RenaissanceRe Holdings Ltd. (NYSE: RNR) (the “Company” or

“RenaissanceRe”) today reported net income available to

RenaissanceRe common shareholders of $56.7 million, or $1.42 per

diluted common share, in the first quarter of 2018, compared to

$92.4 million, or $2.25 per diluted common share, in the first

quarter of 2017. Operating income available to RenaissanceRe common

shareholders was $135.2 million, or $3.40 per diluted common share,

in the first quarter of 2018, compared to $53.7 million, or $1.30

per diluted common share, in the first quarter of 2017. The Company

reported an annualized return on average common equity of 5.7% and

an annualized operating return on average common equity of 13.5% in

the first quarter of 2018, compared to 8.3% and 4.8%, respectively,

in the first quarter of 2017. Book value per common share increased

$0.57, or 0.6%, to $100.29, in the first quarter of 2018, compared

to a 0.8% increase in the first quarter of 2017. Tangible book

value per common share plus accumulated dividends increased $0.73,

or 0.8%, to $111.96 in the first quarter of 2018, compared to a

1.2% increase in the first quarter of 2017.

Kevin J. O'Donnell, CEO, commented: “I am pleased with our solid

results and very strong execution in the first quarter. We

delivered an annualized operating return on average common

equity of 13.5% for the quarter, highlighted by low

catastrophe activity, strong growth in premiums, prior year

favorable development and a continued increase in operating

efficiency. The January 1 renewal was successful, as we

increased both the size and efficiency of our portfolio of

risk. Moving into the mid-year renewals, we remain focused on

implementing our strategy in order to continue to build a diverse

and profitable book of business and maximize shareholder

value.”

FIRST QUARTER 2018

SUMMARY

- Gross premiums written increased by

$237.6 million, or 25.8%, to $1.2 billion, in the first quarter of

2018, compared to the first quarter of 2017, driven by increases of

$186.4 million in the Property segment and $51.1 million in the

Casualty and Specialty segment.

- Underwriting income of $129.6 million

and a combined ratio of 70.6% in the first quarter of 2018. The

Property segment generated underwriting income of $127.2 million

and a combined ratio of 43.5%. The Casualty and Specialty segment

generated underwriting income of $2.6 million and a combined ratio

of 98.8%.

- The Company’s portfolio of fixed

maturity and short term investments had a yield to maturity of 2.9%

at March 31, 2018.

Underwriting Results by Segment

Property Segment

Gross premiums written in the Property segment were $707.0

million in the first quarter of 2018, an increase of $186.4

million, or 35.8%, compared to $520.5 million in the first quarter

of 2017.

Gross premiums written in the catastrophe class of business were

$590.3 million in the first quarter of 2018, an increase of $175.9

million, or 42.4%, compared to the first quarter of 2017. The

increase in gross premiums written in the catastrophe class of

business was driven primarily by an improved rate environment

combined with expanded participation on existing transactions and

certain new transactions in the catastrophe excess of loss market.

Gross premiums written in the other property class of business were

$116.6 million in the first quarter of 2018, an increase of $10.5

million, or 9.9%, compared to the first quarter of 2017. The

increase in gross premiums written in the other property class of

business was primarily driven by growth across a number of the

Company’s underwriting platforms, both from existing relationships

and through new opportunities.

Ceded premiums written in the Property segment were $352.9

million in the first quarter of 2018, an increase of $122.2

million, or 53.0%, compared to $230.7 million in the first quarter

of 2017. The increase in ceded premiums written was principally due

to a significant portion of the increase in gross premiums written

in the catastrophe class of business noted above being subsequently

ceded to third-party investors in the Company’s managed joint

venture, Upsilon RFO.

The Property segment generated underwriting income of $127.2

million and a combined ratio of 43.5% in the first quarter of 2018,

compared to $91.4 million and 51.1%, respectively, in the first

quarter of 2017. Principally impacting the Property segment

underwriting result and combined ratio was favorable development on

prior accident years net claims and claim expenses of $27.6

million, or 12.2 percentage points, during the first quarter of

2018, compared to $0.9 million, or 0.5 percentage points, in the

first quarter of 2017, combined with an increase in net premiums

earned driven by the growth in net premiums written over the

trailing twelve months. The favorable development during the first

quarter of 2018 included $27.1 million of net decreases in the

estimated ultimate losses associated with Hurricanes Harvey, Irma

and Maria, the Mexico City Earthquake and the wildfires in

California during the fourth quarter of 2017, and was principally

within the other property class of business.

