Monarch Casino & Resort, Inc. (Nasdaq:MCRI) (“Monarch” or “the

Company”) today reported operating results for the quarter ended

June 30, 2018, as summarized below:

($ in thousands, except per share data and percentages)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

|

2017 |

|

Increase |

|

|

2018 |

|

|

2017 |

|

Increase |

| Net revenue(1) |

$ |

59,909 |

|

$ |

58,229 |

|

2.9 |

% |

|

$ |

116,177 |

|

$ |

111,643 |

|

4.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA(2) |

|

15,909 |

|

|

15,801 |

|

0.7 |

% |

|

|

28,724 |

|

|

27,916 |

|

2.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

9,239 |

|

$ |

7,239 |

|

27.6 |

% |

|

$ |

15,980 |

|

$ |

12,111 |

|

31.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic EPS |

$ |

0.52 |

|

$ |

0.41 |

|

26.8 |

% |

|

$ |

0.90 |

|

$ |

0.69 |

|

30.4 |

% |

| Diluted EPS |

$ |

0.50 |

|

$ |

0.40 |

|

25.0 |

% |

|

$ |

0.86 |

|

$ |

0.67 |

|

28.4 |

% |

(1) As described in the section below entitled “New Revenue

Recognition Standard” the Company has changed its revenue

recognition policy effective January 1, 2018. This change resulted

in a $0.2 million and $0.3 million increase in Net revenue for the

three and six months ended June 30, 2018, respectively. Please see

the reconciliation provided at the end of this release for more

information related to the changes in revenues and expenses. (2)

Definitions, disclosures and reconciliations of non-GAAP financial

information are included later in the release.

CEO Comment John Farahi,

Co-Chairman and Chief Executive Officer of Monarch, commented: “Our

continued growth in the second quarter highlights our strategic

positioning in two of the country’s most favorable gaming markets.

Second quarter revenue growth of 3% was driven by record second

quarter levels of slot win at Atlantis Casino Resort and Monarch

Black Hawk while Atlantis also delivered its highest ever level of

second quarter hotel revenue. However, flow through to Adjusted

EBITDA was impacted by increased labor expense over the prior year

and incremental construction-related expenses, compounded by

historically low table game hold at Atlantis, resulting in Adjusted

EBITDA growth of 1% for the quarter.

“Atlantis continues to benefit from the overall

health of Reno market and remains well positioned to capitalize on

the region’s long-term economic resurgence thanks to its

world-class amenities and favorable location adjacent to the

Reno-Sparks Convention Center.

“Monarch Casino Black Hawk is driving healthy

visitation, guest play and market share gains which we believe

bodes well for the property’s future. Slot play and visitation

trends at the property remain healthy and consistent, though

Adjusted EBITDA flow through has been hampered by

construction-related operating expenses which we expect will

subside as the new hotel and other amenities open next year.

“Throughout the quarter we made further progress

with our master planned expansion at Monarch Casino Black Hawk,

which remains on schedule and on budget. Our guests are excited

about the property’s transformation and we look forward to

completing the project next year. Our guests and visitors to our

website can see that the 23-story hotel tower now rises past its

halfway point.

“We remain focused on delivering exceptional

guest service as we continue to evaluate our operations and explore

the use of technology and analytics to drive further efficiencies,

improve margins and increase profitability. Overall, we believe

2018 remains on track to be a year of growth for the Company and we

look forward to the second half of the year and the opening in

mid-2019 of our Black Hawk expansion.”

New Revenue Recognition

StandardOn January 1, 2018, the Company adopted accounting

standard update No. 2014-09 (“ASC 606”) and all the related

amendments to all contracts (“new revenue standard”) which provides

consistency in the reported financial information within the gaming

industry. The Company applied the modified retrospective method and

recognized the cumulative effect of the initial application of the

new revenue standard as an adjustment to the opening balance of

retained earnings. The opening retained earnings adjustment

primarily related to the change in the accounting for the slot club

liability from the immediate revenue/cost method to the deferred

revenue method.

