Goldman Sachs BDC, Inc. (“GS BDC” or the “Company”) (NYSE:GSBD)

today announced its financial results for the third quarter ended

September 30, 2018 and filed its Form 10-Q with the U.S. Securities

and Exchange Commission.

QUARTERLY HIGHLIGHTS

- Net investment income for the quarter

ended September 30, 2018 was $0.54 per share, equating to an

annualized net investment income yield on book value of 11.9%;

- The Company announced a fourth quarter

dividend of $0.45 per share payable to shareholders of record as of

December 31, 2018;1

- Net asset value per share for the

quarter ended September 30, 2018 was $18.13, an increase from

$18.08 as of June 30, 2018;

- The Company amended its senior secured

revolving credit facility to, among other things, reduce the

Company’s minimum asset coverage ratio financial covenant to 150%,

as further described below. As a result of this amendment, the

Company has obtained all of the necessary approvals and is

positioned to benefit from the reduced asset coverage requirement

following the passage of the Small Business Credit Availability

Act;

- Gross and net originations during the

quarter were $205.6 million and $93.9 million, respectively. As a

result, the Company’s investment portfolio increased by 7%

quarter-over-quarter. Investments in first lien debt constituted

89% of gross originations during the quarter;2 and

- During the quarter, the Company closed

a $40.0 million upsize of its aggregate principal amount of 4.50%

unsecured convertible notes due April 2022.

SELECTED FINANCIAL HIGHLIGHTS

(in $ millions,

except per share data) As of

September 30, 2018

As of

June 30, 2018

Investment portfolio, at fair value2 $1,318.3 $1,237.3 Total

debt outstanding3 578.9 508.0 Net assets 728.6 726.5 Net asset

value per share $18.13 $18.08 Three Months Ended

September 30, 2018

Three Months Ended

June 30, 2018

Total investment income $38.0 $37.2 Net investment income

after taxes 21.6 20.2 Net increase in net assets resulting from

operations 19.0 17.5 Net investment income per share (basic

and diluted) 0.54 0.50 Earnings per share (basic and diluted) 0.47

0.43 Regular distribution per share 0.45

0.45

INVESTMENT ACTIVITY2

During the three months ended September 30, 2018, new investment

commitments and fundings were $205.6 million and $190.1 million,

respectively. The new investment commitments were across seven new

portfolio companies and eight existing portfolio companies. New

investment commitments were comprised of 99.7% secured debt

investments, including 88.7% first lien debt and 11.0% second lien

debt, and 0.3% in unsecured debt. The Company had sales and

repayments of $111.7 million primarily driven by the full repayment

of investments in two portfolio companies.

Summary of Investment Activity for the Three Months Ended

September 30, 2018:

New Investment Commitments Sales and

Repayments Investment Type $

Millions % of Total $

Millions % of Total 1st Lien/Senior

Secured Debt $182.3 88.7%

$7.9 7.1% 1st Lien/Last-Out Unitranche - -% 57.3

51.3% 2nd Lien/Senior Secured Debt 22.7 11.0% 46.5 41.6% Unsecured

Debt 0.6 0.3% - -% Preferred Stock - -% - -% Common Stock - -% - -%

Investment Funds & Vehicles (SCF) -

-% - -%

Total

$205.6 100.0%

$111.7 100.0%

During the three months ended September 30, 2018, the SCF made

new investment commitments and fundings of $63.7 million and $58.8

million, respectively. The new investment commitments were across

three new portfolio companies and three existing portfolio

companies. The SCF had sales and repayments of $62.7 million,

resulting in net funded portfolio change of $(3.9) million during

the quarter. As of September 30, 2018, the SCF’s investment

portfolio at fair value was $488.0 million. The weighted average

yield on the SCF’s total investment portfolio at amortized cost was

7.5% versus 7.6% from the prior quarter.4 The SCF represents the

Company’s largest investment at both cost and fair value.

PORTFOLIO SUMMARY2

As of September 30, 2018, the Company’s investment portfolio had

an aggregate fair value of $1,318.3 million, comprised of

investments in 66 portfolio companies operating across 32 different

industries. The investment portfolio on a fair value basis was

comprised of 89.6% secured debt investments (56.3% in first lien

debt (including 10.0% in first lien/last-out unitranche debt) and

33.3% in second lien debt), 0.5% in unsecured debt, 1.3% in

preferred stock, 1.6% in common stock, and 7.0% in the SCF.

