SCHEDULE 14C INFORMATION

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

|

¨

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

x

|

Definitive Information Statement

|

|

THUNDER ENERGIES CORPORATION

|

|

(Name of Registrant As Specified in Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No Fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

THUNDER ENERGIES CORPORATION

1444 Rainville Road

Tarpon Springs, FL 34689

Dear Shareholders:

We are writing to advise you that the Board of Directors of Thunder Energies Corporation (the “Company”) has received approval pursuant to a written consent to action by shareholder without a meeting to amend (the “Amendment”) its Articles of Incorporation to effectuate a one-for-twenty (1:20) reverse split of the Company’s Common Stock and maintain the number of authorized shares of Common Stock after the reverse stock split.

This action was approved on May 14, 2019 by our Board of Directors. In addition, our management, who holds a majority voting interest through a beneficial interest in our issued and outstanding Series “A” Convertible Preferred Stock, approved this action by written consent in lieu of a special meeting of our shareholders on May 14, 2019 in accordance with the relevant sections of the Florida Business Corporation Law. The Company’s Board of Directors fixed May 20, 2019 as the record date (the “Record Date”), for determining the holders of its voting capital stock entitled to notice of these actions and receipt of this Information Statement.

THIS INFORMATION STATEMENT IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH IS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The accompanying information statement is furnished only to inform our shareholders of the action described above before it becomes effective in accordance with Rule 14c-2 of the Securities Exchange Act of 1934. This information statement is first mailed to you on or about June 4, 2019. The actions described here in shall be taken on or about June 24, 2019, at least twenty (20) days after the mailing of this Information Statement. You are urged to read the Information Statement in its entirety for a full description of the actions approved by the holders of a majority of the Company’s outstanding voting capital stock.

Please feel free to call us at 727-940-3940 should you have any questions on the enclosed information statement. We thank you for your continued interest in Thunder Energies Corporation

|

|

For the Board of Directors of

THUNDER ENERGIES CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ruggero M. Santilli

|

|

|

|

|

Dr. Ruggero M. Santilli,

|

|

|

|

|

Chairman of the Board

|

|

|

|

|

|

|

|

|

Dated: May 22, 2019

|

|

INFORMATION STATEMENT PURSUANT TO SECTION 14

OF THE SECURITIES EXCHANGE ACT OF 1934

AND REGULATION 14C AND SCHEDULE 14C THEREUNDER

NOTICE OF ACTION BY WRITTEN CONSENT BY

MAJORITY SHAREHOLDER

IN LIEU OF A SPECIAL MEETING

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

To Stockholders of Thunder Energies Corporation:

This Information Statement is being furnished to the shareholders of Thunder Energies Corporation to provide you with information and a description of an action taken by our Board of Directors and by the written consent of the holder of a majority in interest of our issued and outstanding capital stock. On May 14, 2019, our Board of Directors unanimously approved the following action, subject to authorization by consent of a majority in interest of our shareholders and fulfillment of our statutory obligations:

TO AMEND OUR ARTICLES OF INCORPORATION TO EFFECTUATE A ONE-FOR-TWENTY (1:20) REVERSE STOCK SPLIT AND MAINTAIN THE SAME NUMBER OF AUTHORIZED SHARES OF COMMON STOCK AFTER SUCH STOCK SPLIT.

The full text of the Amendment is attached to this Information Statement as Exhibit A. This Information Statement is being mailed on or about June 4, 2019. The above action will be effective on or about June 24, 2019, at least twenty (20) days after mailing of this Information Statement.

On May 14, 2019 in accordance with the relevant sections of the Florida Business Corporation Act, Hadronic Technologies Press, Inc. (“Hadronic Technologies”), a shareholder in our Company, who owns 50,000,000 of our Series “A” Convertible Preferred Stock (with super voting rights at 15 votes per share), approved the Amendment by written consent in lieu of a special meeting of our shareholders.