The new revenue standard also resulted in

reclassifications to and from revenues, promotional allowances and

operating expenses. Pursuant to the new FASB guidelines, food and

beverage, hotel and other complimentaries are now valued at their

retail price and included as revenues within their respective

categories, with a corresponding decrease in gaming revenues, as

the offsetting amount historically included in promotional

allowances has been eliminated. In addition, the cost of providing

these complimentary goods and services are now included as expenses

within their respective categories, resulting in a corresponding

decrease in casino expenses. While those changes have resulted in a

$171 thousand and $316 thousand increase in net revenue for the

three and six months ending June 30, 2018, respectively, they had

no impact on adjusted EBITDA and diluted EPS.

Financial results for the three months and six

months ending June 30, 2017 have not been restated and are reported

under the accounting standards in effect during that period. The

Company has provided reconciliation between the new revenue

standard and the old revenue standard for the three and six months

ending June 30, 2018 at the end of this release.

Summary of 2018 Second Quarter Operating

ResultsFor the 2018 second quarter, consolidated net

revenues of $59.9 million increased 2.9% from $58.2 million in the

prior year. Primarily due to the previously announced change in

revenue recognition accounting casino revenues declined 31.3% year

over year, hotel revenues increased 29.6% and food and beverage

revenues increased 12.7%. See, “MONARCH CASINO & RESORT, INC.

AND SUBSIDIARIES RECONCILIATION OF POST TO PRE ASC 606 ADOPTION”

below. Casino revenue was also impacted during the second quarter

of 2018 by abnormally low table game hold at Atlantis. Underlying

trends in the Company’s slot floor, hotel and food and beverage

operations were healthy on a year over year basis.

Selling, general and administrative (“SG&A”)

expenses for the second quarter of 2018 were $16.2 million compared

to $15.1 million in the prior year period, driven primarily by

increased labor expense, utility expense and repair and maintenance

expense. As a percentage of net revenue, SG&A expenses

increased to 27.0% compared to 25.9% a year ago. Casino operating

expense as a percentage of casino revenue decreased to 34.9% in the

second quarter of 2018 compared to 39.8% in the second quarter of

2017 due to the adoption of the new revenue standard, partially

offset by lower table games revenue at Atlantis. Food and beverage

operating expense as a percentage of food and beverage revenue

increased to 75.2% during the second quarter of 2018 from 41.8% a

year ago as a result of the adoption of the new revenue standard,

partially offset by improvements in product cost. Hotel operating

expense as a percentage of hotel revenue increased to 37.7% in the

second quarter of 2018 compared to 36.0% in the same period in the

prior year, primarily as a result of the adoption of the new

revenue standard, partially offset by underlying hotel revenue

growth.

The Company generated consolidated adjusted

EBITDA of $15.9 million in the second quarter of 2018, an increase

of $0.1 million, or 0.7%, over the same period a year ago. Net

income and diluted EPS for the second quarter of 2018 rose 27.6%

and 25.0%, respectively, partially benefiting from a lower tax rate

as a result of the Tax Cuts and Jobs Act enacted late last

year.

Monarch Black Hawk

ExpansionSummarized below is an update on the Company’s

ongoing upgrade and expansion of Monarch Casino Black Hawk,

including the budgeted costs and completion dates for the project

as well as the amounts spent through June 30, 2018:

| $ in millions |

Budget Cost |

|

Total Spent Through June 30, 2018 |

|

Left to Spend |

|

Estimated Completion Date |

|

| I. Existing

Facility |

|

|

|

|

|

|

|

|

| Monarch

Casino Black Hawk (1) |

$76 |

|

$76 |

|

- |

|

Completed |

|

| Existing

Facility Upgrade (2)(3) |

$34 -

$36 |

|

$23 |

|

$11 -

$13 |

|

Interior completed; Exterior 2018 |

|

|

Total Existing Facility |

$110 - $112 |

|

$99 |

|

$11 - $13 |

|

|

|

| |

|

|

|

|

|

|

|

|

| II. Expansion |

|

|

|

|

|

|

|

|

| Acquired

Land Parcels |

$10 |

|

$10 |

|

- |

|

Completed |

|

| Parking

Structure |

$38 -

$41 |

|

$41 |

|

- |

|

Completed |

|

| Hotel

Tower & Casino (3) |

$264 -

$269 |

|

$69 |

|

$195 -

$200 |

|

2Q19 |

|

|

Other |

$8 - $10 |

|

$10 |

|

- |

|

|

|

|

Total Expansion |

$320 - $330 |

|

$130 |

|

$195 - $200 |

|

|

|

|

Total Cost |

$430 - $442 |

|

$229 |

|

$206 - $213 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) The

Company paid $76.0 million cash or $69.2 million net of acquired

working capital and NOLs when it acquired Monarch Casino Black Hawk

(formerly Riviera Black Hawk Casino) in 2012. |

|

| (2)

Includes upgrades to the interior, which were completed in August

2015, demolition of the original garage, and upgrades to the

exterior of the existing facility to match the design of the master

planned expansion. |

|

| (3) The

Company anticipates funding the hotel tower and casino expansion,

as well as the existing facility exterior upgrades, from a

combination of operating cash flow and the amended and restated

credit facility (the “Amended Credit Facility”). |

|

Monarch continues to expect completion of the

Monarch Casino Black Hawk hotel tower and casino expansion in the

second quarter of 2019.

Credit Facility and

LiquidityCapital expenditures of $28.5 million in the

second quarter of 2018 include construction costs related to the

Monarch Black Hawk expansion and ongoing capital maintenance

spending. Capital expenditures were funded from the Company’s

operating cash flows as well as $10.8 million of new borrowings

against its Amended Credit Facility. The amount outstanding on

Monarch’s Amended Credit Facility as of June 30, 2018 was

approximately $37.0 million.

Interest expense, net of amount capitalized, for

the second quarter of 2018 was $42 thousand, compared to $206

thousand in the second quarter of 2017.

We believe that the combination of operating

cash flow and the approximately $212.4 million available under its

Amended Credit Facility will fund all remaining costs related to

the completion of the Monarch Casino Black Hawk expansion.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, including, but not limited to, statements relating to (i)

our plans, objectives, near- and long-term outlook, opportunities,

expectations, growth prospects and future operations with respect

to Atlantis Casino Resort Spa and Monarch Casino Black Hawk and the

markets in their respective regions; (ii) our plans, costs,

financing, and additional expenses and revenue opportunities as a

result of project and budget modifications, construction,

completion and opening timelines of upgraded, redesigned and/or

expanded facilities at Monarch Casino Black Hawk; and (iii) our

expectations regarding our future position in the market and the

quality of service we provide to our guests. Actual results and

future events and conditions may differ materially from those

described in any forward-looking statements. Important factors that

could cause actual results to differ materially from estimates or

projections contained in the forward-looking statements include,

without limitation:

- construction factors, including

delays, disruptions, increased costs of labor and materials,

availability of labor and materials, zoning issues, environmental

restrictions, soil and water conditions, weather and other hazards,

site access matters, building permit issues and other regulatory

approvals or issues;

- we have not yet entered into a

guaranteed maximum price (“GMP”) construction contract with our

Monarch Casino Black Hawk general contractor;

- components of our Monarch Casino

Black Hawk construction project will be outside the scope of any

GMP contract;

- access to available and reasonable

financing on a timely basis;

- our ability to generate sufficient

operating cash flow to help finance our expansion plans;

- our ability to effectively manage

expenses to optimize its margins and operating results;

- changes in laws and regulations

permitting expanded and other forms of gaming in our key

markets;

- the effects of local and national

economic, credit and capital market conditions on the economy in

general and on the gaming industry and our business in

particular;

- guest acceptance of our expanded

facilities once completed and the resulting impact on our market

position, growth and future financial results; and

- competition in our target market

areas

Additional information concerning potential

factors that could adversely affect all forward-looking statements,

including the Company's financial results, is included in our

Securities and Exchange Commission filings, including our most

recent annual report on Form 10-K and quarterly report on Form

10-Q, which are available on our website at

www.monarchcasino.com.