Summary of Investment Portfolio as of September 30, 2018:

Investments at Fair Value

Investment Type $ Millions

% of Total 1st Lien/Senior Secured Debt

$609.8 46.3% 1st Lien/Last-Out Unitranche 132.1 10.0%

2nd Lien/Senior Secured Debt 438.4 33.3% Unsecured Debt 6.4 0.5%

Preferred Stock 17.6 1.3% Common Stock 21.4 1.6% Senior Credit Fund

(contains 96.9% 1st Lien Debt; 3.1% 2nd Lien Debt)

92.6 7.0%

Total $1,318.3

100.0%

As of September 30, 2018, the weighted average yield of the

Company’s total investment portfolio at amortized cost and fair

value was 10.8% and 11.7%, respectively, as compared to 10.9% and

11.7% respectively, as of June 30, 2018. The weighted average yield

of the Company’s total debt and income producing investments at

amortized cost and fair value was 11.3% and 12.1%, respectively,

versus 11.5% and 12.1%, respectively, as of June 30, 2018.4

On a fair value basis, as of September 30, 2018, 96.4% of the

Company’s debt investments bore interest at a floating rate.5

As of September 30, 2018, the weighted average net debt/EBITDA

of the companies in the Company’s investment portfolio was 5.3x

versus 5.2x as of June 30, 2018. The weighted average interest

coverage of companies comprising interest-bearing investments in

the investment portfolio was 2.2x which was unchanged versus the

prior quarter. The median EBITDA of the portfolio companies was

$36.5 versus $36.7 million as of June 30, 2018.6

As of September 30, 2018, investments on non-accrual status

represented 0.6% and 0.7% of the total investment portfolio at fair

value and amortized cost, respectively.

The Company’s investment in the SCF produced a return of 11.2%

and 11.4%, at amortized cost and fair value, respectively, over the

trailing four quarters ended September 30, 2018.7 The SCF’s

investment portfolio had an aggregate fair value of $488.0 million,

comprised of investments in 35 portfolio companies operating across

20 different industries. The SCF’s investment portfolio on a fair

value basis was comprised of 100.0% secured debt investments (96.9%

in first lien debt and 3.1% in second lien debt). All of the

investments in the SCF were debt investments bearing a floating

interest rate.

As of September 30, 2018, the weighted average net debt/EBITDA

and interest coverage of the companies in the SCF investment

portfolio were 4.8x and 2.5x, respectively. The median EBITDA of

the SCF’s portfolio companies was $50.6 million. 8 As of September

30, 2018, the SCF had one investment on non-accrual status.

RESULTS OF OPERATIONS

Total investment income for the three months ended September 30,

2018 and June 30, 2018 was $38.0 million and $37.2 million,

respectively. The increase in investment income over the

quarter was primarily driven by higher dividend income distributed

by the SCF. The $38.0 million of total investment income was

comprised of $35.6 million from interest income, original issue

discount accretion, payment-in-kind income and dividend income,

$0.5 million from other income and $1.9 million from prepayment

related income.9

Total expenses for the three months ended September 30, 2018 and

June 30, 2018 were $16.0 million and $16.8 million,

respectively. The $0.8 million decrease in expenses was

primarily driven by a decrease in investment advisory fees and

other operating expenses which was partially offset by an increase

in interest and other debt expenses. The $16.0 million of total

expenses were comprised of $6.4 million of interest and credit

facility expenses, $8.2 million of management and incentive fees,

and $1.4 million of other operating expenses.

Net investment income after taxes for the three months ended

September 30, 2018 was $21.6 million, or $0.54 per share, compared

with $20.2 million, or $0.50 per share per share for the three

months ended June 30, 2018.

During the three months ended September 30, 2018, the Company

had net realized and unrealized losses of $(2.4) million and had

provision for taxes on unrealized gains on investments of $(0.1)

million.

Net increase in net assets resulting from operations for the

three months ended September 30, 2018 was $19.0 million, or $0.47

per share.