Casualty and Specialty Segment

Gross premiums written in the Casualty and Specialty segment

were $452.7 million in the first quarter of 2018, an increase of

$51.1 million, or 12.7%, compared to $401.6 million in the first

quarter of 2017. The $51.1 million increase was principally due to

selective growth from new and existing business within certain

classes of business where the Company found comparably attractive

risk-return attributes.

The Casualty and Specialty segment generated underwriting income

of $2.6 million and had a combined ratio of 98.8% in the first

quarter of 2018, compared to an underwriting loss of $49.3 million

and a combined ratio 127.5% in the first quarter of 2017. The

decrease in the Casualty and Specialty segment combined ratio in

the first quarter of 2018, compared to the first quarter of 2017,

was principally driven by a 20.8 percentage point decrease in the

Casualty and Specialty segment net claims and claim expenses ratio

principally as a result of favorable development on prior accident

years net claims and claim expenses compared to adverse development

during the first quarter of 2017, combined with a 7.9 percentage

point decrease in the underwriting expense ratio. The decrease in

the underwriting expense ratio was primarily driven by an increase

in net premiums earned while continuing to leverage the Casualty

and Specialty segment’s existing expense base.

During the first quarter of 2018, the Casualty and Specialty

segment experienced favorable development on prior accident years

net claims and claim expenses of $3.8 million, or 1.8 percentage

points, compared to $30.3 million, or 16.9 percentage points, of

adverse development on prior accident years net claims and claim

expenses in the first quarter of 2017. The favorable development

during the first quarter of 2018 was principally driven by reported

losses being lower than expected, compared to the first quarter of

2017 which experienced adverse development associated with the

decrease in the Ogden rate during that period.

Other Items

- The Company’s total investment result,

which includes the sum of net investment income and net realized

and unrealized gains and losses on investments, was a loss of $25.7

million in the first quarter of 2018, compared to a gain of $97.7

million in the first quarter of 2017, a decrease of $123.4 million.

The decrease in the total investment result was principally due to

realized and unrealized losses on the Company’s fixed maturity

investment portfolio driven by an upward shift in the interest rate

yield curve during the first quarter of 2018, compared to less

pronounced yield curve impacts in the first quarter of 2017. In

addition, the Company’s equity investments trading portfolio

experienced minimal unrealized losses during the first quarter of

2018, compared to significant realized gains during the first

quarter of 2017.

- Effective January 1, 2018 and April 1,

2018, Upsilon RFO issued $600.5 million and $31.7 million,

respectively, of non-voting preference shares to investors,

including $75.0 million and $26.5 million, respectively, to the

Company. Effective April 1, 2018, the Company’s participation in

the risks assumed by Upsilon RFO was 16.9%.

This Press Release includes certain non-GAAP financial measures

including “operating income available to RenaissanceRe common

shareholders”, “operating income available to RenaissanceRe common

shareholders per common share - diluted”, “operating return on

average common equity - annualized”, “tangible book value per

common share” and “tangible book value per common share plus

accumulated dividends.” A reconciliation of such measures to the

most comparable GAAP figures in accordance with Regulation G is

presented in the attached supplemental financial data.

Please refer to the “Investor Information - Financial Reports -

Financial Supplements” section of the Company’s website at

www.renre.com for a copy of the

Financial Supplement which includes additional information on the

Company’s financial performance.

RenaissanceRe will host a conference call on Wednesday, May 2,

2018 at 10:00 a.m. ET to discuss this release. Live broadcast of

the conference call will be available through the “Investor

Information - Event Calendar” section of the Company’s website at

www.renre.com.

About RenaissanceRe

RenaissanceRe is a global provider of reinsurance and insurance

that specializes in matching well-structured risks with efficient

sources of capital. The Company provides property, casualty and

specialty reinsurance and certain insurance solutions to customers,

principally through intermediaries. Established in 1993, the

Company has offices in Bermuda, Ireland, Singapore, Switzerland,

the United Kingdom and the United States.

