Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333

-

227292

PROSPECTUS SUPPLEMENT NO. 1

(TO PROSPECTUS DATED OCTOBER 2, 2018)

JAGUAR HEALTH, INC.

4,625,000 shares of Common Stock issuable upon the exercise of warrants

This prospectus supplement No. 1 supplements and amends the prospectus dated October 4, 2018, relating to the public offering of 4,625,000 shares of common stock which are issuable upon the exercise of outstanding pre-funded warrants and underwriter warrants issued in our public offering of common stock and pre-funded warrants, which closed on October 4, 2018, pursuant to a prospectus dated October 2, 2018.

This prospectus supplement should be read in conjunction with the prospectus dated October 2, 2018, which is to be delivered with this prospectus supplement. This prospectus supplement is qualified by reference to the prospectus except to the extent that the information in this prospectus supplement supersedes the information contained in the prospectus. This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the prospectus, including any amendments or supplements to it.

Our common stock is quoted on The Nasdaq Capital Market under the symbol “JAGX.” On October 4, 2018, the last reported sale price of our common stock on The Nasdaq Capital Market was $0.585 per share.

This prospectus supplement incorporates into our prospectus the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on October 5, 2018 and attached hereto.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 7 of the prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the prospectus to which it relates are truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is October 5, 2018.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 1, 2018

JAGUAR HEALTH, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36714

|

|

46-2956775

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

201 Mission Street, Suite 2375

San Francisco, California

|

|

94105

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(415) 371-8300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

x

Item 1.01 Entry into a Material Definitive Agreement.

On October 1, 2018, Jaguar Health, Inc. (the “Company”) entered into a standstill agreement (the “Standstill Agreement”) with Chicago Venture Partners, L.P. (“CVP”) with respect to the outstanding secured promissory notes issued by the Company to CVP pursuant to the securities purchase agreements dated June 29, 2017, December 8, 2017, February 26, 2018 and March 21, 2018, in each case between the Company and CVP (collectively, the “CVP Notes”). The Standstill Agreement provides that (a) CVP will agree not to exercise its right to redeem up to $500,000 aggregate amount of the CVP Notes in any calendar month (the “Monthly Redemption Right”) before November 1, 2018 (the “Initial Standstill”) and (b) to the extent that the Company redeems at least $1.5 million aggregate amount of the CVP Notes on or before October 31, 2018 (such redemption, the “Proposed Redemption”), CVP will agree not to exercise its Monthly Redemption Right with respect to any portion of the CVP Notes that remain outstanding following the Proposed Redemption until March 2019 (the “Extended Standstill,” and together with the Initial Standstill, the “Standstill”).

In consideration of CVP’s grant of the Standstill, CVP’s fees incurred in preparing the Standstill Agreement and other accommodations set forth in the Standstill Agreement, the Company will pay CVP a fee in the amount of five percent (5%) of the total outstanding balance of the CVP Notes on November 1, 2018 (“Standstill Fee”), which Standstill Fee will be added to the outstanding balance of the oldest CVP Note still outstanding on November 1, 2018. If the Company fails to consummate the Proposed Redemption by October 31, 2018, then CVP will have the right to redeem up to $1 million aggregate amount of the CVP Notes at any time thereafter, which for clarity, is in addition to CVP’s Monthly Redemption Right that resumes following the Initial Standstill period.

The Standstill Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K, and such document is incorporated herein by reference. The foregoing is only a brief description of the material terms of the Standstill Agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to such exhibit.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information contained above in Item 1.01 is hereby incorporated by reference into this Item 2.03 in its entirety.

Item 8.01 Other Events

On October 2, 2018 Jaguar Health, Inc. (the “Company”) announced that it has priced an underwritten public offering pursuant to which the Company issued and sold an aggregate of 11,575,001 shares of its common stock, par value $0.0001 per share (“Common Stock”) and 3,425,000 pre-funded warrants to purchase shares of Common Stock (“Pre-Funded Warrants”). The Common Stock was sold at a purchase price of $0.60 per share and the Pre-Funded Warrants were sold at a purchase price of $0.59 per share, for total gross proceeds of approximately $9 million, before deducting estimated fees and expenses payable by the Company in connection with the Offering. Pursuant to the terms of the Underwriting Agreement, dated October 2, 2018 (the “Underwriting Agreement”), entered into by and between the Company and H.C. Wainwright & Co., LLC, as the representative of the underwriters named therein (the “Underwriters”), the Company granted to the Underwriters a 30-day option to purchase up to an additional 2,250,000 shares of Common Stock to cover over-allotments, if any. The offering closed on October 4, 2018. The shares of Common Stock, the Pre-Funded Warrants, and the shares underlying the Pre-Funded Warrants offered by the Company in this transaction were registered under the Company’s registration statement on Form S-1, as amended (File No. 333-227292), which was declared effective by the Securities and Exchange Commission on October 1, 2018, and a final prospectus filed on October 4, 2018.

