Bridgeline Digital, Inc. (NASDAQ: BLIN), The Digital Engagement

Company™, today announced financial results for its fiscal fourth

quarter and fiscal year ended September 30, 2018.

“Bridgeline has partnered with key

customers to expand its product line to access global markets and

position itself as a leader in the multinational B2B eCommerce

space,” said Ari Kahn, Bridgeline’s President and Chief Executive

Officer. “These investments, along with significant wins in

the manufacturing category, position us for growth 2019.

Furthermore, in the most recent quarter, Bridgeline initiated

strategic conversations that may lead to multi-national growth

in our customer base where our eCommerce investments can be

cross-sold for accelerated growth. Additional strategic

opportunities will be a key focus in 2019.”

Fourth Quarter Summary:

- SaaS revenue was $1.1 million in the fourth quarter of fiscal

2018, compared to $1.4 million in the fourth quarter of fiscal

2017.

- Hosting revenue was $206,000 in the fourth quarter of fiscal

2018, compared to $263,000 in the fourth quarter of fiscal

2017.

- Recurring revenue was $1.4 million in the fourth quarter of

fiscal 2018, compared to $1.8 million in the fourth quarter of

fiscal 2017.

- Subscription and perpetual license revenue was $1.2 million in

the fourth quarter of fiscal 2018, compared to $1.8 million in the

fourth quarter of fiscal 2017.

- Operating expenses (excluding a goodwill impairment charge of

$243,000) were reduced by $534,000, or 20.8% to $2.0 million in the

fourth quarter of fiscal 2018, from $2.6 million in the fourth

quarter of fiscal 2017.

Year to Date Summary:

- SaaS revenue was $5.1 million in fiscal 2018, compared to $5.5

million in fiscal 2017.

- Hosting revenue remained constant at $1.0 million in both

fiscal 2018 and fiscal 2017.

- Recurring revenue was $6.6 million in fiscal 2018, compared to

$7.1 million in fiscal 2017.

- Subscription and perpetual license revenue was $5.6 million in

fiscal 2018, compared to $6.8 million in fiscal 2017.

- Operating expenses (excluding a goodwill impairment charge of

$4.9 million) were reduced by $1.6 million, or 14.9% to $9.0

million in fiscal 2018, from $10.5 million in fiscal 2017.

Financial Results

Fourth Quarter

Revenue for the fourth quarter of fiscal 2018

was $2.8 million, compared to $4.2 million in the fourth quarter of

fiscal 2017. Services revenue was $1.4 million in the fourth

quarter of fiscal 2018, compared to $2.2 million in the fourth

quarter of fiscal 2017. SaaS revenue was $1.1 million in the fourth

quarter of fiscal 2018, compared to $1.4 million in the fourth

quarter of fiscal 2017. Hosting revenue was $206,000 in the fourth

quarter of fiscal 2018, compared to $263,000 in the fourth quarter

of fiscal 2017. Recurring revenue was $1.4 million in the fourth

quarter of fiscal 2018, compared to $1.8 million in the fourth

quarter of fiscal 2017. Subscription and perpetual license revenue

was $1.2 million in the fourth quarter of fiscal 2018, compared to

$1.8 million in the fourth quarter of fiscal 2017.

Operating expenses (excluding goodwill

impairment charge of $243,000) were reduced by $534,000, or 20.8%

to $2.0 million in the fourth quarter of fiscal 2018, compared to

$2.6 million in the fourth quarter of fiscal 2017, reflecting

management’s ongoing expense control initiatives. Loss from

Operations was $842,000 in the fourth quarter of fiscal 2018,

compared to $250,000 in the fourth quarter of fiscal 2017. The

operating loss of $842,000 in the fourth quarter of fiscal 2018 is

inclusive of a goodwill impairment charge of $243,000.

Net loss, including a goodwill impairment charge

of $243,000, was $947,000 in the fourth quarter of fiscal 2018,

compared to a net loss of $332,000 in the fourth quarter of fiscal

2017.

Adjusted EBITDA was a loss of $414,000 in the

fourth quarter of fiscal 2018, compared to income of $41,000 in the

fourth quarter of fiscal 2017.

Year to Date

Revenue in fiscal 2018 was $13.6 million,

compared to $16.3 million in fiscal 2017. SaaS revenue was $5.1

million in fiscal 2018, compared to $5.5 million in fiscal 2017.

Hosting revenue remained constant at $1.0 million in both fiscal

2018 and fiscal 2017. Recurring revenue was $6.6 million in fiscal

2018, compared to $7.1 million in fiscal 2017. Subscription and

perpetual license revenue was $5.6 million in fiscal 2018, compared

to $6.8 million in fiscal 2017.

