Approximate date of commencement of proposed sale of the

securities to the public: As soon as practicable after this Registration

Statement is declared effective.

This registration statement and any amendment thereto shall

become effective upon filing with the Commission in accordance with Rule 467(a).

If any

of the securities being registered on this Form are to be offered on a delayed

or continuous basis pursuant to the home jurisdiction’s shelf prospectus

offering procedures, check the following box. [ ]

If, as a

result of stock splits, stock dividends or similar transactions, the number of

securities purported to be registered on this registration statement changes,

the provisions of Rule 416 shall apply to this registration statement.

Rights

Offering Circular and Notice of Rights Offering, attached hereto.

See the

Rights Offering Circular, attached hereto.

None.

References in this Circular to “we”, “our”, “us” and similar

terms are to CGX Energy Inc. (“

CGX

” or the “

Corporation

”).

References in this Circular to “you”, “your” and similar terms are to holders of

CGX’s Common Shares (as defined below). All amounts herein are presented in

Canadian dollars, unless otherwise stated.

This Circular describes details of the Offering including your

rights and obligations in respect thereof. This Circular is referred to in the

Notice and should be read in conjunction with it.

Enquiries relating to this Offering should be directed to the

Corporation as follows:

Tralisa Maraj, Chief Financial Officer

at

tmaraj@cgxenergy.com

.

The Rights are being offered only to Shareholders resident in

the Qualified Jurisdictions. Shareholders will be presumed to be resident in the

place shown on their registered address, unless the contrary is shown to our

satisfaction. Neither the Notice nor this Circular is to be construed as an

offering of the Rights, nor are the Rights Shares issuable upon exercise of the

Rights offered for sale, in any jurisdiction outside of the Qualified

Jurisdictions or to Shareholders who are residents in any jurisdictions other

than the Qualified Jurisdictions (“

Ineligible Shareholders

”). Ineligible

Shareholders will not be offered Rights. Instead, subject to limited exceptions

set out in this Circular, Ineligible Shareholders will be sent a letter advising

them that their Rights will be held on their behalf by TSX Trust Company (the

“

Rights Agent

” and “

Depositary

”), who will hold such Rights as

agent for the benefit of all such Ineligible Shareholders.

This Circular covers the offer and sale of the Common Shares

issuable upon exercise of the Rights within the United States under the United

States Securities Act of 1933, as amended (the “

U.S. Securities Act

”).

Notwithstanding registration under the U.S. Securities Act, blue sky laws of

certain states (including Arizona, Arkansas, California, Minnesota, Ohio and

Wisconsin) may not permit the Corporation to offer Rights and/or Rights Shares

in such states, or to certain persons in those states, or may otherwise limit

the Corporation’s ability to do so, and as a result the Corporation will not

treat those states as Qualified Jurisdictions under the Offering.

Each Right will entitle the holder thereof to purchase one (1)

Rights Share (the “

Basic Subscription Privilege

”) upon payment of the

Subscription Price (as defined below) per Rights Share. In the event that a

Shareholder exercises the Basic Subscription Privilege in full, the Shareholder

is entitled to exercise additional Rights (the “

Additional Rights

”) to

subscribe for Rights Shares not otherwise purchased, on a pro rata basis,

pursuant to an additional subscription privilege (the “

Additional

Subscription Privilege

”). The number of Additional Rights available will be

the difference, if any, between the total number of Rights that were issued

pursuant to the Offering and the total number of Rights exercised and paid for

pursuant to the Basic Subscription Privilege at the Expiry Time (as defined

below) on the Expiry Date (as defined below). See “

What is the additional

subscription privilege and how can you exercise this privilege?

”.

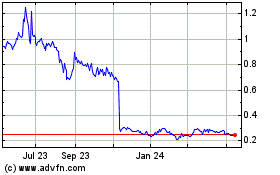

On January 31, 2019, being the last trading day prior to the

announcement of the Offering, the closing price of the Common Shares on the TSX

Venture Exchange (the “

TSX-V

”) was $0.415.

The offer will expire at 5:00 p.m. (Toronto time) (the

“

Expiry Time

”) on March 12, 2019 (the “

Expiry Date

”) after which

time the unexercised Rights, if any, will be void and of no value.

The Corporation reserves the right to extend the Expiry Time

and Expiry Date, in its sole discretion, subject to obtaining any required

regulatory approvals, if the Corporation determines that the timely exercise of

the Rights may have been prejudiced due to disruption in postal service.

Each Right will entitle the holder thereof to purchase one (1)

Rights Share at the Subscription Price. Rights not exercised by the Expiry Time

on the Expiry Date will be void and of no value.

A Right does not entitle the holder thereof to any rights

whatsoever as a security holder of the Corporation other than the right to

subscribe for and purchase a Rights Share on the terms and conditions described

herein.

Holders of Common Shares are entitled to receive notice of and

attend all meetings of the shareholders of the Corporation and are entitled to

one vote in respect of each Common Share held at such meetings. Holders of

Common Shares do not have cumulative voting rights with respect to the election

of directors and, accordingly, holders of a majority of the Common Shares

entitled to vote in any election of directors may elect all directors standing

for election. Holders of Common Shares are entitled to receive rateably such

dividends, if any, as and when declared by the board of directors of the

Corporation at its discretion subject to applicable laws. Upon any liquidation,

dissolution or winding-up of the Corporation, the holders of the Common Shares

are entitled, subject to the rights of holders of any class of shares ranking

senior to or rateably with the Common Shares in respect of any liquidation,

dissolution or winding-up of the Corporation, to share rateably in the remaining

assets of the Corporation. The Common Shares do not carry any pre-emptive,

subscription, redemption or conversion rights.

The Offering is not subject to any minimum subscription level.

However, the Corporation has obtained a stand-by commitment from Frontera Energy

Corporation (“

Frontera

”) to subscribe for a number of Rights that will

ensure aggregate gross proceeds from the Offering of $29,025,579.50.

Assuming the exercise of all Rights, a maximum of 116,102,318

Rights

Shares will be issued in connection with the Offering (subject to adjustment for

rounding).

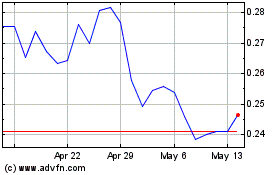

The Common Shares are, and the Rights Shares issuable upon the

exercise of the Rights will be, listed for trading on the TSX-V under the symbol

“OYL” and commence trading “ex-rights” on February 8, 2019, being one trading

day prior to the Record Date.

The Rights will be listed and trade on the TSX-V under the

trading symbol “OYL.RT” until the Expiry Time.

This Circular has been prepared in accordance with the

requirements of securities laws in effect in Canada, which differ from the

requirements of United States securities laws. Accordingly, the reserves

information of the Corporation included or incorporated by reference in the

Circular may not be comparable to the reserves information of U.S. companies

prepared in accordance with U.S. requirements. Prospective investors should

consult their own professional advisors for an understanding of the differences

between Canadian and U.S. reserves reporting standards, and how these

differences might affect the reserves information incorporated by reference

herein. The U.S. Securities and Exchange Commission (the “

SEC

”) generally

permits U.S. reporting oil and gas companies, in their filings with the SEC, to

disclose only proved, probable and possible reserves and production, net of

royalties and interests of others. The SEC generally does not permit U.S.

companies to disclose net present value of future net revenue from reserves

based on forecast prices and costs. Canadian securities laws permit, among other

things, the disclosure of production on a gross basis before deducting

royalties.

The Offering is made by a Canadian issuer that is permitted,

under a multijurisdictional disclosure system adopted by the United States, to

prepare this circular in accordance with the disclosure requirements of Canada.