H.C. Wainwright & Co. acted as the sole book-running manager for the offering.

The Company intends to use the net proceeds of the offering to fund approximately $1.2-1.6 million of non-clinical pipeline and business development activities, and the remainder for the ongoing commercialization of Mytesi® as well as for working capital and other general corporate purposes.

A copy of the press release of the Company, dated October 2, 2018, is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

JAGUAR HEALTH, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Karen S. Wright

|

|

|

|

Name: Karen S. Wright

|

|

|

|

Title: Chief Financial Officer

|

Date: October 5, 2018

4

Exhibit 10.1

STANDSTILL AGREEMENT

This Standstill Agreement (this “

Agreement

”) is entered into as of October 1, 2018, by and between CHICAGO VENTURE PARTNERS, L.P., a Utah limited partnership (“

Lender

”), and JAGUAR HEALTH, INC., a Delaware corporation (“

Borrower

”). Capitalized terms used in this Agreement without definition shall have the meanings given to them in the Notes (as defined below).

A.

Borrower previously issued to Lender a Secured Convertible Promissory Note dated June 29, 2017 and three (3) Secured Promissory Notes dated December 8, 2017, February 26, 2018, and March 21, 2018 (collectively, the “

Notes

,” and together with all other agreements, instruments and documents entered into in connection with the Notes, the “

Transaction Documents

”).

B.

Borrower has requested that Lender refrain from making redemptions under Section 8 of the Notes (“

Redemptions

”) as set forth in this Agreement (the “

Standstill

”).

C.

Pursuant to the terms of the Notes, Lender is allowed to make Redemptions in the amount of up to $500,000.00 per month.

D.

Lender has agreed, subject to the terms, amendments, conditions and understandings expressed in this Agreement, to grant the Standstill.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1.

Recitals

. Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Agreement are true and accurate and are hereby incorporated into and made a part of this Agreement.

2.

Standstill

. Notwithstanding the terms of the Notes, Lender hereby agrees that it will not make any Redemptions for the months of September 2018 and October 2018. Lender further agrees that if Borrower makes a $1,500,000.00 debt reduction payment to Lender by October 31, 2018 (the “

Debt Reduction Payment

”), then Borrower will also refrain from making any Redemptions in the months of November 2018, December 2018, January 2019 and February 2019. However, if Borrower fails to make the Debt Reduction Payment by October 31, 2018, then Lender shall have the right to make up to $1,000,000.00 in Redemptions at any time thereafter in addition and the standard $500,000.00 per month in Redemptions beginning again on November 1, 2018.

3.

Standstill Fee

. In consideration of Lender’s grant of the Standstill, its fees incurred in preparing this Agreement and other accommodations set forth herein, Borrower agrees to pay to Lender a fee in the amount of five (5%) of the total outstanding balance of the Notes on November 1, 2018 (the “

Standstill Fee

”). The Standstill Fee shall be added to the outstanding balance of the oldest Note still outstanding on November 1, 2018.

4.

Representations and Warranties

. In order to induce Lender to enter into this Agreement, Borrower, for itself, and for its affiliates, successors and assigns, hereby

acknowledges, represents, warrants and agrees as follows:

a.

Borrower has full power and authority to enter into this Agreement and to incur and perform all obligations and covenants contained herein, all of which have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice to any governmental authority is required as a condition to the validity of this Agreement or the performance of any of the obligations of Borrower hereunder.

b.

There is no fact known to Borrower or which should be known to Borrower which Borrower has not disclosed to Lender on or prior to the date of this Agreement which would or could materially and adversely affect the understanding of Lender expressed in this Agreement or any representation, warranty, or recital contained in this Agreement.

c.

Except as expressly set forth in this Agreement, Borrower acknowledges and agrees that neither the execution and delivery of this Agreement nor any of the terms, provisions, covenants, or agreements contained in this Agreement shall in any manner release, impair, lessen, modify, waive, or otherwise affect the liability and obligations of Borrower under the terms of the Transaction Documents.

d.

