Securities Registration: Employee Benefit Plan (s-8)

March 29 2019 - 5:28PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on March 29, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Adecoagro S.A.

(Exact name of registrant as specified in its charter)

|

Grand Duchy of Luxembourg

|

|

None

|

|

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification number)

|

Adecoagro S.A.

Société anonyme

Vertigo Naos Building, 6, Rue Eugène Ruppert, L - 2453 Luxembourg

Tel: +352.2644.9372

(Address and Telephone of principal executive offices)

Aurelien Corrion

Vertigo Naos Building, 6, Rue Eugène Ruppert,

L – 2453 Luxembourg

Email:

aurelien.corrion@intertrustgroup.com

Tel: +352.2644.9256

|

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

|

Fourth Amended and Restated Restricted Share and Restricted Stock Unit Plan

(Full title of the plan)

Corporation Service Company

1180 Avenue of the Americas, Suite 210

New York, NY 10036

(800) 927-9801

(Name and address, including zip code, and telephone number, including area code, of agent for service of process)

With a copy to:

Peter A. Baumgaertner, Esq.

Frank Vivero, Esq.

Holland & Knight LLP

New York, New York 10019

(212) 513-3463

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

|

|

|

|

|

|

|

(do not check if a smaller reporting company)

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

Amount to be

Registered(1)

|

Proposed Maximum

Offering Price Per

Share(2)(3)

|

Aggregate Offering

Price(2)(3)

|

Amount of

Registration Fee(3)

|

Common shares, par value $1.50 per share

|

1,264,189

|

$6.83

|

$8,634,410.87

|

$1,046.49

|

Common shares, par value $1.50 per share

|

(1)

|

The amount being registered also includes an indeterminate number of common shares which may be offered as a result of any stock splits, stock dividends and

anti-dilution provisions and other terms in accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”).

|

|

(2)

|

Calculated solely for the purpose of determining the registration fee pursuant to Rule 457(h) and Rule 457(c) under the Securities Act, based upon the average

of the high and low sales prices for the common shares as quoted on the New York Stock Exchange on March 27, 2019 of $6.83 per share.

|

|

(3)

|

Rounded up to the nearest cent.

|

EXPLANATORY NOTE

On April 6, 2011, Adecoagro S.A., a company organized under the laws of Luxembourg (the “

Company

” or the “

Registrant

”), filed

a registration statement on Form S-8 (the “

2011 S-8 Registration Statement

”) with the Securities and Exchange Commission (the “

Commission

”) to register 1,801,038 shares of common stock of the Company, par value, $1.50 per share (“

Common Shares

”), for issuance pursuant to the Adecoagro S.A. Second Amended Restricted Share and Restricted Stock Unit Plan (as amended from time to

time, the “

Plan

”). A Post-Effective Amendment No. 1 to the 2011 S-8 Registration Statement was filed with the Commission on

January 24, 2012 (the “

2012 Post-Effective Amendment

”) to reflect certain amendments to the Plan and to register the associated

plan interests offered under the terms of the Plan. On September 18, 2015, the Company filed a registration statement on Form S-8 with the Commission (the “

2015 S-8 Registration Statement

”) to register an additional 673,663 Common Shares under the Plan.

On March 15, 2016 and March 14, 2017, the Board of Directors approved amendments to the Plan to increase the aggregate number

of Common Shares available for issuance under the Plan from 2,474,701 to 3,464,741 shares. On April 4, 2017, the Company filed a registration statement on Form S-8 (the “

2017 Registration Statement

”) with the Commission to register an additional 990,040 Common Shares to be offered and sold pursuant to the Plan from time to time and to file a copy of the Third

Amended Restricted Share and Unit Plan.

On March 13, 2018 and March 12, 2019, the Board of Directors approved amendments to the Plan to increase the aggregate number

of Common Shares available for issuance under the Plan from 3,464,741 to 4,728,930 shares. The Registrant is filing this Registration Statement on Form S-8 (this “

Registration Statement

”) with the Commission in accordance with the requirements under General Instruction E to Form S-8 to register an additional 1,264,189 Common Shares to be offered and sold

pursuant to the Plan from time to time and to file a copy of the Fourth Amended Restricted Share and Unit Plan.

In accordance with General Instruction E to Form S-8, the Company hereby incorporates by reference the 2011 S-8 Registration

Statement, the 2012 Post-Effective Amendment, the 2015 S-8 Registration Statement and the 2017 Registration Statement together with all exhibits filed therewith or incorporated therein by reference.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

Item 1.

|

Plan Information.*

|

|

Item 2.

|

Registrant Information and Employee Plan Annual Information.*

|

* Pursuant to Rule 428(b)(1) under the Securities Act, the documents containing the information specified in Part I of Form

S-8 will be sent or given to each participant in the Plan. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II below, taken together, constitute the Section 10(a) prospectus.

