Current Report Filing (8-k)

May 20 2019 - 8:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2019 (May 16, 2019)

CRITEO S.A.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

France

|

|

001-36153

|

|

Not Applicable

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

32, rue Blanche, Paris - France

|

|

75009

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: +33 14 040 2290

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

c

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

c

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

c

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

c

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

c

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

c

|

|

|

|

|

|

ITEM 5.03

|

Amendment to Bylaws

|

On May 16, 2019, the shareholders of Criteo S.A. (the "

Company

") amended and restated the By-laws (

statuts

) of the Company, effective immediately. Article 11.1 of the By-laws has been amended to provide that the board of directors of the Company (the "

Board

") shall be composed of at least three and no more than ten members, whereas previously, the maximum number of directors who could serve on the Board was eighteen (the maximum number allowed under French law). The foregoing description is qualified in its entirety by the amended By-laws, the English translation of which is attached hereto as Exhibit 3.1 and incorporated herein by reference.

|

|

|

|

|

|

ITEM 5.07

|

Submission of Matters to a Vote of Security Holders.

|

On May 16, 2019, the Company held its 2019 Annual Combined General Meeting of Shareholders (the "

2019 Annual General Meeting

"). The number of votes cast for and against and the number of abstentions with respect to each matter voted upon at the 2019 Annual General Meeting are set forth below. Because none of the matters voted upon at the 2019 Annual General Meeting were considered “routine” under relevant stock exchange rules, brokers were not permitted to exercise discretion with respect to any matter; accordingly, there were no broker non-votes with respect to any matter.

|

|

|

|

1.

|

The resolution renewing the t

erm of office of Mr. Hubert de Pesquidoux

as Director was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

63,412,033

|

853,982

|

4,500

|

|

|

|

|

2.

|

The resolution renewing the term of office of Ms. Nathalie Balla as Director was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

63,515,294

|

751,398

|

3,823

|

|

|

|

|

3.

|

The resolution renewing the term of office of Ms. Rachel Picard as Director was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

63,819,215

|

447,896

|

3,404

|

|

|

|

|

4.

|

The resolution ratifying

the temporary appointment by the Board of Directors of Ms. Marie Lalleman as Director

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,061,933

|

204,956

|

3,626

|

|

|

|

|

5.

|

The resolution approving, on a non-binding advisory basis, the compensation for the named executive officers of the Company was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

59,599,924

|

4,660,109

|

10,482

|

|

|

|

|

6.

|

The resolution approving the statutory financial statements for the fiscal year ended December 31, 2018 was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,243,423

|

8,994

|

18,098

|

|

|

|

|

7.

|

The resolution approving the consolidated financial statements for the fiscal year ended December 31, 2018 was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,242,067

|

8,502

|

19,946

|

|

|

|

|

8.

|

The resolution approving the discharge (

quitus

) of the members of the board of directors and the statutory auditors for the performance of their duties for the fiscal year ended December 31, 2018 was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

61,350,046

|

2,865,408

|

55,061

|

|

|

|

|

9.

|

The resolution allocating the profits for the fiscal year ended December 31, 2018 was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,246,794

|

10,951

|

12,770

|

|

|

|

|

10.

|

The resolution ratifying an indemnification agreement entered into with Mr. Jean-Baptiste Rudelle (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

50,964,978

|

10,819,275

|

1,257,565

|

|

|

|

|

11.

|

The resolution ratifying an indemnification agreement entered into with Mr. Benoit Fouilland (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,086,129

|

11,796,718

|

1,257,664

|

|

|

|

|

12.

|

The resolution ratifying an indemnification agreement entered into with Mr. Hubert de Pesquidoux (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,215,540

|

11,796,896

|

1,258,079

|

|

|

|

|

13.

|

The resolution ratifying an indemnification agreement entered into with Mr. James Warner (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,215,527

|

11,796,945

|

1,258,043

|

|

|

|

|

14.

|

The resolution ratifying an indemnification agreement entered into with Ms. Sharon Fox Spielman (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,215,090

|

11,797,346

|

1,258,079

|

|

|

|

|

15.

|

The resolution ratifying an indemnification agreement entered into with Mr. Edmond Mesrobian (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,215,126

|

11,798,496

|

1,256,893

|

|

|

|

|

16.