Borrower has no defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes of action of any kind or nature whatsoever against Lender, directly or indirectly, arising out of, based upon, or in any manner connected with, the transactions contemplated hereby, whether known or unknown, which occurred, existed, was taken, permitted, or begun prior to the execution of this Agreement and occurred, existed, was taken, permitted or begun in accordance with, pursuant to, or by virtue of any of the terms or conditions of the Transaction Documents. To the extent any such defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes of action exist or existed, such defenses, rights, claims, counterclaims, actions and causes of action are hereby waived, discharged and released. Borrower hereby acknowledges and agrees that the execution of this Agreement by Lender shall not constitute an acknowledgment of or admission by Lender of the existence of any claims or of liability for any matter or precedent upon which any claim or liability may be asserted.

e.

Borrower represents and warrants that as of the date hereof no Events of Default or other material breaches exist under the Transaction Documents or have occurred prior to the date hereof.

5.

Certain Acknowledgments

. Each of the parties acknowledges and agrees that no property or cash consideration of any kind whatsoever has been or shall be given by Lender to Borrower in connection with the Standstill or any other amendment to the Notes granted herein.

6.

Ratification of the Notes

. The Notes shall be and remain in full force and effect in accordance with their terms, and are hereby ratified and confirmed in all respects. Borrower acknowledges that it is unconditionally obligated to pay the remaining balance of the Notes and represents that such obligation is not subject to any defenses, rights of offset or counterclaims. No forbearance or waiver other than as expressly set forth herein may be implied by this Agreement. Except as expressly set forth herein, the execution, delivery, and performance of this Agreement shall not operate as a waiver of, or as an amendment to, any right, power or remedy

2

of Lender under the Notes or the other Transaction Documents, as in effect prior to the date hereof.

7.

No Reliance

. Borrower acknowledges and agrees that neither Lender nor any of its officers, directors, members, managers, equity holders, representatives or agents has made any representations or warranties to Borrower or any of its agents, representatives, officers, directors, or employees except as expressly set forth in this Agreement and the Transaction Documents and, in making its decision to enter into the transactions contemplated by this Agreement, Borrower is not relying on any representation, warranty, covenant or promise of Lender or its officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Agreement.

8.

Arbitration

. Each party agrees that any dispute arising out of or relating to this Agreement shall be subject to the same arbitration provisions as the Notes.

9.

Governing Law; Venue

. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Utah without regard to the principles of conflict of laws. Each party agrees that the proper venue for any dispute arising out of or relating to this Agreement shall the as the proper venue for the Notes.

BORROWER HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

10.

Attorneys’ Fees

. In the event of any arbitration or action at law or in equity to enforce or interpret the terms of this Agreement, the parties agree that the party who is awarded the most money shall be deemed the prevailing party for all purposes and shall therefore be entitled to an additional award of the full amount of the attorneys’ fees and expenses paid by such prevailing party in connection with the arbitration, litigation and/or dispute without reduction or apportionment based upon the individual claims or defenses giving rise to the fees and expenses. Nothing herein shall restrict or impair an arbitrator’s or a court’s power to award fees and expenses for frivolous or bad faith pleading.

11.

Counterparts

. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. The parties hereto confirm that any electronic copy of another party’s executed counterpart of this Agreement (or such party’s signature page thereof) will be deemed to be an executed original thereof.

12.

Further Assurances

. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank]

3

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the date set forth above.

|

|

BORROWER:

|

|

|

|

|

|

JAGUAR HEALTH, INC.

|

|

|

|

|

|

By:

|

/s/ Lisa A. Conte

|

|

|

Name:

|

Lisa A. Conte

|

|

|

Title:

|

President & CEO

|

|

|

|

|

|

LENDER:

|

|

|

|

|

|

CHICAGO VENTURE PARTNERS, L.P.

|

|

|

|

|

|

By: Chicago Venture Management, L.L.C., its General Partner

|

|

|

|

|

|

By: CVM, Inc., its Manager

|

|

|

|

|

|

By:

|

/s/ John M. Fife

|

|

|

|

John M. Fife, President

|

|

|

|

|

|

[Signature page to Standstill Agreement]

Exhibit 99.1

Jaguar Health Announces Pricing of $9 Million Underwritten Public Offering

San Francisco, CA — October 2, 2018 —

Jaguar Health, Inc. (Nasdaq: JAGX) (“Jaguar” or the “Company”), a commercial stage pharmaceutical company focused on developing novel, sustainably derived gastrointestinal products on a global basis, today announced the pricing of an underwritten public offering of 15,000,001 total shares of its common stock (or common stock equivalents), at a public offering price of $0.60 per share, for gross proceeds of approximately $9.0 million, before deducting underwriting discounts and commissions and other offering expenses payable by Jaguar. Jaguar has granted the underwriter a 30-day option to purchase up to an aggregate of 2,250,000 additional shares of its common stock to cover over-allotments, if any.

