Dave & Buster's Entertainment, Inc., (NASDAQ:PLAY), ("Dave

& Buster's" or "the Company"), an owner and operator of

entertainment and dining venues, today announced financial results

for its second quarter 2019, which ended on August 4, 2019.

Key highlights from the second quarter 2019 compared to

the second quarter 2018 include:

- Total revenues increased 8.0% to $344.6 million from $319.2

million

- Number of stores increased 11.1% to 130 from 117

- Comparable store sales decreased 1.8%

- Net income totaled $32.4 million, or $0.90 per diluted share,

vs. net income of $33.8 million, or $0.84 per diluted share

- EBITDA increased 5.3% to $79.0 million from $75.0 million

- Adjusted EBITDA increased 4.4% to $86.0 million from $82.4

million

- Launched Men in Black: Galactic Getaway, the Company’s fourth

proprietary virtual reality title

- Expanded share repurchase authorization by $200 million to $800

million; repurchased 3.4 million shares for approximately $137

million and paid a quarterly cash dividend of $0.15 per share

“We continue to deliver strong revenue and

earnings per share growth – including record second quarter sales,

EBITDA and EPS – while investing for the future and returning

substantial capital to shareholders through dividends and share

repurchases,” said Brian Jenkins, Chief Executive Officer. “We are

executing on five near-term priorities to improve performance and

capitalize on the growing consumer demand for our offerings. By

realizing operational efficiencies and cost savings, we will fund

investments to fuel comp sales growth going forward. We are acting

decisively to accelerate near and long-term value creation, and to

deliver superior returns for all Dave & Buster’s

shareholders.”

Near-Term Priorities The Company is focused on

five priorities to drive near and long-term value creation:

- Revitalization of existing stores beginning

with the installation of “Wow Walls,” LED television displays that

create high-energy, contemporary, sports and entertainment-oriented

dining areas. This cutting-edge visual technology will be initially

deployed across 35 stores by mid-October to drive greater traffic

and food and beverage penetration. The Company’s revitalization

also includes continued food, beverage and amusements innovation,

including the upcoming launch of Terminator VR, all of which is

part of introducing new “wow” experiences for guests.

- Building deeper guest engagement starting with

the nation-wide launch of the Dave & Buster’s mobile app in

October. This will be coupled with technology upgrades, enhanced

data analytics and digital marketing investments to drive deeper

engagement with customers.

- Disciplined cost management to fuel growth

investments. The Company has identified approximately $15

million of gross annualized cost savings, most of which will be

redeployed towards guest engagement initiatives to fuel comp sales

growth.

- Investment in highest-return new store

locations to strengthen the Dave & Buster’s brand and

portfolio over the long term. This includes optimizing store

formats to match market sales potential and managing the pace of

new store openings to maximize returns and advance the Company’s

store revitalization efforts.

- Continued capital return to shareholders in

the form of share repurchases and dividend payments. The Company

has returned more than $200 million to shareholders through the end

of the second quarter of 2019.

These five priorities will be the focus of the

Company’s efforts in the near term, although the Board and

management team will continue to evaluate other opportunities as

part of the ongoing strategic planning process.

Scott Bowman, Chief Financial Officer, said, “We

intend to maintain and build upon our industry leading position,

even as new entrants in our market are creating a more competitive

operating environment. Despite challenges, our team once again

delivered solid overall results. Consistent with our commitment to

deliver outstanding margins, and in light of our revised outlook,

we have taken cost management actions to facilitate greater

investments to increase traffic and same store sales. We look

forward to reporting on our progress.”

Review of Second Quarter

2019 Operating Results

Compared to Second Quarter 2018

Total revenues increased 8.0% to $344.6 million

from $319.2 million in the second quarter 2018. This growth was

driven by a 9.4% increase in Amusements and Other revenue and a

5.9% increase in Food and Beverage revenue. The mix of Amusement

and Other as a percentage of total revenue increased 80 basis

points to 60.0% in the second quarter of 2019.