Operating expenses (excluding a goodwill

impairment charge of $4.9 million) were reduced by $1.6 million, or

14.9% to $9.0 million in fiscal 2018, compared to $10.5 million in

fiscal 2017, reflecting management’s ongoing expense control

initiatives. Loss from Operations was $7.0 million in fiscal 2018,

compared to $1.4 million in fiscal 2017. The operating loss

of $7.0 million in fiscal 2018 is inclusive of a goodwill

impairment charge of $4.9 million.

Net loss, including a goodwill impairment charge

of $4.9 million, was $7.2 million in fiscal 2018, compared to a net

loss of $1.6 million in fiscal 2017.

Adjusted EBITDA was a loss of $1.0 million in

fiscal 2018, compared to income of $122,000 in fiscal 2017.

Conference Call Information

Bridgeline Digital will host a conference call

to discuss fourth quarter and fiscal year ended 2018 results at

4:30 p.m. ET today. To listen to the conference call, please dial

(877) 837-3910 within the U.S. or (973) 796-5077 for international

callers.

Non-GAAP Financial Measures

This press release contains the following

non-GAAP financial measures: non-GAAP adjusted net income/(loss),

non-GAAP adjusted earnings/(loss) per diluted share, Adjusted

EBITDA and Adjusted EBITDA per diluted share.

Non-GAAP adjusted net income/(loss) and non-GAAP

adjusted earnings/(loss) per diluted share are calculated as net

income/(loss) or net income/(loss) per share on a diluted basis,

excluding, where applicable, amortization of intangible assets,

stock-based compensation, goodwill impairment charges,

restructuring charges, preferred stock dividends and any related

tax effects.

Adjusted EBITDA and Adjusted EBITDA per diluted

share are defined as earnings before interest, taxes, depreciation

and amortization, stock-based compensation charges, goodwill

impairment charges, restructuring charges, loss on disposal of

fixed assets, preferred stock dividends and any related tax

effects. Bridgeline uses non-GAAP adjusted net income/(loss) and

Adjusted EBITDA as supplemental measures of our performance that

are not required by, or presented in accordance with, accounting

principles generally accepted in the United States (“GAAP”).

Bridgeline’s management does not consider these

non-GAAP measures in isolation or as an alternative to financial

measures determined in accordance with GAAP. The principal

limitation of these non-GAAP financial measures is that they

exclude significant expenses and income that are required by GAAP

to be recorded in the Company's financial statements. In addition,

they are subject to inherent limitations as they reflect the

exercise of judgments by management about which expenses and income

are excluded or included in determining these non-GAAP financial

measures. In order to compensate for these limitations, Bridgeline

management presents non-GAAP financial measures in connection with

GAAP results. Bridgeline urges investors to review the

reconciliation of its non-GAAP financial measures to the comparable

GAAP financial measures, which is included in this press release,

and not to rely on any single financial measure to evaluate

Bridgeline's financial performance.

Our definitions of non-GAAP adjusted net

income/(loss) and Adjusted EBITDA may differ from and therefore may

not be comparable with similarly titled measures used by other

companies, thereby limiting their usefulness as comparative

measures. As a result of the limitations that non-GAAP adjusted net

income and Adjusted EBITDA have as an analytical tool, investors

should not consider them in isolation, or as a substitute for

analysis of our operating results as reported under GAAP.

Safe Harbor Statement under the Private Securities

Litigation Reform Act of 1995

All statements included in this press release,

other than statements or characterizations of historical fact, are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates and projections about

our industry, management's beliefs, and certain assumptions made by

us, all of which are subject to change. Forward-looking

statements can often be identified by words such as "anticipates,"

"expects," "intends," "plans," "predicts," "believes," "seeks,"

"estimates," "may," "will," "should," "would," "could,"

"potential," "continue," "ongoing," or similar expressions, and

variations or negatives of these words. These forward-looking

statements are not guarantees of future results and are subject to

risks, uncertainties and assumptions, including, but not limited

to, the impact of the weakness in the U.S. and international

economies on our business, our inability to manage our future

growth effectively or profitably, fluctuations in our revenue and

quarterly results, our license renewal rate, the impact of

competition and our ability to maintain margins or market share,

the limited market for our common stock, the volatility of the

market price of our common stock, the ability to maintain our

listing on the NASDAQ Capital market, the ability to raise capital,

the performance of our products, our ability to respond to rapidly

evolving technology and customer requirements, our ability to

protect our proprietary technology, the security of our software,

our dependence on our management team and key personnel, our

ability to hire and retain future key personnel, or our ability to

maintain an effective system of internal controls as well as other

risks described in our filings with the Securities and Exchange

Commission. Any of such risks could cause our actual results to

differ materially and adversely from those expressed in any

forward-looking statement. We expressly disclaim any obligation to

update any forward-looking statement.