LIQUIDITY AND CAPITAL RESOURCES

During the quarter, the Company closed an offering of $40.0

million aggregate principal amount of 4.50% convertible notes due

April 2022. The convertible notes have identical terms to, are

fungible with, and are part of the Company’s pre-existing $115.0

million convertible notes. In addition, the Company amended its

senior secured revolving credit facility agreement (the “Revolving

Credit Facility”) to, among other things, (i) reduce the Company’s

minimum asset coverage ratio financial covenant to 150% and (ii)

establish a new financial covenant requiring the Company to

maintain a minimum asset coverage ratio of 200% with respect to the

consolidated assets of the Company to the secured debt of the

Company excluding any secured debt at financing subsidiaries. There

was no fee or change in borrowing cost under the Revolving Credit

Facility in connection with the amendment. For further information,

please see the Company’s current report on Form 8-K filed with the

Securities and Exchange Commission on September 17, 2018.

As of September 30, 2018, the Company had $578.9 million of

total principal amount of debt outstanding, comprised of $423.9

million of outstanding borrowings under its revolving credit

facility and $155.0 million of convertible notes. The combined

weighted average interest rate on debt outstanding was 4.03% for

the nine months ended September 30, 2018 as compared to 3.97% for

the six months ended June 30, 2018. As of September 30, 2018, the

Company had $271.1 million of availability under its revolving

credit facility and $4.7 million in cash and cash equivalents.

The Company’s average and ending debt to equity leverage ratio

was 0.70x and 0.79x, respectively, for the three months ended

September 30, 2018, as compared with 0.72x and 0.70x, respectively,

for the three months ended June 30, 2018.10

CONFERENCE CALL

The Company will host an earnings conference call on Friday,

November 2, 2018 at 9:00 am Eastern Time. All interested parties

are invited to participate in the conference call by dialing (866)

884-8289; international callers should dial +1 (631) 485-4531;

conference ID 4849738. All participants are asked to dial in

approximately 10-15 minutes prior to the call, and reference

“Goldman Sachs BDC, Inc.” when prompted. For a slide presentation

that the Company may refer to on the earnings conference call,

please visit the Investor Resources section of the Company’s

website at www.goldmansachsbdc.com. The conference call will be

webcast simultaneously on the Company’s website. An archived replay

of the call will be available from approximately 12:00 pm Eastern

Time on November 2 through December 2. To hear the replay,

participants should dial (855) 859-2056; international callers

should dial +1 (404) 537-3406; conference ID 4849738. An archived

replay will also be available on the Company’s webcast link located

on the Investor Resources section of the Company’s website. Please

direct any questions regarding obtaining access to the conference

call to Goldman Sachs BDC, Inc. Investor Relations, via e-mail, at

gsbdc-investor-relations@gs.com.

ENDNOTES

1 The $0.45 per share dividend is payable on January 15, 2019 to

holders of record as of December 31, 2018. 2 The discussion of the

investment portfolio of both the Company and the SCF excludes their

respective investment in a money market fund managed by an

affiliate of The Goldman Sachs Group, Inc. 3 Total debt outstanding

excluding netting of debt issuance costs of $5.6 million and $3.3

million, respectively, as of September 30, 2018 and June 30, 2018.

