Current Report Filing (8-k)

June 08 2018 - 4:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported)

June 4, 2018

INNERSCOPE HEARING TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified

in Charter)

|

Nevada

|

|

(State or Other Jurisdiction of Incorporation)

|

|

333-209341

|

|

46-3096516

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

2151 Professional Drive, 2

nd

Floor

Roseville, CA

|

|

95661

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

(916) 218-4100

|

|

(Registrant’s telephone number, including area code)

|

|

Not applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (

§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☑

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

☐

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On June 4, 2018, InnerScope Hearing

Technologies, Inc. (the “Company”) issued in the aggregate 9,510,000 shares of its Series A Preferred Stock. The shares

were issued as follows; 3,170,000 shares to the Company’s CEO and director, Matthew Moore (“Matthew’), 3,170,000

shares to the Company’s CFO and director, Kimberly Moore (“Kimberly”) and 3,170,000 shares to the Company’s

Chairman, Mark Moore (“Mark”), in consideration of Matthew, Kimberly and Mark each cancelling 6,340,000 shares of common

stock. The issuances of the shares were made in reliance on the exemption from registration provided by Section 4(a)(2) of the

Securities Act as there was no general solicitation, and the transaction did not involve a public offering.

The Company also issued in the aggregate

900,000 shares of its Series B Preferred Stock. The shares were issued as follows; 300,000 shares to Matthew, 300,000 shares to

Kimberly and 300,000 shares to Mark, in consideration of $15,000 of accrued and unpaid wages to Mathew and Kimberly, respectively,

the Company’s failure to timely pay current and past salaries to Matthew and Kimberly, and their willingness to accrue unpaid

payroll and the non-reimbursement of business expenses without penalty or action for all amounts owed to Matthew, Kimberly and

Mark. The issuances of the shares were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities

Act as there was no general solicitation, and the transaction did not involve a public offering.

|

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On June 4, 2018, the Company filed in

the State of Nevada a Certificate of Designation of a series of preferred stock, the Series A Preferred Stock. 9,510,000 shares

were designated as Series A Preferred Stock. The Series A Preferred Stock has mandatory conversion rights, whereby each share of

Series A Preferred Stock will convert two (2) shares of common stock upon the Company filing Amended and Restated Articles of Incorporation

with the Secretary of State of Nevada, increasing the authorized shares of common stock. The Series A Preferred Stock has voting

rights on an is if converted basis. The Series A Preferred Stock does not have any right to dividends

On June 4, 2018, the Company also filed

in the State of Nevada a Certificate of Designat1ion of a series of preferred stock, the Series B Preferred Stock. 900,000 shares

were designated as Series B Preferred Stock. The Series B Preferred Stock is not convertible into common stock, nor does the Series

B Preferred Stock have any right to dividends and any liquidation preference. The Series B Preferred Stock entitles its holder

to a number of votes per share equal to 1,000 votes.

The foregoing description of the rights

and preferences of the Series A Preferred Stock and the Series B Preferred Stock are qualified in its entirety by the full text

of the Certificate of Designation, which is filed as Exhibit 3.1 and 3.2, respectively, to, and incorporated by reference in, this

report.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

The exhibit listed in the following

Exhibit Index is filed as part of this report:

|

|

3.1

|

Certificate

of Designation of Series A Preferred Stock.

|

|

|

3.2

|

Certificate of Designation of Series B Preferred Stock.

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: June 8, 2018

INNERSCOPE HEARING TECHNOLOGIES, INC.

By:

/s/ Matthew Moore

Matthew Moore

Chief Executive Officer

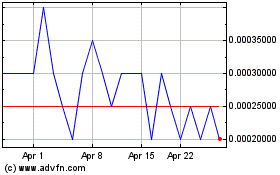

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Mar 2024 to Apr 2024

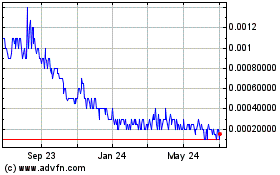

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Apr 2023 to Apr 2024