Comparable store sales decreased 1.8% in the

second quarter 2019, compared to a decrease of 2.4% in the

comparable period last year. The decrease in comparable store sales

was driven by a 2.0% decline in walk-in sales, which was partially

offset by a 0.1% increase in special events sales. Comparable store

sales decreased 0.8% in Amusements & Other and 3.2% in Food

& Beverage. Non-comparable store revenue was $77.2 million in

the second quarter of 2019, an increase of $29.6 million or 62.3%

versus the comparable period last year.

Operating income increased 0.6% to $46.2 million

in the second quarter of 2019 from $45.9 million in the second

quarter of 2018. As a percentage of total revenues, operating

income decreased 100 basis points to 13.4% from 14.4%.

Net income was $32.4 million, or $0.90 per

diluted share (36.0 million diluted share base) in the second

quarter of 2019 compared to $33.8 million, or $0.84 per diluted

share (40.3 million diluted share base) in the second quarter of

2018.

EBITDA increased 5.3% to $79.0 million in the

second quarter of 2019 from $75.0 million in the second quarter of

2018. As a percentage of total revenues, EBITDA decreased 60 basis

points to 22.9% from 23.5%.

Adjusted EBITDA increased 4.4% to $86.0 million

in the second quarter of 2019 from $82.4 million in the second

quarter of 2018. As a percentage of total revenues, Adjusted EBITDA

decreased 80 basis points to 25.0% from 25.8%.

Store operating income before depreciation and

amortization increased 4.8% to $99.7 million in the second quarter

2019 from $95.1 million in last year's second quarter. As a

percentage of total revenues, store operating income before

depreciation and amortization decreased 90 basis points to 28.9%

from 29.8%.

Development

The Company remains on track to open 15 to 16

new locations in fiscal 2019, representing unit growth of

approximately 12% (net of Gwinnett (Duluth), Georgia closing). At

the top end of the range, these store openings will include 11

large and 5 small format locations and will skew towards new

markets for the Dave & Buster’s brand.

During the second quarter of 2019, the Company

opened three new stores located in Winston-Salem, North Carolina;

Natick, Massachusetts (west of Boston); and Gaithersburg, Maryland

(northwest of Washington, D.C.). During the third quarter, the

Company has already opened a store in Huntsville, Alabama and

Concord, California. Two more stores in McDonough, Georgia and

Wichita, Kansas are scheduled to open later in the fiscal third

quarter. As of September 4, 2019, there were six stores under

construction.

Capital Allocation

Initiatives

During the second quarter of 2019, the Company

repurchased 3.4 million shares for approximately $137 million and

at quarter-end had approximately $270 million remaining under the

$800 million authorization. The Company paid a quarterly cash

dividend of $0.15 per share during the second quarter.

Financial Outlook

In light of the competitive environment, and

because the initiatives underway will take time to execute and

drive results, the Company is setting new guidance for fiscal 2019,

which ends February 2, 2020:

- Total revenues of $1.338 billion to $1.359 billion (vs. $1.365

billion to $1.390 billion)

- Comparable store sales of -3.5% to -2.0% (vs. -1.5% to

+0.5%)

- 15 to 16 new stores (unchanged)

- Net income of $91 million to $100 million (vs. $103 million to

$113 million)

- Effective tax rate of 22.0% to 22.5% (unchanged) and diluted

share count of approximately 34.0 million (vs. 36.5 million

shares)

- EBITDA of $272 million to $282 million ($274 million to $284

million excluding approximately $2 million in one-time charges)

(vs. $283 million to $295 million previously)

- Total capital additions (net of tenant improvement allowances

and other landlord payments) of $200 million to $210 million (vs.

$190 million to $200 million)

Conference Call Today

Management will hold a conference call to

discuss these results today at 4:00 p.m. Central Time (5:00 p.m.

