Current Report Filing (8-k)

May 23 2018 - 1:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2018

ASHLAND GLOBAL HOLDINGS INC.

(Exact name of registrant as specified in charter)

|

Delaware

|

|

333-211719

|

|

81-2587835

|

|

(State of Incorporation or Organization)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

50 E. RiverCenter Boulevard

Covington, Kentucky 41011

(Address of principal executive offices)

(859) 815-3333

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12)

|

|

☐

|

Pre‑commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b))

|

|

☐

|

Pre‑commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c))

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

Emerging growth company

☐

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01. Entry into a

Material Definitive Agreement

On May 22, 2018, Ashland LLC, a Kentucky limited liability company (the “

Company

”) and an indirect subsidiary of Ashland Global Holdings Inc., a Delaware corporation (“

Ashland

”), entered into Amendment No. 3 (the “

Amendment

”) to the Credit Agreement, dated as of May 17, 2017, among the Company, as Borrower, the Lenders from time to time party thereto, The Bank of Nova Scotia, as Administrative Agent, Swing Line Lender and an L/C Issuer, each other L/C Issuer from time to time party thereto and Citibank, N.A., as Syndication Agent, and the various other parties thereto (as amended by Amendment No. 1 to the Credit Agreement, dated as of May 19, 2017, as further amended by Amendment No. 2 to the Credit Agreement, dated as of June 14, 2017, and as further amended, restated, modified and supplemented from time to time, the “

Credit Agreement

”). The Amendment provides for a re-pricing of Ashland’s $595.5 million senior secured term loan B facility due 2024 (“

TLB Facility

”).

After giving effect to the Amendment, loans issued under the TLB Facility will bear interest at LIBOR plus 1.75% per annum.

In addition, the Amendment permits Ashland to distribute or otherwise use the net proceeds from the anticipated divestiture of its Composites segment and the butanediol (BDO) manufacturing facility located in Marl, Germany, and related merchant Intermediates and Solvents (I&S) products so long as, following, and giving pro forma effect to, the divestiture (and any associated repayment of indebtedness), the Company’s consolidated gross leverage ratio does not increase from the quarter ending before the divestiture.

The foregoing summary of the Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

The Credit Agreement has been previously filed with, and is described in, Ashland’s Current Report on Form 8-K dated May 18, 2017.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth under “Item 1.01. Entry into a Material Definitive Agreement” is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following Exhibit is filed as part of this Report on Form 8-K.

|

Exhibit

Number

|

|

Description of Exhibit

|

|

10.1

|

|

Amendment No. 3 to the Credit Agreement, dated as of May 17, 2017, dated as of May 22, 2018, among Ashland LLC, as Borrower (the “Borrower”), the Lenders from time to time party thereto, The Bank of Nova Scotia, as Administrative Agent, Swing Line Lender and an L/C Issuer, each other L/C Issuer from time to time party thereto and Citibank, N.A., as Syndication Agent, and the various other parties thereto (as amended by Amendment No. 1 to the Credit Agreement, dated as of May 19, 2017, as further amended by Amendment No. 2 to the Credit Agreement, dated as of June 14, 2017, and as further amended, restated, modified and supplemented from time to time).

|

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Ashland has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “objectives,” “may,” “will,” “should,” “plans” and “intends” and the negative of these words or other comparable terminology. These forward-looking statements include statements relating to Ashland’s amendment to its credit facility. In addition, Ashland may from time to time make forward-looking statements in its annual reports, quarterly reports and other filings with the SEC, news releases and other written and oral communications. These forward-looking statements are based on Ashland’s expectations and assumptions, as of the date such statements are made, regarding Ashland’s future operating performance and financial condition. Ashland’s expectations and assumptions include, without limitation, internal forecasts and analyses of current and future market conditions and trends, management plans and strategies, operating efficiencies and economic conditions (such as prices, supply and demand, cost of raw materials, and the ability to recover raw-material cost increases through price increases), and risks and uncertainties associated with

the following: the program to eliminate certain existing corporate and Specialty & Ingredients expenses

(including the possibility that such cost eliminations may not occur or may take longer to implement than anticipated), the expected divestiture of its Composites segment and for the butanediol (BDO) manufacturing facility in Marl, Germany, and related mer

chant Intermediates and Solvents (I&S) products (including, in each case, the possibility that a transaction may not occur or that, if a transaction does occur, Ashland may not realize the anticipated

benefits from such transaction);

Ashland’s substantial

indebtedness (including the possibility that such indebtedness and related restrictive covenants may adversely affect Ashland’s future cash flows, results of operations, financial condition and its ability to repay debt); the impact of acquisitions and/or

divestitures Ashland has made or may make, including the acquisition of Pharmachem Laboratories, Inc. and its subsidiaries

(“Pharmachem”)

(including the possibility that Ashland may not realize the anticipated benefits of such transactions, such as the exp

ected sales and growth opportunities, synergies and cost savings and the ability of Ashland to integrate the businesses of Pharmachem successfully and efficiently with Ashland

’

s businesses); and severe weather, natural disasters, and legal proceedings and

claims (including environmental and asbestos matters). Various risks and uncertainties may cause actual results to differ materially from those stated, projected or implied by any forward-looking statements, including, without limitation, risks and uncerta

inties affecting Ashland that are described in Ashland’s most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC, which is available on Ashland’s website at http://investor.ashland.com or on the SEC’s website at http://www.sec.gov. Ashlan

d believes its expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless legally required, Ashland undertakes no obligation to update any forward-looking statements made in th

is report whether as a result of new information, future events or otherwise. Information on Ashland’s website is not incorporated into or a part of this report.

SIGNATURE

S

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ASHLAND GLOBAL HOLDINGS INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 23, 2018

|

By:

|

/s/ Peter J. Ganz

|

|

|

|

|

Name: Peter J. Ganz

|

|

|

|

|

Title: Senior Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

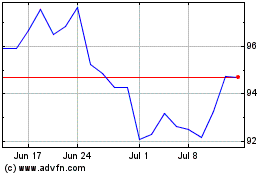

Ashland (NYSE:ASH)

Historical Stock Chart

From Mar 2024 to Apr 2024

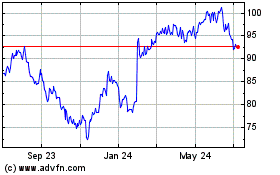

Ashland (NYSE:ASH)

Historical Stock Chart

From Apr 2023 to Apr 2024