Prospective investors should be aware that those requirements are different from

those of the United States. Financial statements included or incorporated

herein, of the Corporation have been prepared in accordance with International

Financial Reporting Standards as issued by the International Accounting

Standards Board, and are subject to Canadian auditing and auditor independence

standards, and thus may not be comparable to financial statements of United

States companies.

Prospective investors should be aware that the acquisition or

disposition of the securities described in this Circular may have tax

consequences in Canada, the United States, or elsewhere. Such consequences for

investors who are resident in, or citizens of, the United States may not be

described fully herein. Prospective investors should consult their own tax

advisors with respect to such tax considerations.

The enforcement by investors of civil liabilities under United

States federal securities laws may be adversely affected by the fact that the

Corporation is incorporated under the laws of Ontario, that some or all of its

officers and directors may be residents of a country other than the United

States, that some or all of the experts named in the Circular may be located

outside of the United States and that all or a substantial portion of the assets

of said persons may be located outside the United States.

NEITHER THE RIGHTS NOR THE COMMON SHARES HAVE BEEN APPROVED

OR DISAPPROVED BY THE SEC OR ANY STATE SECURITIES COMMISSION AND NEITHER THE SEC

NOR ANY STATE SECURITIES COMMISSION HAS PASSED UPON THE ACCURACY OR ADEQUACY OF

THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

USE OF AVAILABLE FUNDS

What will our available funds be upon closing of the

Offering?

The Corporation estimates that it will have the following funds

available after giving effect to the Offering:

|

A

|

Amount to be raised by the Offering

|

$29,025,579

|

|

B

|

Selling commissions and fees

|

N/A

|

|

C

|

Estimated offering costs (e.g., legal,

accounting, audit)

|

$841,349

|

|

D

|

Available funds: D = A • (B + C)

|

$28,184,230

|

|

E

|

Additional sources of funding required

|

$66,433,500

1

|

|

F

|

Working capital deficiency (surplus) as at

October 31, 2018

|

$34,099,909

2

|

|

G

|

Total: G = (D + E) • F

|

$60,517,821

|

|

(1)

|

CGX intends to pursue additional financing alternatives

by the end of June 2019 in order to obtain the additional funding required

to meet its liquidity requirements over the next 12 months. There is no

assurance that CGX will be able to raise funds on a timely basis or at

all. Absent the additional required funding, CGX would not be able to meet

its liquidity requirements.

|

|

(2)

|

The working capital balance has been adjusted to exclude

the amount of $12,074,279 owed to Prospector PTE Ltd. and the total amount

of US $17,705,692 due to Japan Drilling Co., Ltd. (“

JDC

”), a

company which exercises control over

14,726,264

Common Shares,

representing approximately

12.7

% of the outstanding Common Shares

of the Corporation..

|

How will we use the available funds?

The references below reflect amounts in Canadian dollars

equivalent to the

actual US dollar amounts to be paid by CGX. The Canadian dollar equivalent has been determined

using the average daily exchange rate for the 10 days ending January 31, 2019,

as reported by the Bank of Canada for the conversion of U.S. dollars into

Canadian dollars, being U.S. $1.00 equals to Canadian $1.33.

- 5 -

|

Description of intended use of available funds listed in

order of priority

|

|

|

Payment of settlement amount

(1)

|

$10,512,369

|

|

Corentyne Well Commitment

|

$11,210,127

|

|

Demerara Petroleum Agreement expenditure

|

$1,330,000

|

|

Berbice Petroleun Agreement expenditure

|

$489,246

|

|

General corporate purposes

|

$36,976,079

|

|

Total

(2)

:

|

$60,517,821

|

|

(1)

|

This amount intended to be used to pay off debt of

US$7,904,037 from the net proceeds of the Offering to JDC,

|

|

(2)

|

The amount shown includes the net proceeds from the

Offering as well as proceeds anticipated to be raised over the next 12

months through additional financing. There is no assurance that CGX will

be able to raise additional capital over the next 12 months or that

additional financing will be available on terms satisfactory to

CGX.

|

The Offering, the cash flows from certain joint venture

agreements to be entered into by CGX Resources Inc. (“

CGX Resources

”) and

Frontera or a subsidiary thereof with respect to the exploration and development

of the Corentyne and Demerara blocks in Guyana (the “

Joint Venture

Agreements

”), as well as additional financings which the Corporation hopes

to close by the end of June 2019, are expected to provide the funds necessary to

meet all of the Corporation’s short-term liquidity requirements over the next 12

months.

Approximately $10,512,369 of the net proceeds of $28,184,230

will be used to pay a settlement amount in respect of debt owed to JDC pursuant

to an agreement between the Corporation, CGX Resources and JDC dated October 30,

2018

(the “

Agreement

”). The Agreement was entered into to settle

all liabilities claimed by JDC against the Corporation arising from a drilling

contract that was terminated in 2015. Pursuant to the Agreement, the Corporation

shall pay JDC an aggregate amount of US$7,904,037, being 45% of the principal

amount of the funds claimed and recorded together with interest accrued on such

reduced amount. To the knowledge of the Corporation, JDC exercises control over

14,726,264

Common Shares, representing approximately

12.7

% of

the outstanding Common Shares of the Corporation.

The remainder of the net proceeds of $28,184,230 along with

additional funding obtained through the Joint Venture Agreements and/or

additional financings, will be used towards the drilling of the exploration

wells under the terms of the commitments outlined in the Corporation’s petroleum

agreements, and to fund the Corporation’s capital, operating, and general and

administrative expenses over the next 12 months. There is no assurance that the

additional financing will be available to the Corporation or on terms acceptable

to the Corporation.

The Corporation intends to spend the available funds from the

Offering as stated. The Corporation will reallocate funds only for sound

business reasons.

Notwithstanding anything stated herein to the contrary,

there are material uncertainties that cast significant doubt upon the

Corporation’s ability to continue as a going concern.

How long will the available funds last?

We expect the Rights Offering will be insufficient to meet our

working capital requirements for the next 12 months. however, it is sufficient

to meet our working capital over the next six months during which the

Corporation will execute its work plan to drill the Utawaaka1 well, a committed

well under the terms of its agreement in respect of the Corentyne block.

CGX, CGX Resources and Frontera entered into a letter of intent

dated December 4, 2018, as amended and restated as of December 14, 2018 and as

further amended and restated as of January 10, 2019 (the “

LOI

”) which

contemplates that Frontera or a subsidiary thereof and CGX Resources will enter

into the Joint Venture Agreements covering CGX’s two shallow water offshore

petroleum assets in Guyana, the Corentyne and Demerara blocks, which is subject to approval from the Government of Guyana. Upon

completion of the agreement and receipt of regulatory approval, Frontera will

acquire a 33.33% working interest in the two blocks in exchange for a US$33.3

million signing bonus. In connection with the Joint Venture Agreements, Frontera

has agreed to pay one-third of the applicable joint venture costs plus an

additional 8.333% of CGX’s direct drilling costs of certain exploratory wells up

to maximum amounts.

- 6 -

The US$33.3 million will be used:

1. to settle the full amount of the

Frontera Legacy Debt (as defined in the LOI), the full amount of any outstanding

Interim Support (as defined in the LOI), and the full amount of any outstanding

Excess Bridge Amount (as defined in the LOI), together with any interest accrued

and payable on such amounts, which credit will satisfy the Frontera Legacy Debt,

the Interim Support and the Excess Bridge Amount (in full, such amounts to be

calculated upon the execution of the Joint Venture Agreements.

2. for expenditure related to general

and administrative expenditure and capital expenditure related to the Utwaaka1

well.