About Monarch Casino &

Resort, Inc.

Monarch Casino & Resort, Inc., through its

subsidiaries, owns and operates the Atlantis Casino Resort Spa, a

hotel/casino facility in Reno, Nevada, and the Monarch Casino Black

Hawk in Black Hawk, Colorado, approximately 40 miles west of

Denver. For additional information on Monarch, visit Monarch's

website at www.monarchcasino.com.

The Atlantis features approximately 61,000

square feet of casino space; 824 guest rooms; eight food outlets;

two espresso and pastry bars; a 30,000 square-foot health spa and

salon with an enclosed year-round pool; two retail outlets offering

clothing and traditional gift shop merchandise; an 8,000

square-foot family entertainment center; and approximately 52,000

square feet of banquet, convention and meeting room space. The

casino features approximately 1,450 slot and video poker machines;

approximately 38 table games, including blackjack, craps, roulette,

and others; a race and sports book; a 24-hour live keno lounge; and

a poker room.

The Monarch Casino Black Hawk features

approximately 30,000 square feet of casino space; approximately 740

slot machines; 14 table games; a 250-seat buffet-style restaurant;

a snack bar and a new nine-story parking structure with

approximately 1,350 spaces, plus additional existing valet parking

bringing total parking capacity to 1,500 spaces. Once completed,

the Monarch Casino Black Hawk expansion will nearly double the

casino space and will add a 23-story hotel tower with approximately

500 guest rooms and suites, an upscale spa and pool facility, three

restaurants (bringing the total to four restaurants), additional

bars, and associated support facilities.

Contacts:David FarahiChief

Operating Officer775/825-4700 or dfarahi@monarchcasino.com

Joseph Jaffoni, Richard Land, James

LeahyJCIR212/835-8500 or mcri@jcir.com

- financial tables follow -

| MONARCH CASINO & RESORT, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME(In thousands, except per share data)

