio consists

of seven issued patents, of which one is jointly owned with Rutgers University, two are jointly owned with Nokia (formerly Lucent

Technologies) and four are licensed from Nokia. We also have four patent applications related to the Smart Surfaces technology

that have been filed with the United States Patent Office and other foreign patent offices that are in various stages of examiner

review, as well as four additional patent applications related to other Smart Surfaces technologies under review. Our pending

patent applications may never be granted for various reasons, including the existence of conflicting patents or defects in our

applications. Even if additional U.S. patents are ultimately granted, there are significant risks regarding enforcement of patents

in international markets. There are many patents being filed as the science of nanotechnology develops and the Company has limited

financial resources compared to large, well established companies to bring patent litigation based upon claims of patent infringement.

Our

products may not be accepted in the marketplace.

The

degree of market acceptance of those products will depend on many factors, including:

|

|

●

|

Our

ability to manufacture or obtain from third party manufacturers sufficient quantities of our product candidates with acceptable

quality and at an acceptable cost to meet demand, and

|

|

|

|

|

|

|

●

|

Marketing

and distribution support for our products.

|

We

cannot predict or guarantee that either military or commercial entities, in general, will accept or utilize any of our product

candidates. Failure to achieve market acceptance would limit our ability to generate revenue and would have a material adverse

effect on our business. In addition, if any of our product candidates achieve market acceptance, we may not be able to maintain

that market acceptance over time if competing products or technologies are introduced that are received more favorably or are

more cost-effective.

Risks

Related to Third Party Reliance

We

depend on third parties to assist us in the development of new products extensively, and any failure of those parties to fulfill

their obligations could result in costs and delays and prevent us from successfully commercializing our product candidates on

a timely basis, if at all.

We

engage consultants and contract research organizations to help design, develop and manufacture our products. The consultants and

contract research organizations we engage provide us critical skills, resources and finished products for sale that we do not

have within our own company. As a result, we depend on these consultants and contract research and product supply organizations

to deliver our existing automotive products and to perform the necessary research and development to create new products. We may

face delays in developing and bringing new products to market if these parties do not perform their obligations in a timely or

competent fashion or if we are forced to change service providers.

We

depend on our collaborators to help us develop and test our proposed products, and our ability to develop and commercialize products

may be impaired or delayed if collaborations are unsuccessful.

Our

strategy for the development, testing and commercialization of our proposed products requires that we enter into collaborations

with corporate partners, licensors, licensees and others. Some of these collaborators will be located in India and other countries

outside of the United States which pose additional legal and economic risks. We are dependent upon the subsequent success of these

other parties in performing their respective responsibilities and the continued cooperation of our partners. Under agreements

with collaborators, we may rely significantly on such collaborators to, among other things:

|

|

●

|

Fund

research and development activities with us;

|

|

|

|

|

|

|

●

|

Pay

us fees upon the achievement of milestones under STIR and SBIR programs; and

|

|

|

|

|

|

|

●

|

Market

with us any commercial products that result from our collaborations.

|

Our

collaborators may not cooperate with us or perform their obligations under our agreements with them. We cannot control the amount

and timing of our collaborators’ resources that will be devoted to our research and development activities related to our

collaborative agreements with them. Our collaborators may choose to pursue existing or alternative technologies in preference

to those being developed in collaboration with us.

The

development and commercialization of potential products will be delayed if collaborators fail to conduct these activities in a

timely manner, or at all.

If

various outside vendors and collaborators do not achieve milestones set forth in our agreements, or if our collaborators breach

or terminate their collaborative agreements with us, our business may be materially harmed.

Our

reliance on the activities of our non-employee consultants, research institutions, and scientific contractors, whose activities

are not wholly within our control, may lead to delays in development of our proposed products.

We

rely extensively upon and have relationships with outside consultants and companies having specialized skills to conduct research.

These consultants are not our employees and may have commitments to, or consulting or advisory contracts with, other entities

that may limit their availability to us. We have limited control over the activities of these consultants and, except as otherwise

required by our collaboration and consulting agreements to the extent they exist, can expect only limited amounts of their time

to be dedicated to our activities. These research facilities may have commitments to other commercial and non-commercial entities.