Our ability to take these actions without holding a shareholders’ meeting is made possible by Section 607.0704 of the Florida Business Corporation Act which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes that would be necessary to authorize such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a special meeting of our shareholders, our Board of Directors voted to utilize the written consent of the holder of a majority in interest of our common stock and preferred stock.

This Information Statement is first being mailed on or about June 4, 2019 to shareholders of record. This Information Statement is being delivered only to inform you of the corporate actions described herein in accordance with Rule 14c-2 of the Securities Exchange Act of 1934.

OUTSTANDING SHARES AND VOTING RIGHTS

As of the Record Date, the Company’s authorized capitalization consisted of 900,000,000 shares of Common Stock, of which 134,325,104 shares were issued and outstanding and 750,000,000 shares of blank check preferred stock, of which 50,000,000 shares of Series “A” Convertible Preferred Stock were issued and outstanding to Hadronic Technologies. Holders of Common Stock of the Company have no preemptive rights to acquire or subscribe to any of the additional shares of Common Stock.

Each share of Common Stock entitles its holder to one vote on each matter submitted to the shareholders. Each share of our Series “A” Convertible Preferred Stock entitles its holder to 15 votes on each matter submitted to the shareholders. Because shareholder Hadronic Technologies, holding at least a majority of the voting rights of all outstanding shares of capital stock as of May 14, 2019, has voted in favor of the foregoing proposal by written consent, and having sufficient voting power to approve such proposal through its ownership of capital stock, no other shareholder consents will be solicited in connection with this Information Statement.

The following shareholder (holding the indicated number of shares) voted in favor of the proposal outlined in this Information Statement:

|

Shareholder

|

|

Class of Stock

|

|

Number of Shares

|

|

|

Number of Voting Shares(1)

|

|

|

Hadronic Technologies Press, Inc.

|

|

Series “A” Convertible Preferred Stock

|

|

|

50,000,000

|

|

|

|

750,000,000

|

|

________

|

(1)

|

Holders of Series “A” Convertible Preferred Stock are entitled to vote together with the holders of our common stock on all matters submitted to shareholders at the rate of 15 votes for each share held. Holders of Series “A” Convertible Preferred Stock are also entitled, at their option, to convert their shares into shares of our Common Stock on a 10-for-1 basis.

|

Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the actions described herein will not be implemented until a date at least 20 days after the date on which this Information Statement has been mailed to shareholders. The Company anticipates that the actions contemplated herein will be effectuated on or about the close of business on June 24, 2019.

The entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record by them, and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material. This Information Statement will serve as written notice to the stockholders of the Company pursuant to Section 607.0704 of the Florida Business Corporation Act.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth as of the Record Date certain information to us with respect to the beneficial ownership of the Company’s voting securities by (i) each person who is known by us to own of record or beneficially more than 5% of the outstanding common stock, (ii) each of the Company’s directors and executive officers, and (iii) all of the Company’s and its executive officers as a group. Unless otherwise indicated each of the stockholders can be reached at the Company’s principal executive offices located at 1444 Rainville Road, Tarpon Springs, FL 34689.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities. In accordance with the SEC rules, shares of our common stock which may be acquired upon exercise of stock options or warrants which are currently exercisable or which become exercisable within 60 days of the date of the table are deemed beneficially owned by the optionees, if applicable. Subject to community property laws, where applicable, the persons or entities named below have sole voting and investment power with respect to all shares of our common stock indicated as beneficially owned by them.

|

Title of Class

|

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Owner (1)

|

|

|

Percent of Class (2)

|

|

|

Common Stock

|

|

Dr. Ruggero M. Santilli (1)(2)(3)

1444 Rainville Road

Tarpon Springs, FL 34689

|

|

|

28,293,042

|

|

|

|

27.17

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Mrs. Carla Santilli (1)(2)(3)