Eastern Time). The conference call can be accessed over the phone

by dialing (323) 794-2423 or toll-free (888) 204-4368. A

replay will be available after the call for one year beginning at

7:00 p.m. Central Time (8:00 p.m. Eastern Time) and can be accessed

by dialing (412) 317-6671 or toll-free (844) 512-2921; the passcode

is 6093533.

Additionally, a live and archived webcast of the

conference call will be available

at www.daveandbusters.com under the Investor Relations

section.

About Dave & Buster’s Entertainment,

Inc.

Founded in 1982 and headquartered in Dallas,

Texas, Dave & Buster's Entertainment, Inc., is the owner and

operator of 132 venues in North America that combine entertainment

and dining and offer customers the opportunity to "Eat Drink Play

and Watch," all in one location. Dave & Buster's offers a full

menu of entrées and appetizers, a complete selection of alcoholic

and non-alcoholic beverages, and an extensive assortment of

entertainment attractions centered around playing games and

watching live sports and other televised events. Dave &

Buster's currently has stores in 39 states, Puerto Rico, and

Canada.

Forward-Looking Statements

The statements contained in this release that

are not historical facts are forward-looking statements. These

forward-looking statements involve risks and uncertainties and,

consequently, could be affected by our level of indebtedness,

general business and economic conditions, the impact of

competition, the seasonality of the Company's business, adverse

weather conditions, future commodity prices, guest and employee

complaints and litigation, fuel and utility costs, labor costs and

availability, changes in consumer and corporate spending, changes

in demographic trends, changes in governmental regulations,

unfavorable publicity, our ability to open new stores, and acts of

God. Accordingly, actual results may differ materially from the

forward-looking statements, and the Company therefore cautions you

against relying on such forward-looking statements. Dave &

Buster's intends these forward-looking statements to speak only as

of the time of this release and does not undertake to update or

revise them as more appropriate information becomes available,

except as required by law.

Non-GAAP Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with

GAAP, the Company uses the following non-GAAP financial measures:

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Store operating income before depreciation and amortization, and

store operating income before depreciation and amortization margin

(collectively the "non-GAAP financial measures"). The presentation

of this financial information is not intended to be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP. The

Company uses these non-GAAP financial measures for financial and

operational decision making and as a means to evaluate

period-to-period comparisons. The Company believes that they

provide useful information about operating results, enhance the

overall understanding of our operating performance and future

prospects, and allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision making. The non-GAAP measures used by the Company in this

press release may be different from the measures used by other

companies.

| |

| DAVE &

BUSTER'S ENTERTAINMENT, INC. |

| Condensed

Consolidated Balance Sheets |

| (in

thousands) |

| |

| |

|

|

|

|

|

ASSETS |

|

August 4,

2019 |

|

February 3,

2019 |

| |

|

(unaudited) |

|

(audited) |

| Current

assets: |

|

|

|

|

| |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

23,318 |

|

$ |

21,585 |

|

Other current assets |

|

|

54,897 |

|

|

69,508 |

|

|

|

|

|

|

|

Total current assets |

|

|

78,215 |

|

|

91,093 |

| |

|

|

|

|

| Property and

equipment, net |

|

|

851,715 |

|

|

805,337 |

| |

|

|

|

|

| Operating

lease right of use assets |

|

|

924,461 |

|

|

- |

| |

|

|

|

|

| Intangible

and other assets, net |

|

|

379,686 |

|

|

376,757 |

| |

|

|

|

|

|

Total assets |

|

$ |

2,234,077 |

|

$ |

1,273,187 |

| |

|

|

|

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| |

|

|

|

|

| Total

current liabilities |

|

$ |

256,641 |

|

$ |

244,390 |

| |

|

|

|

|

| Operating

lease liabilities |

|

|

1,125,874 |

|

|

- |

| |

|

|

|

|

| Other

long-term liabilities |

|

|

50,181 |

|

|

262,491 |

| |

|

|

|

|

| Long-term

debt, net |

|

|

552,079 |

|

|

378,469 |

| |

|

|

|

|

|

Stockholders' equity |

|

|

249,302 |

|

|

387,837 |

| |

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

2,234,077 |

|

$ |

1,273,187 |

| |

|

|

|

|

| DAVE &

BUSTER'S ENTERTAINMENT, INC. |

| Consolidated

Statements of Operations (Unaudited) |

| (in

thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

| |

|

13 Weeks Ended |

|

13 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Food and beverage revenues |

