Current Report Filing (8-k)

January 22 2019 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 21, 2019

Date of Report (Date of Earliest Event Reported)

ITRON, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File No.)

|

(IRS Employer

Identification No.)

|

|

2111 N. Molter Road, Liberty Lake, WA 99019

|

|

(Address of Principal Executive Offices, Zip Code)

|

|

|

|

(509) 924-9900

|

|

(Registrant's Telephone Number, Including Area Code)

|

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the

Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On January 22, 2019, Itron, Inc., a Washington corporation (the “

Company

”), announced that Philip C. Mezey has informed the Company of his intention to retire as the Company’s President and Chief Executive Officer and a member of the Company’s board of

directors (the “

Board

”). In order to ensure an orderly transition, the Company and Mr. Mezey have entered into a Transition and Retirement Agreement, dated as of

January 21, 2019 (the “

Transition Agreement

”), pursuant to which the Company and Mr. Mezey have mutually agreed that Mr. Mezey will continue to serve as the Company’s

President and Chief Executive Officer and a member of the Board until August 31, 2019, unless a new Chief Executive Officer is appointed earlier (the “

Transition Period

”).

Mr. Mezey’s separation is not due to any disagreement related to the Company’s operations, policies or practices, financial status or financial statements.

The Board has commenced a search process to identify the Company’s next Chief Executive

Officer, and will evaluate both internal and external candidates. The process is being led by a newly formed CEO Search Committee of the Board, composed of independent directors, with the assistance of a nationally recognized executive search firm.

The Transition Agreement provides that Mr. Mezey will continue to receive the same base salary

and benefits that he received immediately before entering into the Transition Agreement and will continue to vest in his outstanding equity awards in accordance with their existing terms. In addition, the Transition Agreement provides that if Mr.

Mezey remains in employment through the expiration of the Transition Period, executes a release of claims in favor of the Company and continues to comply with certain restrictive covenants, then he will be eligible to receive a pro-rated annual cash

bonus for the year of termination, will continue to vest in his outstanding equity awards and will be eligible to exercise his vested stock options for up to three years following his termination.

The Transition Agreement further provides that during the period beginning upon the expiration

of the Transition Period and ending on December 31, 2019 (the “

Consulting Period

”), Mr, Mezey will serve as a non-employee consultant to the Company with the title of

Senior Advisor for a monthly consulting fee of $130,000. During the Consulting Period, Mr. Mezey will transition all duties and responsibilities to the new Chief Executive Officer, provide such assistance as may be requested by the new Chief

Executive Officer, and perform any other duties or responsibilities as reasonably requested by the Board.

The foregoing summary of the Transition Agreement does not purport to be complete and is

qualified in its entirety by reference to the Transition Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On January 22, 2019, the Company issued a press release announcing the foregoing leadership

succession process, a copy of which is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

ITRON, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: January 22, 2019

|

By:

|

/s/ Sarah Hlavinka

|

|

|

|

Sarah Hlavinka

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

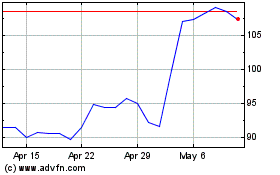

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

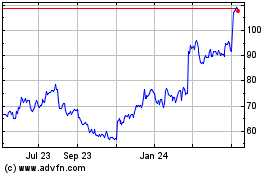

Itron (NASDAQ:ITRI)

Historical Stock Chart

From Apr 2023 to Apr 2024