(Unaudited) |

| |

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

Casino |

|

$ |

31,142 |

|

|

$ |

45,323 |

|

|

$ |

61,087 |

|

|

$ |

86,633 |

|

| Food and

beverage |

|

|

17,541 |

|

|

|

15,562 |

|

|

|

34,479 |

|

|

|

31,052 |

|

|

Hotel |

|

|

8,097 |

|

|

|

6,248 |

|

|

|

14,460 |

|

|

|

11,888 |

|

|

Other |

|

|

3,129 |

|

|

|

3,070 |

|

|

|

6,151 |

|

|

|

5,848 |

|

| Gross

revenues |

|

|

59,909 |

|

|

|

70,203 |

|

|

|

116,177 |

|

|

|

135,421 |

|

| Less

promotional allowances |

|

|

- |

|

|

|

(11,974) |

|

|

|

- |

|

|

|

(23,778) |

|

| Net

revenues |

|

|

59,909 |

|

|

|

58,229 |

|

|

|

116,177 |

|

|

|

111,643 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

Casino |

|

|

10,856 |

|

|

|

18,060 |

|

|

|

21,552 |

|

|

|

35,740 |

|

| Food and

beverage |

|

|

13,196 |

|

|

|

6,510 |

|

|

|

26,290 |

|

|

|

12,762 |

|

|

Hotel |

|

|

3,056 |

|

|

|

2,249 |

|

|

|

6,555 |

|

|

|

4,457 |

|

|

Other |

|

|

1,565 |

|

|

|

1,022 |

|

|

|

3,110 |

|

|

|

2,007 |

|

| Selling,

general and administrative |

|

|

16,152 |

|

|

|

15,080 |

|

|

|

31,337 |

|

|

|

29,719 |

|

|

Depreciation and amortization |

|

|

3,738 |

|

|

|

3,769 |

|

|

|

7,430 |

|

|

|

7,675 |

|

| Loss

(gain) on disposition of assets |

|

|

4 |

|

|

|

(14) |

|

|

|

4 |

|

|

|

4 |

|

| Total

operating expenses |

|

|

48,567 |

|

|

|

46,676 |

|

|

|

96,278 |

|

|

|

92,364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

operations |

|

|

11,342 |

|

|

|

11,553 |

|

|

|

19,899 |

|

|

|

19,279 |

|

| |

|

|

|

|

|

|

|

|

| Other expenses |

|

|

|

|

|

|

|

|

| Interest expense, net

of amounts capitalized |

|

|

(42) |

|

|

|

(206) |

|

|

|

(122) |

|

|

|

(478) |

|

| Total

other expense |

|

|

(42) |

|

|

|

(206) |

|

|

|

(122) |

|

|

|

(478) |

|

| |

|

|

|

|

|

|

|

|

| Income

before income taxes |

|

|

11,300 |

|

|

|

11,347 |

|

|

|

19,777 |

|

|

|

18,801 |

|

| Provision for income

taxes |

|

|

(2,061) |

|

|

|

(4,108) |

|

|

|

(3,797) |

|

|

|

(6,690) |

|

| Net

income |

|

$ |

9,239 |

|

|

$ |

7,239 |

|

|

$ |

15,980 |

|

|

$ |

12,111 |

|

| |

|

|

|

|

|

|

|

|

| Earnings per share of

common stock |

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.52 |

|

|

$ |

0.41 |

|

|

$ |

0.90 |

|

|

$ |

0.69 |

|

|

Diluted |

|

$ |

0.50 |

|

|

$ |

0.40 |

|

|

$ |

0.86 |

|

|

$ |

0.67 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average number

of common shares and potential common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

17,821 |

|

|

|

17,527 |

|

|

|

17,795 |

|

|

|

17,502 |

|

|

Diluted |

|

|

18,569 |

|

|

|

18,208 |

|

|

|

18,556 |

|

|

|

18,114 |

|

| MONARCH CASINO & RESORT, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(In thousands, except shares) |