Additionally, CGX plans to pursue additional financing

alternatives by the end of June 2019. Management has been able to source funding

in the past, and we expect to continue with the ability to attract capital, as

needed. However, there is no assurance that we will be able to raise additional

financing on a timely basis or at all.

INSIDER PARTICIPATION

Will insiders be p

a

rticipating?

Certain insiders of the Corporation, including

certain of

Corporation’s directors, officers and

certain persons controlling over 10%

of the Common Shares have indicated their intention to participate in the

Offering.

This reflects the intentions of such insiders (as defined in

applicable Canadian securities legislation) as of the date hereof to the extent

such intentions are reasonably known to the Corporation, however such insiders

may alter their intentions before the Expiry Time on the Expiry Date. No

assurance can be given that the respective insiders will exercise their Rights

to acquire Rights Shares.

As at the date hereof, insiders of the Corporation own or

exercise control or direction over, directly or indirectly, 86,429,647 Common

Shares, representing approximately 74.44% of the issued and outstanding Common

Shares. In the event that these insiders purchase 86,429,647 Rights Shares

pursuant to the Basic Subscription Privilege, these insiders would own an

aggregate of 172,859,294 Common Shares. If no other shareholders were to

exercise Rights under the Offering and these insiders exercised their Additional

Subscription Privilege, such insiders would own an aggregate of 202,531,965

Common Shares upon completion of the Offering, representing approximately

87.22% of the Corporation.

Who are the holders of 10% or more of the Common Shares

before and after the Offering?

To the knowledge of the directors and officers of the

Corporation, as at the date hereof, no person or company beneficially owns,

directly or indirectly, or controls or directs more than 10% of any class of

voting securities of the Corporation, other than as set out below.

|

Shareholder

|

Holdings before

the

Offering (non-

diluted)

(1)

|

Percentage before

the

Offering

|

Holdings after

the

Offering (non-

diluted)

|

Percentage after

the

Offering

|

|

Frontera Energy Corp.

|

56,066,214

|

48.29%

|

Up to

172,168,532

(2)

|

Up to 74.15%

(2)

|

|

Japan Drilling Co., Ltd.

|

14,726,264

|

12.68

%

|

14,726,264

|

6.34

%

|

|

Prospector PTE Ltd.

|

15,534,310

|

13.38

%

|

15,534,310

|

6.69

%

|

|

(1)

|

The Corporation and its directors and officers do not

warrant the accuracy of third party share ownership

information.

|

|

(2)

|

The number assumes that no other Shareholder exercises

their Right to purchase Rights Shares under the Offering and Frontera

requires the maximum number of Standby Shares. Frontera's ownership could

increase up to 77.9% if Frontera elects to convert into Common Shares

certain debt owed by the Corporation to Frontera pursuant to Frontera's

conversion right under the loan agreement.

|

- 7 -

JDC is expected to receive proceeds from the Offering in

payment of obligations owed pursuant to the Agreement (see “

Use of Available

Funds

”). As a result, the Offering is considered to be a related party

transaction under Multilateral Instrument 61-101 (“

MI 61-101

”), which

absent exemptions would obligate the Corporation to obtain a formal valuation

and obtain approval from a minority of the Shareholders. The Corporation is

exempt from the formal valuation requirement pursuant to section 5.5(b) of MI

61-101 due to its Common Shares being listed only on the TSX-V, and is exempt

from the minority approval requirement pursuant to section. 5.7(1)(e) of MI

61-101 on the basis that: (i) the Corporation is in serious financial

difficulty, (ii) the Offering is designed to improve the financial position of

the Corporation, (iii) section 5.5(f) of MI 61-101 is not applicable in

connection with the Offering, (iv) the Corporation has one or more independent

directors in respect of the Offering, (v) the board of directors of the

Corporation including all independent directors therein, acting in good faith,

have determined that items (i) and (ii) above apply and that the terms of the

Offering are reasonable in the circumstances of the Corporation, and (vi) there

is no other requirement to hold a meeting of Shareholders to approve the

Offering.

DILUTION

If you do not exercise your Rights, by how much will your

security holdings be diluted?

Assuming that all of the Rights are exercised (either pursuant

to the Basic Subscription Privilege or the Additional Subscription Privilege),

then your percentage ownership of the Common Shares will be diluted by

approximately 50% upon completion of the Offering.

STAND-BY COMMITMENT

Who is the stand-by guarantor and what are the fees?

Frontera, the Corporation’s largest shareholder, has confirmed

to the Corporation that it commits to buying all of the Rights Shares not

subscribed for by other Shareholders of the Corporation. Pursuant to the standby

purchase agreement between Frontera and the Corporation dated January 31, 2019

(the “

Standby Purchase Agreement

”), Frontera has agreed, subject to

certain terms, conditions and limitations, to exercise its Basic Subscription

Privilege and, in addition thereto, acquire any additional Rights Shares

available as a result of any unexercised Rights under the Offering (the

“

Standby Shares

”), such that the Corporation will, subject to the terms

of the Standby Purchase Agreement, be guaranteed to issue 116,102,318 Rights

Shares in connection with the Offering for aggregate gross proceeds of

$29,025,579.50.

Frontera is a “related party” of the Corporation under

applicable securities laws as it holds more than 10% of the outstanding Common

Shares.

Frontera may terminate the Standby Purchase Agreement in the

following circumstances: (a) any material adverse change occurs at any time

following execution of the Standby Purchase Agreement; (b) CGX is in material

default of its obligations under the Standby Purchase Agreement and fails to

remedy such breach within five days of written notice of such breach; (c) any of

the conditions in favour of Frontera as set forth in the Standby Purchase

Agreement are not satisfied or waived by Frontera by the closing time of the

Offering; (d) CGX fails to satisfy any of the timing requirements set out in the

Standby Purchase Agreement; or (e) closing of the Offering has not occurred by

March 15, 2019.

In consideration for the stand-by commitment, Frontera shall

receive common share purchase warrants (the “

Warrants

”) to purchase 25%

of the Common Shares that Frontera has agreed to acquire pursuant its commitment

under the Standby Purchase Agreement (for greater certainty, which does not

include the Right Shares that Frontera is entitled to subscribe for under the

Basic Subscription Privilege and the Additional Subscription Privilege) or such

lesser number of Warrants as the parties may agree to. The exercise price of the

Warrants shall be equal to the closing price of the Common Shares on January 31,

2019, being the last trading day prior to the announcement of the terms of this

Offering. The Warrants expire five (5) years from the date of issue.

Have we confirmed that the stand-by guarantor has the

financial ability to carry out its stand-by commitment?

To the knowledge of the Corporation, after reasonable inquiry,

Frontera has the financial ability to carry out its stand-by commitment.

- 8 -

What are the security holdings of the stand-by guarantor

before and after the Offering?

|

Shareholder

|

Holdings of

Common Shares

before the Offering

(non-diluted)

|

Percentage

before the

Offering

|

Holdings of

Common Shares

after the Offering

if the

stand-by

guarantor takes

up the entire

stand-by

commitment

(1)

|

Percentage after

the Offering if the

stand-by

guarantor

takes

up the entire

stand-by

commitment

|

|

Frontera Energy Corp.

|

56,066,214

Common Shares

|

48.29%

|

Up to

172,168,532

Common

Shares

|

Up to

74.15

%

|

|

(1)

|

Does not include Common Shares issuable pursuant to the

Warrants.

|

MANAGING DEALER, SOLICITING DEALER AND UNDERWRITING CONFLICTS

Who is the managing or soliciting dealer and what are its

fees?

There is no managing dealer or soliciting dealer in respect of

the Offering.