Cautionary Statement Regarding Forward-Looking

Statements

Any forward-looking statements made in this Press Release

reflect RenaissanceRe’s current views with respect to future events

and financial performance and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These statements are subject to numerous factors that could cause

actual results to differ materially from those set forth in or

implied by such forward-looking statements, including the

following: the frequency and severity of catastrophic and other

events that the Company covers; the effectiveness of the Company’s

claims and claim expense reserving process; the Company’s ability

to maintain its financial strength ratings; the effect of climate

change on the Company’s business; collection on claimed

retrocessional coverage, and new retrocessional reinsurance being

available on acceptable terms and providing the coverage that we

intended to obtain; the effects of U.S. tax reform legislation and

possible future tax reform legislation and regulations, including

changes to the tax treatment of the Company’s shareholders or

investors in the Company’s joint ventures or other entities the

Company manages; the effect of emerging claims and coverage issues;

soft reinsurance underwriting market conditions; the Company’s

reliance on a small and decreasing number of reinsurance brokers

and other distribution services for the preponderance of its

revenue; the Company’s exposure to credit loss from counterparties

in the normal course of business; the effect of continued

challenging economic conditions throughout the world; a contention

by the Internal Revenue Service that Renaissance Reinsurance Ltd.,

or any of the Company’s other Bermuda subsidiaries, is subject to

taxation in the U.S.; the Company’s ability to retain key senior

officers and to attract or retain the executives and employees

necessary to manage its business; the performance of the Company’s

investment portfolio; losses that the Company could face from

terrorism, political unrest or war; the effect of cybersecurity

risks, including technology breaches or failure on the Company’s

business; the Company’s ability to successfully implement its

business strategies and initiatives; the Company’s ability to

determine the impairments taken on investments; the effect of

inflation; the ability of the Company’s ceding companies and

delegated authority counterparties to accurately assess the risks

they underwrite; the effect of operational risks, including system

or human failures; the Company’s ability to effectively manage

capital on behalf of investors in joint ventures or other entities

it manages; foreign currency exchange rate fluctuations; the

Company’s ability to raise capital if necessary; the Company’s

ability to comply with covenants in its debt agreements; changes to

the regulatory systems under which the Company operates, including

as a result of increased global regulation of the insurance and

reinsurance industry; changes in Bermuda laws and regulations and

the political environment in Bermuda; the Company’s dependence on

the ability of its operating subsidiaries to declare and pay

dividends; the success of any of the Company’s strategic

investments or acquisitions, including the Company’s ability to

manage its operations as its product and geographical diversity

increases; aspects of the Company’s corporate structure that may

discourage third-party takeovers or other transactions; the

cyclical nature of the reinsurance and insurance industries;

adverse legislative developments that reduce the size of the

private markets the Company serves or impede their future growth;

consolidation of competitors, customers and insurance and

reinsurance brokers; the effect on the Company’s business of the

highly competitive nature of its industry, including the effect of

new entrants to, competing products for and consolidation in the

(re)insurance industry; other political, regulatory or industry

initiatives adversely impacting the Company; increasing barriers to

free trade and the free flow of capital; international restrictions

on the writing of reinsurance by foreign companies and government

intervention in the natural catastrophe market; the effect of

Organisation for Economic Co-operation and Development or European

Union (“EU”) measures to increase the Company’s taxes and reporting

requirements; the effect of the vote by the U.K. to leave the EU;

changes in regulatory regimes and accounting rules that may impact

financial results irrespective of business operations; the

Company’s need to make many estimates and judgments in the

preparation of its financial statements; and other factors

affecting future results disclosed in RenaissanceRe’s filings with

the Securities and Exchange Commission, including its Annual

Reports on Form 10-K and Quarterly Reports on Form 10-Q.