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with the introductory note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference

.

|

The following documents filed with the Commission by the Company, are incorporated herein by reference:

|

|

(a)

|

the description of the Company’s common shares contained in its Registration Statement on Form 8-A (File No. 001-35052) filed with the Commission on

January 24, 2011 pursuant to Section 12(b) of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”),

which incorporates by reference the description of the Company’s common shares set forth under “Description of Share Capital” in the Company’s prospectus dated January 13, 2011 filed with the Commission on January 13, 2011,

including any amendment or report filed for the purpose of updating such description;

|

|

(b)

|

the Company’s annual report on Form 20-F for fiscal year end 2017 filed with the Commission on April 27, 2018 (the “

Annual Report

”); and

|

|

(c)

|

all other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the Company’s Annual Report

referred to in (b) above, including the Report of Foreign Private Issuer on Form 6-K filed on March 15, 2019 which includes the Company’s Unaudited Consolidated Interim Financial Statements as of and for the year-ended December 31,

2018.

|

All documents subsequently filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Exchange Act, and to the extent, if at all, designated therein, certain reports on Form 6-K furnished by the Company prior to the filing of a post-effective amendment to this Registration Statement, which indicates that all securities offered

have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed

to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or

supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. Copies of these documents are not required to he filed with this

Registration Statement.

|

Item 4.

|

Description of Securities.

|

Not Applicable.

|

Item 5.

|

Interests of Named Experts and Counsel.

|

Not Applicable.

|

Item 6.

|

Indemnification of Directors and Officers.

|

Our directors are not held personally liable for the indebtedness or other obligations of the Company. As agents of the

Company, they are responsible for the performance of their duties. Subject to the exceptions and limitations set forth below, every person who is, or has been, a director or officer of the Company shall be indemnified by the Company to the

fullest extent permitted by law against liability and against all expenses reasonably incurred or paid by him in connection with any claim, action, suit or proceeding which he becomes involved as a party or otherwise by virtue of his being or

having been such director or officer and against amounts paid or incurred by him in the settlement thereof. The words “claim”, “action”, “suit” or “proceeding” shall apply to all claims, actions, suits or proceedings (civil, criminal or otherwise

including appeals) actual or threatened and the words “liability” and “expenses” shall include without limitation attorneys’ fees, costs, judgments, amounts paid in settlement and other liabilities.

No indemnification shall however be provided to any director or officer: (i) against any liability to the Company or its

shareholders by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office; (ii) with respect to any matter as to which he shall have been finally adjudicated to have acted

in bad faith and not in the interest of the Company; or (iii) in the event of a settlement, unless the settlement has been approved by a court of competent jurisdiction or by our board of directors.

The right of indemnification herein provided shall be severable, shall not affect any other rights to which any director or

officer may now or hereafter be entitled, shall continue as to a person who has ceased to be such Director or officer and shall inure to the benefit of the heirs, executors and administrators of such a person. Nothing contained herein shall

affect any rights to indemnification to which corporate personnel, including directors and officers, may be entitled by contract or otherwise under law.

Expenses in connection with the preparation and representation of a defense of any claim, action, suit or proceeding of the

character described above shall be advanced by the Company prior to final disposition thereof upon receipt of any undertaking by or on behalf of the officer or director, to repay such amount if it is ultimately determined that he is not entitled

to indemnification.

|

Item 7.

|

Exemption from Registration Claimed.

|

Not Applicable.

The Exhibits listed on the accompanying Exhibit Index are filed as a part of, and incorporated by reference into, this

Registration Statement.

|

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

1.

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

i.

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

ii.

|

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the

Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective Registration Statement.

|

|

iii.

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to

such information in this Registration Statement;

|

provided

,

however

, that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

|

2.

|

That, for the purpose of determining any liability under the Securities Act, each such post- effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

3.

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the

offering.