4 Computed based on the (a) annual actual interest rate or yield

earned plus amortization of fees and discounts on the performing

debt and other income producing investments as of the reporting

date, divided by (b) the total performing debt and other income

producing investments (excluding investments on non-accrual) at

amortized cost or fair value, respectively. 5 The fixed versus

floating composition has been calculated as a percentage of

performing debt investments, including income producing stock

investments and excludes investments, if any, placed on

non-accrual. 6 For a particular portfolio company, we calculate the

level of contractual indebtedness net of cash (“net debt”) owed by

the portfolio company and compare that amount to measures of cash

flow available to service the net debt. To calculate net debt, we

include debt that is both senior and pari passu to the tranche of

debt owned by us but exclude debt that is legally and contractually

subordinated in ranking to the debt owned by us. We believe this

calculation method assists in describing the risk of our portfolio

investments, as it takes into consideration contractual rights of

repayment of the tranche of debt owned by us relative to other

senior and junior creditors of a portfolio company. We typically

calculate cash flow available for debt service at a portfolio

company by taking net income before net interest expense, income

tax expense, depreciation and amortization (“EBITDA”) for the

trailing twelve month period. Weighted average net debt to EBITDA

is weighted based on the fair value of our debt investments,

including our exposure to underlying debt investments in the SCF

and excluding investments where net debt to EBITDA may not be the

appropriate measure of credit risk, such as cash collateralized

loans and investments that are underwritten and covenanted based on

recurring revenue. For a particular portfolio company, we also

calculate the level of contractual interest expense owed by the

portfolio company, and compare that amount to EBITDA (“interest

coverage ratio”). We believe this calculation method assists in

describing the risk of our portfolio investments, as it takes into

consideration contractual interest obligations of the portfolio

company. Weighted average interest coverage is weighted based on

the fair value of our performing debt investments, including our

exposure to underlying debt investments in the SCF and excluding

investments where interest coverage may not be the appropriate

measure of credit risk, such as cash collateralized loans and

investments that are underwritten and covenanted based on recurring

revenue. Median EBITDA is based on our debt investments, including

our exposure to underlying debt investments in the SCF and

excluding investments where net debt to EBITDA may not be the

appropriate measure of credit risk, such as cash collateralized

loans and investments that are underwritten and covenanted based on

recurring revenue. Portfolio company statistics are derived from

the financial statements most recently provided to us of each

portfolio company as of the reported end date. Statistics of the

portfolio companies have not been independently verified by us and

may reflect a normalized or adjusted amount. As of September 30,

2018 and June 30, 2018, investments where net debt to EBITDA may

not be the appropriate measure of credit risk represented 15.5% and

10.5%, respectively, of total debt investments, including our

investment in the SCF, at fair value. Portfolio company statistics

are derived from the financial statements most recently available

to us of each portfolio company as of the respective reported end

date. Portfolio company statistics have not been independently

verified by us and may reflect a normalized or adjusted amount. 7

Computed based on the net investment income earned from the SCF for

the trailing twelve months ended September 30, 2018, which may

include dividend income and loan origination and structuring fees,

divided by GS BDC’s average member’s equity at cost and fair value,

adjusted for equity contributions. 8 For a particular portfolio

company of the SCF, we calculate the level of net debt owed by the

portfolio company, and compare that amount to measures of cash flow

available to service the net debt. To calculate net debt, we

include debt that is both senior and pari passu to the tranche of

debt owned by the SCF, but exclude debt that is legally and

contractually subordinated in ranking to the debt owned by the

Senior Credit Fund. We believe this calculation method assists in

describing the risk of the SCF’s portfolio investments, as it takes

into consideration contractual rights of repayment of the tranche

of debt owned by the SCF relative to other senior and junior

creditors of a portfolio company. We typically calculate cash flow

available for debt service at a portfolio company by taking EBITDA

for the trailing twelve month period. For a particular portfolio

company of the SCF, we also calculate the interest coverage ratio.

We believe this calculation method assists in describing the risk

of the SCF’s portfolio investments, as it takes into consideration

contractual interest obligations of the portfolio company. Median

EBITDA is based on the SCF’s debt investments. Portfolio company

statistics are derived from the financial statements most recently

available to us of each portfolio company of the SCF as of the

respective reported end date. Statistics of the SCF’s portfolio

companies have not been independently verified by us and may

reflect a normalized or adjusted amount. 9 Interest income excludes

prepayment premiums, accelerated accretion of upfront loan

origination fees and unamortized discounts. Prepayment related

income includes prepayment premiums and accelerated accretion of

upfront loan origination fees and unamortized discounts. 10 The

average debt to equity leverage ratio has been calculated using the

average daily borrowings during the quarter divided by average net

assets, adjusted for equity contributions. The ending and average

debt to equity leverage ratios exclude unfunded commitments.

Goldman Sachs BDC, Inc.