H.C. Wainwright & Co. is acting as the sole book-running manager for the offering.

The Company intends to use the net proceeds of the offering to fund approximately $1.2-1.6 million of non-clinical pipeline and business development activities, and the remainder for the ongoing commercialization of Mytesi

®

as well as for working capital and other general corporate purposes.

The offering is expected to close on or about October 4, 2018, subject to satisfaction of customary closing conditions.

The offering is being made pursuant to a registration statement on Form S-1 (File No. 333-227292) that Jaguar previously filed with the Securities and Exchange Commission (“SEC”) and which was declared effective on October 1, 2018. This offering will be made only by means of a prospectus. A final prospectus will be filed with the SEC and once filed, will be available on the SEC’s website at www.sec.gov and may also be obtained from H.C. Wainwright & Co., LLC, 430 Park Avenue, 3rd Floor, New York, NY 10022, by calling (646) 975-6996 or e-mailing placements@hcwco.com.

This press release shall not constitute an offer to sell or the solicitation of any offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification of these securities under the securities laws of any such state or jurisdiction.

About Jaguar Health, Inc.

Jaguar Health, Inc. is a commercial stage pharmaceuticals company focused on developing novel, sustainably derived gastrointestinal products on a global basis. Our wholly-owned subsidiary, Napo Pharmaceuticals, Inc., focuses on developing and commercializing proprietary human gastrointestinal pharmaceuticals for the global marketplace from plants used traditionally in rainforest areas. Our Mytesi

®

(crofelemer) product is approved by the

U.S. FDA for the symptomatic relief of noninfectious diarrhea in adults with HIV/AIDS on antiretroviral therapy. For more information about Jaguar, please visit jaguar.health.

About Mytesi

®

Mytesi (crofelemer) is an antidiarrheal indicated for the symptomatic relief of noninfectious diarrhea in adult patients with HIV/AIDS on antiretroviral therapy (ART). Mytesi is not indicated for the treatment of infectious diarrhea. Rule out infectious etiologies of diarrhea before starting Mytesi. If infectious etiologies are not considered, there is a risk that patients with infectious etiologies will not receive the appropriate therapy and their disease may worsen. In clinical studies, the most common adverse reactions occurring at a rate greater than placebo were upper respiratory tract infection (5.7%), bronchitis (3.9%), cough (3.5%), flatulence (3.1%), and increased bilirubin (3.1%).

See full Prescribing Information at Mytesi.com. Crofelemer, the active ingredient in Mytesi, is a botanical (plant-based) drug extracted and purified from the red bark sap of the medicinal

Croton lechleri

tree in the Amazon rainforest. Napo has established a sustainable harvesting program for crofelemer to ensure a high degree of quality and ecological integrity.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements.” These include statements regarding the expectation that the offering will close on or about October 4, 2018 and use of proceeds. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this release are only predictions. Jaguar has based these forward-looking statements largely on its current expectations and projections about future events. These forward-looking statements speak only as of the date of this release and are subject to a number of risks, uncertainties and assumptions, some of which cannot be predicted or quantified and some of which are beyond Jaguar’s control. Except as required by applicable law, Jaguar does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Source: Jaguar Health, Inc.

Contact:

Peter Hodge

Jaguar Health, Inc.

phodge@jaguar.health

Jaguar-JAGX

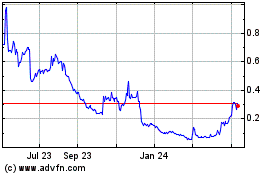

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

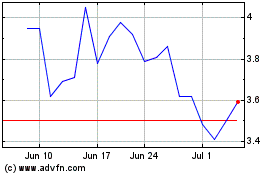

Jaguar Health (NASDAQ:JAGX)

Historical Stock Chart

From Apr 2023 to Apr 2024