RenaissanceRe Holdings Ltd. Summary Consolidated

Statements of Operations (in thousands of United States

Dollars, except per share amounts and percentages) (Unaudited)

Three months ended March 31,

2018 March 31, 2017

Revenues Gross premiums written $ 1,159,652 $ 922,090

Net premiums written $ 663,044 $ 544,136 Increase in

unearned premiums (222,762 ) (178,091 ) Net premiums earned 440,282

366,045 Net investment income 56,476 54,325 Net foreign exchange

gains 3,757 8,165 Equity in earnings (losses) of other ventures 857

(1,507 ) Other (losses) income (1,242 ) 1,665 Net realized and

unrealized (losses) gains on investments (82,144 ) 43,373

Total revenues 417,986 472,066

Expenses

Net claims and claim expenses incurred 171,703 193,081 Acquisition

expenses 97,711 83,282 Operational expenses 41,272 47,283 Corporate

expenses 6,733 5,286 Interest expense 11,767 10,526

Total expenses 329,186 339,458 Income before

taxes 88,800 132,608 Income tax benefit (expense) 3,407 (334

)

Net income 92,207 132,274 Net income attributable to

noncontrolling interests (29,899 ) (34,327 )

Net income attributable to

RenaissanceRe

62,308 97,947 Dividends on preference shares (5,595 ) (5,595 )

Net income available to RenaissanceRe common shareholders $

56,713 $ 92,352 Net income available to

RenaissanceRe common shareholders per common share - basic $ 1.42 $

2.26 Net income available to RenaissanceRe common shareholders per

common share - diluted $ 1.42 $ 2.25 Operating income available to

RenaissanceRe common shareholders per common share - diluted (1) $

3.40 $ 1.30 Average shares outstanding - basic 39,552 40,408

Average shares outstanding - diluted 39,599 40,623 Net

claims and claim expense ratio 39.0 % 52.7 % Underwriting expense

ratio 31.6 % 35.7 % Combined ratio 70.6 % 88.4 % Return on

average common equity - annualized 5.7 % 8.3 % Operating return on

average common equity - annualized (1) 13.5 % 4.8 %

(1) See Comments on Regulation G for a reconciliation of

non-GAAP financial measures.

RenaissanceRe Holdings Ltd. Summary Consolidated

Balance Sheets (in thousands of United States Dollars, except

per share amounts)

March 31,

2018 December 31, 2017 Assets

(Unaudited) (Audited) Fixed maturity investments trading, at fair

value $ 7,404,761 $ 7,426,555 Short term investments, at fair value

1,616,597 991,863 Equity investments trading, at fair value 387,462

388,254 Other investments, at fair value 692,652 594,793

Investments in other ventures, under equity method 120,232

101,974 Total investments 10,221,704 9,503,439 Cash and cash

equivalents 647,973 1,361,592 Premiums receivable 1,684,630

1,304,622 Prepaid reinsurance premiums 794,921 533,546 Reinsurance

recoverable 1,572,321 1,586,630 Accrued investment income 43,069

42,235 Deferred acquisition costs 477,010 426,551 Receivable for

investments sold 111,431 103,145 Other assets 127,571 121,226

Goodwill and other intangibles 241,572 243,145

Total

assets $ 15,922,202 $ 15,226,131

Liabilities,

Noncontrolling Interests and Shareholders’ Equity

Liabilities Reserve for claims and claim expenses $

4,912,727 $ 5,080,408 Unearned premiums 1,961,746 1,477,609 Debt

989,995 989,623 Reinsurance balances payable 1,758,948 989,090

Payable for investments purchased 306,664 208,749 Other liabilities

130,505 792,771

Total liabilities 10,060,585

9,538,250 Redeemable noncontrolling interest 1,425,364 1,296,506

Shareholders’ Equity Preference shares 400,000 400,000

Common shares 40,246 40,024 Additional paid-in capital 38,552

37,355 Accumulated other comprehensive income 194 224 Retained

earnings 3,957,261 3,913,772

Total shareholders’ equity

attributable to RenaissanceRe 4,436,253 4,391,375

Total liabilities, noncontrolling interests and shareholders’

equity $ 15,922,202 $ 15,226,131

Book value

per common share $ 100.29 $ 99.72

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Segment Information (in thousands of United States Dollars,

except percentages) (Unaudited)