|

$ |

137,921 |

|

|

40.0 |

% |

|

$ |

130,242 |

|

40.8 |

% |

| Amusement

and other revenues |

|

|

206,678 |

|

|

60.0 |

% |

|

|

188,946 |

|

59.2 |

% |

|

Total revenues |

|

|

344,599 |

|

|

100.0 |

% |

|

|

319,188 |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

| Cost of food

and beverage (as a percentage of food and beverage revenues) |

|

|

36,934 |

|

|

26.8 |

% |

|

|

33,998 |

|

26.1 |

% |

| Cost of

amusement and other (as a percentage of amusement and other

revenues) |

|

|

22,689 |

|

|

11.0 |

% |

|

|

21,558 |

|

11.4 |

% |

|

Total cost of products |

|

|

59,623 |

|

|

17.3 |

% |

|

|

55,556 |

|

17.4 |

% |

| Operating

payroll and benefits |

|

|

80,927 |

|

|

23.5 |

% |

|

|

73,736 |

|

23.1 |

% |

| Other store

operating expenses |

|

|

104,376 |

|

|

30.3 |

% |

|

|

94,825 |

|

29.7 |

% |

| General and

administrative expenses |

|

|

15,991 |

|

|

4.6 |

% |

|

|

14,764 |

|

4.6 |

% |

| Depreciation

and amortization expense |

|

|

32,745 |

|

|

9.5 |

% |

|

|

29,049 |

|

9.1 |

% |

| Pre-opening

costs |

|

|

4,723 |

|

|

1.4 |

% |

|

|

5,328 |

|

1.7 |

% |

|

Total operating costs |

|

|

298,385 |

|

|

86.6 |

% |

|

|

273,258 |

|

85.6 |

% |

| |

|

|

|

|

|

|

|

|

|

Operating income |

|

|

46,214 |

|

|

13.4 |

% |

|

|

45,930 |

|

14.4 |

% |

| |

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

|

4,605 |

|

|

1.3 |

% |

|

|

3,228 |

|

1.0 |

% |

| |

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

41,609 |

|

|

12.1 |

% |

|

|

42,702 |

|

13.4 |

% |

| Provision

for income taxes |

|

|

9,253 |

|

|

2.7 |

% |

|

|

8,923 |

|

2.8 |

% |

|

Net income |

$ |

32,356 |

|

|

9.4 |

% |

|

$ |

33,779 |

|

10.6 |

% |

| |

|

|

|

|

|

|

|

|

| Net income

per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.91 |

|

|

|

|

$ |

0.86 |

|

|

|

Diluted |

|

$ |

0.90 |

|

|

|

|

$ |

0.84 |

|

|

| Weighted

average shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

Basic shares |

|

|

35,407,965 |

|

|

|

|

|

39,355,105 |

|

|

|

Diluted shares |

|

|

36,015,710 |

|

|

|

|

|

40,280,301 |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Other

information: |

|

|

|

|

|

|

|

|

|

Company-owned and operated stores open at end of period |

|

130 |

|

|

|

|

|

117 |

|

|

| |

| |

|

|

|

|

|

|

|

|

| The following table

sets forth a reconciliation of net income to EBITDA and Adjusted

EBITDA for the periods shown: |

| |

|

|

|

|

|

|

|

|

| |

|

13 Weeks Ended |

|

13 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Net income |

$ |

32,356 |

|

|

9.4 |

% |

|

$ |

33,779 |

|

10.6 |

% |

|

Add back: Interest expense, net |

|

4,605 |

|

|

|

|

|

3,228 |

|

|

|

Provision for income taxes |

|

|

9,253 |

|

|

|

|

|

8,923 |

|

|

|

Depreciation and amortization expense |

|

|

32,745 |

|

|

|

|

|

29,049 |

|

|

|

EBITDA |

|

78,959 |

|

|

22.9 |

% |

|

|

74,979 |

|

23.5 |

% |

|

Add back: Loss on asset disposal |

|

406 |

|

|

|

|

|

431 |

|

|

|

Share-based compensation |

|

|

1,907 |

|

|

|

|

|

1,626 |

|

|

|

Pre-opening costs |

|

|

4,723 |

|

|

|

|

|

5,328 |

|

|

|

Other costs |

|

|

(13 |

) |

|

|

|

|

26 |

|

|

|

Adjusted EBITDA |

$ |

85,982 |

|

|

25.0 |

% |

|

$ |

82,390 |

|

25.8 |

% |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| The following table

sets forth a reconciliation of operating income to store operating

income before depreciation and amortization for the periods

shown: |

| |

|

|

|

|

|

|

|

|

| |

|

13 Weeks Ended |

|

13 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Operating income |

$ |

46,214 |

|

|

13.4 |

% |

|

$ |

45,930 |

|

14.4 |

% |

|

Add back: General and administrative expenses |

|

15,991 |

|

|

|

|

|

14,764 |

|

|

|

Depreciation and amortization expense |

|

|

32,745 |

|

|

|

|

|

29,049 |

|

|

|

Pre-opening costs |

|

|

4,723 |

|

|

|

|

|

5,328 |

|

|

|

Store operating income before depreciation and

amortization |

$ |

99,673 |

|

|

28.9 |

% |

|

$ |

95,071 |

|

29.8 |

% |

| |

|

|

|

|

|

|

|

|

| DAVE &

BUSTER'S ENTERTAINMENT, INC. |

| Consolidated

Statements of Operations (Unaudited) |

| (in

thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

| |

|

26 Weeks Ended |

|

26 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Food and beverage revenues |