About Bridgeline Digital

Bridgeline Digital, The Digital Engagement

Company™, helps customers maximize the performance of their full

digital experience from websites and intranets to eCommerce

experiences. Bridgeline’s Unbound platform is a Digital Experience

Platform that deeply integrates Web Content Management, eCommerce,

eMarketing, Social Media management, and Web Analytics (Insights)

with the goal of assisting marketers to deliver exceptional digital

experiences that attract, engage, nurture and convert their

customers across all channels. Headquartered in Burlington, Mass.,

Bridgeline has thousands of quality customers that range from

small- and medium-sized organizations to Fortune 1000 companies. To

learn more, please visit www.bridgeline.com or call (800)

603-9936.

Contact:Company ContactBridgeline Digital,

Inc.Carole A. TynerChief Financial Officer(781)

497-3020ctyner@bridgeline.com

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| BRIDGELINE DIGITAL, INC. |

| RECONCILIATION OF GAAP TO NON-GAAP

RESULTS |

| (Dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

September 30 |

|

September 30 |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Reconciliation

of GAAP net loss to |

|

|

|

|

|

|

|

|

| non-GAAP

adjusted net loss: |

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

$ |

(1,026 |

) |

|

$ |

(406 |

) |

|

$ |

(7,529 |

) |

|

$ |

(1,883 |

) |

|

Amortization of intangible assets |

|

|

30 |

|

|

|

71 |

|

|

|

242 |

|

|

|

285 |

|

| Goodwill

impairment charge |

|

|

243 |

|

|

|

- |

|

|

|

4,859 |

|

|

|

- |

|

|

Stock-based compensation |

|

|

120 |

|

|

|

126 |

|

|

|

492 |

|

|

|

559 |

|

|

Restructuring charges |

|

|

1 |

|

|

|

37 |

|

|

|

127 |

|

|

|

286 |

|

| Preferred

stock dividends |

|

|

79 |

|

|

|

74 |

|

|

|

310 |

|

|

|

281 |

|

| Non-GAAP

adjusted net loss |

|

$ |

(553 |

) |

|

$ |

(98 |

) |

|

$ |

(1,499 |

) |

|

$ |

(472 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Reconciliation

of GAAP net loss per diluted share to |

|

|

|

|

|

|

|

|

| non-GAAP

adjusted net loss per diluted share: |

|

|

|

|

|

|

|

|

| GAAP net

loss per share |

|

$ |

(0.24 |

) |

|

$ |

(0.10 |

) |

|

$ |

(1.78 |

) |

|

$ |

(0.45 |

) |

|

Amortization of intangible assets |

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.06 |

|

|

|

0.07 |

|

| Goodwill

impairment charge |

|

|

0.05 |

|

|

|

- |

|

|

|

1.15 |

|

|

|

- |

|

|

Stock-based compensation |

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.12 |

|

|

|

0.13 |

|

|

Restructuring charges |

|

|

- |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.07 |

|

| Preferred

stock dividends |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.07 |

|

|

|

0.07 |

|

| Non-GAAP

adjusted net loss per diluted share |

|

$ |

(0.13 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

| Reconciliation

of GAAP net loss to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

| GAAP net

loss |

|

$ |

(1,026 |

) |

|

$ |

(406 |

) |

|

$ |

(7,529 |

) |

|

$ |

(1,883 |

) |

| Provision

for income tax |

|

|

(14 |

) |

|

|

3 |

|

|

|

(3 |

) |

|

|

16 |

|

| Interest

expense, net |

|

|

119 |

|

|

|

34 |

|

|

|

244 |

|

|

|

128 |

|

|

Amortization of intangible assets |

|

|

30 |

|

|

|

71 |

|

|

|

242 |

|

|

|

285 |

|

| Goodwill

impairment charge |

|

|

243 |

|

|

|

- |

|

|

|

4,859 |

|

|

|

- |

|

|

Depreciation |

|

|

20 |

|

|

|

41 |

|

|

|

105 |

|

|

|

256 |

|

| Loss on

disposal of fixed assets |

|

|

- |

|

|

|

45 |

|

|

|

60 |

|

|

|

94 |

|

|

Restructuring charges |

|

|

1 |

|

|

|

37 |

|

|

|

127 |

|

|

|

286 |

|

| Other

amortization |

|

|

14 |

|

|

|

16 |

|

|

|

66 |

|

|

|

100 |

|

|

Stock-based compensation |

|

|

120 |

|

|

|

126 |

|

|

|

492 |

|

|

|

559 |

|

| Preferred

stock dividends |

|

|

79 |

|

|

|

74 |

|

|

|

310 |

|

|

|

281 |

|

| Adjusted

EBITDA |

|

$ |

(414 |

) |

|

$ |

41 |

|

|

$ |

(1,027 |

) |

|

$ |

122 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Reconciliation

of GAAP net loss per diluted share

to |

|

|

|

|

|

|

|

|

| Adjusted EBITDA

per diluted share: |

|

|

|

|

|

|

|

|

| GAAP net

loss per share |

|

$ |

(0.24 |

) |

|

$ |

(0.10 |

) |

|

$ |

(1.78 |

) |

|

$ |

(0.45 |

) |

| Provision

for income tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Interest

expense, net |

|

|

0.03 |

|

|

|

0.01 |

|

|

|

0.06 |

|

|

|

0.03 |

|

|

Amortization of intangible assets |

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.06 |

|

|

|

0.07 |

|

| Goodwill

impairment charge |

|

|

0.05 |

|

|

|

- |

|

|

|

1.15 |

|

|

|

- |

|

|

Depreciation |

|

|

- |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.06 |

|

| Loss on

disposal of fixed assets |

|

|

- |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

Restructuring charges |

|

|

- |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.07 |

|

| Other

amortization |

|

|

- |

|

|

|

- |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

Stock-based compensation |

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.12 |

|

|

|

0.13 |

|

| Preferred

stock dividends |

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.07 |

|

|

|

0.07 |

|

| Adjusted

EBITDA per diluted share |

|

$ |

(0.10 |

) |

|

$ |

0.01 |

|

|

$ |

(0.24 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| BRIDGELINE DIGITAL, INC. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Dollars in thousands, except share and per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

