Senseonics Holdings, Inc. (NYSE American: SENS), a medical

technology company focused on the design, development and

commercialization of a long-term, implantable continuous glucose

monitoring (CGM) system for people with diabetes, today reported

financial results for the quarter ended March 31, 2019.

RECENT HIGHLIGHTS & ACCOMPLISHMENTS:

- First quarter 2019 revenue of $3.4

million

- Launched Eversense Bridge Patient

Access Program to expand Eversense access for patients across the

U.S.

- Received positive coverage decision for

Eversense from Techniker, the largest payor in Germany covering

over 10 million lives

- Initiated Eversense CGM data

integration with the Glooko platform to provide patients and

providers insights and actions for diabetes management based on

personal glucose profiles

“We are pleased with our progress this year, which is

marked by growing interest and support of Eversense from users,

prescribers and payors,” said Tim Goodnow, President and Chief

Executive Officer of Senseonics. “We are seeing meaningful

growth in both covered lives and new users through our European

partners. In the U.S., the launch of the Eversense Bridge Patient

Access Program is simplifying the reimbursement process for new

patients and supporting their ability to act on the interest we see

across patients and providers. It is also enabling additional

opportunities to get in front of the largest national payors.

Through constructive experiences with these payors, we

believe that we will obtain additional positive

coverage decisions in the future. We are looking forward to

building on this momentum.”

FIRST QUARTER 2019 RESULTS:

Revenue was $3.4 million for the first quarter of 2019 including

adjustments for the bridge program, compared to $2.9 million for

the first quarter of 2018.

First quarter 2019 gross profit decreased by $2.9 million

year-over year, to ($3.3) million. The decrease in gross profit was

associated with one-time component obsolescence due to product

upgrades and product expiry due to the timing of the extension of

the company’s distribution agreement with Roche.

First quarter 2019 sales and marketing expenses increased $9.4

million year-over year, to $12.8 million. The increase in sales and

marketing expenses was primarily driven by the build out of the

U.S. salesforce.

First quarter 2019 research and development expenses decreased

$1.0 million year-over-year, to $7.1 million. The decrease in

research and development expenses was primarily driven by the

completion of all activities associated with the U.S. PMA Panel

meeting for Eversense.

First quarter 2019 general and administrative expenses increased

$2.5 million, year-over-year, to $6.5 million. The increase in

general and administrative expenses was primarily driven by an

increase in compensation, legal and other administrative expenses

associated with supporting operational growth.

Net loss was $29.4 million, or $0.17 per share, in the first

quarter of 2019, compared to $22.3 million, or $0.16 per share, in

the first quarter of 2018.

As of March 31, 2019, cash and cash equivalents were $103.7

million and outstanding indebtedness was $65.2 million.

2019 Financial Outlook

Revenue for full year 2019 is expected to be in the range of $25

to $30 million.

CONFERENCE CALL AND WEBCAST INFORMATION

Company management will host a conference call at 4:30 pm

(Eastern Time) today, May 9, 2019, to discuss these financial

results and recent business developments. This conference call can

be accessed live by telephone or through Senseonics’ website.

Live

Teleconference Information:Dial in number:

888-378-4398Entry Number: 756769International dial

in: 786-789-4775

Live Webcast

Information:

Visit http://www.senseonics.com and select

the “Investor Relations” section

A replay of the call can be accessed on Senseonics’ website

http://www.senseonics.com under “Investor Relations.”

About Senseonics

Senseonics Holdings, Inc. is a medical technology company

focused on the design, development and commercialization of

transformative glucose monitoring products designed to help people

with diabetes confidently live their lives with ease. From its

inception, Senseonics has been advancing the integration of novel,

fluorescence sensor technology with smart wearable devices. The

Eversense® CGM System received PMA approval from the FDA for up to

90 days of continuous use and is available in the United States.

The Eversense® XL CGM System received CE mark for up to 180 days of

continuous use and is available in Europe. For more information on

Senseonics, please visit www.senseonics.com.