We have limited control over the operations of these collaborators and can expect only limited amounts of time to be dedicated

to our research and product development goals.

Risks

Related to Competition

The

market for energy storage products, artificial intelligence and machine learning is highly competitive.

We

expect that our most significant competitors will be large more established companies. These companies are developing products

that compete with ours and they have significantly greater capital resources in research and development, manufacturing, testing,

obtaining regulatory approvals, and marketing capabilities. Many of these potential competitors are further along in the process

of product development and also operate large, company-funded research and development programs. As a result, our competitors

may develop more competitive or affordable products, or achieve earlier patent recognition and filings.

Our

industry is characterized by rapidly evolving technology and intense competition. Our competitors include major multinational

energy-storage device and battery companies as well as nanotechnology companies that specialize in micro fluid dynamics and smart

surfaces.

Many

of these companies are well-established and possess technical, research and development, financial and sales and marketing resources

significantly greater than ours. In addition, certain smaller nanotechnology companies have formed strategic collaborations, partnerships

and other types of joint ventures with larger, well established industry competitors that afford these companies’ potential

research and development and commercialization advantages. Academic institutions, governmental agencies and other public and private

research organizations are also conducting and financing research activities which may produce products directly competitive to

those we are developing. Moreover, many of these competitors may be able to obtain patent protection, obtain regulatory approvals

and begin commercial sales of their products before we do.

Our

competition includes both public and private organizations and collaborations among academic institutions and large companies,

most of which have significantly greater experience and financial resources than we do.

Private

and public academic and research institutions also compete with us in the research and development of nanotechnology products

based on micro-fluid dynamics. In the past several years, the nanotechnology industry has selectively entered into collaborations

with both public and private organizations to explore the development of new products evolving out of research in micro-fluid

dynamics.

Risks

Related To Financial Aspects Of Our Business

We

may not be able to raise the required capital to conduct our operations and develop and commercialize our products. We

require substantial additional capital resources in order to conduct our operations and develop and commercialize our products

and run our facilities. We will need significant additional funds or collaborative partners, or both, to finance the research

and development activities of our potential products. Accordingly, we are continuing to pursue additional sources of financing.

Our future capital requirements will depend upon many factors, including:

|

|

●

|

The

continued progress and cost of our research and development programs,

|

|

|

|

|

|

|

●

|

The

costs in preparing, filing, prosecuting, maintaining and enforcing patent claims,

|

|

|

|

|

|

|

●

|

The

costs of developing sales, marketing and distribution channels and our ability to sell the products if developed,

|

|

|

|

|

|

|

●

|

The

costs involved in establishing manufacturing capabilities for commercial quantities of our proposed products,

|

|

|

|

|

|

|

●

|

Competing

technological and market developments,

|

|

|

|

|

|

|

●

|

Market

acceptance of our proposed products, and

|

|

|

|

|

|

|

●

|

The

costs for recruiting and retaining employees and consultants.

|

Additional

financing through strategic collaborations, public or private equity financings or other financing sources may not be available

on acceptable terms, or at all Our prior failure to be timely in our required periodic filings of quarterly and annual financial

reports with the SEC may significantly limit our ability to raise additional capital. Additional equity financing could result

in significant dilution to our shareholders. Further, if additional funds are obtained through arrangements with collaborative

partners, these arrangements may require us to relinquish rights to some of our technologies, product candidates or products that

we would otherwise seek to develop and commercialize on our own. If sufficient capital is not available, we may be required to

delay, reduce the scope of or eliminate one or more of our programs or potential products, any of which could have a material

adverse effect on our financial condition or business prospects.

Risks

Relating to Earn Out Agreement with the new CEO of the Company

At

June 30, 2019, the Company estimated by application of a Black Scholes option pricing model that $18,695,227 of unrecognized pre-tax

non-cash compensation expense, which the Company expects to recognize, based on a weighted-average period of 2 years and 5 ½

months. The Company will record the compensation expense over the estimated requisite service term or vesting period to earn the

conditions of the warrant. There are an estimated 37,390,000 total shares issuable under the warrant that are attainable under

the agreement as of June 30, 2019. Such issuance will cause periodic dilution of the Company’s stock during the course of

the Earn-Out period and reductions to book income with respect to the first $15 million in revenues realized by the Company.