HOW TO EXERCISE THE RIGHTS

How does a securityholder that is a registered holder

participate in the Offering?

The Notice for the Offering has been sent to Shareholders in

the Qualified Jurisdictions. For registered holders of Common Shares, a Rights

Certificate representing the number of Rights to which the Shareholder is

entitled as of the Record Date has been included with the Notice. In order to

exercise the Rights represented by the Rights Certificate, a holder of Rights

must complete and deliver the Rights Certificate to the offices of the

Depositary by mail or courier to TSX Trust Company, 301-100 Adelaide Street

West, Toronto, Ontario M5H 4H1, before the Expiry Time on the Expiry Date in the

manner and upon the terms set out in the Rights Certificate and as set out

below. The method of delivery is at the discretion and risk of the holder of the

Rights Certificate and delivery to the Depositary will only be effective when

actually received by the Depositary. If mail is used, registered mail is

recommended.

In order to exercise your Rights, you must:

|

|

1.

|

Complete and sign Form 1, 2, 3 or 4, as the case may

be, on the Rights Certificate

. The maximum number of Rights that you

may exercise under the Basic Subscription Privilege is shown in the box on

the upper right hand corner of the face of the Rights Certificate. By

completing the appropriate form appearing on the front of the Rights

Certificate, a Rights Certificate holder may: (i) subscribe for Rights

Shares (Form 1); (ii) exercise Additional Rights (Form 2); (iii) sell or

transfer Rights (Form 3); or (iv) divide or combine the Rights Certificate

(Form 4). If you complete Form 1 so as to exercise some but not all of the

Rights evidenced by the Rights Certificate, you will be deemed to have

waived the unexercised balance of such Rights, unless you otherwise

specifically advise the Depositary at the time the Rights Certificate is

surrendered to the Depositary.

|

|

|

|

|

|

|

2.

|

Additional Subscription Privilege

. Complete and

sign Form 2 on the Rights Certificate only if you also wish to participate

in the Additional Subscription Privilege. You must exercise the Basic

Subscription Privilege in full to be eligible to exercise the Additional

Subscription Privilege. See “

What is the Additional Subscription

Privilege and how can you exercise this privilege?

”.

|

|

|

|

|

|

|

3.

|

Enclose payment in Canadian funds by certified cheque,

bank draft or money order payable to the order of TSX Trust Company

.

To exercise the Rights, you must pay $0.25 per Rights Share, and you may

purchase one Rights Share for every one Common Share you hold. In addition

to the amount payable for any Rights Shares you wish to purchase under the

Basic Subscription Privilege, you must also pay

the amount required for any Rights Shares subscribed for under the

Additional Subscription Privilege, if any. Amounts paid in respect of the

Additional Subscription Privilege not ultimately used to acquire Rights will be

returned to you. See “

What is the Additional Subscription Privilege and how

can you exercise this privilege

?”.

|

- 9 -

|

|

4.

|

Delivery

. Deliver or mail the completed Rights

Certificate (including Form 1 and Form 2) and payment in the enclosed

return envelope addressed to the Depositary at the address below so that

it is received before the Expiry Time on the Expiry Date. If you are

mailing your documents, registered mail is recommended. Please allow

sufficient time to avoid late delivery as the payments together with Form

1, Form 2 and any other applicable forms, must be received by the Expiry

Time on the Expiry Date.

|

TSX Trust Company

301 • 100

Adelaide St. West

Toronto, ON M5H 4H1

Attention: Corporate Actions

Rights Certificates will expire and be of no value unless they

are returned with a properly completed Form 1, 2, 3 or 4, as the case may be,

and received with payment for the Rights Shares subscribed for, at the office of

the Depositary before the Expiry Time on the Expiry Date.

The signature of the Rights Certificate holder must correspond

in every particular with the name that appears on the face of the Rights

Certificate. Signatures by a trustee, executor, administrator, guardian,

attorney, officer of a company or any person acting in a fiduciary or

representative capacity should be accompanied by evidence of authority

satisfactory to the Depositary. All questions as to the validity, form,

eligibility (including time of receipt) and acceptance of any subscriptions will

be determined by Corporation in its sole discretion, and any determination by

the Corporation will be final and binding. All subscriptions are irrevocable.

The Corporation reserves the absolute right to reject any subscription if it is

not in proper form or if the acceptance thereof or the issuance of Rights Shares

pursuant thereto could be deemed unlawful. The Corporation is not and will not

be under any duty to give any notice of any defect or irregularity in any

subscription, nor will they be liable for the failure to give any such notice.

Certificates for Rights Shares issued upon exercise of Rights

in accordance with the Offering, including Rights Shares purchased through the

Additional Subscription Privilege, will be registered in the name of the person

to whom the Rights Certificate was issued or to whom the Rights were transferred

in accordance with the terms thereof, and mailed to the address of the

subscriber for the Common Shares as stated on the Rights Certificate, unless

otherwise directed, as soon as practicable after the Expiry Date. Once mailed or

delivered in accordance with the instructions of the subscriber, the Corporation

assumes no further responsibility for the certificates evidencing the Rights

Shares.

How does a security holder that is not a registered

holder participate in the Offering?

Shareholders in the Qualified Jurisdictions who hold Common

Shares through a securities broker or dealer, bank or trust company or other

participant (a “

CDS Participant

”) in the book-based system administered

by CDS Clearing and Depository Services Inc. (“

CDS

”), will be issued

their respective Rights as of the Record Date to CDS and will be deposited with

CDS following the Record Date.

If you are a beneficial holder of Common Shares in the

Qualified Jurisdictions, in order to exercise your Rights, you must:

|

|

1.

|

Instruct the CDS Participant to exercise, purchase or

transfer all or a specified number of such Rights, and forward to such CDS

Participant, the aggregate Subscription Price for the Rights Shares you

wish to subscribe for in accordance with the terms of the Offering. It is

anticipated by the Corporation that each purchaser of Rights Shares will

receive a customer confirmation of issuance or purchase, as applicable,

from the CDS Participant through which such Rights Shares are issued or

purchased in accordance with the practices and policies of such CDS

Participant; and

|

- 10 -

|

|

2.

|

You may subscribe for additional Rights Shares pursuant

to the Additional Subscription Privilege by instructing such CDS

Participant to exercise the Additional Subscription Privilege in respect

of the number of additional Rights Shares you wish to subscribe for, and

forwarding to such CDS Participant the aggregate Subscription Price for

such additional Rights Shares requested. Any excess funds will be returned

by mail or credited to the applicable CDS Participant for the account of

the beneficial holder without interest or

deduction.

|

Subscriptions for Rights Shares made through a CDS Participant

will be irrevocable and Shareholders will be unable to withdraw their

subscriptions for Rights Shares once submitted. CDS Participants may have an

earlier deadline for receipt of instructions and payment than the Expiry Time on

the Expiry Date.

Only registered Shareholders will be provided with Rights

Certificates. For all non-registered, beneficial Shareholders who hold their

Common Shares through a CDS Participant in the book-based systems administered

by CDS, the total number of Rights to which

all such beneficial Shareholders as at the Record Date are entitled will be issued to and deposited with CDS

following the Record Date. The Corporation expects that each

beneficial Shareholder will receive a confirmation of the number of Rights

issued to it from its CDS Participant in accordance with the practices and

procedures of that CDS Participant. CDS will be responsible for establishing and

maintaining book-entry accounts for CDS Participants holding Rights.

