Current Report Filing (8-k)

August 07 2019 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 1, 2019

Regional Health Properties, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Georgia

|

|

001-33135

|

|

81-5166048

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

454 Satellite Boulevard, NW

Suite 100

Suwanee, Georgia 30024

(Address of Principal Executive Offices, and Zip Code)

(678) 869-5116

(Registrant’s telephone number, including area code)

Not applicable.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

RHE

|

NYSE American

|

|

10.875% Series A Cumulative Redeemable Preferred Stock, no par value

|

RHE-PA

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.01

Completion

of Acquisition or Disposition of Assets.

On August 1, 2019, Regional Health Properties, Inc. (the “Company”), through certain of its wholly owned subsidiaries (collectively, “Seller”), sold three skilled nursing facilities (collectively, the “Facilities”), together with substantially all of the fixtures, equipment, furniture, leases and other assets relating to such Facilities (the “Asset Sale”), to affiliates of MED Healthcare Partners LLC (collectively, “Buyer”), pursuant to that certain Purchase and Sale Agreement, dated April 15, 2019, as subsequently amended from time to time (the “PSA”), between Seller and Buyer. In connection with the Asset Sale: (i) Buyer paid to the Company a cash purchase price for the Facilities equal to $26.1 million; and (ii) the Company incurred approximately $0.4 million in sales commission expenses and transferred approximately $0.1 million in lease security deposits to Buyer.

The Facilities sold by the Company in the Asset Sale are the: (i) 182-bed skilled nursing facility commonly known as Attalla Health & Rehab located in Attalla, Alabama (the “Attalla Facility”); (ii) 100-bed skilled nursing facility commonly known as Healthcare at College Park located in College Park, Georgia (the “College Park Facility”); and (iii) 118-bed skilled nursing facility commonly known as Quail Creek Nursing Home located in Oklahoma City, Oklahoma (the “Quail Creek Facility”).

The PSA originally provided for the sale of the Facilities along with the 100-bed skilled nursing facility commonly known as Northwest Nursing Center located in Oklahoma City, Oklahoma (the “Northwest Facility”) for an aggregate purchase price of $28.5 million, with a scheduled closing date of August 1, 2019. The Sixth Amendment to Purchase and Sale Agreement, dated July 31, 2019, amended the PSA to: (i) extend the scheduled closing date for the sale of the Northwest Facility to August 30, 2019, subject to the satisfaction or waiver of customary closing conditions (provided, however, that such closing date may be further extended to September 30, 2019 if Buyer provides notice to Seller in writing by August 28, 2019 and pays to Seller a non-refundable fee of $0.075 million); and (ii) reduce the purchase price for the Northwest Facility by approximately $0.1 million for building improvements, thereby bringing the purchase price for the Northwest Facility to approximately $2.3 million. There is no assurance that the sale of the Northwest Facility will be completed by August 30, 2019 (or by September 30, 2019), or will be completed on the terms described above, or will be completed at all.

Item 8.01

Other Events.

On August 1, 2019, the Company used a portion of the proceeds from the Asset Sale to repay approximately $21.3 million to Pinecone Realty Partners II, LLC (“Pinecone”) to extinguish all indebtedness owed by the Company under a loan agreement (the “Pinecone Credit Facility”) dated February 15, 2018, as amended from time to time, between the Company and Pinecone, with an original aggregate principal amount of $16.25 million, which was classified as current due to the Company’s noncompliance with certain covenants under the Pinecone Credit Facility. The Pinecone Credit Facility had a maturity date of August 15, 2020, bore interest of 13.5%, paid in kind interest of 2.5% per annum and was secured by the Attalla Facility, the College Park Facility and the Northwest Facility and a pledge of the equity interests in substantially all of the Company’s direct and indirect wholly owned subsidiaries. The amount repaid to Pinecone was comprised of: (i) approximately $20.7 million in principal (net of $0.1 million loan forgiveness); (ii) $0.5 million in interest; and (iii) $0.1 million in legal expenses.

Under the Pinecone Credit Facility, for a period of three months following such repayment Pinecone will continue to have: (i) a right of first refusal to provide first mortgage financing for any acquisition of a healthcare facility by the Company; and (ii) an exclusive option to refinance the Company’s existing first mortgage loan, with a balance of $5.3 million at July 31, 2019, on the Company’s 124-licensed bed skilled nursing facility located in Glencoe, Alabama known as Coosa Valley Health Care, in each case, subject to the terms and conditions of the Pinecone Credit Facility.

On August 1, 2019, the Company also used a portion of the proceeds from the Asset Sale to repay approximately $3.8 million to Congressional Bank to extinguish all indebtedness owed by the Company under a term loan agreement, dated September 27, 2013, as amended from time to time, between the Company and Congressional Bank, with an original aggregate principal of $5.0 million (the “Quail Creek Credit Facility”). The Quail Creek Credit Facility matured on June 30, 2019, bore interest at LIBOR plus 4.75% and was secured by the Quail Creek Facility. The amount repaid to Congressional Bank was comprised of $3.9 million in principal, after application of approximately $0.1 million in restricted cash.

2

Item 9.01

Financial

Statements and Exhibits

(b)

Pro Forma Financial Information.

The

unaudited

pro forma consolidated financial statements of the Company giving effect to the Asset Sale

are filed as Exhibit 99.1 to this

Current

Report on Form 8-K and are incorporated herein by reference.

The Company’s unaudited pro forma consolidated balance sheet as of March 31, 2019 illustrates the estimated effects of the Asset Sale as if it had occurred on such date. The unaudited pro forma consolidated statements of operations for the three months ended March 31, 2019 and for the year ended December 31, 2018 include certain pro forma adjustments to illustrate the estimated effect of the Asset Sale as if it had occurred on the first day of the earliest period presented.

The unaudited pro forma consolidated financial statements are presented for informational purposes only and do not purport to be indicative of the Company’s financial results as if the Asset Sale had occurred on the first day of the earliest period presented. Further, the unaudited pro forma consolidated financial statements should not be viewed as indicative of the Company’s financial results in the future and should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2018, and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2019.

(d) Exhibits

|

2.

0

|

Purchase and Sale Agreement dated as of April 15, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

1

|

First Amendment to Purchase and Sale Agreement dated as of May 15, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

2

|

Second Amendment to Purchase and Sale Agreement dated as of May 20, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

3

|

Third Amendment to Purchase and Sale Agreement dated as of May 23, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

4

|

Fourth Amendment to Purchase and Sale Agreement dated as of May 31, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

5

|

Fifth Amendment to Purchase and Sale Agreement dated as of June 11, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

|

2.

6

|

Sixth Amendment to Purchase and Sale Agreement dated as of July 31, 2019, by and between Northwest Property Holdings, LLC, QC Property Holdings, LLC, Attalla Nursing ADK, LLC, and CP Property Holdings, LLC, and Attalla Realty LLC, College Park Realty LLC, Quail Creek Realty LLC, and Northwest Realty LLC

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

|

August 7, 2019

|

|

REGIONAL HEALTH PROPERTIES, INC.

|

|

|

|

|

|

|

|

|

|

/s/ Brent Morrison

|

|

|

|

|

Brent Morrison

|

|

|

|

|

Chief Executive Officer and President

|

4

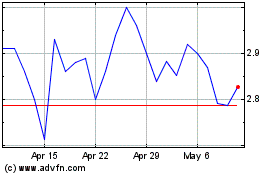

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

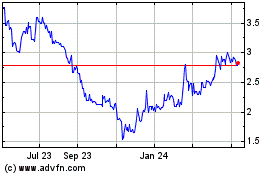

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Apr 2023 to Apr 2024