Risks

Relating to Our Debt Financings

If

we are required for any reason to repay our outstanding debt, we would be required to deplete our working capital, if available,

or raise additional funds. Our failure to repay the debt, if required, could result in future legal action against us, which could

require y depletion of our working capital.

At

June 30, 2019 the amount recorded in Current Liabilities for convertible note plus accrued interest thereon previously issued

to JMJ Financial was $109,000 and $84,287, respectively. As of June 30, 2019, the aggregate remaining amount of convertible securities

held by JMJ could be converted into 9,664 common shares at the conversion price of $20.

As

of December 15, 2014, a Convertible Debenture Holder has a Judgment in the amount of approximately $1.6 million entered into by

the United States District Court of the Northern District of Illinois.

The

Company has entered into a Forbearance Agreement, as amended, with John Fife currently its largest debt- holder arising out of

a lawsuit and judgment in connection with the default on a Convertible Note in the original principal amount of $550,000 issued

on September 13, 2011.

On

December 10, 2018 this agreement was modified to eliminate the conversion feature of the underlying security. Monthly payments

of $15,000 are due and payable on the 15th day of each month through February 15, 2020 with a final payment of $195,000 due and

payable on March 15, 2020. Failure to pay such amounts would enable Fife to immediately enforce the remaining about of the debt

owed by the Company.

Under

the Judgement Settlement Agreement $855,660 is included in the line item “Current portion, liabilities in arears - judgement

settlement agreement” in the current liabilities section of the Company’s Balance Sheet at June 30, 2019.

Should

the Company satisfy this liability under the Judgement Settlement Agreement we would realize a gain on such settlement of approximately

$580,000.

The

Company recorded $60,296 of finance charges for the fiscal year ended June 30, 2019. At June 30, 2019, $58,142 of finance charges

remained outstanding under this note.

On

June 25, 2019, the Company entered into a Securities Purchase Agreement dated as of June 19, 2019 with Power Up Lending Group,

(“Lender”).The Company issued an 8% Convertible Promissory Note in the principal amount of $78,000 to the Lender with

a maturity date of June 19, 2020. The Company received net proceeds in the amount of $45,800, with $25,000 refinancing a prior

promissory note due to the Lender that had been in default, $3,000 being paid to reimburse the Lender for legal and due diligence

fees incurred with respect to this Securities Purchase Agreement and Convertible Promissory Note, and $4,200 being paid to the

Company’s Transfer Agent to satisfy an outstanding balance. This note becomes due in full, together with accrued interest

in June 2020 for approximately $85,000. Should we fail to make such payments, the lender can demand shares of our stock to satisfy

this obligation at a 38% discount to its then market value, resulting in dilution to satisfy this obligation.

On

July 30, 2019, the Company entered into a second Securities Purchase Agreement dated as of July 30, 2019 with Power Up Lending

Group, (“Lender”) and issued an 8% Convertible Promissory Note in the principal amount of $53,000 to the Lender with

a maturity date of July 30, 2020. The Company received net proceeds in the amount of $50,000 as a result of $3,000 being paid

to reimburse Lender for legal and due diligence fees incurred with respect to this Securities Purchase Agreement and Convertible

Promissory Note. This note becomes due in full, together with accrued interest in July 2020 for approximately $58,000. Should

we fail to make such payments, the lender can demand shares of our stock to satisfy this obligation at a 38% discount to its then

market value, resulting in dilution to satisfy this obligation.

On

September 5, 2019, the Company entered into a third Securities Purchase Agreement dated as of September 5, 2019 with Power Up

Lending Group, (“Lender”) and issued an 8% Convertible Promissory Note in the principal amount of $53,000 to the Lender

with a maturity date of September 5, 2020. On September 9, 2019, the Company received net proceeds in the amount of $46,800 as

a result of $3,000 being paid to reimburse Lender for legal and due diligence fees incurred with respect to this Securities Purchase

Agreement and Convertible Promissory Note and $3,200 being paid to the Company’s Transfer Agent to satisfy an outstanding

balance. This note becomes due in full, together with accrued interest in September 2020

for approximately $58,000. Should we fail to make such payments, the lender can demand shares of our stock to satisfy this

obligation at a 38% discount to its then market value, resulting in dilution to satisfy this obligation.