| |

| |

|

June 30, |

|

December 31, |

| |

|

|

2018 |

|

|

|

2017 |

|

| ASSETS |

|

(unaudited) |

|

|

| Current assets |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

27,133 |

|

|

$ |

29,151 |

|

|

Receivables, net |

|

|

5,003 |

|

|

|

6,925 |

|

| Income

taxes receivable |

|

|

460 |

|

|

|

2,008 |

|

|

Inventories |

|

|

3,300 |

|

|

|

3,335 |

|

| Prepaid

expenses |

|

|

4,178 |

|

|

|

4,612 |

|

| Total

current assets |

|

|

40,074 |

|

|

|

46,031 |

|

| Property and

equipment |

|

|

|

|

| Land |

|

|

30,034 |

|

|

|

30,034 |

|

| Land

improvements |

|

|

7,281 |

|

|

|

7,249 |

|

|

Buildings |

|

|

193,286 |

|

|

|

193,286 |

|

| Buildings

improvements |

|

|

25,461 |

|

|

|

24,745 |

|

| Furniture

and equipment |

|

|

141,915 |

|

|

|

140,404 |

|

|

Construction in progress |

|

|

101,370 |

|

|

|

48,834 |

|

| Leasehold

improvements |

|

|

3,782 |

|

|

|

3,800 |

|

|

|

|

|

503,129 |

|

|

|

448,352 |

|

| Less

accumulated depreciation and amortization |

|

|

(204,447) |

|

|

|

(197,638) |

|

| Net

property and equipment |

|

|

298,682 |

|

|

|

250,714 |

|

| Other assets |

|

|

|

|

|

Goodwill |

|

|

25,111 |

|

|

|

25,111 |

|

|

Intangible assets, net |

|

|

3,286 |

|

|

|

3,869 |

|

| Deferred

income taxes |

|

|

3,544 |

|

|

|

3,544 |

|

| Other

assets, net |

|

|

2,549 |

|

|

|

2,818 |

|

| Total

other assets |

|

|

34,490 |

|

|

|

35,342 |

|

|

Total assets |

|

$ |

373,246 |

|

|

$ |

332,087 |

|

| |

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

| Current

liabilities |

|

|

|

|

| Accounts

payable |

|

$ |

7,411 |

|

|

$ |

8,184 |

|

|

Construction accounts payable |

|

|

19,385 |

|

|

|

5,823 |

|

| Accrued

expenses |

|

|

28,872 |

|

|

|

25,406 |

|

| Total

current liabilities |

|

|

55,668 |

|

|

|

39,413 |

|

| Long - term debt |

|

|

36,970 |

|

|

|

26,200 |

|

| Total

liabilities |

|

|

92,638 |

|

|

|

65,613 |

|

| |

|

|

|

|

| Stockholders'