September 30 |

|

September 30 |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenue: |

|

|

|

|

|

|

|

|

| Digital

engagement services |

|

$ |

1,355 |

|

|

$ |

2,201 |

|

|

$ |

6,914 |

|

|

$ |

8,498 |

|

|

Subscription and perpetual licenses |

|

|

1,242 |

|

|

|

1,770 |

|

|

|

5,609 |

|

|

|

6,788 |

|

| Managed

service hosting |

|

|

206 |

|

|

|

263 |

|

|

|

1,045 |

|

|

|

1,007 |

|

| Total

revenue |

|

|

2,803 |

|

|

|

4,234 |

|

|

|

13,568 |

|

|

|

16,293 |

|

| |

|

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

| Digital

engagement services |

|

|

807 |

|

|

|

1,342 |

|

|

|

4,473 |

|

|

|

4,911 |

|

|

Subscription and perpetual licenses |

|

|

508 |

|

|

|

501 |

|

|

|

2,011 |

|

|

|

1,969 |

|

| Managed

service hosting |

|

|

51 |

|

|

|

71 |

|

|

|

264 |

|

|

|

280 |

|

| Total

cost of revenue |

|

|

1,366 |

|

|

|

1,914 |

|

|

|

6,748 |

|

|

|

7,160 |

|

| Gross

profit |

|

|

1,437 |

|

|

|

2,320 |

|

|

|

6,820 |

|

|

|

9,133 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Sales and

marketing |

|

|

906 |

|

|

|

1,147 |

|

|

|

3,951 |

|

|

|

4,807 |

|

| General

and administrative |

|

|

696 |

|

|

|

861 |

|

|

|

2,852 |

|

|

|

3,256 |

|

| Research

and development |

|

|

383 |

|

|

|

412 |

|

|

|

1,604 |

|

|

|

1,587 |

|

|

Depreciation and amortization |

|

|

51 |

|

|

|

113 |

|

|

|

356 |

|

|

|

582 |

|

| Goodwill

impairment |

|

|

243 |

|

|

|

- |

|

|

|

4,859 |

|

|

|

- |

|

|

Restructuring charges |

|

|

- |

|

|

|

37 |

|

|

|

187 |

|

|

|

286 |

|

| Total

operating expenses |

|

|

2,279 |

|

|

|

2,570 |

|

|

|

13,809 |

|

|

|

10,518 |

|

| Loss from

operations |

|

|

(842 |

) |

|

|

(250 |

) |

|

|

(6,989 |

) |

|

|

(1,385 |

) |

| Interest

and other expense, net |

|

|

(119 |

) |

|

|

(79 |

) |

|

|

(233 |

) |

|

|

(201 |

) |

| Loss before income

taxes |

|

|

(961 |

) |

|

|

(329 |

) |

|

|

(7,222 |

) |

|

|

(1,586 |

) |

|

(Benefit)/provision for income taxes |

|

|

(14 |

) |

|

|

3 |

|

|

|

(3 |

) |

|

|

16 |

|

| Net loss |

|

$ |

(947 |

) |

|

$ |

(332 |

) |

|

$ |

(7,219 |

) |

|

$ |

(1,602 |

) |

| Dividends on

convertible preferred stock |

|

|

(79 |

) |

|

|

(74 |

) |

|

|

(310 |

) |

|

|

(281 |

) |

| Net loss applicable to

common shareholders |

|

$ |

(1,026 |

) |

|

$ |

(406 |

) |

|

$ |

(7,529 |

) |

|

$ |

(1,883 |

) |

| Net loss per share

attributable to common shareholders: |

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.10 |

) |

|

$ |

(1.78 |

) |

|

$ |

(0.45 |

) |

| Number of weighted

average shares outstanding: |