On

September 24, 2019, the Company entered into another Securities Purchase Agreement with accredited investors and issued 8% Convertible

Promissory Notes in the aggregate principal amount of $124,200 (including an aggregate of $9,200 in original issuance discounts)

(the “Notes”) to the accredited investors with maturity dates of September 24, 2020. On September 27, 2019, the Company

received net proceeds in the amount of $112,000 as a result of $3,000 being paid to reimburse the accredited investors for legal

and due diligence fees incurred with respect to this Securities Purchase Agreement and Notes. The Notes become due in full, together

with accrued interest in September 2020 for approximately $135,000. Should we fail to make such payments, the accredited investors

can demand shares of our stock to satisfy this obligation at a 38% discount to its then market value, resulting in dilution to

satisfy this obligation.

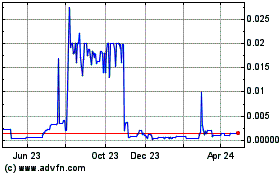

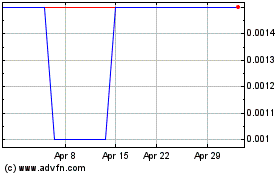

mPhase’s

stock price has suffered significant declines during the past ten years and remains volatile.

The

market price of our common stock closed at $7.88 on July 26, 2000 and, despite a significant reverse-split of 5000/1 effective

May 22, 2019 is currently at $0.875 as of October 30, 2019. Stocks in microcap companies having stock values below

$5.00 per share generally have much more volatility than higher priced stocks. Our common stock is a highly speculative investment

and is suitable only for such investors with financial resources that enable them to sustain the loss of their entire investment

in such stock. Because the price of our common stock is less than $5.00 per share and is not traded on the NASDAQ National or

NASDAQ Small Cap exchanges, it is considered to be a “penny stock,” limiting the type of customers that broker/dealers

can sell to. Such customers consist only of “established customers” and “Accredited Investors” (within

the meaning of Rule 501 of Regulation D of the Securities Act of 1933, as amended), generally individuals and entities of substantial

net worth, thereby limiting the liquidity of our common stock. Finally, the OTC markets group has designated our stock a “shell

risk” which causes brokerage firms and their clearing agents to not accept newly issued shares of our common stock for deposit

in street name and allow the holder to sell such stock.

Other

General Risks

We

may not be able to raise sufficient capital to market our new products in the areas of artificial intelligence and machine learning

and our Smart NanoBattery product applications of our technology on any meaningful scale.

We

may not be able to obtain the amount of additional capital needed until the Company has established significant and predictable

sales and revenues from our technology. We have been successful in the past as a micro-cap development stage company in raising

capital; however, recent trends in the capital markets are likely to pose significant challenges for the Company. Factors affecting

the availability of capital include:

|

(1)

|

the

price, volatility and trading volume of our common stock;

|

|

|

|

|

(2)

|

future

financial results including sales and revenues generated from operations;

|

|

|

|

|

(3)

|

the

market’s view of the business sector of nanotechnology reserve batteries and emergency flashlights; and

|

|

|

|

|

(4)

|

the

perception in the capital markets of our ability to execute our business plan.

|

We

have reported net operating losses for each of our fiscal years from our inception in

We

have reported net operating losses for each of our fiscal years from our inception in 1996 through the present and may not be

able to operate profitability in the future.

We

have had net losses of approximately $213,633,853 since our inception in 1996 and cannot be certain when or if we will ever be

profitable. We expect to continue to have net losses for the foreseeable future. We need to raise not less than $5 million in

additional cash in the next 12 months through further equity private placements to continue operations and implement the acquisition

plans of the Company’s new management including the completion of the acquisitions of AIRobitca and Travel Buddha as well

as potentially complete a merger with Scepter Commodities LLC. As of June 30, 2019, we have working capital deficit of approximately

$2,440,289 and a stockholders’ equity of $605,638.

Our

independent auditor’s report expresses doubt about our ability to continue as a going concern.