equity |

|

|

|

|

| Preferred

stock, $.01 par value, 10,000,000 shares authorized; none

issued |

|

|

- |

|

|

|

- |

|

| Common

stock, $.01 par value, 30,000,000 shares authorized; |

|

|

191 |

|

|

|

191 |

|

|

19,096,300 shares issued; 17,874,653 outstanding at June 30,

2018; |

|

|

|

|

|

17,759,446 outstanding at December 31, 2017 |

|

|

|

|

|

Additional paid-in capital |

|

|

28,280 |

|

|

|

26,890 |

|

| Treasury

stock, 1,221,647 shares at June 30, 2018; 1,336,854 shares at |

|

|

(16,501) |

|

|

|

(18,123) |

|

| December

31, 2017 |

|

|

|

|

| Retained

earnings |

|

|

268,638 |

|

|

|

257,516 |

|

| Total

stockholders' equity |

|

|

280,608 |

|

|

|

266,474 |

|

| Total

liabilities and stockholders' equity |

|

$ |

373,246 |

|

|

$ |

332,087 |

|

| |

|

|

|

|

|

|

|

|

| MONARCH CASINO & RESORT, INC. AND

SUBSIDIARIES RECONCILIATION OF POST TO PRE ASC 606

ADOPTION (In thousands, unaudited) |

|

|

| |

|

Three Months Ended June 30, 2018 |

| |

Pre ASC 606 Adoption |

|

ASC 606 Changes |

|

|

Post ASC 606 Adoption |

| Revenues |

|

|

|

|

|

|

|

Casino |

$45,967 |

|

|

($14,825) |

|

(a)(b)(c)(d) |

|

$31,142 |

| Food and

beverage |

|

16,178 |

|

|

|

1,363 |

|

(a)(d)(e) |

|

|

17,541 |

|

Hotel |

|

6,818 |

|

|

|

1,279 |

|

(a)(f) |

|

|

8,097 |

|

Other |

|

3,149 |

|

|

|

(20) |

|

(a)(d) |

|

|

3,129 |

| Gross

revenues |

|

72,112 |

|

|

|

(12,203) |

|

|

|

|

59,909 |

| Less

promotional allowances |

|

(12,374) |

|

|

|

12,374 |

|

(a)(d) |

|

|

- |

| Net

revenues |

$59,738 |

|

|

$171 |

|

(b)(c)(e)(f) |

|

$59,909 |

| |

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

Casino |

$18,905 |

|

|

($8,049) |

|

(b)(c)(g) |

|

$10,856 |

| Food and

beverage |

|

6,252 |

|

|

|

6,944 |

|

(e)(g) |

|

|

13,196 |

|

Hotel |

|

2,296 |

|

|

|

760 |

|

(f)(g) |

|

|

3,056 |

|

Other |

|

1,049 |

|

|

|

516 |

|

(g) |

|

|

1,565 |

| Selling,

general and administrative |

|

16,152 |

|

|

|

- |

|

|

|

|

16,152 |

|

Depreciation and amortization |

|

3,738 |

|

|

|

- |

|

|

|

|

3,738 |

| Loss on

disposal of assets |

|

4 |

|

|

|

- |

|

|

|

|

4 |

| Total

operating expenses |

|

48,396 |

|

|

|

171 |

|

|

|

|

48,567 |

| Income

from operations |

$11,342 |

|

|

|

- |

|

|

|

$11,342 |

| Adjusted

EBITDA (1) |

$15,909 |

|

|

|

- |

|

|

|

$15,909 |

|

|

|

|

|

|

|

|

(1) Definitions, disclosures and reconciliations of non-GAAP

financial information are included later in the release.

(a) Change as a result of reclassification of current period

complimentaries at estimated retail price from promotional

allowances to casino, food and beverage, hotel, spa and retail

revenues.(b) Change as a result of reclassification of the earned

and unused points during the period from casino expense to casino

revenue.(c) Change as a result of reclassification of the wide area

progressive system expense from casino revenue to casino

expense.(d) Change as a result of the change of the casino floor

bars menu prices and some retail outlets prices from discounted to

retail price.(e) Change as a result of reclassification of the

banquets service fees from food and beverage expense to food and

beverage revenue.(f) Change as a result of reclassification of the

groups rebate and commissions from hotel expense to hotel

revenue.(g) Change as a result of the elimination of the

reclassification journal entry that reclassified the costs of

complimentaries from hotel, food and beverage and other expense

categories to casino expense. Under ASC 606, the costs of

complimentaries stay in the complimentaries revenue producing

department.

| MONARCH CASINO & RESORT, INC. AND

SUBSIDIARIES RECONCILIATION OF POST TO PRE ASC 606

ADOPTION (In thousands, unaudited) |

|

|

| |

|

Six Months Ended June 30, 2018 |

| |

Pre ASC 606 Adoption |

|

ASC 606 Changes |

|

|

Post ASC 606 Adoption |

| Revenues |

|

|

|

|

|

|

|

Casino |

$89,673 |

|

|

($28,586) |

|

(a)(b)(c)(d) |

|

$61,087 |

| Food and

beverage |

|

31,663 |

|

|

|

2,816 |

|

(a)(d)(e) |

|

|

34,479 |

|

Hotel |

|

12,523 |

|

|

|

1,937 |

|

(a)(f) |

|

|

14,460 |

|

Other |

|

6,195 |

|

|

|

(44) |

|

(a)(d) |

|

|

6,151 |

| Gross

revenues |

|

140,054 |

|

|

|

(23,877) |

|

|

|

|

116,177 |

| Less

promotional allowances |

|

(24,193) |

|

|

|

24,193 |

|

(a)(d) |

|

|

- |

| Net

revenues |

$115,861 |

|

|

$316 |

|

(b)(c)(e)(f) |

|

$116,177 |

| |

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

Casino |

$37,883 |

|

|

($16,331) |

|

(b)(c)(g) |

|

$21,552 |

| Food and

beverage |

|

12,423 |

|

|

|

13,867 |

|

(e)(g) |

|

|

26,290 |

|

Hotel |

|

4,822 |

|

|

|

1,733 |

|

(f)(g) |

|

|

6,555 |

|

Other |

|

2,063 |

|

|

|

1,047 |

|

(g) |

|

|

3,110 |

| Selling,

general and administrative |

|

31,337 |

|

|

|

- |

|

|

|

|

31,337 |

|

Depreciation and amortization |

|

7,430 |

|

|

|

- |

|

|

|

|

7,430 |

| Loss on

disposal of assets |

|

4 |

|

|

|

- |

|

|

|

|

4 |

| Total

operating expenses |

|

95,962 |

|

|

|

316 |

|

|

|

|

96,278 |

| Income

from operations |

$19,899 |

|

|

|

- |

|

|

|

$19,899 |

| Adjusted

EBITDA (1) |

$28,724 |

|

|

|

- |

|

|

|

$28,724 |

|

|

|

|

|

|

|

|

(1) Definitions, disclosures and reconciliations of non-GAAP

financial information are included later in the release.

