Current Report Filing (8-k)

January 15 2019 - 1:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

December 28, 2018

Date of Report (Date of earliest event reported)

Canbiola, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Florida

|

|

333-208293

|

|

20-3624118

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.

|

|

|

|

|

960 South Broadway, Suite 120

Hicksville, NY

|

|

11801

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

516-205-4751

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

¨

|

Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company X

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

1

Item 1.01 Entry into a Material Definitive Agreement

Membership Purchase Agreement

On December 28, 2018, Canbiola, Inc. (the “Company”) entered into a Membership Purchase Agreement (the “Purchase Agreement”) with Pure Health Partners, LLC (“PHP”). Pursuant to the Purchase Agreement, the Company purchased all of the shares of PHP in exchange for cancellation of a promissory note owed by PHP to the Company in the amount of $83,825 (the “Note”) and the issuance of 3,096,827 shares of the Company’s common stock (the “Purchase Shares”) to the members of PHP (the “PHP Members”). Furthermore, pursuant to the Purchase Agreement, the Company agreed to appoint Pasquale Ferro (“Ferro”) as President of PHP. As a result of the aforementioned transactions, PHP became a wholly-owned subsidiary of the Company. The Purchase Agreement otherwise contains standard terms and conditions.

Employment Agreement

On December 28, 2018, the Company entered into an Employment Agreement (the “Employment Agreement”) with Ferro and PHP, pursuant to which Ferro agreed to serve as President of PHP for an initial term of four (4) years. The term of the Employment Agreement will automatically be renewed for consecutive three (3) year terms unless otherwise terminated by the parties. Ferro will earn a base salary of $15,000 per month (the “Base Salary”), with annual increases by the greater of three percent (3%) or the prior year-end annual percentage increase in EBITDA as reported in the Company’s 10-K filing. Ferro will also be entitled to (i) receive annual incentive bonuses in cash and/or stock, (ii) participate in any welfare, health and life insurance and pension benefit and incentive programs as may be adopted from time to time by PHP, and (iii) receive four (4) weeks paid vacation time each year and five (5) paid days for illness each year. Ferro’s above-mentioned compensation and benefits are guaranteed by the Company. Furthermore, pursuant to the Employment Agreement, the Company agreed to issue five (5) of the Company’s Series A Preferred Stock upon execution of this Agreement, which shall be considered fully earned upon issuance, which shall be one and one-quarter Series A Preferred share at December 31, 2018, 2019, 2020, and 2021 and may be convertible at one-quarter (1/4) of a Series A Preferred share or twelve million five hundred thousand (12,500,000) shares of common stock each year-end commencing December 31, 2018, for the initial four (4) years of the Employment Agreement. PHP also agreed to indemnify Ferro to the extent permitted by its governing documents except for acts constituting negligence or willful misconduct and the Company guaranteed PHP’s indemnification.

If the Employment Agreement is terminated by PHP without cause, Ferro will be entitled to continue to receive his Base Salary through the longer of the end of the Employment Agreement’s term over the course of the then remaining Term plus 12 months, plus an amount equal to the premiums charged by PHP to maintain COBRA benefits continuation coverage for Ferro and his eligible dependents, to the extent such coverage is then in place. Furthermore, PHP will pay any accrued obligations to Ferro as lump sum within 30 days of his termination without cause. The Company has guaranteed PHP’s foregoing obligations. The Employment Agreement otherwise contains standard terms and conditions.

The foregoing discussion is for summary purposes only and is qualified in its entirety by the actual terms of the Purchase Agreement and Employment Agreement, both of which are included herewith as Exhibits.

2

Item 2.01 Completion of Acquisition or Disposition of Assets.

See Item 1.01 for discussion of the Company’s acquisition of all the assets of PHP via acquisition of 100% of its membership interests, which closed December 28, 2018.

Item 3.02 Unregistered Sales of Equity Securities.

See Item 1.01 for discussion of issuance of the Purchase Shares to the PHP Members under the Purchase Agreement and the issuance of five (5) Series A Preferred Shares to Ferro under the Employment Agreement, all of which were issued pursuant to Section 4(a)(2) of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed herewith.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Canbiola, Inc.

|

|

|

|

|

|

|

|

Date: January 15, 2019

|

By:

|

/s/ Marco Alfonsi

________

Marco Alfonsi, CEO

|

|

|

|

|

|

4

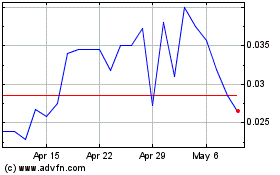

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Mar 2024 to Apr 2024

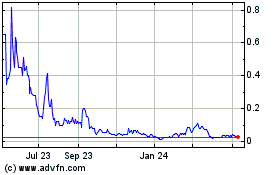

CAN B (QB) (USOTC:CANB)

Historical Stock Chart

From Apr 2023 to Apr 2024