Three months ended

March 31, 2018 Property Casualty and

Specialty Other Total

Gross premiums written $ 706,968 $ 452,684 $ —

$ 1,159,652 Net premiums written $ 354,077 $ 308,967

$ — $ 663,044 Net premiums earned $ 225,049 $

215,233 $ — $ 440,282 Net claims and claim expenses incurred 30,607

141,078 18 171,703 Acquisition expenses 40,721 56,990 — 97,711

Operational expenses 26,546 14,593 133 41,272

Underwriting income (loss) $ 127,175 $ 2,572 $

(151 ) 129,596 Net investment income 56,476 56,476 Net foreign

exchange gains 3,757 3,757 Equity in earnings of other ventures 857

857 Other loss (1,242 ) (1,242 ) Net realized and unrealized losses

on investments (82,144 ) (82,144 ) Corporate expenses (6,733 )

(6,733 ) Interest expense (11,767 ) (11,767 ) Income before taxes

and redeemable noncontrolling interests 88,800 Income tax benefit

3,407 3,407 Net income attributable to redeemable noncontrolling

interests (29,899 ) (29,899 ) Dividends on preference shares (5,595

) (5,595 ) Net income attributable to RenaissanceRe common

shareholders $ 56,713 Net claims and claim expenses

incurred – current accident year $ 58,169 $ 144,869 $ — $ 203,038

Net claims and claim expenses incurred – prior accident years

(27,562 ) (3,791 ) 18 (31,335 ) Net claims and claim

expenses incurred – total $ 30,607 $ 141,078 $ 18

$ 171,703 Net claims and claim expense ratio –

current accident year 25.8 % 67.3 % 46.1 % Net claims and claim

expense ratio – prior accident years (12.2 )% (1.8 )% (7.1 )% Net

claims and claim expense ratio – calendar year 13.6 % 65.5 % 39.0 %

Underwriting expense ratio 29.9 % 33.3 % 31.6 % Combined ratio 43.5

% 98.8 % 70.6 %

Three months ended March 31, 2017

Property Casualty and Specialty Other

Total Gross premiums written $ 520,529 $ 401,561

$ — $ 922,090 Net premiums written $ 289,871

$ 254,265 $ — $ 544,136 Net premiums

earned $ 186,988 $ 179,059 $ (2 ) $ 366,045 Net claims and claim

expenses incurred 38,838 154,571 (328 ) 193,081 Acquisition

expenses 29,103 54,179 — 83,282 Operational expenses 27,665

19,607 11 47,283 Underwriting income (loss) $

91,382 $ (49,298 ) $ 315 42,399 Net investment income

54,325 54,325 Net foreign exchange gains 8,165 8,165 Equity in

losses of other ventures (1,507 ) (1,507 ) Other income 1,665 1,665

Net realized and unrealized gains on investments 43,373 43,373

Corporate expenses (5,286 ) (5,286 ) Interest expense (10,526 )

(10,526 ) Income before taxes and noncontrolling interests 132,608

Income tax expense (334 ) (334 ) Net income attributable to

noncontrolling interests (34,327 ) (34,327 ) Dividends on

preference shares (5,595 ) (5,595 ) Net income available to

RenaissanceRe common shareholders $ 92,352 Net claims

and claim expenses incurred – current accident year $ 39,766 $

124,309 $ — $ 164,075 Net claims and claim expenses incurred –

prior accident years (928 ) 30,262 (328 ) 29,006 Net

claims and claim expenses incurred – total $ 38,838 $

154,571 $ (328 ) $ 193,081 Net claims and

claim expense ratio – current accident year 21.3 % 69.4 % 44.8 %

Net claims and claim expense ratio – prior accident years (0.5 )%

16.9 % 7.9 % Net claims and claim expense ratio – calendar year

20.8 % 86.3 % 52.7 % Underwriting expense ratio 30.3 % 41.2 % 35.7

% Combined ratio 51.1 % 127.5 % 88.4 %

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Gross Premiums Written (in thousands of United States Dollars)

(Unaudited)

Three months ended March

31, 2018 March 31, 2017

Property

Segment

Catastrophe $ 590,337 $ 414,424 Other property 116,631

106,105 Property segment gross premiums written $ 706,968 $

520,529

Casualty and

Specialty Segment

Professional liability (1) $ 157,113 $ 132,306 General casualty (2)

126,626 122,293 Financial lines (3) 93,267 85,143 Other (4) 75,678

61,819 Casualty and Specialty segment gross premiums written

$ 452,684 $ 401,561 (1) Includes directors and

officers, medical malpractice, and professional indemnity. (2)

Includes automobile liability, casualty clash, employer’s

liability, umbrella or excess casualty, workers’ compensation and

general liability (3) Includes financial guaranty, mortgage

guaranty, political risk, surety and trade credit. (4) Includes

accident and health, agriculture, aviation, cyber, energy, marine,

satellite and terrorism. Lines of business such as regional

multi-line and whole account may have characteristics of various

other classes of business, and are allocated accordingly.