|

$ |

286,142 |

|

40.4 |

% |

|

$ |

269,997 |

|

41.5 |

% |

| Amusement

and other revenues |

|

|

422,039 |

|

59.6 |

% |

|

|

381,381 |

|

58.5 |

% |

|

Total revenues |

|

|

708,181 |

|

100.0 |

% |

|

|

651,378 |

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

| Cost of food

and beverage (as a percentage of food and beverage revenues) |

|

|

75,688 |

|

26.5 |

% |

|

|

70,018 |

|

25.9 |

% |

| Cost of

amusement and other (as a percentage of amusement and other

revenues) |

|

|

45,660 |

|

10.8 |

% |

|

|

42,677 |

|

11.2 |

% |

|

Total cost of products |

|

121,348 |

|

17.1 |

% |

|

|

112,695 |

|

17.3 |

% |

| Operating

payroll and benefits |

|

|

163,800 |

|

23.1 |

% |

|

|

146,630 |

|

22.5 |

% |

| Other store

operating expenses |

|

|

210,621 |

|

29.8 |

% |

|

|

188,165 |

|

28.9 |

% |

| General and

administrative expenses |

|

|

32,837 |

|

4.6 |

% |

|

|

30,418 |

|

4.7 |

% |

| Depreciation

and amortization expense |

|

|

63,886 |

|

9.0 |

% |

|

|

56,555 |

|

8.7 |

% |

| Pre-opening

costs |

|

|

11,725 |

|

1.7 |

% |

|

|

12,381 |

|

1.9 |

% |

|

Total operating costs |

|

|

604,217 |

|

85.3 |

% |

|

|

546,844 |

|

84.0 |

% |

| |

|

|

|

|

|

|

|

|

|

Operating income |

|

|

103,964 |

|

14.7 |

% |

|

|

104,534 |

|

16.0 |

% |

| |

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

|

8,661 |

|

1.2 |

% |

|

|

6,085 |

|

0.9 |

% |

| |

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

95,303 |

|

13.5 |

% |

|

|

98,449 |

|

15.1 |

% |

| Provision

for income taxes |

|

|

20,504 |

|

2.9 |

% |

|

|

22,520 |

|

3.4 |

% |

|

Net income |

$ |

74,799 |

|

10.6 |

% |

|

$ |

75,929 |

|

11.7 |

% |

| |

|

|

|

|

|

|

|

|

| Net income

per share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

2.07 |

|

|

|

$ |

1.92 |

|

|

|

Diluted |

|

$ |

2.03 |

|

|

|

$ |

1.88 |

|

|

| Weighted

average shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

Basic shares |

|

|

36,117,815 |

|

|

|

|

39,525,263 |

|

|

|

Diluted shares |

|

|

36,803,001 |

|

|

|

|

40,444,201 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Other

information: |

|

|

|

|

|

|

|

|

|