1444 Rainville Road

Tarpon Springs, FL 34689

|

|

|

28,293,042

|

|

|

|

27.17

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Brian K. Buckley

4637 Murcross Lane

New Port Richey, FL 34653

|

|

|

12,983,431

|

|

|

|

9.63

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Officers and Directors as a group

|

|

|

28,293,042

|

|

|

|

27.17

|

%

|

________

|

(1)

|

Dr. Ruggero M. Santilli and Mrs. Carla Santilli are married and each own fifty percent of the equity in Clean Energies Tech, Inc. which owns 4,232,273 shares of our common stock.

|

|

(2)

|

Dr. Ruggero M. Santilli and Mrs. Carla Santilli each own fifty percent of the equity in Global Beta, LLC which owns 6,170,000 shares of our common stock.

|

|

(3)

|

Mrs. Carla Santilli is a member of the board of directors of The R.M. Santilli Foundation, Inc., a non-profit Florida corporation. Dr. Santilli’s indirect beneficial interest is through his spouse, Mrs. Carla Santilli. Mrs. Carla Santilli owns 4,723,077 shares of our common stock.

|

Dr. Santilli is our Chief Executive Officer and a director for our Company. Mrs. Carla Santilli is our Treasurer and a director for our Company.

The following table sets forth, as of December 31, 2018, the number of shares of our Series “A” Convertible Preferred Stock owned of record and beneficially by our executive officers, directors and persons who beneficially own more than 5% of such outstanding shares.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

|

|

|

Percentage of Class

|

|

|

Hadronic Technologies Press, Inc. (1)

35246 US Highway 19 North, Suite #215

Palm Harbor, FL 34684

|

|

|

50,000,000

|

|

|

|

100

|

%

|

______

|

(1)

|

Dr. Ruggero M. Santilli and Mrs. Carla Santilli are married and each own fifty percent of the equity in Hadronic Technologies Press, Inc., which owns 50,000,000 shares of our Series “A” Convertible Preferred Stock. The Series “A” Convertible Preferred Stock has 15 votes per share and is convertible into 10 shares of our common stock at the election of the shareholder.

|

AMENDMENT TO OUR ARTICLES OF INCORPORATION TO

EFFECTUATE A ONE-FOR-TWENTY (1:20) REVERSE STOCK SPLIT AND MAINTAIN THE SAME NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK AFTER THE STOCK SPLIT

On May 14, 2019, our Board of Directors unanimously approved the following action, subject to authorization by consent of a majority in interest of our shareholders and fulfillment of our statutory obligations:

TO AMEND OUR ARTICLES OF INCORPORATION TO EFFECTUATE A ONE-FOR-TWENTY (1:20) REVERSE SPLIT OF OUR COMMON STOCK AND MAINTAIN THE SAME NUMBER OF AUTHORIZED SHARES OF COMMON STOCK AFTER SUCH STOCK SPLIT.

The full text of the Amendment is attached to this Information Statement as Exhibit A. This Information Statement is being mailed on or about June 4, 2019. The above action will be effective on or about June 24, 2019, at least twenty (20) days after mailing of this Information Statement. The Company was previously listed on the OTCQB market, but the share price of the Company Common Stock fell below the OTCQB standards for a sufficient period of time that the Company Common Stock was removed from the OTCQB market and presently trades on the OTC Pink market. The reverse stock split will adjust the price per share back to within the parameters of the OTCQB market and the Company intends to reapply to the OTCQB market.

On May 14, 2019 in accordance with the relevant sections of the Florida Business Corporation Act, Hadronic Technologies Press, Inc. (“Hadronic Technologies”), a shareholder in our Company, who owns 50,000,000 of our Series “A” Convertible Preferred Stock (with super voting rights at 15 votes per share), approved the Amendment by written consent in lieu of a special meeting of our shareholders.

Our ability to take these actions without holding a shareholders’ meeting is made possible by Section 607.0704 of the Florida Business Corporation Act which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes that would be necessary to authorize such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding a special meeting of our shareholders, our Board of Directors voted to utilize the written consent of the holder of a majority in interest of our common stock and preferred stock.