The

reports of the Company’s outside auditors Assurance Dimensions, and its prior auditors D’Arelli Pruzansky, P.A., Demetrius

Berkower, LLC., Rosenberg, Rich, Baker, Berman & Company, and Arthur Andersen & Co., with respect to its latest audited

reports on Form10-K for each of the fiscal years commencing in the fiscal year ended June 30, 2001 through the fiscal year ended

June 30, 2018, stated that “there is substantial doubt of the Company’s ability to continue as a going concern.”

Such opinion from our outside auditors makes it significantly more difficult and expensive for the Company to raise additional

capital necessary to continue our operations.

Risk

Factors Related To Our Operations

We

have not to date had completed final military or commercial development of our flagship product, the Smart NanoBattery.

We

have derived no material revenues from our Smart NanoBattery from inception of development in February 2004 through June 30, 2019.

Risks

Related To Our Targeted Markets

The

sale of new high technology products often has a long lead-time and a multiplicity of risks.

Commercialization

of new technology products often has a very long lead time since it is not possible to predict when major companies will license

such technology for sale to their customers. The scientific disciplines of artificial intelligence, machine learning, nanotechnology

and microfluidics used to develop our Smart NanoBattery are each in their very early stages and acceptance and demand for such

products can often be a long evolutionary process.

The

sciences of artificial intelligence, machine learning and nanotechnology is at a very early stage as disciplines and each is subject

to great uncertainty and swift changes in technology.

Microfluid

dynamics and the manipulation of materials of nano size and dimensions is a very new science and the creation of new products

is dependent upon new and different properties of such materials created that will result in many uncertain applications and rapid

change. The evolution of nanotechnology as a new science adds greater uncertainty to new applications and new and improved product

introductions is unpredictable. Artificial intelligence and machine learning are even newer sciences and are subject to many uncertain

future developments.

We

may not be able to create new products from our intellectual property using microfluidics that will be acceptable in water purification,

oil separation from water and other environment markets.

The

market for “green” products and solutions is characterized by changing regulatory standards, new and improved product

introductions, and changing customer demands.

Large

companies such as Amazon, Google, Microsoft, and Facebook have great resources and are currently focusing significant capital

for new solutions using artificial intelligence and machine learning. Such companies have made significant inroads to date in

the areas of artificial intelligence and machine learning owing to their substantial capital resources and focused and committed

research and development.

Our

future success will depend upon our ability to achieve compelling technology innovations that are economic and practical to produce

in large quantities. Success in new technology, products and services is a complex and uncertain process requiring high levels

of innovation, highly-skilled engineering and development personnel, and the accurate anticipation of technological and market

trends. We may not be able to identify, develop, market or support new or enhanced technology, products, or services on a timely

basis, if at all, owing to our size and limited financial resources.

The

commercialization of many applications of our technologies will depend on our ability to establish strategic relationships with

commercial partners.

We

are seeking commercial partners with established lines of business and greater financial resources than our own. Such partners

may not place the priority that we do on joint projects because the success or failure of such projects is not as material to

other existing well- developed lines of business.

Our

Smart NanoBattery and our potential applications of our technology are components of end products and therefore our products are

tied to the success of such end products.

The

compelling need for critical mission batteries and other applications of our nanotechnology will depend upon both military and

commercial needs going forward and the demand for our products as components. Thus, the success of our Smart NanoBattery and other

applications of our technology will depend upon the continuing need for the end user products and market demand.

The

sale of new high technology products often has a long lead-time and a multiplicity of risks.

Commercialization

of new technology products often has very long lead time since it is not possible to predict when major companies will license

such technology for sale to their customers. The science of artificial intelligence and machine learning as well as nanotechnology

and microfluidics used to develop our Smart NanoBattery are each in their very early stages and acceptance and demand for such

products can often be a long evolutionary process.

The

science of nanotechnology is at a very early stage as a discipline and is subject to great uncertainty and swift changes in technology.

Microfluid

dynamics and the manipulation of materials of nano size and dimensions is a very new science and the creation of new products

is dependent upon new and different properties of such materials created that will result in many uncertain applications and rapid

change. The evolution of nanotechnology as a new science adds greater uncertainty to new applications and new and improved product

introductions is unpredictable.