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual

report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant

pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter

has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

|

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it

meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Buenos Aires, Argentina on March 29, 2019.

|

|

Adecoagro S.A.

|

|

|

|

|

|

|

By:

|

/s/ Mariano Bosch

|

|

|

Name:

|

Mariano Bosch

|

|

|

Title:

|

Chief Executive Officer

|

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Mariano Bosch and

Carlos A. Boero Hughes each his attorney-in-fact with full power of substitution for him in any and all capacities, to sign any amendments to this Registration Statement, including any and all pre-effective and post-effective amendments and to

file such amendments thereto, with exhibits thereto and other documents in connection therewith, with the Commission, hereby ratifying and confirming all that said attorney-in-fact, or each his substitute or substitutes, may do or cause to be

done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following

persons in the capacities and on the date indicated.

|

|

Signature

|

|

Title

|

Date

|

|

|

|

|

|

|

|

|

/s/ Mariano Bosch

|

|

Chief Executive Officer,

|

March 29, 2019

|

|

|

Mariano Bosch

|

|

Director

|

|

|

|

|

|

|

|

|

|

/s/ Carlos A. Boero Hughes

|

|

Chief Financial Officer

|

March 29, 2019

|

|

|

Carlos A. Boero Hughes

|

|

Chief Accounting Officer

|

|

|

|

|

|

|

|

|

|

/s/ Plinio Musetti

|

|

Chairman of the

|

March 29, 2019

|

|

|

Plinio Musetti

|

|

Board of Directors

|

|

|

|

|

|

|

|

|

|

/s/ Alan Leland Boyce

|

|

Director

|

March 29, 2019

|

|

|

Alan Leland Boyce

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Guillaume van der Linden

|

|

Director

|

March 29, 2019

|

|

|

Guillaume van der Linden

|

|

|

|

|

|

/s/ Marcelo Vieira

|

|

Director

|

March 29, 2019

|

|

|

Marcelo Vieira

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ivo Andres Sarjanovic

|

|

Director

|

March 29, 2019

|

|

|

Ivo Andres Sarjanovic

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mark Schachter

|

|

Director

|

March 29, 2019

|

|

|

Mark Schachter

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Marcelo Sanchez

|

|

Director

|

March 29, 2019

|

|

|

Marcelo Sanchez

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Daniel Gonzalez

|

|

Director

|

March 29, 2019

|

|

|

Daniel Gonzalez

|

|

|

|

|

|

|

|

|

|

|

|

/s/ James David Anderson

|

|

Director

|

March 29, 2019

|

|

|

James David Anderson

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Andrés Velasco Brañes

|

|

Director

|

March 29, 2019

|

|

|

Andrés Velasco Brañes

|

|

|

|

SIGNATURE OF AUTHORIZED U.S. REPRESENTATIVE

Under the Securities Act, the undersigned, the duly authorized representative in the United States of Adecoagro S.A., has

signed this Registration Statement in Newark, Delaware, on

March 29, 2019

.

|

|

Puglisi & Associates

|

|

|

|

|

|

|

By:

|

/s/ Donald J. Puglisi

|

|

Name:

|

Donald J. Puglisi

|

|

|

Title:

|

Managing Director

|

|

Exhibit No.

|

Description

|

|

|

|

|

|

|

4.1

|

Amended and Restated Articles of Association of Adecoagro S.A., incorporated herein by reference to Exhibit 1.1 to the Company's Annual

Report on Form 20-F for the year ended December 31, 2017 filed on April 27, 2018.

|

|

|

|

|

|

|

|

Opinion of Elvinger Hoss Prussen, société anonyme, regarding the legality of the shares being registered

|

|

|

|

|

|

|

|

Consent of PriceWaterhouse & Co. S.RL

|

|

|

|

|

|

|

|

Consent of Elvinger Hoss Prussen, société anonyme (contained in Exhibit 5.1)

|

|

|

|

|

|

|

|

Consent of Cushman & Wakefield Argentina S.A.

|

|

|

|

|

|

|

|

Power of Attorney (included on the signature page hereto)

|

|

|

|

|

|

|

|

Amended and Restated Adecoagro/IFH 2004 Stock Incentive Option Plan, incorporated herein by reference to Exhibit 99.1 to the Registration

Statement on Form S-8 filed on September 18, 2015

|

|

|

|

|

|

|

|

Adecoagro/IFH 2007/2008 Equity Incentive Plan, incorporated herein by reference to Exhibit 10. 35 to the Company’s Amendment No. 1 to the

registration statement on Form F-1 (File No. 333-171683)

|

|

|

|

|

|

|

|

Fourth Amended and Restated Adecoagro S.A. Restricted Share and Restricted Stock Unit Plan.

|

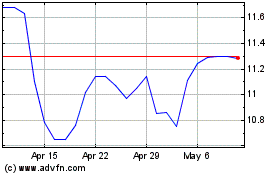

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adecoagro (NYSE:AGRO)

Historical Stock Chart

From Apr 2023 to Apr 2024