(a) Change as a result of reclassification of current period

complimentaries at estimated retail price from promotional

allowances to casino, food and beverage, hotel, spa and retail

revenues.(b) Change as a result of reclassification of the earned

and unused points during the period from casino expense to casino

revenue.(c) Change as a result of reclassification of the wide area

progressive system expense from casino revenue to casino

expense.(d) Change as a result of the change of the casino floor

bars menu prices and some retail outlets prices from discounted to

retail price.(e) Change as a result of reclassification of the

banquets service fees from food and beverage expense to food and

beverage revenue.(f) Change as a result of reclassification

of the groups rebate and commissions from hotel expense to hotel

revenue.(g) Change as a result of the elimination of the

reclassification journal entry that reclassified the costs of

complimentaries from hotel, food and beverage and other expense

categories to casino expense. Under ASC 606, the costs of

complimentaries stay in the complimentaries revenue producing

department.

MONARCH CASINO & RESORT, INC. AND

SUBSIDIARIES RECONCILIATION OF ADJUSTED EBITDA TO

NET INCOME (In thousands, unaudited)

The following table sets forth a reconciliation of Adjusted

EBITDA, a non-GAAP financial measure, to net income, a GAAP

financial measure:

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Adjusted

EBITDA (1) |

$15,909 |

|

|

$15,801 |

|

|

$28,724 |

|

|

$27,916 |

|

| Expenses: |

|

|

|

|

|

|

|

| Stock

based compensation |

|

(825) |

|

|

|

(493) |

|

|

|

(1,391) |

|

|

|

(958) |

|

|

Depreciation and amortization |

|

(3,738) |

|

|

|

(3,769) |

|

|

|

(7,430) |

|

|

|

(7,675) |

|

| Interest

expense, net of amount capitalized |

|

(42) |

|

|

|

(206) |

|

|

|

(122) |

|

|

|

(478) |

|

| Gain

(loss) on disposition of assets |

|

(4) |

|

|

|

14 |

|

|

|

(4) |

|

|

|

(4) |

|

| Provision

for income taxes |

|

(2,061) |

|

|

|

(4,108) |

|

|

|

(3,797) |

|

|

|

(6,690) |

|

| Net

income |

$9,239 |

|

|

$7,239 |

|

|

$15,980 |

|

|

$12,111 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted EBITDA, a non-GAAP financial measure, consists of

net income plus loss on disposal of assets, provision for income

taxes, stock based compensation expense, other one-time charges,

interest expense, depreciation and amortization less interest

income, any benefit for income taxes and gain on disposal of

assets. Adjusted EBITDA should not be construed as an alternative

to operating income (as determined in accordance with US Generally

Accepted Accounting Principles), as an indicator of the Company's

operating performance, as an alternative to cash flows from

operating activities (as determined in accordance with US GAAP) or

as a measure of liquidity. This measure enables comparison of the

Company's performance over multiple periods, as well as against the

performance of other companies in our industry that report Adjusted

EBITDA, although some companies do not calculate this measure in

the same manner and, therefore, the measure as presented may not be

comparable to similarly titled measures presented by other

companies.

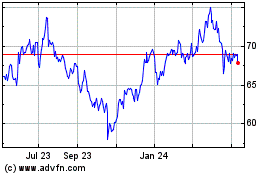

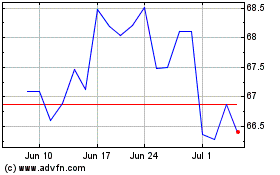

Monarch Casino and Resort (NASDAQ:MCRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Monarch Casino and Resort (NASDAQ:MCRI)

Historical Stock Chart

From Apr 2023 to Apr 2024