Consolidated Statements of Assets and

Liabilities

(in thousands, except share and per

share amounts)

September 30,

2018(Unaudited)

December 31, 2017 Assets Investments, at fair

value Non-controlled/non-affiliated investments (cost of $1,082,170

and $1,053,226, respectively) $ 1,076,354 $ 1,050,179

Non-controlled affiliated investments (cost of $143,138 and

$109,528, respectively) 126,676 95,468 Controlled affiliated

investments (cost of $119,065 and $114,911, respectively) 115,290

112,666 Investments in affiliated money market fund (cost of $4 and

$11,539, respectively) 4 11,539 Cash 4,648 11,606 Receivable for

investments sold 268 – Unrealized appreciation on foreign currency

forward contracts 2 – Interest and dividends receivable from

non-controlled/affiliated investments and

non-controlled/non-affiliated investments 10,815 8,302 Dividend

receivable from controlled affiliated investments 3,000 2,400 Other

income receivable from controlled affiliated investments - 1,308

Deferred financing costs 5,773 4,847 Deferred offering costs 145

275 Other assets 228 2

Total assets $

1,343,203 $ 1,298,592

Liabilities Debt

(net of debt issuance costs of $5,644 and $3,724, respectively) $

573,292 $ 542,526 Interest and other debt expenses payable 4,594

1,688 Management fees payable 3,255 4,647 Incentive fees payable

4,962 3,180 Distribution payable 18,088 18,059 Payable for

investments purchased 5,465 – Directors’ fees payable 107 – Accrued

offering costs 362 289 Accrued expenses and other liabilities

4,438 2,373

Total liabilities $ 614,563

$ 572,762

Commitments and Contingencies Net

Assets Preferred stock, par value $0.001 per share

(1,000,000 shares authorized, no shares issued and outstanding)

$

–

$

–

Common stock, par value $0.001 per share (200,000,000 shares

authorized, 40,196,049 and 40,130,665 shares issued and outstanding

as of September 30, 2018 and December 31, 2017, respectively) 40 40

Paid-in capital in excess of par 802,046 799,936 Accumulated net

realized gain (loss) (84,304) (85,451 ) Accumulated undistributed

net investment income 38,305 32,078 Net unrealized appreciation

(depreciation) (26,026) (19,352 ) Allocated income tax expense

(1,421) (1,421 )

TOTAL NET ASSETS $

728,640 $ 725,830

TOTAL LIABILITIES AND NET ASSETS $

1,343,203 $ 1,298,592 Net asset value per share $

18.13 $ 18.09

Goldman Sachs BDC, Inc.

Consolidated Statements of

Operations

(in thousands, except share and per

share amounts)

(Unaudited)

For the three months endedSeptember

30, For the nine months ended September

30, 2018 2017 2018 2017

Investment Income: From non-controlled/non-affiliated

investments: Interest income $ 30,322 $ 28,204 $ 91,340 $ 85,383

Payment-in-kind 672 – 672 – Other income 508

1,255 1,481 2,090 Total

investment income from non-controlled/non-affiliated investments

31,502 29,459 93,493 87,473 From non-controlled affiliated

investments: Payment-in-kind 2,028 1,885 5,931 5,287 Interest

income 889 354 1,936 1,476 Dividend income 86 7 103 20 Other income

11 7 26 19

Total investment income from non-controlled affiliated

investments 3,014 2,253 7,996 6,802 From controlled affiliated

investments: Payment-in-kind 467 – 1,273 – Dividend income 3,000

2,350 8,000 7,250 Other income - 350

- 1,096 Total investment income

from controlled affiliated investments 3,467

2,700 9,273 8,346

Total investment income $ 37,983 $ 34,412 $

110,762 $ 102,621

Expenses: Interest

and other debt expenses $ 6,432 $ 4,884 $ 18,328 $ 14,235

Management fees 3,255 4,369 12,537 13,181 Incentive fees 4,962

4,624 13,988 9,595 Professional fees 580 509 2,308 1,443

Administration, custodian and transfer agent fees 230 219 693 608

Directors’ fees 118 177 336 525 Other expenses 412

302 1,091 925

Total expenses $ 15,989 $ 15,084 $ 49,281

$ 40,512

NET INVESTMENT INCOME (LOSS)

BEFORE TAXES $ 21,994 $ 19,328 $ 61,481 $

62,109 Excise tax $ 428 $ 383 $ 1,017

$ 1,116

NET INVESTMENT INCOME (LOSS) AFTER

TAXES $ 21,566 $ 18,945 $ 60,464 $ 60,993

Net realized and unrealized gains

(losses): Net realized gain (loss) from:

