Fidelity launches company to facilitate crypto trading

October 16 2018 - 6:07AM

ADVFN Crypto NewsWire

Fidelity launches company to facilitate

crypto trading

Finance industry establishment splits between lovers and haters

of digital currencies

Robin Wigglesworth, US markets editor

Fidelity has launched a company to facilitate cryptocurrency

trading for hedge funds, endowments and family offices,

underscoring how some establishment players in the finance industry

are attempting to profit from the wild west frontier of digital

assets.

The Boston-based investment giant said it would offer institutional

investors access to “enterprise-quality custody and trade execution

services” for cryptocurrencies, such as bitcoin or ethereum, as a

first step towards creating a full platform for the nascent

industry.

“Our goal is to make digitally-native assets, such as bitcoin, more

accessible to investors,” Abigail Johnson, chairman and chief

executive of Fidelity Investments, said in a statement. “We expect

to continue investing and experimenting, over the long-term, with

ways to make this emerging asset class easier for our clients to

understand and use.”

"

I’m here because I love this stuff . . . all that the future might

hold

Abigail Johnson, Fidelity chief executive, at bitcoin conference in

2017

Bitcoin, the first and biggest of a swelling ecosystem of

cryptographic digital currencies, emerged in the wake of the

financial crisis and has quickly become one of the hottest — and

most controversial — subjects on Wall Street. Critics say

cryptocurrencies enable crime, are a fad, and in many cases

fraudulent. Supporters argue that they will revolutionise

capitalism.

Howard Marks, the founder of Oaktree, has argued that bitcoin “will

be shown not to have any substance”, while JPMorgan Chase’s Jamie

Dimon has called cryptocurrencies “a scam”.

However, there has been rising interest from the some of the

financial industry establishment to capitalise on the mania. The

Chicago Mercantile Exchange and Cboe Global Markets, two big

exchange groups, have launched bitcoin futures, Intercontinental

Exchange earlier this year launched Bakkt, a group that also aims

to build modern market infrastructure for the crypto industry.

The gradual entry of the Wall Street establishment has done little

to quell the industry’s volatility, with bitcoin tumbling from a

high of over $19,500 in December to $6,420 today.

Bitcoin’s average volatility this year is more than five times the

average volatility of the US stock market. Fidelity said it had

started exploring cryptocurrencies and blockchain, the

decentralised ledger that backs bitcoin, in 2013, and had since

then experimented with mining bitcoin and partnering with other

players in the nascent industry, as Ms Johnson starts to stamp her

mark on a company founded by her grandfather.

“Some of you might be wondering: Why am I here today?” Ms Johnson

said at a cryptocurrency conference in 2017. “I’m here because I

love this stuff . . . all that the future might hold.”

But while Coinbase and other cryptocurrency platforms are primarily

aimed at retail investors, Fidelity said its new “Fidelity Digital

Assets” arm would help more sophisticated institutional investors

into the field by helping trade and store cryptocurrency assets

safely.

“We started exploring blockchain and digital assets several years

ago, and those efforts have been successful in helping us

understand and advance our thinking around cryptocurrencies,” Tom

Jessop, head of Fidelity Digital Assets, said in the statement.

“The creation of Fidelity Digital Assets is the first step in a

long-term vision to create a full-service enterprise-grade platform

for digital assets.”

By Robin Wigglesworth, US markets

editor

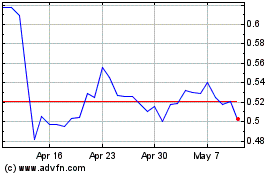

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

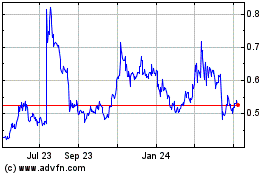

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024