Beneficial Shareholders in the Qualified Jurisdictions may also

accept the Offering in the Qualified Jurisdictions by following the procedures

for book-based transfer, provided that a confirmation of the book-based transfer

of their Rights through CDS on-line tendering system into the Corporation’s

account at CDS, is received by the Corporation prior to the Expiry Time on the

Expiry Date. The Corporation has established an account at CDS for the purpose

of the Offering. Any financial institution that is a participant in CDS may

cause CDS to make a book-based transfer of a holder’s Rights into the

Corporation’s account in accordance with CDS procedures for such transfer.

Delivery of Rights using the CDS book-based transfer system will constitute a

valid tender under the Offering.

The Corporation will not have any liability for: (i) the

records maintained by CDS or CDS Participants relating to the Rights or the

book-entry accounts maintained by them; (ii) maintaining, supervising or

reviewing any records relating to such Rights; or (iii) any advice or

representations made or given by CDS or CDS Participants with respect to the

rules and regulations of CDS or any action to be taken by CDS or their CDS

Participants.

Can I combine, exchange or divide my Rights Certificate?

Rights Certificates may be combined, divided or exchanged by

delivering such Rights Certificates, accompanied by appropriate instructions or

a completed Form 4 on the Rights Certificate, to the Rights Agent as set out

above. Rights Certificates must be surrendered for division, combination or

exchange by such date as will permit new Rights Certificates to be issued and

used by the holder thereof prior to the Expiry Time on the Expiry Date.

Who is eligible to receive Rights?

The Rights are being offered to Shareholders resident in the

Qualified Jurisdictions. Shareholders will be presumed to be resident in the

place of their registered address, unless the contrary is shown to the

satisfaction of the Corporation. This Circular is not to be construed as an

offering of the Rights, or the Rights Shares issuable upon exercise of the

Rights, for sale in any jurisdiction outside of the Qualified Jurisdictions (the

“

Non-Participating Jurisdictions

”), or to Ineligible Shareholders.

The Corporation will not accept subscriptions from any Shareholder or from

any transferee of Rights who is or appears to be, or who the Corporation has

reason to believe is, resident in a Non-Participating Jurisdiction. This

Circular will not be delivered to any Ineligible Shareholders unless such

Ineligible Shareholder satisfies the Corporation that it is an Approved

Ineligible Shareholder (as defined below). Rights delivered to brokers, dealers

or other intermediaries may not be delivered by those intermediaries to

beneficial Shareholders who are resident in Non-Participating Jurisdictions.

An Ineligible Shareholder that satisfies the Corporation, in

its sole discretion, that such offering to and subscription by such Shareholder

or transferee is lawful and in compliance with all applicable securities and

other laws where such Shareholder or transferee is resident (such Shareholder is

referred to herein as an “

Approved Ineligible

Shareholder

”) may have its Rights Certificates issued

and forwarded by the Rights Agent upon direction from the Corporation.

- 11 -

The Rights Agent will hold the Rights of Ineligible

Shareholders until March 2, 2019. Ineligible Shareholders must satisfy the

Corporation as to their eligibility to participate in the Offering on or before

March 2, 2019 to claim the Rights Certificate. The Rights Certificate, and

any Rights Shares that may be issued upon the exercise of the Rights, may be

endorsed with restrictive legends according to applicable securities laws.

Ineligible Shareholders will be sent the Notice, for

information purposes only, together with a letter advising them that their

Rights Certificates will be held by the Rights Agent (except in the case of an

Approved Ineligible Shareholder as set out above) and that the Rights

Certificates will be issued to and held on their behalf by the Depositary until

5:00 p.m. (Toronto Time) March 2, 2019, after which time and prior to the

Expiry Time, the Depositary shall attempt to sell the Rights of such Ineligible

Shareholders represented by Rights Certificates in the possession of the

Depositary on such date(s) and at such price(s) as the Depositary determines in

its sole discretion.

A registered Ineligible Shareholder whose address of record is

outside the Qualified Jurisdictions but who holds Common Shares on behalf of a

holder who is eligible to participate in the Offering must notify the

Corporation, in writing, on or before the tenth day prior to the Expiry Time on

the Expiry Date if such beneficial holder wishes to participate in the Offering.

No charge will be made for the sale of Rights by the Depositary

except for a proportionate share of any brokerage commissions incurred by the

Depositary and costs incurred by the Depositary in connection with the sale of

the Rights. Ineligible Shareholders will not be entitled to instruct the

Depositary in respect of the price or the time at which the Rights are to be

sold. The Depositary will endeavour to effect sales of Rights on the open market

and any proceeds received by the Depositary with respect to the sale of Rights,

net of brokerage fees and costs incurred and, if applicable, the Canadian tax

required to be withheld, will be divided on a pro rata basis among such

Ineligible Shareholders and delivered by mailing cheques (in Canadian funds) of

the Depositary therefor as soon as practicable to such Ineligible Shareholders.

Amounts of less than $10.00 will not be remitted. The Depositary will act in its

capacity as agent of the Ineligible Shareholder on a best efforts basis only and

we and the Depositary do not accept responsibility for the price obtained on the

sale of, or the inability to sell, the Rights on behalf of any Ineligible

Shareholder. Neither we nor the Depositary will be subject to any liability for

the failure to sell any Rights of Ineligible Shareholders or as a result of the

sale of any Rights at a particular price or on a particular day. There is a risk

that the proceeds received from the sale of Rights will not exceed the costs

incurred by the Depositary in connection with the sale of such Rights and, if

applicable, the Canadian tax required to be withheld. ln such event, no proceeds

will be remitted.

Holders of Rights who are not resident in Canada should be

aware that the purchase and sale of Rights or Rights Shares may have tax

consequences in the jurisdiction where they reside, which are not described

herein. Accordingly, such holders should consult their own tax advisors about

the specific tax consequences in the jurisdiction where they reside or

acquiring, holding, and disposing of Rights or Common Shares.

What is the Additional Subscription Privilege and how can

you exercise this privilege?

A holder of a Rights Certificate who is not an Ineligible

Shareholder and who has exercised all the Rights evidenced by such Rights

Certificate may exercise Additional Rights, if available, at a price equal to

the Subscription Price. The number of Additional Rights available will be the

difference, if any, between the total number of Rights that were issued pursuant

to the Offering and the total number of Rights validly exercised and paid for

pursuant to the Basic Subscription Privilege at the Expiry Time on the Expiry

Date. Subscriptions for the exercise of Additional Rights will be received

subject to allotment only and the number of Additional Rights, if any, that may

be allotted to each subscriber will be equal to the lesser of; (i) the number of

Additional Rights that such subscriber has exercised under the Additional

Subscription Privilege; and (ii) the product (disregarding fractions, if any)

obtained by multiplying the number of Additional Rights available to be issued

by a fraction, the numerator of which is the number of Rights previously

exercised by the subscriber pursuant to the Basic Subscription Privilege and the

denominator of which is the aggregate number of Rights previously exercised

pursuant to the Basic Subscription Privilege by all holders of Rights who have

exercised and paid for Additional Rights. If any Rights holder has exercised

fewer Additional Rights than such Rights holder’s pro rata allotment of

Additional Rights, the excess Additional Rights will be allotted in a similar manner among

the Rights holders who were allotted fewer Additional Rights than they

exercised.

- 12 -

To exercise Additional Rights under the Additional Subscription

Privilege:

|

|

•

|

a registered holder must: (i) complete Form 2 of the

Rights Certificate, and (ii) deliver the Rights Certificate, together with

payment for those Additional Rights, to the Depositary at or before the

Expiry Time on the Expiry Date as provided above; and

|

|

|

|

|

|

|

•

|

a beneficial holder must deliver payment and instructions

to the CDS Participant sufficiently in advance of the Expiry Time on the

Expiry Date to allow the CDS Participant to properly exercise the

Additional Subscription Privilege, in each case in accordance with your

instructions to the CDS Participant.

|

If payment for all additional Rights Shares subscribed for

pursuant to the Additional Subscription Privilege does not accompany the

subscription, the over-subscription will be invalid.