Our

future success will depend upon our ability to achieve compelling technology innovations that are economic and practical to produce

in large quantities. Success in new technology, products and services is a complex and uncertain process requiring high levels

of innovation, highly-skilled engineering and development personnel, and the accurate anticipation of technological and market

trends. We may not be able to identify, develop, market or support new or enhanced technology, products, or services on a timely

basis, if at all, owing to our size and limited financial resources.

General

Risks Relating to Our Business

We

depend on key personnel for our continued operations and future success, and a loss of certain key personnel could significantly

hinder our ability to move forward with our business plan.

Because

of the specialized nature of our business, we are highly dependent on our ability to identify, hire, train and retain highly qualified

scientific and technical personnel for the research and development activities we conduct or sponsor. The loss of one or more

certain key executive officers, or scientists, would be significantly detrimental to us. In addition, recruiting and retaining

qualified scientific personnel to perform research and development work is critical to our success. Our anticipated growth and

expansion into areas and activities requiring additional expertise, such as new applications for “smart surfaces”,

manufacturing and marketing, will require the addition of new management personnel and the development of additional expertise

by existing management personnel. Despite the current economic conditions and job market there is significant competition for

qualified personnel in the areas of our present and planned activities, and there can be no assurance that we will be able to

continue to attract and retain the qualified personnel necessary for the development of our business. The failure to attract and

retain such personnel or to develop such expertise would adversely affect our business.

Our

insurance policies are limited in scope and coverage and may potentially expose us to unrecoverable risks.

We

do not carry director and officer insurance and have limited commercial insurance policies. Any significant insurance claims would

have a material adverse effect on our business, financial condition and results of operations. Insurance availability, coverage

terms and pricing continue to vary with market conditions. We endeavor to obtain appropriate insurance coverage for insurable

risks that we identify, however, we may, due to limited financial resources, be unable to correctly cover those risks that we

can anticipate or quantify as insurable risks. We may not be able to obtain appropriate insurance coverage, and insurers may not

respond as we intend to cover insurable events that may occur. We have observed rapidly changing conditions in the insurance markets

relating to nearly all areas of traditional corporate insurance. Such conditions have resulted in higher premium costs, higher

policy deductibles, and lower coverage limits. For some risks, we may not have or maintain insurance coverage because of cost

or availability.

We

have no product liability insurance, which may leave us vulnerable to future claims we will be unable to satisfy.

The

testing, manufacturing, marketing and sale of consumer products entail an inherent risk of product liability claims, and we cannot

assure you that substantial product liability claims will not be asserted against us. We have no product liability insurance.

In the event we are forced to expend significant funds on defending product liability actions, and in the event those funds come

from operating capital, we will be required to reduce our business activities, which could lead to significant losses.

We

cannot assure you that adequate insurance coverage will be available in the future on acceptable terms, if at all, or that, if

available, we will be able to maintain any such insurance at sufficient levels of coverage or that any such insurance will provide

adequate protection against potential liabilities. Whether or not a product liability insurance policy is obtained or maintained

in the future, any product liability claim could harm our business or financial condition.

We

face risks related to compliance with corporate governance laws and financial reporting standards.

The

Sarbanes-Oxley Act of 2002, as well as related new rules and regulations implemented by the Securities and Exchange Commission

and the Public Company Accounting Oversight Board, require changes in the corporate governance practices and financial reporting

standards for public companies. These new laws, rules and regulations, including compliance with Section 404 of the Sarbanes-Oxley

Act of 2002 relating to internal control over financial reporting, referred to as Section 404, have materially increased our legal

and financial compliance costs and made some activities more time-consuming and more burdensome.

We

may not be able to adequately defend against piracy of intellectual property in foreign jurisdictions.

Considerable

research in the areas of micro fluid dynamics is being performed in countries outside of the United States, and a number of potential

competitors are located in these countries. The laws protecting intellectual property in some of those countries may not provide

adequate protection to prevent our competitors from misappropriating our intellectual property. Several of these potential competitors

may be further along in the process of product development and also operate large, company-funded research and development programs.

