Tesco, Carrefour to Join Forces Amid Fierce Competition -- Update

July 02 2018 - 4:52AM

Dow Jones News

By Saabira Chaudhuri in London and Nick Kostov in Paris

Two of the world's biggest grocery chains, Tesco PLC and

Carrefour SA, have struck a deal to collaborate on how they source

from suppliers in an effort to cut prices amid mounting competition

from Amazon.com Inc. and other rivals.

Tesco, Britain's largest grocery chain, and Carrefour, the

French giant, said they would jointly source certain products to

lower prices, raise quality and broaden their product offerings.

The agreement, which the companies said would initially last three

years, will give the pair more scale in negotiations with global

suppliers. It will cover joint purchasing of own brand products and

goods not for resale, like cleaning products or pallets.

Financial terms of the deal, which is expected to be formally

agreed within the next two months, weren't disclosed. "We are light

on detail," said a Tesco spokeswoman. "The details are very much

still being worked out."

The deal is the latest in a string of moves by traditional

grocers the world over as they race to find new ways to compete

with Amazon's growing food ambitions and fast-changing shopper

behavior. Online shopping, discounters and meal-delivery services

are all eating into once reliable profit margins.

Monday's announcement comes just over a year after Amazon said

it would buy Whole Foods for $13.7 billion. Since then, Amazon has

slashed prices and used the Whole Foods network of stores to ramp

up its online-grocery business.

In the U.K., like the U.S., Amazon has also ramped up its fresh

food delivery service, recently expanding outside London. In

France, Amazon earlier this year signed a deal with Casino

Guichard-Perrachon SA to deliver items from its Monoprix chain.

Amazon's inroads into the grocery sector have struck fear into

supermarket chains world-wide and prompted a number of recent

deals.

Kroger Co., America's largest grocery chain, in May said it

would increase its stake in British online delivery specialist

Ocado Group PLC and license its technology to run automated

warehouses and process online orders.

Analysts say Amazon's ambitions were also partly responsible for

Walmart Inc.'s decision in April to sell its British arm Asda Group

Ltd. to J Sainsbury PLC, creating the largest player in the U.K.'s

fiercely competitive grocery market. That deal is expected to

pressure Tesco in its home market, with the combined Asda-Sainsbury

pledging to cut prices.

Both Tesco and Carrefour have moved to beef up their online

delivery and technology in the face of growing competition.

A year ago, Carrefour named Alexandre Bompard chief executive,

tapping someone who had gone toe-to-toe with Amazon when he ran

book, music and electronics retailer Fnac Darty to help close its

e-commerce gap. Mr. Bompard announced a new five year growth

strategy in January that included a pledge to invest EUR2.8 billion

($3.27 billion) in digital commerce by 2022, and a target of EUR5

billion in sales in food e-commerce in five years -- a six times

increase on last year.

Tesco last week said it would trial a checkout-free method of

payment for its convenience stores that would allowing shoppers to

scan products on their mobile devices and then leave with them.

Last year it became the U.K.'s first retailer to offer a same day

grocery delivery service across the U.K.

Both companies have also made deals to beef up their purchasing

heft. Carrefour teamed up with French competitor Système U to pool

purchases in France. Tesco bought British wholesaler Booker.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and Nick

Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

July 02, 2018 04:37 ET (08:37 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

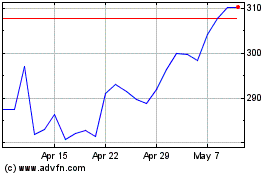

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

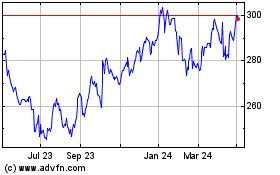

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024