|

The resolution ratifying an indemnification agreement entered into with Ms. Nathalie Balla (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,215,137

|

11,798,445

|

1,256,933

|

|

|

|

|

17.

|

The resolution ratifying an indemnification agreement entered into with Ms. Rachel Picard (agreement referred to in Article L. 225-38 et seq. of the French Commercial Code) was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

51,209,896

|

11,797,086

|

1,256,213

|

|

|

|

|

18.

|

The resolution delegating authority to the Board of Directors to execute a buyback of Company stock in accordance with Article L. 225-209-2 of the French Commercial Code was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,106,525

|

114,997

|

48,993

|

|

|

|

|

19.

|

The resolution delegating authority to the Board of Directors

to reduce the Company’s share capital by canceling shares as part of the authorization to the Board of Directors allowing the Company to buy back its own shares in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

63,686,187

|

572,828

|

11,500

|

|

|

|

|

20.

|

The resolution determining

the maximum number of the members of the Board of Directors and subsequent amendment of Article 11.1 of the Company’s By-laws

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,245,428

|

13,137

|

11,950

|

|

|

|

|

21.

|

The resolution delegating

authority to the Board of Directors to issue and grant warrants (

bons de souscription d’actions

) for the benefit of a category of persons meeting predetermined criteria, without shareholders’ preferential subscription rights

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

48,070,171

|

16,137,067

|

63,277

|

|

|

|

|

22.

|

The resolution

approving the maximum number of shares that may be issued or acquired pursuant to resolution 15 (authorization to grant options to purchase or to subscribe shares), resolution 16 (authorization to grant time-based free shares/restricted stock units to employees of the Company and of its subsidiaries) and resolution 17 (authorization to grant performance-based free shares/restricted stock units to executives and certain employees of the Company and its subsidiaries) adopted by the Shareholders’ Meeting held on June 28, 2018 and pursuant to the item 21 above

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

63,406,396

|

854,777

|

9,342

|

|

|

|

|

23.

|

The resolution d

elegating authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, for the benefit of a category of persons meeting predetermined criteria (underwriters), without shareholders’ preferential subscription rights above

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

61,621,053

|

2,638,217

|

11,245

|

|

|

|

|

24.

|

The resolution d

elegating authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares or any securities giving access to the Company’s share capital in the context of a private placement, without shareholders’ preferential subscription rights above

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

59,829,481

|

4,429,489

|

11,545

|

|

|

|

|

25.

|

The resolution authorizing authority to the Board of Directors to increase the number of securities to be issued as a result of a share capital increase pursuant to items 23 and 24 above, without shareholders’ preferential subscription rights was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

48,792,784

|

15,416,104

|

61,627

|

|

|

|

|

26.

|

The resolution

authorizing the Board of Directors to increase the Company’s share capital through incorporation of premiums, reserves, profits or any other amounts that may be capitalized

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,222,644

|

36,170

|

11,701

|

|

|

|

|

27.

|

The resolution

authorizing the Board of Directors to increase the Company’s share capital by way of issuing shares and securities giving access to the Company’s share capital for the benefit of members of a Company savings plan (

plan d'épargne d’entreprise

)

was approved, based upon the following votes:

|

|

|

|

|

|

|

|

Number of Ordinary Shares

|

|

Voted For

|

Voted Against

|

Abstained

|

|

64,018,922

|

240,772

|

10,821

|

|

|

|

|

|

|

ITEM 9.01

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

CRITEO S.A.

|

|

Date: May 20, 2019

|

By:

|

/s/ Benoit Fouilland

|

|

|

Name:

|

Benoit Fouilland

|

|

|

Title:

|

Chief Financial Officer

|

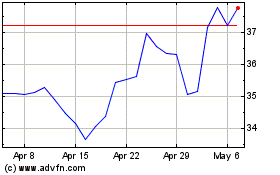

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

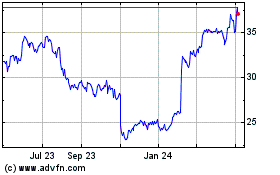

Criteo (NASDAQ:CRTO)

Historical Stock Chart

From Apr 2023 to Apr 2024