As a result, our competitors may develop more competitive or affordable products, or achieve earlier patent protection or product

commercialization than we are able to achieve. Competitive products may render any products or product candidates that we develop

obsolete.

We

may incur substantial expenditures in the future in order to protect our intellectual property.

We

believe that our intellectual property with respect to our Smart NanoBattery, our proprietary rights with respect to the Company’s

permeable membrane design consisting of both micro and nano scale silicon features that are coated with a monolayer chemistry

used to repel liquids, and our recent entry into the area of artificial intelligence and machine learning are critical to our

future success. The Company’s current battery related patent portfolio consists of Smart Surfaces technologies. Our pending

patent applications may never be granted for various reasons, including the existence of conflicting patents or defects in our

applications. Even if additional U.S. patents are ultimately granted, there are significant risks regarding enforcement of patents

in international markets. There are many patents being filed as the science of nanotechnology develops and the Company has limited

financial resources compared to large, well established companies to bring patent litigation based upon claims of patent infringement.

FORWARD-LOOKING

STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as “may,” “assumes,”

“forecasts,” “positions,” “predicts,” “strategy,” “will,” “expects,”

“estimates,” “anticipates,” “believes,” “projects,” “intends,” “plans,”

“budgets,” “potential,” “continue” and variations thereof, and other statements contained

in this prospectus, regarding matters that are not historical facts and are forward-looking statements. Because these statements

involve risks and uncertainties, as well as certain assumptions, actual results may differ materially from those expressed or

implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not

limited to risks inherent in: our early stage of development, including a lack of operating history, lack of profitable operations

and the need for additional capital; the development and commercialization of largely novel and unproven technologies and products;

our ability to protect, maintain and defend our intellectual property rights; uncertainties regarding our ability to obtain the

capital resources needed to continue research and development operations and to conduct research; uncertainty regarding our overall

ability to compete effectively in a highly complex, rapidly developing, capital intensive and competitive industry. See “Risk

Factors” set forth herein for a more complete discussion of these factors. Readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the date that they are made. We undertake no obligation to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking

statements include our plans and objectives for future operations, including plans and objectives relating to our products and

our future economic performance. Assumptions relating to the foregoing involve judgments with respect to, among other things,

future economic, competitive and market conditions, future business decisions, and the time and money required to successfully

complete development and commercialization of our technologies, all of which are difficult or impossible to predict accurately

and many of which are beyond our control. Although we believe that the assumptions underlying the forward-looking statements contained

herein are reasonable, any of those assumptions could prove inaccurate and, therefore, we cannot assure you that the results contemplated

in any of the forward-looking statements contained herein will be realized. Based on the significant uncertainties inherent in

the forward-looking statements included herein, the inclusion of any such statement should not be regarded as a representation

by us or any other person that our objectives or plans will be achieved.

USE

OF PROCEEDS

We

will receive no proceeds from the sale of shares of Common Stock offered by the selling stockholders.

DETERMINATION

OF OFFERING PRICE

The

selling stockholders may sell their shares in the over-pink sheet market or otherwise, at market prices prevailing at the time

of sale, at prices related to the prevailing market price, or at negotiated prices.

SELLING

SECURITY HOLDERS

The

following table details the name of each selling stockholder, the number of shares owned by that selling stockholder, and the

number of shares that may be offered by each selling stockholder for resale under this prospectus. The selling stockholders may

sell up to 10,477,800 shares of our Common Stock from time to time in one or more offerings under this prospectus. Because each

selling stockholder may offer all, some or none of the shares it holds, and because, based upon information provided to us, there

are currently no agreements, arrangements, or understandings with respect to the sale of any of the shares, no definitive estimate

as to the number of shares that will be held by each selling stockholder after the offering can be provided. The following table

has been prepared on the assumption that all shares offered under this prospectus will be sold to parties unaffiliated with the

selling stockholders.

|

Name

|

|

Number

of

Shares of

Common Stock

|

|

|

|

|

|

|

|

Ace

Fenimore LLC

|

|

|

15,000

|

|

|

|

|

|

|

|

|

ADMK

Holdings LLC

|

|

|

221,775

|

|

|

|

|

|

|

|

|

American

European Insurance Company

|

|

|

3,000

|

|