FORWARD LOOKING STATEMENTS

Any statements in this press release about future expectations,

plans and prospects for Senseonics, including statements about the

potential additional positive coverage decisions, the potential

commercialization of Eversense in additional markets, Senseonics’

projected revenue for full year 2019, the ongoing commercialization

of Eversense in the U.S. and Eversense XL in Europe, growing

patient and clinician demand for Eversense, and the potential

life-enhancing benefits Eversense offers people with diabetes, and

other statements containing the words “believe,” “expect,”

“intend,” “may,” “projects,” “will,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. Actual results

may differ materially from those indicated by such forward-looking

statements as a result of various important factors, including:

uncertainties in the development and regulatory approval processes,

uncertainties inherent in the commercial launch and commercial

expansion of the product, and such other factors as are set forth

in the risk factors detailed in Senseonics’ Annual Report on Form

10-K for the year ended December 31, 2018, Senseonics’ Quarterly

Report on Form 10-Q for the quarter ended March 31, 2019, and

Senseonics’ other filings with the SEC under the heading “Risk

Factors.” In addition, the forward-looking statements included in

this press release represent Senseonics’ views as of the date

hereof. Senseonics anticipates that subsequent events and

developments will cause Senseonics’ views to change. However, while

Senseonics may elect to update these forward-looking statements at

some point in the future, Senseonics specifically disclaims any

obligation to do so except as required by law. These

forward-looking statements should not be relied upon as

representing Senseonics’ views as of any date subsequent to the

date hereof.

Senseonics Holdings, Inc. Condensed

Consolidated Balance Sheets (in thousands, except share and

per share data) March 31, December 31,

2019 2018 (unaudited)

Assets Current

assets: Cash and cash equivalents $ 103,675 $ 136,793

Accounts receivable (primarily from a

related party)

2,367 7,097 Inventory, net 14,370 10,231 Prepaid expenses and other

current assets 4,698 3,985 Total

current assets 125,110 158,106 Deposits and other assets 114

117 Property and equipment, net 2,046 1,750 Right of use asset,

building 2,131 — Total assets $ 129,401

$ 159,973

Liabilities and Stockholders’

Equity Current liabilities: Accounts payable $ 3,274 $ 4,407

Accrued expenses and other current liabilities 13,754 13,851 Right

of use liability, building, current portion 431 — Deferred revenue

— 628 Term Loans, current portion 10,000

10,000 Total current liabilities 27,459 28,886 Term

Loans, net of discount and current portion 2,347 4,783 2023 Notes,

net of discount 36,949 36,103 Derivative liability 15,019 17,091

Term Loans, accrued interest 1,892 1,764 Right of use liability,

building, net of current portion 1,791 — Other liabilities —

85 Total liabilities 85,457 88,712

Stockholders’ equity:

Common stock, $0.001 par value per share;

450,000,000 shares authorized; 176,958,487 and 176,918,381 shares

issued and outstanding as of March 31, 2019 and December 31,

2018

177 177 Additional paid-in capital 430,926 428,878 Accumulated

deficit (387,159 ) (357,794 ) Total stockholders'

equity 43,944 71,261 Total liabilities

and stockholders’ equity $ 129,401 $ 159,973

Senseonics Holdings, Inc. Unaudited Condensed

Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

Three Months Ended March 31, 2019

2018 Revenue, primarily from a related party $ 3,423 $ 2,946

Cost of sales 6,733 3,308 Gross profit

(3,310 ) (362 ) Expenses: Sales and marketing expenses

12,834 3,441 Research and development expenses 7,108 8,113 General

and administrative expenses 6,516 4,011

Operating loss (29,768 ) (15,927 ) Other income (expense), net:

Interest income 627 184 Interest expense (2,034 ) (1,771 ) Change

in fair value of derivative liability 2,072 (4,847 ) Other

(expense) income (262 ) 88 Total other income

(expense), net 403 (6,346 ) Net loss

(29,365 ) (22,273 ) Total comprehensive loss $ (29,365 ) $ (22,273

) Basic and diluted net loss per common share $ (0.17 ) $

(0.16 ) Basic and diluted weighted-average shares outstanding

176,954,116 137,069,008

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190509005906/en/

INVESTOR CONTACTLynn Lewis or Philip TaylorInvestor

Relations415-937-5406Investors@senseonics.com

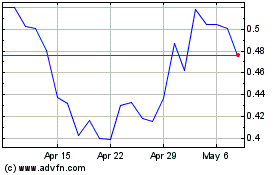

Senseonics (AMEX:SENS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Senseonics (AMEX:SENS)

Historical Stock Chart

From Apr 2023 to Apr 2024