If the Offering is fully subscribed, then the funds included

for any over-subscriptions will be returned by the Corporation to the relevant

Shareholders. If the Offering is not fully subscribed, certificates representing

Rights Shares due to Shareholders as a result of over-subscriptions will be

delivered by the Corporation as soon as practicable, together with the

certificates representing Rights Shares due to those Shareholders pursuant to

their subscriptions in accordance with the Basic Subscription Privilege. In

addition, the Corporation will return to any over-subscribing Shareholder within

30 calendar days of the Expiry Date any excess funds paid in respect of an

over-subscription for Rights Shares where the number of additional Rights Shares

available to that Shareholder is less than the number of Additional Rights

exercised. No interest will be payable by the Corporation in respect of any

excess funds returned to Shareholders.

How does a Rights holder sell or transfer Rights?

The Rights will trade on the TSX-V under the trading symbol

“OYL.RT” until the Expiry Time on the Expiry Date. Holders of Rights

Certificates not wishing to exercise their Rights may sell or transfer them

directly or through their securities broker or dealer at the holder’s expense,

subject to any applicable resale restrictions. Rights Certificates will not be

registered in the name of an Ineligible Shareholder. Holders of Rights

Certificates may elect to exercise only a part of their Rights and dispose of

the remainder, or dispose of all of their Rights. Any commission or other fee

payable in connection with the exercise or any trade of Rights (other than the

fee for services to be performed by the Depositary as described herein) is the

responsibility of the holder of such Rights. Depending on the number of Rights a

holder may wish to sell, the commission payable in connection with a sale of

Rights could exceed the proceeds received from such sale.

If you wish to transfer your Rights, as a registered holder,

you must: (i) complete Form 3 of the Rights Certificate and have the signature

guaranteed by an “eligible institution” to the satisfaction of the Depositary,

and (ii) deliver the Rights Certificate to the transferee. “Eligible

institution” means a Canadian Schedule 1 chartered bank, a major trust company

in Canada, a member of the Securities Transfer Agents Medallion Program (STAMP)

or a member of the Stock Exchange Medallion Program (SEMP). Members of these

programs are usually members of a recognized stock exchange in Canada or members

of the Investment Industry Regulatory Organization of Canada. It is not

necessary for a transferee to obtain a new Rights Certificate to exercise the

rights or the Additional Subscription Privilege, but the signature of the

transferee on Forms 1 and 2 of the Rights Certificate must correspond in every

particular with the name of the transferee shown on Form 3 of the Rights

Certificate. If Form 3 of the Rights Certificate is properly completed, the

Corporation and the Depositary will treat the transferee (or the bearer if no

transferee is specified) as the absolute owner of the Rights Certificate for all

purposes and will not be affected by notice to the contrary. A Rights

Certificate so completed should be delivered to the appropriate person in ample

time for the transferee to use it before the expiration of the Rights.

If you are a beneficial holder, you must arrange for the

transfer of Rights through the CDS Participant.

- 13 -

When can you trade the Rights Shares issuable upon the

exercise of your Rights?

All Rights Shares issuable on exercise of the Rights will be

listed and posted for trading on the TSX-V under the symbol “OYL” as soon as

practicable after closing of the Offering.

Are there restrictions on the resale of Rights and Rights

Shares?

Except for the Rights being issued hereunder and the Rights

Shares issuable upon exercise of the Rights (collectively, the

“

Securities

”) distributed to Shareholders in the Eligible U.S.

Jurisdictions, the Securities are being distributed by the Corporation in the

Qualified Jurisdictions pursuant to exemptions from the registration and

prospectus requirements under securities legislation in the Qualified

Jurisdictions. Resale of the Securities may be subject to restrictions pursuant

to applicable securities legislation then in force. Set out below is a general

summary of the restrictions governing first trades in the Rights Shares in the

Qualified Jurisdictions. Additional restrictions may apply to “insiders” of the

Corporation and holders of the Common Shares who are “control persons” or the

equivalent or who are deemed to be part of what is commonly referred to as a

“control block” in respect of the Corporation for purposes of securities

legislation. Each holder of Rights is urged to consult his or her professional

advisors to determine the exact conditions and restrictions applicable to trades

of the Common Shares.

Generally, the first trade of any of the Securities will be

exempt from the prospectus requirements of securities legislation in the

Qualified Jurisdictions and such Securities may be resold without hold period

restrictions if: (i) the Corporation is and has been a “reporting issuer” in a

jurisdiction of Canada for the four months immediately preceding the trade; (ii)

the trade is not a “control distribution” as defined in applicable securities

legislation; (iii) no unusual effort is made to prepare the market or to create

a demand for the Securities; (iv) no extraordinary commission or other

consideration is paid in respect of such trade; and (v) if the seller is an

insider or officer of the Corporation, the seller has no reasonable grounds to

believe that the Corporation is in default of applicable securities legislation.

If such conditions have not been met, then the Securities may

not be resold except pursuant to a prospectus or prospectus exemption, which may

only be available in limited circumstances. As at the date hereof the

Corporation has been a reporting issuer for more than four months in each of the

following provinces of Canada: British Columbia, Alberta, Saskatchewan,

Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and

Newfoundland.

The Corporation has filed with the SEC in the United States a

Registration Statement on Form F-7 under the U.S. Securities Act so that the

Common Shares issuable upon the exercise of the Rights will not be subject to

transfer restrictions. However, the Rights are “restricted securities” within

the meaning of Rule 144 under the U.S. Securities Act and may not be transferred

to any person within the United States. Holders of Common Shares in the United

States who receive Rights may transfer or resell them only in transactions

outside of the United States in accordance with Regulation S under the U.S.

Securities Act and subject to resale restrictions imposed by Canadian securities

laws and regulations.

The foregoing is a summary only and is not intended to be

exhaustive. Holders of Rights should consult with their advisors concerning

restrictions on resale, and should not resell their Securities until they have

determined that any such resale is in compliance with the requirements of

applicable legislation.

Will the Corporation issue fractional underlying Rights

Shares upon exercise of the Rights?

The Corporation will not issue fractional Rights Shares upon

the exercise of Rights. Where the issuance of Rights would otherwise entitle the

holder of Rights to fractional Rights Shares, the holder’s entitlement will be

reduced to the next lowest whole number of Rights Shares, with no additional

compensation.

- 14 -

APPOINTMENT OF DEPOSITARY

Who is the depositary?

TSX Trust Company has been appointed to act as the Depositary

and the Rights Agent for the Offering and to: (i) receive subscriptions and

payments from Rights holders for the Rights Shares subscribed for under the

Basic Subscription Privilege and, if applicable, the Additional Subscription

Privilege and (ii) perform the services relating to the exercise and transfer of

the Rights, including the issuance of the Rights Shares.

The Corporation will pay for all such services of the Rights

Agent and Depositary. The Rights Agent and Depositary will accept subscriptions

for Rights Shares and payment of the Subscription Price from Rights holders by

mail or courier to the office of the Rights Agent and Depositary:

TSX Trust Company

301-100 Adelaide Street West

Toronto,

Ontario M5H 4H1

Attention: Corporate Actions

Enquiries relating to the Offering should be addressed to the

Rights Agent and Depositary by telephone at (416)342-1091 or by sending an email

to tmxeinvestorservices@tmx.com.

The method of delivery of Rights Certificates and funds to the

Depositary is at the discretion of the Rights holder. Neither the Depositary nor

the Corporation will be liable for the failure to deliver or the delivery of

Rights Certificates or funds to an address other than the address set out above.