This Information Statement is first being mailed on or about June 4, 2019 to shareholders of record. This Information Statement is being delivered only to inform you of the corporate actions described herein in accordance with Rule 14c-2 of the Securities Exchange Act of 1934.

The Amendment was filed with the Secretary of State of the State of Florida on May 17, 2019. We anticipate that the Amendment will be effective June 24, 2019, after the twentieth (20

th

) day following the mailing of this Information Statement to our shareholders.

VOTE REQUIRED

The vote of the holders of a majority of the outstanding shares of Company’s capital stock is required for the approval of the (1:20) reverse split of the Company’s Common Stock. The (1:20) reverse split of the Company’s Common Stock was approved by a shareholder owning 100% (50,000,000 shares with 750,000,000 votes) of the issued and outstanding shares of Company Series “A” Convertible Preferred Stock.

APPRAISAL RIGHTS

No appraisal rights are available under the Florida Business Corporation Act or under our Articles of Incorporation as a result of the Amendment. This means that no shareholder is entitled to receive any cash or other payment as a result of, or in connection with the amendment to our Articles of Incorporation, even if a shareholder has not been given an opportunity to vote.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSTION TO MATTERS TO BE ACTED UPON

No persons have any substantial interest in the reverse split of our Company’s Common Stock.

Forward-Looking Statements and Information

This Information Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this Information Statement. We desire to take advantage of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

This filing contains a number of forward-looking statements which reflect management’s current views and expectations with respect to our business, strategies, products, future results and events, and financial performance. All statements made in this filing other than statements of historical fact, are forward looking statements. In particular, the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “may,” variations of such words, and similar expressions identify forward-looking statements, but are not the exclusive means of identifying such statements, and their absence does not mean that the statement is not forward-looking. These forward-looking statements are subject to certain risks and uncertainties. Our actual results, performance or achievements could differ materially from historical results as well as those expressed in, anticipated, or implied by these forward-looking statements. We do not undertake any obligation to revise these forward-looking statements to reflect any future events or circumstances.

Readers should not place undue reliance on these forward-looking statements, which are based on management’s current expectations and projections about future events, are not guarantees of future performance, are subject to risks, uncertainties and assumptions (including those described below), and apply only as of the date of this filing. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors which could cause or contribute to such differences include, but are not limited to, the risks to be discussed in our Annual Report on Form 10-K and in the press releases and other communications to shareholders issued by us from time to time which attempt to advise interested parties of the risks and factors which may affect our business. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ADDITIONAL INFORMATION

The Company will provide upon request and without charge to each shareholder receiving this Information Statement a copy of the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2018, including the financial statements and financial statement schedule information included therein, as filed with the SEC. Reports and other information filed by us can be inspected and copied at the public reference facilities maintained at the SEC at 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street, N.E., Washington, DC 20549 at prescribed rates. The SEC maintains a website on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

EXHIBIT INDEX

Exhibit A, Articles of Amendment to the Articles of Incorporation.

Exhibit B, Written Consent to Action By Shareholder Without A Meeting

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommended approval of the Amendment to the Articles of Incorporation to the shareholder holding a majority of the voting power of the Company’s capital stock.

|

|

By Order of the Board of Directors,

THUNDER ENERGIES CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ruggero M. Santilli

|

|

|

|

|

Dr. Ruggero M. Santilli, Chairman

|

|

EXHIBIT A

EXHIBIT B

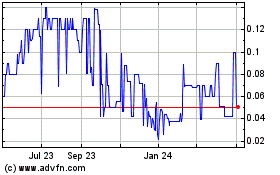

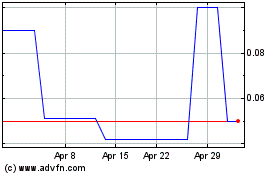

Thunder Energies (PK) (USOTC:TNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Thunder Energies (PK) (USOTC:TNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024