Freeport, Rio Tinto Agree to Prelim $3.85 Billion Deal to Transfer Majority Control of Mine to Indonesia -- Update

July 12 2018 - 8:09AM

Dow Jones News

By Ben Otto and Anita Rachman

JAKARTA, Indonesia--Freeport-McMoRan Inc., Rio Tinto and

Indonesia unveiled a tentative $3.85 billion deal that would give

Jakarta majority control of the world's second-biggest copper

mine.

The preliminary agreement signed Thursday comes after a

yearslong conflict that has spooked mining investors and threatened

metal supplies.

Under the tentative deal, Indonesia agreed to pay a combined

$3.85 billion to mining titans Freeport and Rio Tinto for a

controlling stake in Grasberg, a massive copper-and-gold mine that

has been run by Freeport in the country's remote east since the

early 1990s.

The deal would raise Indonesia's stake in the lucrative mine to

about 51% from less than 10% currently.

In a two-step deal, state-owned mining holding company PT

Indonesia Asahan Aluminium, or Inalum, would pay $3.5 billion for

an interest Rio Tinto holds in Grasberg, Inalum head Budi Gunadi

Sadikin told reporters. Freeport would then convert that interest

into an equity stake and sell Inalum an additional, approximately

9% stake for $350 million, giving Indonesia a controlling stake,

Mr. Sadikin said.

Rio Tinto in a news release confirmed the deal's proposed price

for its production interest in Grasberg and said the agreement was

nonbinding. The Anglo-Australian company said all parties would

seek to sign a binding deal by the end of the year.

Reza Pratama, a Freeport spokesman, confirmed the proposed $3.85

billion of payments.

Rio Tinto's U.S.-listed shares rose 1.2% in premarket trade and

U.S.-based Freeport's stock gained 1.8%.

--Deden Sudrajat contributed to this article

Write to Ben Otto at ben.otto@wsj.com and Anita Rachman at

anita.rachman@wsj.com

(END) Dow Jones Newswires

July 12, 2018 07:54 ET (11:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

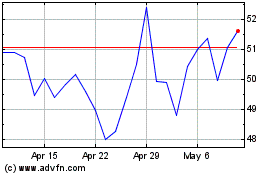

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024