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

|

4,241,225 |

|

|

|

4,200,119 |

|

|

|

4,227,442 |

|

|

|

4,147,140 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| BRIDGELINE DIGITAL, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (Dollars in thousands, except share and per share

data) |

| (Unaudited) |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

| |

|

September 30 |

|

September 30 |

| |

|

2018 |

|

2017 |

| Current Assets: |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

644 |

|

|

$ |

748 |

|

| Accounts

receivable and unbilled revenues, net |

|

|

1,721 |

|

|

|

3,026 |

|

| Prepaid

expenses and other current assets |

|

|

473 |

|

|

|

352 |

|

| Total

current assets |

|

|

2,838 |

|

|

|

4,126 |

|

| Property and equipment,

net |

|

|

80 |

|

|

|

209 |

|

| Intangible assets,

net |

|

|

20 |

|

|

|

263 |

|

| Goodwill |

|

|

7,782 |

|

|

|

12,641 |

|

| Other assets |

|

|

280 |

|

|

|

334 |

|

| Total

assets |

|

$ |

11,000 |

|

|

$ |

17,573 |

|

| |

|

|

|

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

| |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

1,577 |

|

|

$ |

1,241 |

|

| Accrued

liabilities |

|

|

580 |

|

|

|

920 |

|

| Debt,

current portion |

|

|

1,017 |

|

|

|

- |

|

| Deferred

revenue |

|

|

594 |

|

|

|

1,466 |

|

| Total

current liabilities |

|

|

3,768 |

|

|

|

3,627 |

|

| Debt, net of current

portion |

|

|

2,574 |

|

|

|

2,500 |

|

| Other long term

liabilities |

|

|

234 |

|

|

|

172 |

|

| Total

liabilities |

|

|

6,576 |

|

|

|

6,299 |

|

| |

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

| |

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

| Preferred

stock - $0.001 par value; 1,000,000 shares authorized, 264,000

designated as Series A Preferred stock; |

|

|

- |

|

|

|

- |

|

| 264,000

and 262,364 at September 30, 2018 and 243,536 and 241,900 at

September 30, 2017 issued and outstanding (liquidation preference

$2,624 at September 30, 2018) |

|

|

|

|

| Common

stock - $0.001 par value; 50,000,000 shares authorized; |

|

|

5 |

|

|

|

4 |

|

| 4,241,225

at September 30, 2018 and 4,200,119 at September 30, 2017, issued

and outstanding |

|

|

|

|

|

Additional paid-in-capital |

|

|

66,548 |

|

|

|

65,869 |

|

|

Accumulated deficit |

|

|

(61,778 |

) |

|

|

(54,249 |

) |

|

Accumulated other comprehensive loss |

|

|

(351 |

) |

|

|

(350 |

) |

| Total

stockholders' equity |

|

|

4,424 |

|

|

|

11,274 |

|

| Total

liabilities and stockholders' equity |

|

$ |

11,000 |

|

|

$ |

17,573 |

|

| |

|

|

|

|

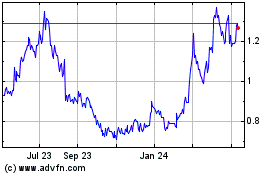

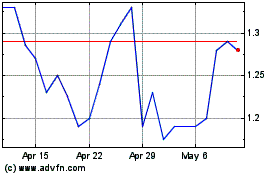

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Apr 2023 to Apr 2024