Delivery to an address other than the address set out above may result in a

subscription for Rights Shares or a transfer of Rights not being accepted. If

mail is used, registered mail is recommended.

What happens if the Corporation does not proceed with the

Offering or if the Corporation does not receive funds from the stand-by

guarantor?

The Depositary will hold all funds received in payment for

Rights Shares subscribed for on exercise of Rights in a segregated account

pending completion of the Offering. If the Offering is not fully subscribed,

such funds will be returned (without interest) to the applicable subscriber or

CDS Participants.

RISKS AND UNCERTAINTIES

The business of the Corporation consists of oil and gas

exploration in Guyana, South America. There are a number of inherent risks

associated with oil and gas exploration and development, as well as local,

national and international economic and political conditions that may affect the

success of CGX which are beyond CGX’s control, particularly since its operations

are located in a foreign country. Many of these factors involve a high degree of

risk which a combination of experience, knowledge and careful evaluation may not

overcome. CGX’s interests are held by way of participating interests in

Petroleum Prospecting Licenses governed by Petroleum Agreements. The operations,

exploration and development of the Corporation’s interests require licenses from

governmental authorities in Guyana and the process for obtaining and renewing

licenses from governmental authorities often takes an extended period of time

and is subject to numerous delays, costs and uncertainties. Any unexpected

delays or costs or failure to obtain or renew such licenses could delay or

prevent the development of the Corporation’s interests or impede the operations,

which could adversely impact the Corporation’s operations, profitability,

prospects and financial results. The Corporation may be unable, on a timely

basis, to obtain, renew or maintain in the future all necessary licenses that

may be required to explore and develop its interests under exploration or

development or to maintain continued operations that economically justify the

cost. Delays in obtaining or failure to obtain, renew, or retain licenses may

adversely affect the Corporation’s prospects and operations, including its

ability to explore or develop its interests, commence production or continue

operations. The reasons for any such failure or delay could be beyond the

control of the Corporation, including possibly as a result of the actions or

omissions of other parties having an interest in the Petroleum Prospecting

Licenses. Please refer to the section entitled “Risk and Uncertainties” in the

Corporation’s Annual MD&A for the fiscal year ended December 31, 2017, available

on SEDAR at www.sedar.com.

ADDITIONAL INFORMATION

Where can you find more information about the

Corporation?

Further information regarding the Corporation, its activities

and its financial results, including copies of the financial statements and

other continuous disclosure documents filed by the Corporation with applicable

Canadian securities regulatory authorities, may be obtained under the

Corporation’s profile on SEDAR at

www.sedar.com

. Further information

regarding the Corporation may also be found at the corporate website of CGX at

www.cgxenergy.ca

.

FORWARD-LOOKING STATEMENTS

This Circular contains “forward-looking information” within the

meaning of applicable Canadian securities legislation and “forward-looking

statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995 (collectively, “

forward-looking

statements

”) that relate to the Corporation’s current expectations and view

of future events. The forward-looking statements are contained principally in

the sections titled “

What will our available funds be upon closing of the

Offering?

”, “

How will we use the available funds?” and “How long will the

available funds last?

”

In some cases, these forward-looking statements can be

identified by words or phrases such as “may”, “could”, “will”, “expect”,

“anticipate, “intend”, “plan”, believe”, “estimate” or “project”. The

Corporation has based these forward-looking statements on its current

expectations and projections about future events and financial trends that it

believes may affect its financial condition, results of

operations, business strategy and financial needs. These forward-looking

statements include, among other things, statements relating to: (i) the funds to

be raised under the Offering; (ii) estimated costs of the Offering; (iii)

available funds to the Corporation after expenses of the Offering; (iv)

additional sources of required funding for the Corporation; (v) the use of the

funds raised under the Offering; (vi) the Corporation’s estimate of how long the

funds raised in the Offering will last from the Expiry Date; (vii) the intention

and commitment of insiders to exercise their Rights; (viii) estimated G&A

requirements; (ix) the anticipated dilution to Shareholders who do not

participate in the Offering and (x) the Corporation’s ability as a going

concern.

- 15 -

The forward-looking statements are based on a number of key

expectations and assumptions made by the Corporation’s management relating to

the Corporation including, but not limited to: (i) the estimated costs of the

Offering; (ii) the estimated amount of funds raised under the Offering; (iii)

the operating expenses of the Corporation following the Expiry Date; and (iv)

Frontera complying with its obligations under the Standby Purchase Agreement and

the conditions to funding thereafter being met, satisfied or waived. These

assumptions are subject to risks and uncertainties.

Although the Corporation believes that the assumptions

underlying these statements are reasonable, they may prove to be incorrect.

Forward-looking statements are not guarantees of future performance and

accordingly, Shareholders shall not place undue reliance on such statements in

light of their inherent uncertainty and assumptions, and the risks as set out

above, and assumptions. Whether actual results, performance or achievements will

conform to the Corporation’s expectations and predictions is subject to a number

of known and unknown risks, uncertainties, assumptions and other factors, which

include: (i) the uncertainty associated with estimating actual costs incurred in

the Offering; (ii) the actual amount of funds raised under the Offering; (iii)

the actual operating expenses of the Corporation for the 12-month period

following the Expiry Date; (iv) delays in obtaining or failure to obtain

required approvals to complete the Offering and the stand-by commitment; and (v)

other risks related to the Corporation’s business. These risks, uncertainties,

assumptions and other factors could cause the Corporation’s actual results,

performance, achievements and experience to differ materially from the

Corporation’s expectations, future results, performances or achievements

expressed or implied by the forward-looking statements, and even if such actual

results are realized or substantially realized, there can be no assurance that

they will have the expected consequences to, or effects on, the Corporation. In

light of the significant risks and uncertainties in the forward-looking

statements, Shareholders should not place undue reliance on or regard these

statements as a representation or warranty by the Corporation or any other

person that the Corporation will achieve its objectives, strategies and plans in

any specified time frame, if at all.

The forward-looking statements made in this Circular relate

only to events or information as of the date on which the statements are made in

this Circular and is subject to change. Except as required by law, the

Corporation undertakes no obligation to update or revise publicly or otherwise

any forward-looking statements, whether as a result of new information, future

events or otherwise, after the date on which the statements are made or to

reflect the occurrence of unanticipated events. A Shareholder should read this

Circular with the understanding that the Corporation’s actual future results may

be materially different from what it expects. Future-oriented financial

information in this Circular relates to the Corporation’s view of future events

and is not appropriate to use for other purposes.

MATERIAL FACTS AND MATERIAL CHANGES

There is no material fact or material change about the Corporation that has not

been generally disclosed.

RIGHTS OFFERING NOTICE

Filed pursuant to National

Instrument 45-106

Prospectus Exemptions

CGX ENERGY INC.

Notice to security holders – February 1, 2019

The purpose of this notice is to advise holders of the

outstanding common shares (the “

Common Shares

”) of CGX Energy Inc.

(“

CGX

” or the “

Corporation

”) of a proposed offering of rights of

the Corporation.

References in this notice to “we”, “our”, “us” and similar

terms mean to the Corporation. References in this notice to “you”, “your” and

similar terms mean to shareholders of the Corporation. All amounts herein are

presented in Canadian dollars, unless otherwise stated.

We currently have sufficient working capital to last less

than two months. We require 100% of the rights offering to meet our working

capital requirements for the next six months without other sources of financing.

The rights offering is being undertaken to raise additional working capital and

to pay off certain debt as disclosed herein and in the Rights Offering Circular

(as defined below).

Who can participate in the Offering?