RenaissanceRe Holdings Ltd. Supplemental Financial Data -

Total Investment Result (in thousands of United States Dollars)

(Unaudited)

Three months ended

March 31, 2018 March 31, 2017 Fixed

maturity investments $ 45,643 $ 43,419 Short term investments 5,304

1,724 Equity investments trading 698 811 Other investments Private

equity investments (434 ) 7,802 Other 8,023 4,072 Cash and cash

equivalents 565 189 59,799 58,017 Investment expenses

(3,323 ) (3,692 )

Net investment income 56,476 54,325

Gross realized gains 4,583 11,461 Gross realized

losses (25,853 ) (16,533 ) Net realized losses on fixed maturity

investments (21,270 ) (5,072 ) Net unrealized (losses) gains on

fixed maturity investments trading (55,372 ) 24,635 Net realized

and unrealized losses on investments-related derivatives (4,364 )

(56 ) Net realized gains on equity investments trading 234 20,915

Net unrealized (losses) gains on equity investments trading (1,372

) 2,951

Net realized and unrealized (losses) gains on

investments (82,144 ) 43,373

Total investment

result $ (25,668 ) $ 97,698

Total investment

return - annualized (1.0 )% 4.1 %

Comments on Regulation G

In addition to the GAAP financial measures set forth in this

Press Release, the Company has included certain non-GAAP financial

measures within the meaning of Regulation G. The Company has

provided these financial measures in previous investor

communications and the Company’s management believes that these

measures are important to investors and other interested persons,

and that investors and such other persons benefit from having a

consistent basis for comparison between quarters and for comparison

with other companies within the industry. These measures may not,

however, be comparable to similarly titled measures used by

companies outside of the insurance industry. Investors are

cautioned not to place undue reliance on these non-GAAP measures in

assessing the Company’s overall financial performance.

The Company uses “operating income available to RenaissanceRe

common shareholders” as a measure to evaluate the underlying

fundamentals of its operations and believes it to be a useful

measure of its corporate performance. “Operating income

available to RenaissanceRe common shareholders” as used herein

differs from “net income available to RenaissanceRe common

shareholders,” which the Company believes is the most directly

comparable GAAP measure, by the exclusion of net realized and

unrealized gains and losses on investments, and the associated

income tax expense or benefit, and the exclusion of the write-down

of a portion of the Company's deferred tax asset as a result of the

reduction in the U.S. corporate tax rate from 35% to 21% effective

January 1, 2018 pursuant to the Tax Bill, which was enacted on

December 22, 2017. The Company’s management believes that

“operating income available to RenaissanceRe common shareholders”

is useful to investors because it more accurately measures and

predicts the Company’s results of operations by removing the

variability arising from fluctuations in the Company’s fixed

maturity investment portfolio, equity investments trading and

investments-related derivatives, the associated income tax expense

or benefit of those fluctuations, and the non-recurring impact of

the write-down of a portion of the Company's deferred tax assets as

a result of the reduction in the U.S. corporate tax rate from 35%

to 21% effective January 1, 2018 pursuant to the Tax Cuts and Jobs

Act of 2017 (the “Tax Bill”), which was enacted on December 22,

2017. The Company also uses “operating income available to

RenaissanceRe common shareholders” to calculate “operating income

available to RenaissanceRe common shareholders per common share -

diluted” and “operating return on average common equity -

annualized”. The following is a reconciliation of: 1) net

income available to RenaissanceRe common shareholders to operating

income available to RenaissanceRe common shareholders; 2) net

income available to RenaissanceRe common shareholders per common

share - diluted to operating income available to RenaissanceRe

common shareholders per common share - diluted; and 3) return on

average common equity - annualized to operating return on average

common equity - annualized:

Three months ended (in thousands of United

States Dollars, except percentages)

March 31, 2018

March 31, 2017 Net income available to

RenaissanceRe common shareholders $ 56,713 $ 92,352 Adjustment for

net realized and unrealized losses (gains) on investments 82,144

(43,373 ) Adjustment for income tax (benefit) expense (1) (3,648 )

4,707 Operating income available to RenaissanceRe common

shareholders $ 135,209 $ 53,686 Net income

available to RenaissanceRe common shareholders per common share -

diluted $ 1.42 $ 2.25 Adjustment for net realized and unrealized

losses (gains) on investments 2.07 (1.07 ) Adjustment for income

tax (benefit) expense (1) (0.09 ) 0.12 Operating income

available to RenaissanceRe common shareholders per common share -

diluted $ 3.40 $ 1.30 Return on average common

equity - annualized 5.7 % 8.3 % Adjustment for net realized and

unrealized losses (gains) on investments 8.2 % (3.9 )% Adjustment

for income tax (benefit) expense (1) (0.4 )% 0.4 % Operating return

on average common equity - annualized 13.5 % 4.8 % (1)

Adjustment for income tax (benefit) expense represents the

income tax (benefit) expense associated with the adjustment for net

realized and unrealized losses (gains) on investments. The income

tax impact is estimated by applying the statutory rates of

applicable jurisdictions, after consideration of other relevant

factors.

The Company has included in this Press Release “tangible book

value per common share” and “tangible book value per common share

plus accumulated dividends”. “Tangible book value per common share”

is defined as book value per common share excluding goodwill and

intangible assets per share. “Tangible book value per common share

plus accumulated dividends” is defined as book value per common

share excluding goodwill and intangible assets per share, plus

accumulated dividends. The Company’s management believes “tangible

book value per common share” and “tangible book value per common

share plus accumulated dividends” are useful to investors because

they provide a more accurate measure of the realizable value of

shareholder returns, excluding the impact of goodwill and

intangible assets. The following is a reconciliation of book value

per common share to tangible book value per common share and

tangible book value per common share plus accumulated

dividends:

At March 31, 2018

December 31, 2017 September 30,

2017 June 30, 2017

March 31, 2017 Book value per common share $ 100.29 $

99.72 $ 100.00 $ 113.08 $ 109.37 Adjustment for goodwill and other

intangibles (1) (6.66 ) (6.49 ) (6.55 ) (6.56 ) (6.55 ) Tangible

book value per common share 93.63 93.23 93.45 106.52 102.82

Adjustment for accumulated dividends 18.33 18.00

17.68 17.36 17.04 Tangible book value per

common share plus accumulated dividends $ 111.96 $ 111.23

$ 111.13 $ 123.88 $ 119.86

Quarterly change in book value per common share 0.6 % (0.3 )% (11.6

)% 3.4 % 0.8 % Quarterly change in tangible book value per common

share plus change in accumulated dividends 0.8 % 0.1 % (12.0 )% 3.9

% 1.2 % (1) At March 31, 2018, December 31, 2017,

September 30, 2017, June 30, 2017 and March 31, 2017, goodwill and

other intangibles included $26.3 million, $16.7 million, $17.4

million, $18.1 million and $18.9 million, respectively, of goodwill

and other intangibles included in investments in other ventures,

under equity method.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180501006829/en/

INVESTORS:RenaissanceRe Holdings Ltd.Keith McCue,

441-239-4830Senior Vice President, Finance and Investor

RelationsorMEDIA:RenaissanceRe Holdings Ltd.Keil Gunther,

441-239-4932Vice President, Marketing & CommunicationsorKekst

and CompanyPeter Hill or Dawn Dover, 212-521-4800

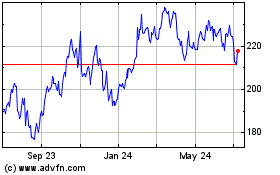

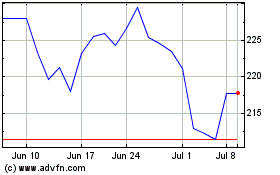

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

RenaissanceRe (NYSE:RNR)

Historical Stock Chart

From Apr 2023 to Apr 2024