Non-controlled/non-affiliated investments $ (1 ) $ 138 $ 1,766 $

(38,138 ) Non-controlled affiliated investments - (2,495 ) 9 (2,495

) Foreign currency transactions (182 ) – (182 ) – Net change in

unrealized appreciation (depreciation) from: Non

controlled/non-affiliated investments (1,985 ) (341 ) (2,769 )

24,874 Non-controlled affiliated investments 75 1,574 (2,402 )

(7,942 ) Controlled affiliated investments (481 ) 291 (1,530 ) (30

) Foreign currency forward contracts 2 – 2 – Foreign currency

translations 171 – 171

–

Net realized and unrealized gains

(losses) $ (2,401 ) $ (833 ) $ (4,935 ) $ (23,731 )

(Provision) benefit for taxes on realized gain/loss on investments

$ - $ – $ (446 ) $ – (Provision) benefit for taxes on unrealized

appreciation/depreciation on investments (146 ) –

(146 ) –

NET INCREASE IN NET

ASSETS RESULTING FROM OPERATIONS $ 19,019 $ 18,112

$ 54,937 $ 37,262 Net investment

income (loss) per share (basic and diluted) $ 0.54 $ 0.47 $ 1.51 $

1.60 Earnings per share (basic and diluted) $ 0.47 $ 0.45 $ 1.37 $

0.98 Weighted average shares outstanding 40,192,683 40,106,702

40,171,874 38,130,304 Distributions declared per share $ 0.45 $

0.45 $ 1.35 $ 1.35

ABOUT GOLDMAN SACHS BDC, INC.

Goldman Sachs BDC, Inc. is a specialty finance company that has

elected to be regulated as a business development company under the

Investment Company Act of 1940. GS BDC was formed by The Goldman

Sachs Group, Inc. (“Goldman Sachs”) to invest primarily in

middle-market companies in the United States, and is externally

managed by Goldman Sachs Asset Management, L.P., an SEC-registered

investment adviser and a wholly-owned subsidiary of Goldman Sachs.

GS BDC seeks to generate current income and, to a lesser extent,

capital appreciation primarily through direct originations of

secured debt, including first lien, first lien/last-out unitranche

and second lien debt, and unsecured debt, including mezzanine debt,

as well as through select equity investments. For more information,

visit www.goldmansachsbdc.com. Information on the website is not

incorporated by reference into this press release and is provided

merely for convenience.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements that

involve substantial risks and uncertainties. You can identify these

statements by the use of forward-looking terminology such as “may,”

“will,” “should,” “expect,” “anticipate,” “project,” “target,”

“estimate,” “intend,” “continue,” or “believe” or the negatives

thereof or other variations thereon or comparable terminology. You

should read statements that contain these words carefully because

they discuss our plans, strategies, prospects and expectations

concerning our business, operating results, financial condition and

other similar matters. These statements represent the Company’s

belief regarding future events that, by their nature, are uncertain

and outside of the Company’s control. Any forward-looking statement

made by us in this press release speaks only as of the date on

which we make it. Factors or events that could cause our actual

results to differ, possibly materially from our expectations,

include, but are not limited to, the risks, uncertainties and other

factors we identify in the sections entitled “Risk Factors” and

“Cautionary Statement Regarding Forward-Looking Statements” in

filings we make with the Securities and Exchange Commission, and it

is not possible for us to predict or identify all of them. We

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181101006185/en/

Goldman Sachs BDC, Inc.Investors: Katherine Schneider,

212-902-3122orMedia: Patrick Scanlan, 212-902-6164

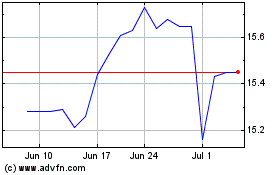

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

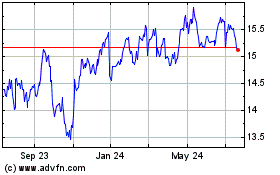

Goldman Sachs BDC (NYSE:GSBD)

Historical Stock Chart

From Apr 2023 to Apr 2024