The Corporation is issuing to the holders of Common Shares (the

“

Shareholders

”) of record at the close of business (Toronto time) on

February 11, 2019 (the “

Record Date

”) an aggregate of 116,102,318

transferable rights (each, a “

Right

”) to subscribe for an aggregate of

116,102,318 Common Shares (the “

Rights Shares

”) on the terms set forth

herein (the “

Offering

”) and as more particularly described in the

Corporation’s rights offering circular dated February 1, 2019 (the “

Rights

Offering Circular

”).

Who is eligible to receive Rights?

The Offering is being made to Shareholders in all provinces of

Canada except Québec and in each state of the United States other than in the

states of Arizona, Arkansas, California, Minnesota, Ohio and Wisconsin (the

“

Qualified Jurisdictions

”). The offer of the Rights is being made only to

Shareholders resident in the Qualified Jurisdictions. Shareholders will be

presumed to be resident in the place shown on their registered address, unless

the contrary is shown to our satisfaction. This notice is not to be construed as

an offering of Rights, nor are the Rights Shares issuable upon exercise of the

Rights, in any jurisdiction outside of the Qualified Jurisdictions or to

Shareholders who are residents of any jurisdiction other than the Qualified

Jurisdictions (“

Ineligible Shareholders

”). Instead, Ineligible

Shareholders will be sent a letter advising them that their Rights will be held

on their behalf by TSX Trust Company (the “

Depositary

”), who will hold

such Rights as agent for the benefit of all such Ineligible Shareholders.

How many Rights is CGX offering?

An aggregate of 116,102,318 Rights are being issued to purchase

116,102,318 Rights Shares pursuant to the Offering.

How many Rights will you receive?

A Shareholder will receive (1) Right for each Common Share

owned by the Shareholder as at the Record Date.

- 2 -

What does one (1) Right entitle you to receive?

Each Right will entitle the holder thereof to purchase one (1)

Rights Share (the “

Basic Subscription Privilege

”) upon payment of a

subscription price of $0.25

(the “

Subscription Price

”) per Rights

Share until the Expiry Time (as defined below) on the Expiry Date (as defined

below).

Rights holders who exercise their Rights in full pursuant to

the Basic Subscription Privilege are entitled to exercise additional Rights (the

“

Additional Rights

”) not otherwise purchased, on a pro rata basis,

pursuant to an additional subscription privilege (the “

Additional

Subscription Privilege

”). The number of Additional Rights available will be

the difference, if any, between the total number of Rights that are issued

pursuant to the Offering and the total number of Rights exercised and paid for

pursuant to the Basic Subscription Privilege at the Expiry Time on the Expiry

Date.

Subscriptions for the exercise of Additional Rights will be

received subject to allotment only and the number of Additional Rights, if any,

that may be allotted to each subscriber will be equal to the lesser of; (i) the

number of Additional Rights that such subscriber has exercised under the

Additional Subscription Privilege; and (ii) the product (disregarding fractions,

if any) obtained by multiplying the number of Additional Rights available to be

issued by a fraction, the numerator of which is the number of Rights previously

exercised by the subscriber pursuant to the Basic Subscription Privilege and the

denominator of which is the aggregate number of Rights previously exercised

pursuant to the Basic Subscription Privilege by all holders of Rights who have

exercised and paid for Additional Rights. If any Rights holder has exercised

fewer Additional Rights than such Rights holder’s pro rata allotment of

Additional Rights, the excess Additional Rights will be allotted in a similar

manner among the Rights holders who were allotted fewer Additional Rights than

they exercised.

Shareholders who exercise their Rights must enclose payment in

full for all Rights subscribed for (including any subscription pursuant to the

Additional Subscription Privilege) in Canadian funds by certified cheque, bank

draft or money order payable to the order of TSX Trust Company.

How will you receive your Rights?

If you are a registered Shareholder (a “

Registered

Holder

”), a rights certificate (“

Rights Certificate

”) evidencing the

Rights to which you are entitled has been delivered with this Notice. Please

review the Rights Certificate and the Rights Offering Circular for instructions

as to how to exercise your Rights.

If you are a beneficial Shareholder (a “

Beneficial

Holder

”) whose Common Shares are held through a securities broker or dealer,

bank or trust company or other participant (a “

CDS Participant

”) in the

book-based system administered by CDS Clearing and Depository Services Inc.

(“

CDS

”), you will not receive a Rights Certificate. The total number of

Rights to which all Beneficial Holders as at the Record Date are entitled will

be issued to and deposited with CDS following the Record Date. Please review the

Rights Offering Circular and contact your CDS Participant for instructions as to

how to exercise your Rights.

When and how can you exercise your Rights?

If you are a Registered Holder, the period to exercise the

Rights expires at 5:00 p.m. (Toronto time) (the “

Expiry Time

”) on March

12, 2019 (the “

Expiry Date

”).

If you are a Beneficial Holder, you may subscribe for Rights

Shares by instructing the CDS Participant holding the your Rights to exercise

all or a specified number of such Rights and forwarding the Subscription Price

for each Rights Share subscribed for to such CDS Participant in accordance with

the terms of the Offering. If you wish to exercise the Additional Subscription

Privilege, if available, you must exercise the Basic Subscription Privilege in

respect of all of the Rights issued to you and forward your request to the CDS

Participant that holds the your Rights prior to the Expiry Time, along with

payment for the number of Additional Rights requested. Any excess funds will be

returned by mail or credited to your account with your CDS Participant

without interest or deduction. Subscriptions for Rights Shares made through a

CDS Participant will be irrevocable and you will be unable to withdraw your subscriptions for Rights Shares once submitted.

CDS Participants may have an earlier deadline for receipt of instructions and

payment than the Expiry Time on the Expiry Date.

- 3 -

Only Registered Holders will be provided with Rights

Certificates. For all Beneficial Holder the

total number of Rights to which all such Beneficial Holders as at the Record

Date are entitled will be issued to and deposited with CDS following the

Record Date.

The Corporation expects that each Beneficial Holder will receive a confirmation

of the number of Rights issued to it from its CDS Participant in accordance with

the practices and procedures of that CDS Participant. CDS will be responsible

for establishing and maintaining book-entry accounts for CDS Participants

holding Rights.

Beneficial Holders must arrange for exercises, purchases or

transfers of Rights through their CDS Participant and should contact the CDS

Participant to instruct them accordingly. It is anticipated by the Corporation

that each purchaser of Rights Shares will receive a customer confirmation of

issuance or purchase, as applicable, from the CDS Participant through which such

Rights Shares are issued or purchased in accordance with the practices and

policies of such CDS Participant.

What are the next steps?

This document contains key information you should know about

CGX. You can find more details in CGX’s Rights Offering Circular. To obtain a

copy, visit CGX’s profile on the SEDAR website

(

www.sedar.com

), visit CGX’s website

(

www.cgxenergy.ca

), ask your dealer representative for a

copy or contact Tralisa Maraj of the Corporation at (416)364-5569. You should

read the Rights Offering Circular, along with CGX’s continuous disclosure

record, to make an informed decision.

CGX Energy Inc.

Per:

“

Tralisa Maraj

”

Tralisa Maraj

Chief Financial Officer

February 1, 2019

PART II—INFORMATION NOT REQUIRED TO BE SENT TO SHAREHOLDERS

EXHIBIT INDEX

|

Exhibit

|

Description

|

|

|

|

|

99.1

|

Consolidated

Financial Statements for the years ended December 31, 2017 and 2016

|

|

|

|

|

99.2

|

Management

Discussion and Analysis for the year ended December 31, 2017

|

|

|

|

|

99.3

|

Notice