At $2 Million, New Novartis Drug Is Priciest Ever

May 24 2019 - 5:28PM

Dow Jones News

By Denise Roland

The world's most expensive medicine is about to hit the

market.

A one-time treatment for a devastating infant muscle-wasting

disease won approval from the U.S. Food and Drug Administration

Friday. Its maker Novartis AG says the gene therapy will cost

$2.125 million.

The therapy, called Zolgensma, treats an inherited disease

called spinal muscular atrophy, or SMA, whose victims typically die

before the age of two if untreated. It is the latest gene therapy

-- a technique that introduces new DNA into the body to correct a

faulty gene -- to win approval.

Gene therapies promise the chance to cure diseases whose

diagnoses were death sentences, but the prices for the first few to

be greenlighted raise concerns about whether they can be afforded

by governments and health insurers that have been struggling to

control health spending.

Zolgensma's price tag makes it the world's most expensive

medicine by a large margin, with the next most expensive drug a

gene therapy called Luxturna that is priced at $850,000. However,

some drugs that are taken repeatedly would cost more over the

lifetime of a patient.

To allay concerns over the cost, Novartis said it would offer

insurers the option to pay for the treatment in equal, annual

installments over five years. The company also pledged to issue

partial refunds if the treatment doesn't work.

Novartis also defended the overall price by comparing it to a

treatment already on the market. David Lennon, head of Novartis's

AveXis unit that developed Zolgensma, said in a call with reporters

it would cost half that of the current standard treatment,

Spinraza, over a 10-year period.

Biogen Inc. priced Spinraza, which patients would have to take

for a lifetime, at $750,000 for the first year and then $375,000

for each year after that.

Dr. Lennon also pointed to a revised cost-effectiveness analysis

by the independent nonprofit Institute for Clinical and Economic

Review, which said the treatment could justify a price tag of up to

$2.1 million.

ICER had previously said Zolgensma should cost no more than $1.5

million, but updated its analysis after new clinical trial data

showed promising results in very young babies treated before the

symptoms of SMA set in.

Zolgensma "is highly cost effective and represents a product at

a fair and reasonable price," Dr. Lennon said.

Spinal muscular atrophy is the most common genetic cause of

death in infants, affecting 400 to 500 children born in the U.S.

each year, around 300 of whom have the most severe version that

kills by age 2. It lacked drug treatment until the FDA approved

Spinraza in 2016.

All 12 babies treated in Zolgensma's first clinical trial have

passed their second birthday, with most hitting key milestones like

holding up their heads, eating by mouth and sitting unaided,

according to the FDA's announcement. The therapy's long-term

effects aren't known yet.

"Today's approval marks another milestone in the

transformational power of gene and cell therapies to treat a wide

range of diseases," acting FDA Commissioner Ned Sharpless said in a

statement.

The prospect of more expensive gene and cell therapies hitting

the market concerns insurers. The FDA expects to approve 10 to 20

gene and cell therapies a year by 2025.

"The big plans can handle [Zolgensma] financially," said Steve

Miller, chief clinical officer at Cigna Corp. "They are more

worried about the precedent it sets than the impact on cash

flow."

Novartis had been trying to lay the groundwork for Zolgensma's

price tag by talking publicly about a multimillion-dollar figure

and playing up the therapy's effectiveness.

Michael Sherman, chief medical officer of health plan Harvard

Pilgrim Health Care, said Novartis's pricing was fair. "We're

comfortable that it's within the pricing we would deem

appropriate," Dr. Sherman said, pointing to the updated ICER

analysis.

He said Harvard Pilgrim is finalizing a deal with Novartis to

get some money back if Zolgensma proves ineffective.

Drugmakers' plans to offer such "value-based agreements" have

been stymied by the pricing rules of the U.S. federal government's

Medicaid health-insurance program, which place an upper limit of

around 17% on any rebate that drugmakers can offer for pediatric

drugs.

To get around the roadblock, Novartis will get paid in full

upfront by a middleman, the specialty pharmacy Accredo owned by

Cigna, which will then manage the installment payments.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

May 24, 2019 17:13 ET (21:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

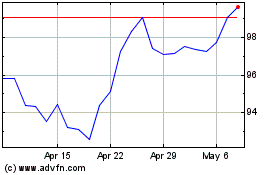

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

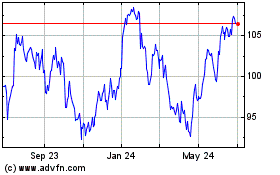

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024