Company-owned and operated stores open at end of period |

|

130 |

|

|

|

|

117 |

|

|

| |

| |

|

|

|

|

|

|

|

|

| The following table

sets forth a reconciliation of net income to EBITDA and Adjusted

EBITDA for the periods shown: |

| |

|

|

|

|

|

|

|

|

| |

|

26 Weeks Ended |

|

26 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Net income |

$ |

74,799 |

|

10.6 |

% |

|

$ |

75,929 |

|

11.7 |

% |

|

Add back: Interest expense, net |

|

8,661 |

|

|

|

|

6,085 |

|

|

|

Provision for income taxes |

|

|

20,504 |

|

|

|

|

22,520 |

|

|

|

Depreciation and amortization expense |

|

|

63,886 |

|

|

|

|

56,555 |

|

|

|

EBITDA |

|

167,850 |

|

23.7 |

% |

|

|

161,089 |

|

24.7 |

% |

|

Add back: Loss on asset disposal |

|

826 |

|

|

|

|

693 |

|

|

|

Share-based compensation |

|

|

3,732 |

|

|

|

|

4,014 |

|

|

|

Pre-opening costs |

|

|

11,725 |

|

|

|

|

12,381 |

|

|

|

Other costs |

|

|

33 |

|

|

|

|

121 |

|

|

|

Adjusted EBITDA |

$ |

184,166 |

|

26.0 |

% |

|

$ |

178,298 |

|

27.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The following table

sets forth a reconciliation of operating income to store operating

income before depreciation and amortization for the periods

shown: |

| |

|

|

|

|

|

|

|

|

| |

|

26 Weeks Ended |

|

26 Weeks Ended |

| |

|

August 4, 2019 |

|

August 5, 2018 |

| |

|

|

|

|

|

|

|

|

|

Operating income |

$ |

103,964 |

|

14.7 |

% |

|

$ |

104,534 |

|

16.0 |

% |

|

Add back: General and administrative expenses |

|

32,837 |

|

|

|

|

30,418 |

|

|

|

Depreciation and amortization expense |

|

|

63,886 |

|

|

|

|

56,555 |

|

|

|

Pre-opening costs |

|

|

11,725 |

|

|

|

|

12,381 |

|

|

|

Store operating income before depreciation and amortization |

$ |

212,412 |

|

30.0 |

% |

|

$ |

203,888 |

|

31.3 |

% |

| |

|

|

|

|

|

|

|

|

For Investor Relations Inquiries:

Arvind Bhatia, CFADave & Buster’s Entertainment,

Inc.214.904.2202arvind.bhatia@daveandbusters.com

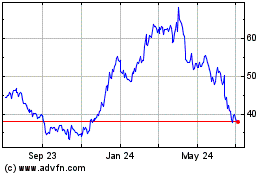

Dave and Busters Enterta... (NASDAQ:PLAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

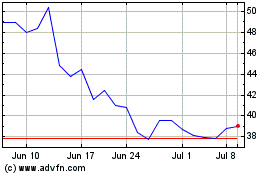

Dave and Busters Enterta... (NASDAQ:PLAY)

Historical Stock Chart

From Apr 2023 to Apr 2024